The Bureau of Economic Analysis released its Advance Estimate of 3rd Quarter GDP, and Wall Street was not pleased. A 2.8% annual growth rate was slightly below expectations, leaving them hopeful there would be an upward revision down the road.

GDP growth was slightly less than expected by economists surveyed by Dow Jones. They had expected 3.1% real GDP growth in the third quarter.

Second quarter GDP growth was initially reported as 2.8% and revised upward to 3% in August.

Still, corporate media took comfort that consumption apparently stayed strong.

The report confirms that the U.S. expansion has continued despite elevated interest rates and long-standing worries that the burst of fiscal and monetary stimulus that carried the economy through the Covid crisis wouldn’t be enough to sustain growth.

However, resilient consumer spending, which accounts for about two-thirds of all activity, has helped keep the economy moving, as has a relentless wave of government spending that pushed the budget deficit to more than $1.8 trillion in fiscal 2024.

As long as people are willing to spend money, Wall Street is content.

Should Wall Street be content? No. The GDP numbers are not disappointing—they are alarming. The “disappointing” growth obscures a very real investment deficit in the third quarter.

Wall Street was, for its part, mostly content with yesterday’s GDP release. Equities started out positive and only shifted negative later in the day.

While not supremely enthusiastic, the initial response to the GDP numbers was also not supremely pessimistic.

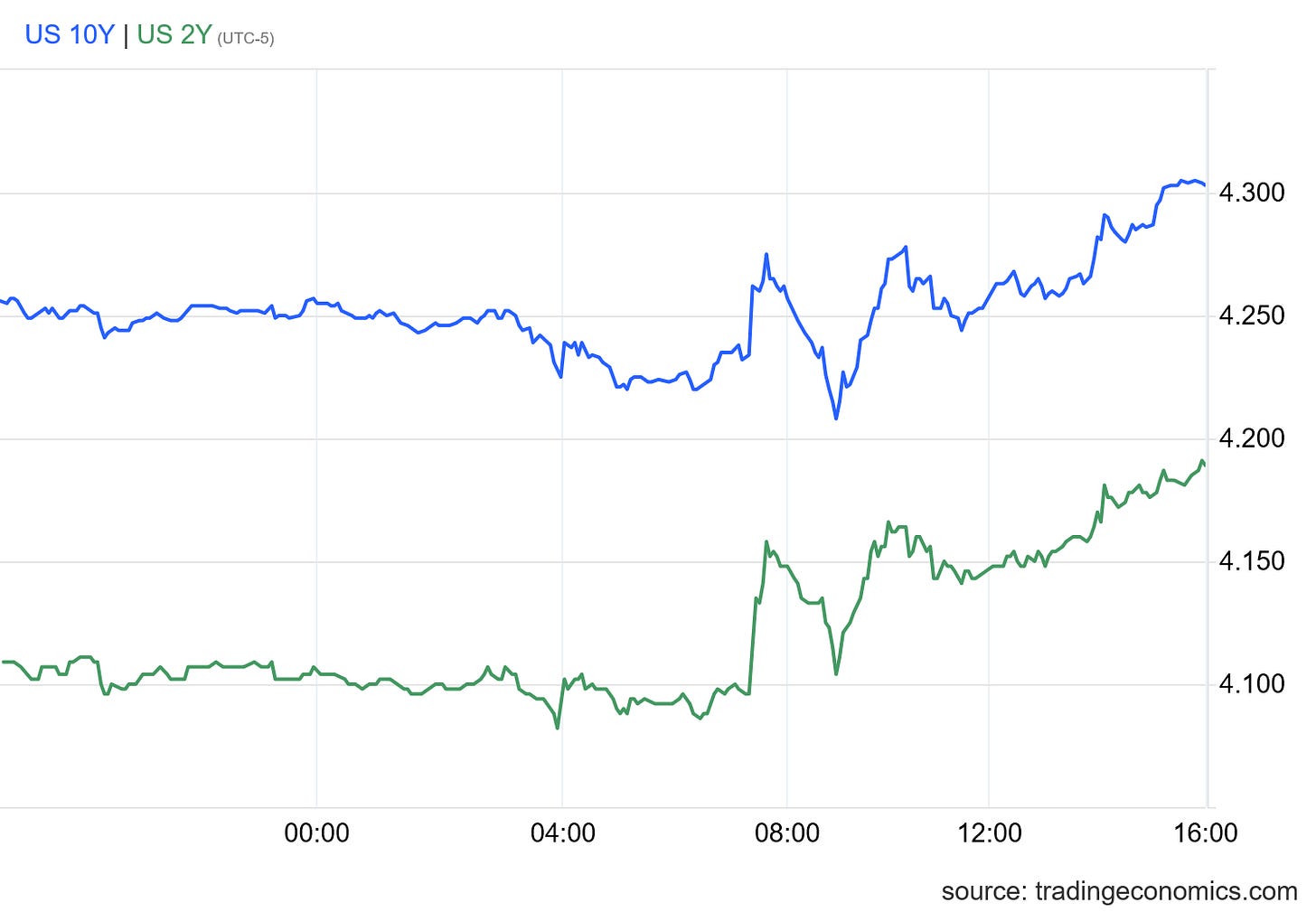

Treasury Yields also rose about 10bps on the day.

Wall Street was slightly disappointed, but not extremely so.

What was in those GDP numbers that almost gave Wall Street pause?

Let’s peel back the layers and see.

The GDP Advance Estimate on the surface is a mixture of good and bad news.

The increase in real GDP primarily reflected increases in consumer spending, exports, and federal government spending (table 2). Imports, which are a subtraction in the calculation of GDP, increased.

The increase in consumer spending reflected increases in both goods and services. Within goods, the leading contributors were other nondurable goods (led by prescription drugs) and motor vehicles and parts. Within services, the leading contributors were health care (led by outpatient services) as well as food services and accommodations. The increase in exports primarily reflected an increase in goods (led by capital goods, excluding automotive). The increase in federal government spending was led by defense spending. The increase in imports primarily reflected an increase in goods (led by capital goods, excluding automotive).

Compared to the second quarter, the deceleration in real GDP in the third quarter primarily reflected a downturn in private inventory investment and a larger decrease in residential fixed investment. These movements were partly offset by accelerations in exports, consumer spending, and federal government spending. Imports accelerated.

Consumption was up, which is overall a net plus for any economy that is driven largely by consumption.

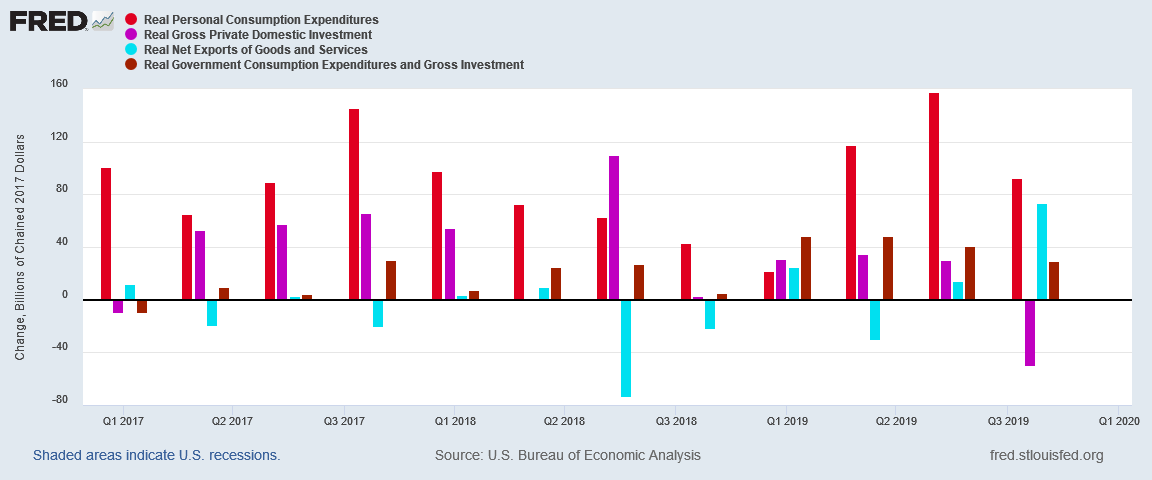

And when we look at the distribution of Real GDP overall, there seems little that changed in Q3 from Q2.

However, things start to look a bit differently when we look at the change in each of these GDP elements.

Most notably, growth in Real Gross Private Domestic Investment practically evaporated between Q2 and Q3.

Real consumption increased, and real government spending increased, but private domestic investment growth is just not there.

Where did private investment go? “Away”, apparently.

Investment in equipment increased after having increased also in Q2, but investment in nonresidential structures as well as residential fixed investment both dropped significantly.

Not only are such declines a drag on private domestic investment, and thus GDP, they are also a reminder that real estate—in particular commercial real estate—could easily devolve into a major financial crisis.

Moreover, the declines have been building all year. Investment spending in the US is right now on the decline. It’s hard to reconcile that with actual economic growth.

As the BEA’s news release stated, government spending was also a contributor to GDP.

In particular, defense spending was where the government chose to put your Q3 tax dollars (and I’m sure everyone agrees that money was always spread around properly!)

Defense spending had actually declined in Q1, but it rose strongly in Q2 and the increase nearly doubled for Q3. As a result of the surge in defense spending, government spending was other major contributor to GDP growth.

Consumption and government spending. That GDP growth during the 3rd Quarter.

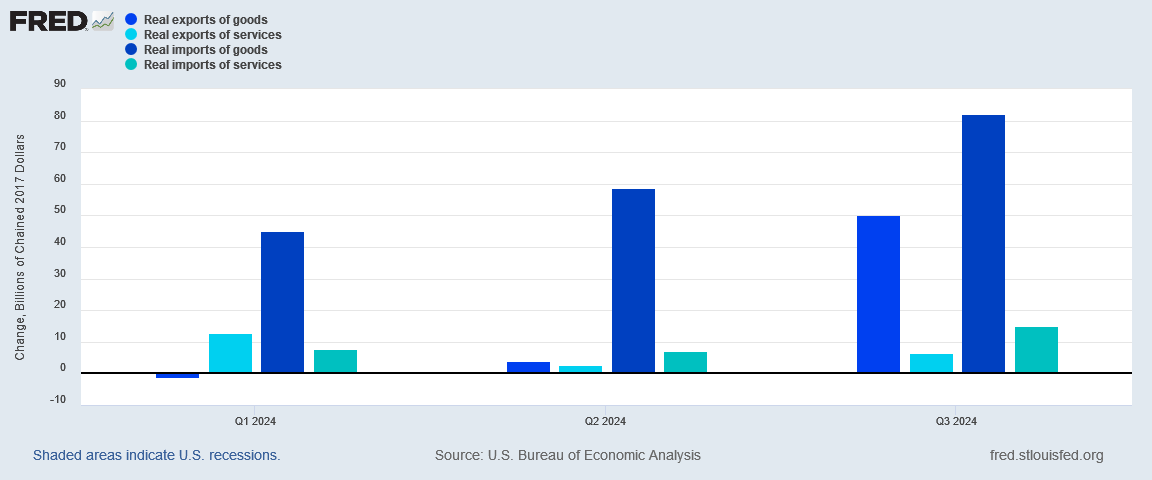

Even at that, however, GDP growth would have been greater had not there also been a surge in imports for both goods and services.

While there is good news in that there was also an increase in exports of goods especially, in the third quarter import growth far outpaced export growth.

Imports are always a decrease in GDP, while exports are an increase. With imports the money goes out, and with exports the money comes in. To grow GDP, the money has to be coming in, and in the third quarter the net of exports and imports was that more money was going out of the US than in the second quarter.

The increase in the exports of goods does call attention to one area of economic growth that is undeniably positive: the consumption of goods.

The personal consumption of goods has been steadily increasing throughout the year.

Increased goods consumption offers a glimmer of hope for manufacturing, which has been languishing in this country for quite some time.

An increase in the consumption of both durable and nondurable goods points to a growing market which in turn has the potential to sustain increased manufacturing.

Intriguingly, America’s languishing manufacturing is the inverse of China’s deflation crisis. China has an abundance of manufacturing but not nearly enough consumption.

The US is experiencing solid growth in demand for goods, which it is currently filling with imports.

China needs to boost consumption. The US needs to boost manufacturing. Guess which one will cost the least and be the easiest to accomplish.

Addressing the imbalance between imports and exports would also resolve imbalances which have long been developing in the US economy’s personal income distribution.

When we talk about income, there is a tendency to focus on wages and paychecks. To be sure, that is where the bulk of the nation’s Personal Income originates. However, it is not the sole source of income for Americans. There are, in fact, several sources.

What matters more for our purposes, is the ratio of each of these income sources to overall personal income.

As with so many things, it’s the relative sizes of income sources that have the greatest economic significance. As aggregate Personal Income grows, the ratio of the individual income sources to Personal Income gives us some insight into the quality of that growth.

It should be intuitively obvious, that Employee Compensation and Proprietor’s Income are income sources which contribute to a higher “quality” of Personal Income than transfer receipts (i.e., welfare and entitlement payments). Employee Compensation and Proprietor’s Income are income sources which indicate growth of a productive economy, where real wealth can be generated and not merely shuffled among individuals.

While income distribution by these sources remained fairly consistent throughout President Trump’s pre-COVID years, post-COVID income distribution has become increasingly distorted.

Since COVID, Employee Compensation has decreased in this country, as has Proprietor’s Income, relative to 2017. Rental Income, Personal Income Reciepts On Assets, and Personal Current Transfer Receipts have all increased.

In other words, people in the US are getting paid less (and less often) to make make things and do things, while passive forms of income (rental properties and investments), are on the rise.

We should note that there was growth in Private Domestic Investment early on in the (Biden-)Harris Administration.

We should also note that growth in Private Domestic Investment tapered off in 2022 and has not really returned—and in the 3rd Quarter it all but disappeared.

However, there was much greater emphasis on investment during President Trump’s pre-COVID economy.

It takes little economics understanding to realize that any economy is better served when the bulk of its people are involved in making “things”. Widgets, gadgets, and doohickeys are what lead to the creation of wealth—physical, long-lived assets that can retain value.

Right now, there is diminished emphasis in this country on producing widgets, gadgets, and doohickeys, even though there is demand for widgets, gadgets, and doohickeys.

This is both a major alarm signal and an opportunity. America needs to be making more widgets, gadgets, and doohickeys—but America has the demand to absorb the production of widgets, gadgets, and doohickeys. This puts us in a much better position than China, which has the capacity to produce widgets, gadgets, and doohickeys but no capacity to absorb them, and no means to boost domestic consumption in order to create the capacity to absorb them.

However, when investment growth disappears, as it did during Q3, then not enough is being done in the economy to spur manufacturing growth. Not enough is being spent on new production plants. Without investment—much of it upfront investment—increases to manufacturing plant are not going to happen.

In the third quarter, investment growth went into an economic black hole.

Why are wages on the decline? No investment.

Why are manufacturing jobs on the decline? No investment.

Why has employment plateaued twice during the (Biden-)Harris Reign of Error? No investment.

Despite all the pontifications from Joe Biden and Kamala Harris about “Investing in America”, what did we see in the third quarter? No investment.

Wall Street looks at 2.8% Real GDP growth and considers it a “disappointment.” I look at 0% Real Gross Private Investment growth and consider it downright alarming.

Why is the economy not doing well? No investment. And the third quarter GDP numbers prove it.

I appreciate you peeling back the layers, Peter. Increased consumer spending doesn’t bode well if it’s being spent on pharmaceuticals and health care expenses (better known as ‘disease management’). And increased government spending doesn’t bode well if it’s just money being given to the bottomless hole of the Ukrainian war. (And by the way, are the government figures adjusted for ACTUAL inflation, or their ‘narrative’ inflation?)

What’s more, the government spending is all increased national debt, which is disastrous for our future. And how much of the consumer spending is just more credit card debt? We know from other reporting that credit card debt is soaring.

We need investment in things that will actually improve our quality of life!

Trump has proposed a policy that will allow buyers of new cars to deduct the interest expense from their taxes - but ONLY if it’s a car made in America by American workers. This will give an incentive to companies such as Toyota to build manufacturing plants in America, and hire Americans as well-paid workers. THIS is the kind of investment-oriented policy that will fuel an actual increase in the American standard of living.

Vote trump!