Inflation Rising? It's BEEN Rising

October Is Just The Month The "Experts" Finally Noticed

There is little doubt about consumer price inflation right now: it is rising.

Consumer price inflation has been rising, and in the October Consumer Price Index Summary, the increases finally bubbled up to the headline number, leading corporate media to at last admit the obvious: consumer price inflation is rising.

Only inflation didn’t just rise in October. It’s been rising, and has now finally risen enough for even the “experts” to notice.

That is how corporate media can churn out lede paragraphs such as this:

Progress in the fight to tame pandemic-era inflation appears to have stalled out in October, despite lower prices at the gasoline pump and a moderation in other consumer staples such as groceries.

Progress has not “stalled out”. Progress wasn’t being made, because inflation hasn’t been going away. There has been no lack of rising prices in recent months, and so there has been no lack of inflation.

Even a cursory glance at the October inflation report is enough to see that prices are rising in quite a few areas.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in October, the same increase as in each of the previous 3 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.6 percent before seasonal adjustment.

The index for shelter rose 0.4 percent in October, accounting for over half of the monthly all items increase. The food index also increased over the month, rising 0.2 percent as the food at home index increased 0.1 percent and the food away from home index rose 0.2 percent. The energy index was unchanged over the month, after declining 1.9 percent in September.

The index for all items less food and energy rose 0.3 percent in October, as it did in August and September. Indexes that increased in October include shelter, used cars and trucks, airline fares, medical care, and recreation. The indexes for apparel, communication, and household furnishings and operations were among those that decreased over the month.

The all items index rose 2.6 percent for the 12 months ending October, after rising 2.4 percent over the 12 months ending September. The all items less food and energy index rose 3.3 percent over the last 12 months. The energy index decreased 4.9 percent for the 12 months ending October. The food index increased 2.1 percent over the last year.

The rise to 2.6% year on year inflation is the cumulative effect of persistent price increases across the entirety of the Consumer Price Index data set—which means if those price increases continue, year on year inflation is going to rise to more than 2.6% over the near term.

Ironically, the 2.6% year on year rise in inflation also represents one of the few moments when I agreed with Wall Street’s “experts”, as I concluded yesterday’s article by saying that 2.6% was the probable level.

As it turned out, my assessment of several of the drivers of that 0.2pp uptick were accurate as well, most especially on the crucial driver of energy price inflation.

We should expect reduced energy price deflation in October, or perhaps even a very small amount of energy price inflation.

That was exactly what we saw, with the energy price subindex remaining almost unchanged in October, after having the third largest decline for the year in September.

It turned out I was somewhat off about food prices, as the month on month inflation rate moved down in October.

However, even with the retreat from Septebmer’s substantial increase, the food price subindex still showed a larger increase in October than in August.

Food price inflation in October very nearly matched the July rate of increase, making October yet another month with food price inflation printing higher than it did in the spring.

Food price inflation is still trending higher overall, even though September is looking like a bit of an outlier month on month.

We should also note that the rise in headline inflation month on month was the largest such increase since April.

That inflation rose year on year this past month actually means that the uptick in the headline Consumer Price Index inflation rate which began over the summer has been sustained.

Between April and June the Consumer Price Index itself had largely plateaued, only to begin moving up again after June. Remember, inflation is fundamentally the rate of increase in the Consumer Price Index, and a rise in consumer price inflation means the Consumer Price Index is increasing at a faster rate than it was before.

That faster rate of increase began in June and July and has been sustained through October—when the “experts” finally noticed.

Despite the historical reality that higher inflation has been here for several months, that the headline rate only saw an incremental uptick was viewed as very good news by the Fed’s Neel Kashkari—President of the Minneapolis Federal Reserve—who is of the opinion inflation is moving in the right direction.

“Right now, I think that inflation is headed in the right direction. I’ve got confidence about that, but we need to wait,” Kashkari said Wednesday during an interview with Bloomberg Television. “We’ve got another month or six weeks of data to analyze before we make any decisions.”

Obviously, a small uptick in consumer price inflation is better than a large uptick, but, in addition to overlooking the higher inflation which we’ve had since the summer, Kashkari’s comments also failed to acknowledge not only the magnitude of inflation under the (Biden-)Harris Administration but also the wide spectrum of price increases.

Of the major categories in the inflation report, four of them—including the extremely important food and energy price subindices—have seen prices rises greater than 20% January 2021 and the start of the (Biden-)Harris Administration.

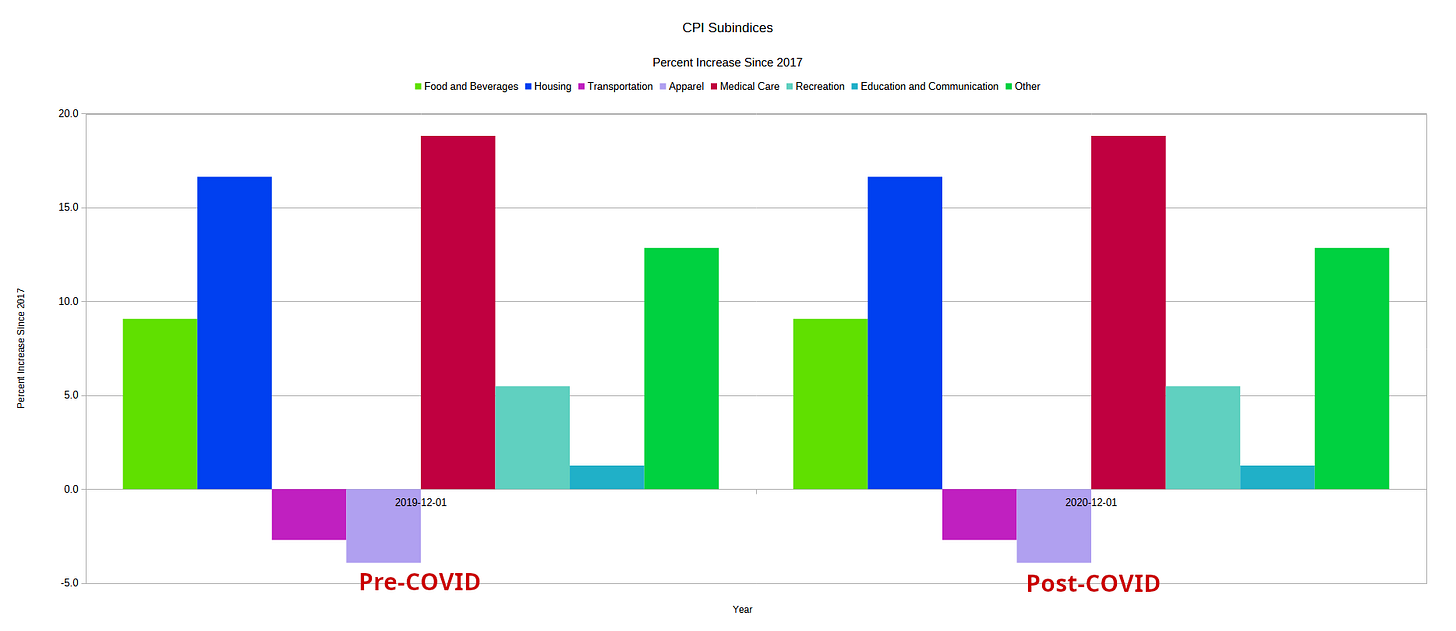

This a marked contrast to inflation during President(-elect) Donald Trump’s first term of office, in which no category saw prices rise by 20%, even with COVID making an entrance in 2020.

Given how much inflation has already shifted from Donald Trump’s first term, even a small uptick in inflation is going to lead to noticeable inflation, simply because of the magnitude of price rises to date. With consumers still digesting fairly massive overall price hikes since 2021, the prospect of even more price hikes is something consumers are going to notice.

If the year on year inflation rate is doing anything but declining, it means inflation is in a period of sustained increase, which is unequivocally not the “right direction” for inflation, regardless of what “experts” such as Neel Kashkari want to believe.

One area where the Consumer Price Index increases must come with a caveat is housing rents.

According to the CPI data, rents moved up significantly in October, rising by more than a tenth of a percentage point.

Yet when we look at a privately maintained index of housing rents, the Zillow Obesrved Rent Index (ZORI), which is a more forward-looking index of housing rents, housing inflation actually went down—the ZORI printed housing deflation month on month for October.

Even the year on year inflation rate declined on the ZORI, despite the CPI shelter index ticking up.

However, while housing rents were either rising or falling, depending on which index one checked, transportation prices were up—and significantly so.

Transportation as a category within the Consumer Price Index data has experienced some of the most dramatic price rises since 2021. While transportation prices have flirted with deflation in the past few months, that appears to be ending.

Despite having been in a cooling trend earlier in the year, food, housing, and transportation prices have been heating up since around mid-year.

These are the various categories of physical goods which showed rising prices in October. This is where we were seeing goods price inflation.

This is in addition to the ongoing ramp-up in service price inflation, which has moved up month on month for the past four months.

These variances among the categories and subindices within the Consumer Price Index data set highlight the mistake Kashkari—and the whole of the “expert” class on Wall Street and in corporate media—persist in making on inflation. They insist on focusing on just the headline inflation rate, or perhaps the headline and the “core” rate with food and energy prices removed, and because of that focus they are missing a key aspect of consumer price behavior—a lot of prices are actually rising.

As I have stated more than once, as we are seeing less energy price deflation, inflation rates within services and within various categories of goods begin to show greater influence on the headline inflation rate.

Services have been exhibing elevated rates of inflation all along, without ever having shown the degree of disinflation and deflation we have seen in goods prices.

Transportation goods have been rising since the summer.

Food prices have been moving up since the spring.

Corporate media, by focusing on the seemingly small increase in year on year inflation, ignores how that seemingly small increase happens because of sustained upward price pressures across several categories of goods and services, pressures which have been present for most of the year if not longer.

The year on year inflation uptick is not evidence that inflation is starting to heat up again, but confirmation that inflation has been heating up, and is continuing to heat up.

Inflation has been rising, and if the trends within inflation are any guide, inflation is going to continue to rise for the near term at least.

This is the kind of analysis that gives you so much credibility in the eyes of your readers, Peter. Clear-eyed, objective, detailed, spot-on, and SMART. You are just better at this than the slop in the mainstream media.

Politically, the next game for the Left is going to be blaming everything on the new Trump administration (A return to their old game of blaming everything on Trump, of course.) I hope you will continue to seize every opportunity to point out that the inflation, recession, and other troubles started months ago under Biden, not Trump. I think it’s going to be especially important to NOT let them get away with their blame-game, if Trump’s new efforts are to succeed. I just wish there was some way to get your factual analysis printed in the Wall Street Journal, The NY Times, WaPo, etc. Fat chance of that, but maybe historians will unearth your posts someday and bring the spotlight to your amazing insights. ‘The truth will out’!

Now that Trump is the President-Elect, it’s all his fault. We’ve been watching this for months.