Inflation: Heating Up Or Cooling Down?

What Might We Expect In October's Inflation Report?

The point of all data analytics is to understand how our world is unfolding. Used effectively, data helps us understand what has happened and lets us see a little bit of what is about to happen. Knowing what might come next can be invaluable in just about any aspect of day-to-day living.

With the October Consumer Price Index Summary due to be published on Wednesday (November 13) by the Bureau of Labor Statistics, now is a good time to take a look at where Wall Street is projecting the inflation numbers to be, and explore what the economic data can tell us about where inflation might be headed.

Does Wall Street have a handle on where consumer prices are headed? Are we seeing inflation heating up or are we seeing it cool down?

As always, what does the data say?

The consensus of the economists and pundits polled by several media outlets is that inflation is likely to heat up somewhat. Broadly speaking, the “expert take” is that inflation is going to move up from 2.4% year on year for September.

CPI for October is expected to come in at an annual pace of 2.6%, according to economists polled by Reuters. That would be a slight uptick from the 2.4% pace in September, which was the smallest gain since 2021, but well below the four-decade highs reached in 2022 that led the Fed to hike interest rates.

While the overarching narrative in this country has been that inflation is cooling, recently there is some rising awareness within the financial press that the inflation beast never really was slain,

“Important leading indicators of inflation continue to decline although there are some that have now turned higher,” said economist and long-time Fed watcher Hugh Johnson. “It’s about an even split here but we need to watch these carefully. They may be signaling a turn higher in inflation in the second half of 2025. Too early to tell yet.”

Even so, the thought process in several corners is that, even if inflation notches a small gain in October, the overarching trend is still a downward trajectory towards the Fed’s “Holy Grail” of 2% year on year inflation.

The FOMC is becoming comfortable that inflation is under control. That’s why policymakers have started cutting interest rates and signaled that further cuts are coming. In essence, the FOMC is plans to remove a lot of the interest rate increases that were necessary as inflation surged. October’s inflation numbers are likely to provide more reassurance to the FOMC.

Thus, while inflation is projected to move up incrementally, the consensus is that inflation is still trending down, and the uptick is merely reflective of normal fluctuations seen as year on year inflation rates get closer to 2%.

The first data the Fed will consider ahead of its next meeting will come out on Wednesday with the release of the October Consumer Price Index (CPI). Wall Street economists expect headline inflation rose just 2.6% annually in October, an increase from the 2.4% rise in September. Prices are set to rise 0.2% on a month-over-month basis, per economist projections, in line with the increase seen in September.

On a "core" basis, which strips out food and energy prices, CPI is forecast to have risen 3.3% over last year in October, unchanged from September's increase. Monthly core price increases are expected to clock in at 0.3%, also in line with the September gain.

"The October CPI report will likely support the notion that the last mile of inflation's journey back to target will be the hardest," Wells Fargo's economics team led by Jay Bryson wrote in a weekly note to clients on Friday.

Broadly, Wall Street is anticipating inflation to be running at 2.6% year on year during the month of October, but does not think there is much reason to be alarmed by the uptick.

There are several reasons to give the Wall Street consensus a fair bit of credibility. Perhaps the strongest argument for taking the 2.6% inflation rate prediction seriously is that the Cleveland Federal Reserve’s Inflation “NowCast” has been projecting that same inflation leve throughout most of October and into November.

With the NowCast at 2.6% for headline inflation and 3.3% for core inflation, Wall Street is doing little more than playing follow the leader on inflation—and there’s very little reason why they should do more. Over the past several months the Cleveland Fed’s NowCast has been fairly close to the final released numbers from the BLS.

Why is inflation heating up in October? Energy prices almost certainly play a major role. Both benchmark crude prices and futures prices on gasoline rose during October.

Perhaps most importantly, energy commodity prices had a sustained rise during the final week of October. Energy price inflation unquestionably did happen during the momth.

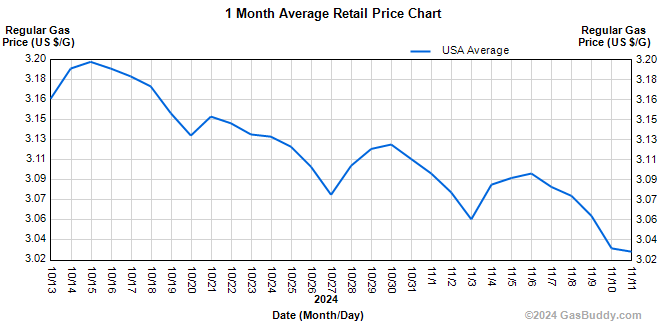

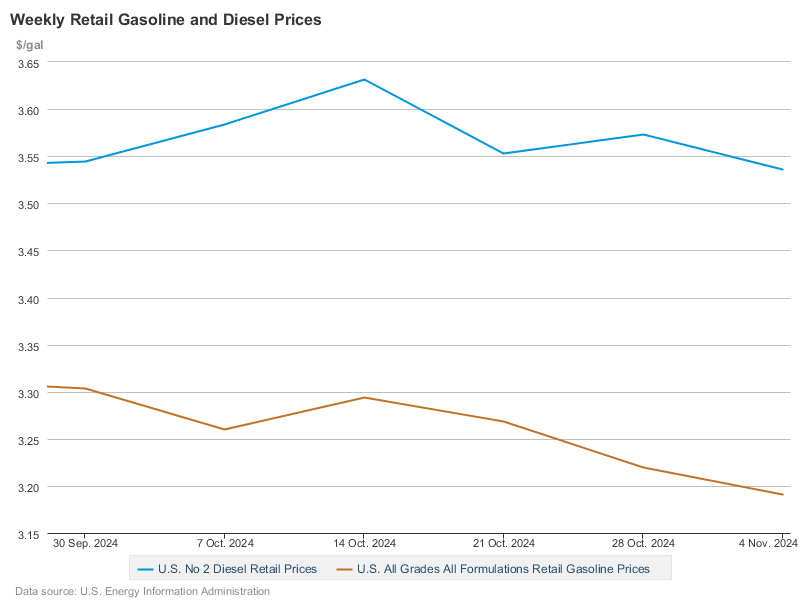

Energy prices are not moving up across the board, however, as retail gasoline prices trended down during October according to travel site GasBuddy.com

While the EIA’s weekly updates of retail gasoline prices track higher than the GasBuddy average overall, the EIA also shows the retail price of gasoline trended lower in October.

Energy price inflation in the markets, coupled with energy price deflation at the gas pump, would seem to argue that at most there will be a small uptick in the Energy subindex of the CPI. Energy price deflation is showing signs of reaching its bottom, at which point declines in the Energy subindex of the CPI end and the trend reverses.

We should expect reduced energy price deflation in October, or perhaps even a very small amount of energy price inflation.

One area we will likely see some noticeable increase is food price inflation. While the Food subindex of the CPI has been hovering just above the 2% threshold for most of the year, it has been increasing again, moving up 0.2pp year on year in September.

Month on Month, the Food subindex made a considerable jump in September.

Given that there have been a number of staple foods whose prices have been rising significantly of late, we should not be surprised to see that trend continue into October.

Eggs saw the biggest price increase of any grocery staple, rising from $2.06 per dozen to $3.82 over the year analyzed — a hike of 85 percent.

The average price of beef also grew considerably (11 percent), followed by tomatoes (5 percent), chicken (4.1 percent) and whole milk (1.4 percent).

At a minimum, we should be anticipating another uptick in food price inflation, thus pushing up headline inflation as well.

Within core inflation the data is a bit more muddled. Non-durable goods plateaued in September of last year, and then has trended down every so slightly.

Durable goods have been in outright deflation since 2022.

Services stand in marked contrast to both, with service price inflation continuing to be remarkably constant, a point that stands out also when we look at the year on year changes in prices.

Service price inflation rose the least and fell the least, and has shown the least volatility since before the hyperinflation of 2022.

Much of this is undoubtedly due to the strength services have shown in the overall economy.

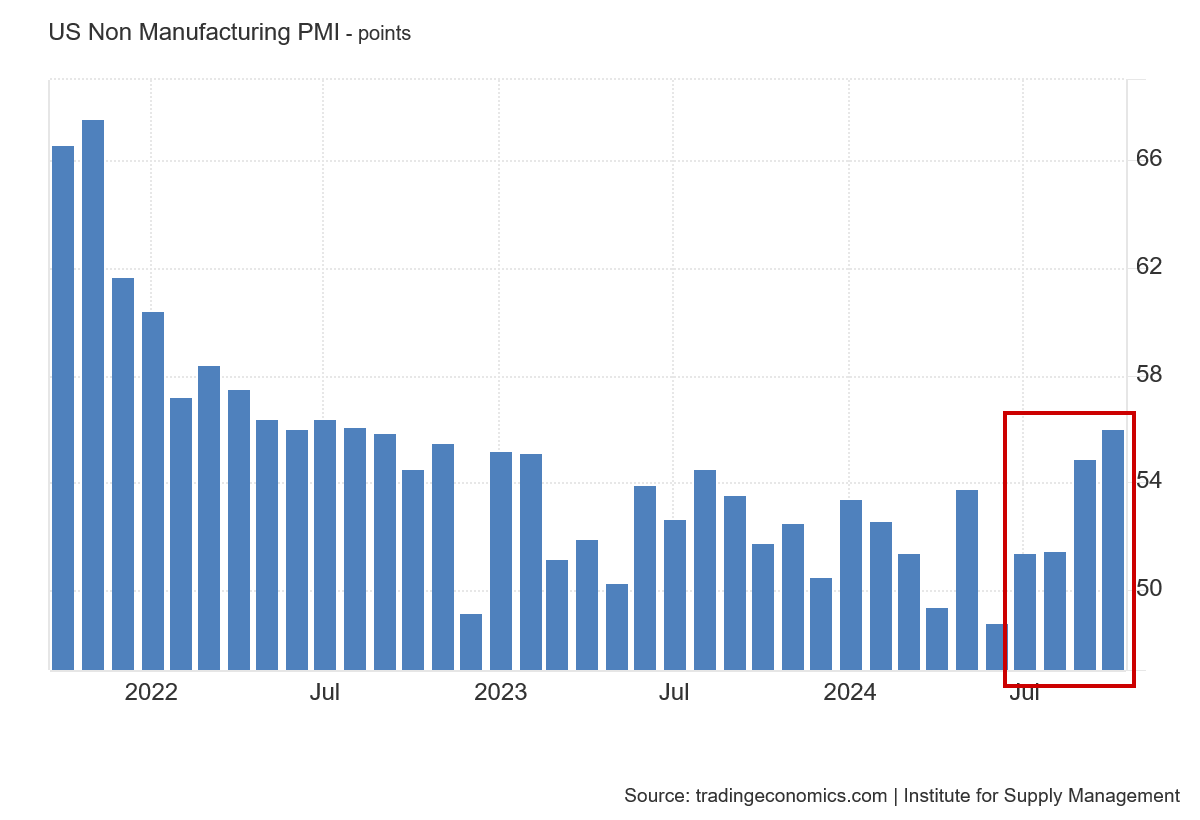

The S&P Global Services PMI data shows services remaining in a strong expansionary mode going back to the beginning of 2023 (with the PMI data sets, any reading above 50 indicates expansion, and any reading below 50 equals contraction).

Even the ISM Services PMI data shows services activity increasing sharpy over the past few months.

According to the ISM data, service pricing has also been expanding of late, which would be an additional inflationary pressure.

The services PMI data stands as an independent confirmation of trends we can see when we look at consumption data from the Bureau of Economic Analysis.

Consumption of—and spending on—services has been at an elevated level going back through 2021 at least.

This sustained demand for services is undoubtedly a large part of why service price inflation has not abated at much as goods price inflation.

Adding to the inflationary pressures on services especially are rising levels of government spending. State and local government spending especially, but also defense spending, has been moving back up again the past several quarters, after having abated from the last half of 2022 through about the third quarter of 2023.

No matter who is in office, rising government spending will always add inflationary pressure to the economy.

The significance of government spending as an inflationary pressure is highlighted by the fact that, for several quarters, government spending has only been outpaced by personal consumption spending on services.

From multiple perspectives and through multiple data sets, we can see there are clear inflationary pressures within the economy, and they are starting to heat up.

Will these inflationary pressures amount to consumer price inflation moving up incrementally in October?

That we have multiple inflationary pressures presenting across multiple data sets from independent data sources means we have to consider the possibility that consumer price inflation will rise. Indeed, we could very easily see consumer price inflation move up by more than the currently projected 0.2pp year on year.

A lot will depend on how much residual energy price deflation we will see for October. Energy commodities prices are showing signs of reaching a market bottom, which will become apparent when we see a period within energy markets where there is no clear price trend up or down.

Once the benchmark prices for crude rise, those increases will ripples through energy markets, and the retail prices for gasoline will also have to rise. We may already be closer to that point as it stands than we realize. Barring a dramatic downturn in benchmark energy prices, however, we are approaching a market bottom for energy prices, and thus the end of energy price deflation is not far off.

The extended energy price deflation we have seen, along with the extended price deflation in durable goods, means that the magnitudes of service price inflation have largely been obscured and thus ignored. Those magnitudes are why core inflation prints consistently higher than headline inflation.

When energy price rises finally do get reflected in the Energy subindex, instead of obscuring service price inflation rising energy prices will come to magnify that.

Will consumer price inflation print at around 2.6% year on year for October? It is possibe. It is, in fact, probable.

It is possible that we will see inflation print at higher than 2.6% year on year.

Whether inflation prints at 2.6% year on year or whether it prints higher, however, Wall Street is right that inflation is going to be rising.

I really appreciate solid data like this, Peter. Decades ago I could find it in the MSM, but now they seem to only push propaganda that supports a narrative. You still have objectivity and integrity. Thank you.

About two weeks before the Election I saw a headline proclaiming that Trump’s tariffs would lead to higher inflation. This was during the campaign-tactic era of ramping up fear porn against “Hitler” Trump, so I didn’t even bother to read the article. However, it does pose the question: do you see anything in Trump’s proposed policies that is likely to significantly affect inflation rates? For example, he had promised to immediately end the wars, so that would dramatically cut defense spending - but he has also spoke of needing to strengthen our defenses (i.e. replenish our diminished armament). Taking all of his proposed increases in spending, such as that amount necessary secure our borders, minus proposed cuts in government employment, from eliminating agencies, and what is likely to be the net effect ? Anything in particular that would affect inflation?