GDP and Personal Incomes: Still Not Good News

The Trends Within The Details Are Still Headed In A Wrong Direction

Today we have a double whammy of data. The Bureau of Economic Analysis released its Second Estimate for the Third Quarter GDP, and then the October Personal Incomes and Outlays Report.

Neither one can be said to have good news.

On the surface, the GDP estimate said nothing had really changed. That, at least, was how corporate media viewed the report. However, what that really means is that the corporate media types once again really did not read the report, which contained buried in the middle of the report a couple of downward revisions that make the report even more alaring than the Advance Estimate was.

Regarding Personal Incomes, the report reaffirmed the earlier Consumer Price Index Summary, and showed that inflation is still heating up, and corporate media is still blissfully unaware that inflation has been building for some time.

Let’s peel back the layers and look at the important data points that corporate media managed to overlook.

For it’s part, corporate media was happy to look at just the lead paragraphs of the Second Estimate, and report only on that to the general public (because why let a little thing like actual effort get in the way of a nearly perfect streak of incompetence and sheer laziness?).

The American economy expanded at a healthy 2.8% annual pace from July through September on strong consumer spending and a surge in exports, the government said Wednesday, leaving unchanged its initial estimate of third-quarter growth.

However, that superficial layer of reporting means not looking down on page three of the full report, which contained this rather notable paragraph.

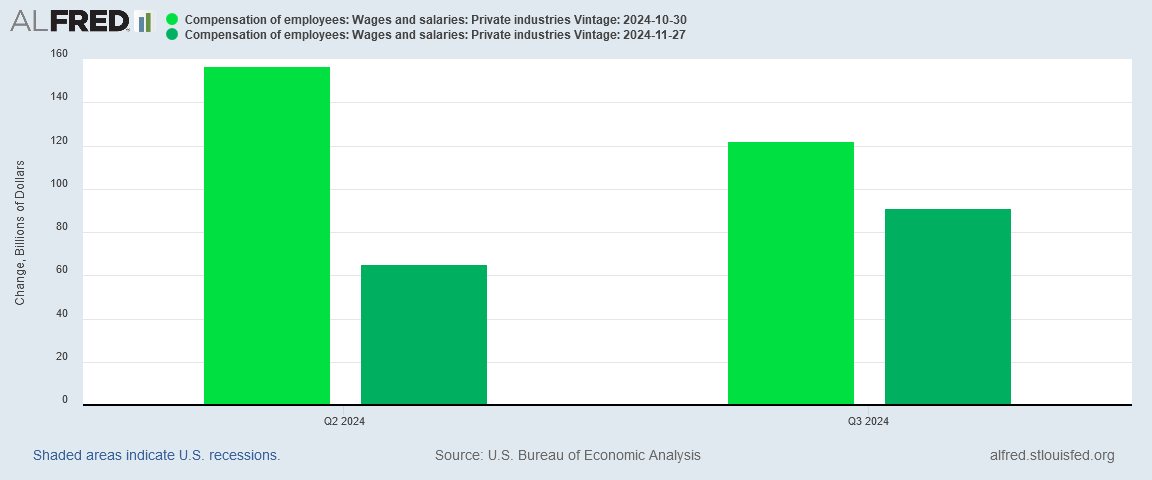

Updates to Second-Quarter Wages and Salaries

In addition to presenting updated estimates for the third quarter, today's release presents revised estimates of second-quarter wages and salaries, personal taxes, and contributions for government social insurance, based on updated data from the Bureau of Labor Statistics Quarterly Census of Employment and Wages program. Private wages and salaries are now estimated to have increased $65.0 billion in the second quarter, a downward revision of $91.8 billion. Personal current taxes are now estimated to have increased $39.8 billion, a downward revision of $15.5 billion. Contributions for government social insurance are now estimated to have increased $7.0 billion, a downward revision of $12.4 billion. With the incorporation of these new data, real gross domestic income is now estimated to have increased 2.0 percent in the second quarter, a downward revision of 1.4 percentage points from the previously published estimate.

Let that paragraph sink in for just a moment. The estimates for Q2 GDP overstated private wages by $92 Billion—or 58.5% of the initial level reported. Apparently, private sector employees earned a whole lot less in the second quarter than initially believed.

Call me cynical, but I tend to view that big of a miss as a pretty big deal, especially when it’s a downward revision to income.

The BEA did much better in the third quarter, overstating private wages in the Advance Estimate by only $30 Billion, or 25% of the Advance Estimate level. Still, between Q2 and Q3, the BEA has managed to make over $100 Billion of private wages and salaries disappear.

I would think that warrants some significant attention, myself. But I don’t write for the Associated Press!

The net effect of these little errors is that Gross Domestic Income for the Second Quarter ended up being overstated by $98 Billion, or 23% of the Advance Estimate level.

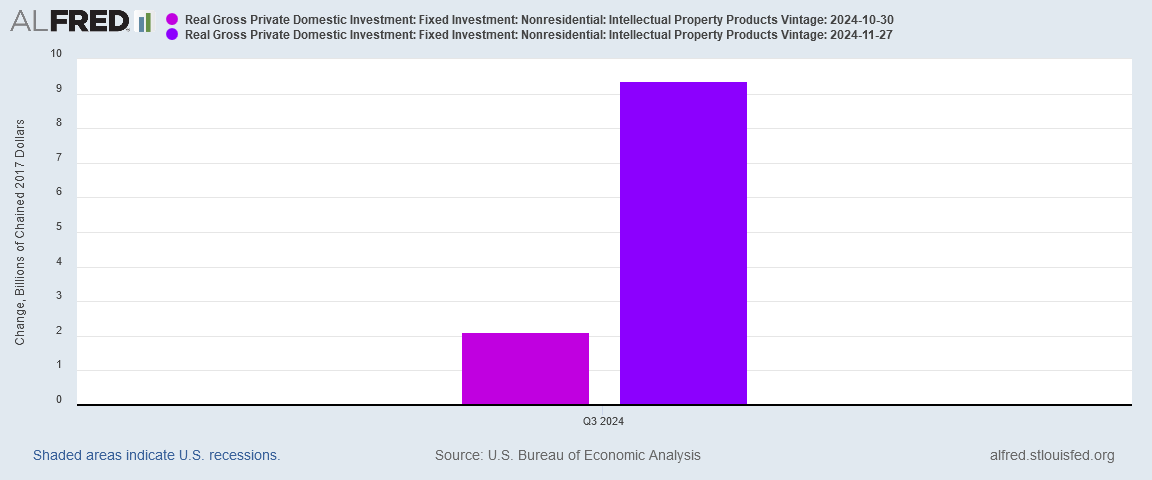

About the only bright spot in the Second Estimate is that Fixed Investment in Intellectual Property Products was revised upward by $9 Billion.

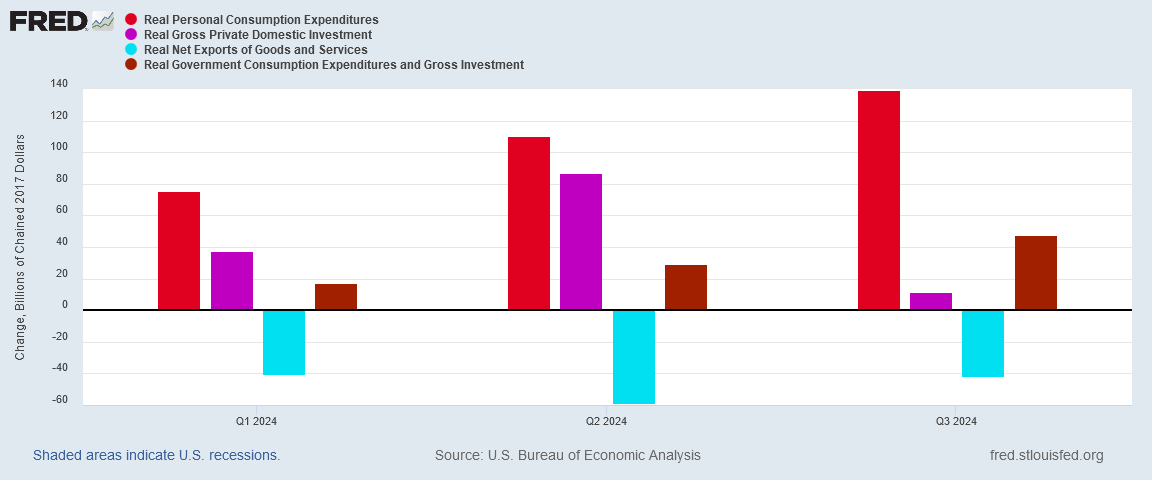

While this does improve investment somewhat, the distribution of Real GDP still shows a major drop in investment, and that is still a problem.

To recap, the Second Estimate was the same as the Advance Estimate, except for a little thing of $100 Billion in income disappearing (the BEA must be hiring their accounting staff away from Macy’s).

Nothing to see here! Move along!

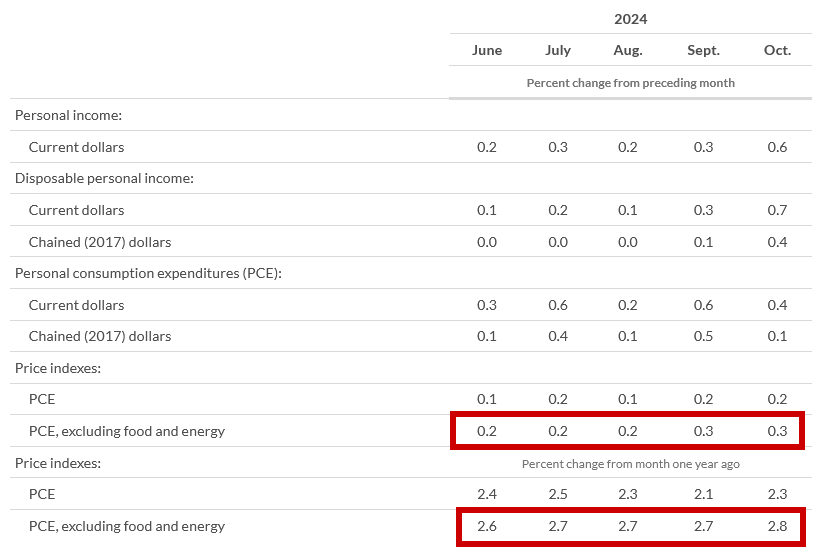

In digesting the Personal Incomes and Outlays Report, corporate media was again their usual superficial unaware self, acknowledging the obvious—that consumer price inflation is rising—but ignoring that inflation has been heating up in several sectors for some time now.

After stripping out volatile food and fuel costs to get a better sense of the underlying trend in prices, a “core” index climbed 2.8 percent from a year earlier. That was up from 2.7 percent previously.

Looking at how much prices climbed over just the past month, the overall index rose 0.2 percent from September, and the core index increased 0.3 percent. Both changes were in line with their previous readings and with economist expectations. Policymakers sometimes look at monthly price changes to get an up-to-date sense of how inflation is evolving.

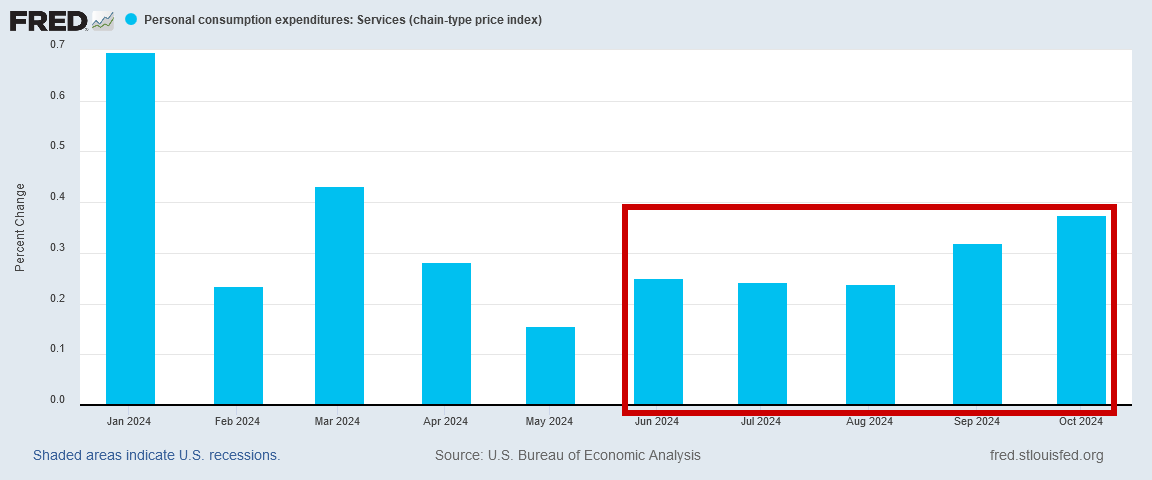

What does not get said is that both month on month core inflation and year on year core inflation within the PCE Price Index (PCEPI) has been incrementally rising since at least June.

As in keeping with the inflation trends already established, most of that core inflation increase traces back to service price inflation heating up.

This is a continuation of the same trend to which corporate media has been oblivious until very recently.

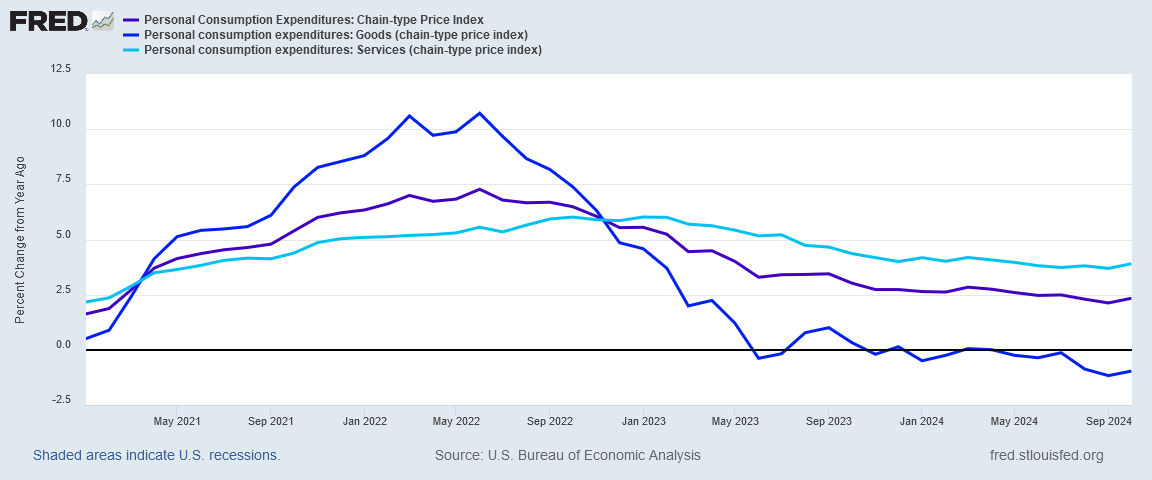

As has been the case all along, the magnitude of service price inflation is being largely masked by goods price deflation, which continues to be the trend.

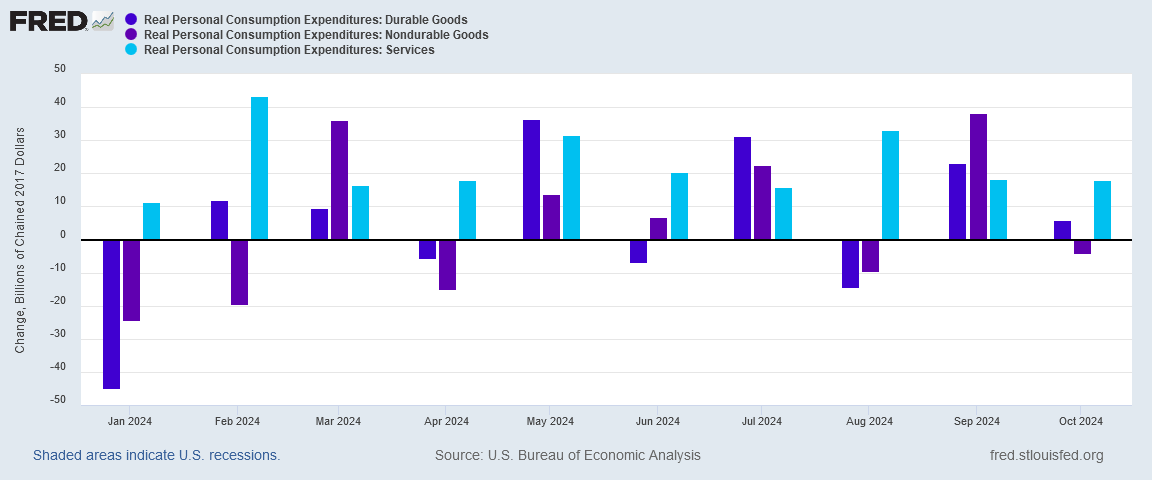

While real expenditures on durable goods did increase during October, real expenditures on non-durable goods declined.

How significant is service price inflation at the present time?

Significant enough to override these levels of deflation in physical goods prices. Proving once again that service price inflation is still running significantly hotter than either core or headline inflation.

Service price inflation is significant enough to be steadily increasing a chasm between growth in service prices and growth in goods prices.

Remember, the most destructive aspect of consumer price inflation is the distortions that are introduced as various prices rise and even fall at different rates. Throughout the bulk of the (Biden-)Harris Administration, inflation has been steadily distorting previous price relationships between goods and services. That trend has never ceased and the distortion continues to increase.

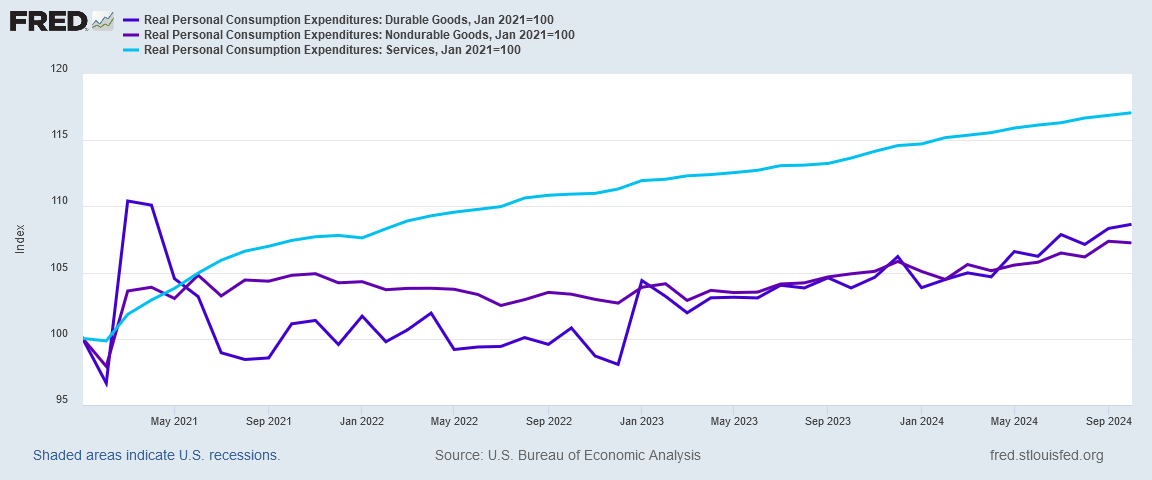

We can see that there is a detectable distortion because when we look at the history for these price elements, we find that non-durable goods inflation historically tracks relatively closely with service price inflation.

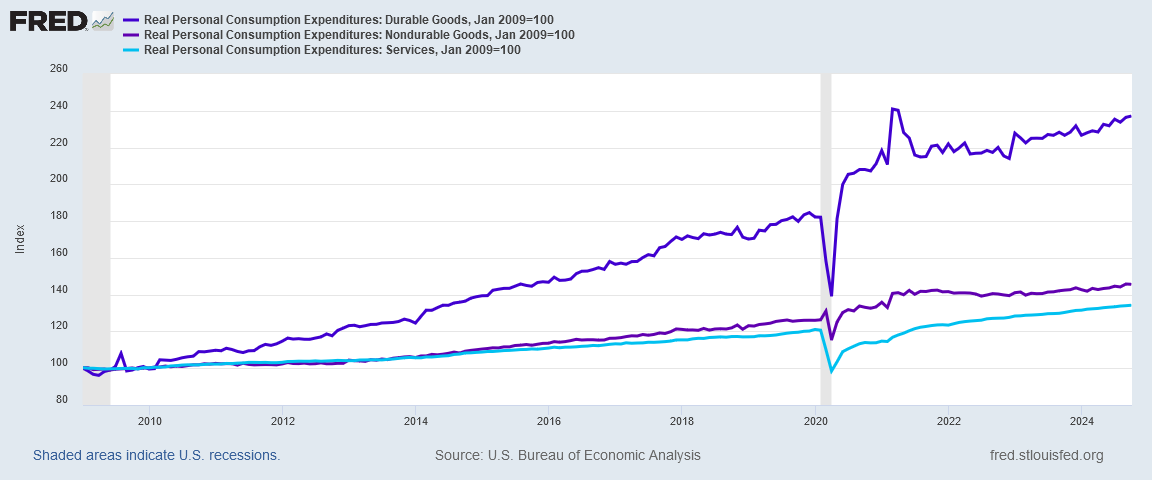

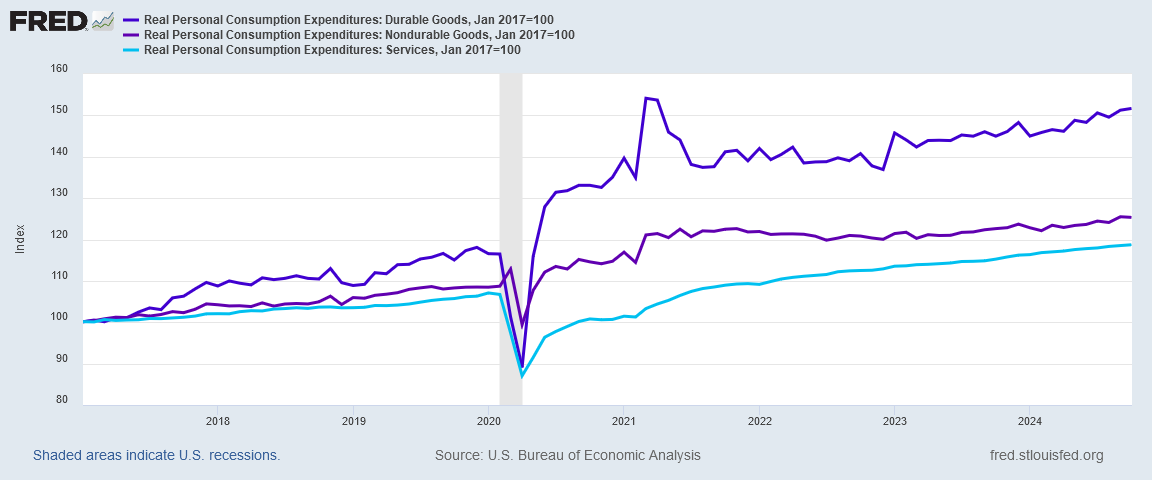

When we index these price elements to the start of the Obama Administration, we see that durable goods inflation has historically been far more significant than service price inflation or non-durable goods inflation.

If we reindex to the start of Donald Trump’s first term, we see the same trends.

After early 2021, however, as the graph above shows, service prices have increased more dramatically relative to both durable and non-durable goods, and durable and non-durable goods are growing as similar rates.

One does not need a PhD in economics to infer that the inversion of these inflation trends is an artifact and consequence of the COVID Pandemic Panic in 2020—a major economic dislocation the effects of which are still reverberating through the economy.

It is fitting that both the Second GDP Estimate and the Personal Income and Outlays Report came out on the same day—a quirk of the calendar with Thanksgiving being tomorrow—as the takeaway message from both reports truly is the same: the US economy is showing growing weaknesses and vulnerabilities within the details.

The weakness in private investment within the GDP estimate carries a certain symmetry with the continued divergence and distortion between goods prices and services prices, a complete reversal of a long-standing historical norm.

Neither trend augurs well for the economy. Manufacturing jobs are routinely the highest paying jobs, and they are the jobs that are involved in actual wealth creation—physical assets that stick around. As a rule, the economy is going to be in rude health if we are making goodly amounts of “things”, and to be making goodly amounts of things we want to be buying goodly amounts of “things”.

Instead, we have in this country a trend where we are making fewer things, and where we are buying fewer things.

One can even argue that this decline in manufacturing and in goods consumption is a contributing factor to the decline in ordinary American’s share of the nation’s wealth. Surely it is not a coincidence that as the economy becomes unbalanced wealth inequality rises.

These trends are not good news, not in the GDP Estimate and not in the Personal Incomes and Outlays Report. These trends are but the latest reminder that the US economy is still heading in a wrong direction.

These trends are what need to change in the economy, but are not changing yet.

Big picture: various government agencies (and the MSM covering their press releases) seem to have spent this past election year massaging, hiding, delaying, and spinning crucial economic data so as to give the impression that the Biden administration has been doing a better job than they actually have been doing. This is a deliberate, criminal misrepresentation of data that businesses use to decide whether to expand or con tract their operations, and the responsible parties should be held to account.

Here’s what I’d love to see, Peter: if you could find a way to get this article, plus some of your other articles regarding the BLS and other agencies, into the hands of someone at DOGE, we could maybe get some heads to roll. For that matter, I’d love to see you get a job with DOGE, factually exposing the ways that government employees have been deceiving the public. You would be an avenging angel for America, smiting the evildoers who have been creating the deception and wasting taxpayers’ dollars!

Please consider it.

Happy Thanksgiving to you, Peter. I am thankful to have your magnificence in my life. I wish I could have the pleasure of cooking up the feast for you!

How does America start having a real or robust GDP? How does this get fixed and dealing with the trillion dollars of debt? And with technology and other businesses laying off as AI and robots replace labor force and small/medium stores can’t compete with massive Amazon warehouses…beyond me.

I do hope your articles make to DOGE or even Bloomberg, Varney, PBS, CNN, Yahoo - somewhere to peel back the curtains so we can face reality.

Happy Thanksgiving!