Corporate Media Gaslighting On Inflation

Personal Income and Outlays Report Does NOT Show Cooling Inflation

Corporate media has lost their damn minds.

Oh, wait, you already knew that. Allow me to elaborate.

Several major media outlets never bothered to actually read the Bureau of Economic Analysis’ Personal Income and Outlays Report for September, choosing instead to just cherry pick the year on year inflation number rather than delving into the entire report.

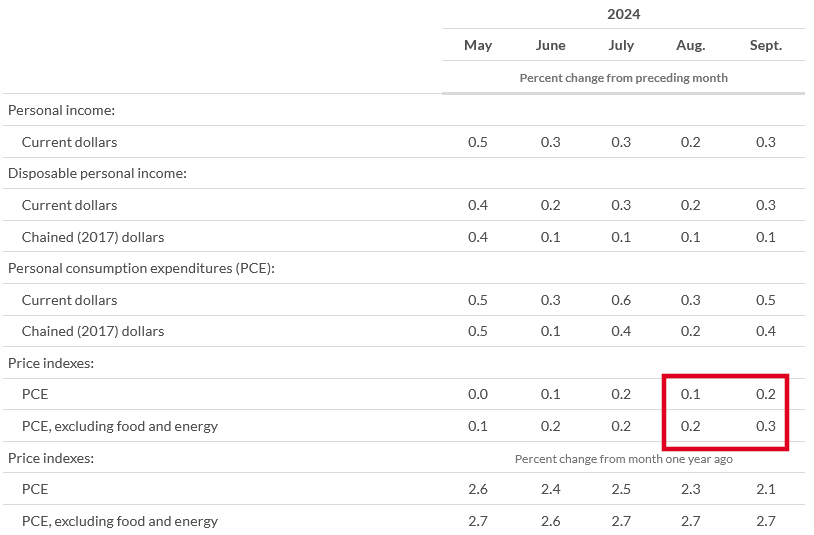

From the preceding month, the PCE price index for September increased 0.2 percent (table 5). Prices for goods decreased 0.1 percent and prices for services increased 0.3 percent. Food prices increased 0.4 percent and energy prices decreased 2.0 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Detailed monthly PCE price indexes can be found on Table 2.4.4U.

From the same month one year ago, the PCE price index for September increased 2.1 percent (table 7). Prices for goods decreased 1.2 percent and prices for services increased 3.7 percent. Food prices increased 1.2 percent and energy prices decreased 8.1 percent. Excluding food and energy, the PCE price index increased 2.7 percent from one year ago.

A number of major media outlets decided to just run with the Year on Year Percent change in the PCE Price Index and announce that there was “cooling inflation”.

And then reality (and the data) set in. As I will now demonstrate.

First, let’s establish what corporate media said to open their reporting.

From CNN:

Inflation has slowed further and is just a hair’s breadth from the Federal Reserve’s 2% target.

The Personal Consumption Expenditures price index, which is the Fed’s preferred inflation gauge, showed prices rose 2.1% for the year ended in September, a slowdown from 2.3% in August, according to Commerce Department data released Thursday.

From the Guardian:

A closely watched measure of US inflation has slipped to its lowest level since 2021, within striking distance of policymakers’ target, after the Federal Reserve scrambled to bring down price growth from its highest level in a generation.

The personal consumption expenditures (PCE) price index rose at an annual rate of 2.1% last month, down from 2.2% in August and in line with economists’ expectations.

Here’s the table from the news release on the BEA’s website.

Note the monthly changes? Even with common core math, 0.2% is larger than 0.1%, and 0.3% is larger than 0.2%.

Month on month, inflation as measured by the PCE Price Index rose in September. Rising inflation is by definition not cooling inflation.

To be fair, CNBC did report the BEA data more or less accurately.

Inflation increased slightly in September and moved closer to the Federal Reserve’s target, according to a Commerce Department report Thursday.

The personal consumption expenditures price index showed a seasonally adjusted 0.2% increase for the month, with the 12-month inflation rate at 2.1%, both in line with Dow Jones estimates. The Fed uses the PCE reading as its primary inflation gauge, though policymakers also follow a variety of other indicators.

Reuters also managed to correctly report the month on month data.

The Commerce Department's personal consumption expenditures (PCE) price index, closely watched by the Federal Reserve, increased 0.2% in September after an unrevised 0.1% gain in August. Economists had forecast PCE inflation climbing 0.2%.

As the headline inflation rate month on month shows, prices are far from coming down across the board. There are some crucial sub-components of the headline inflation rate that do not show any sort of cooling trend.

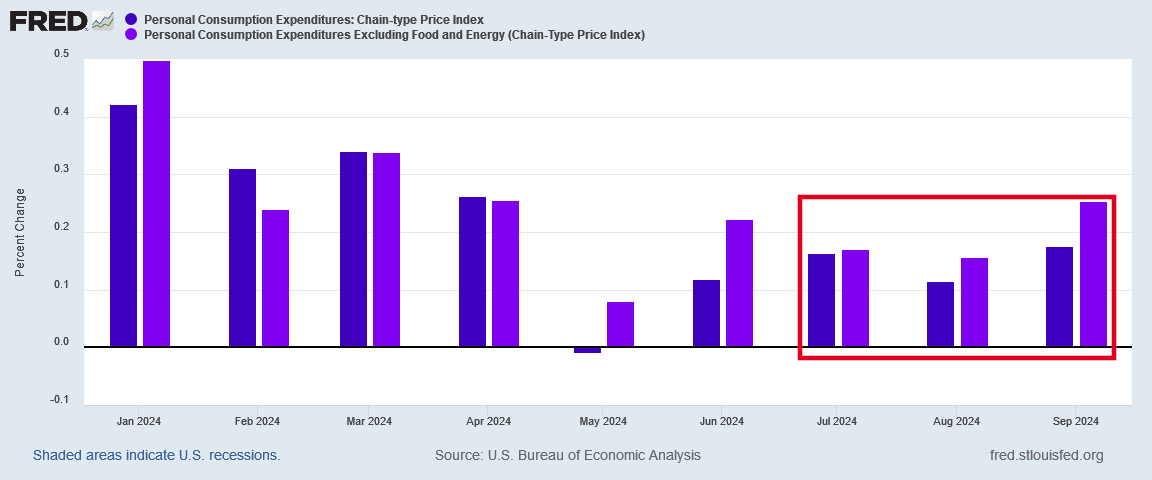

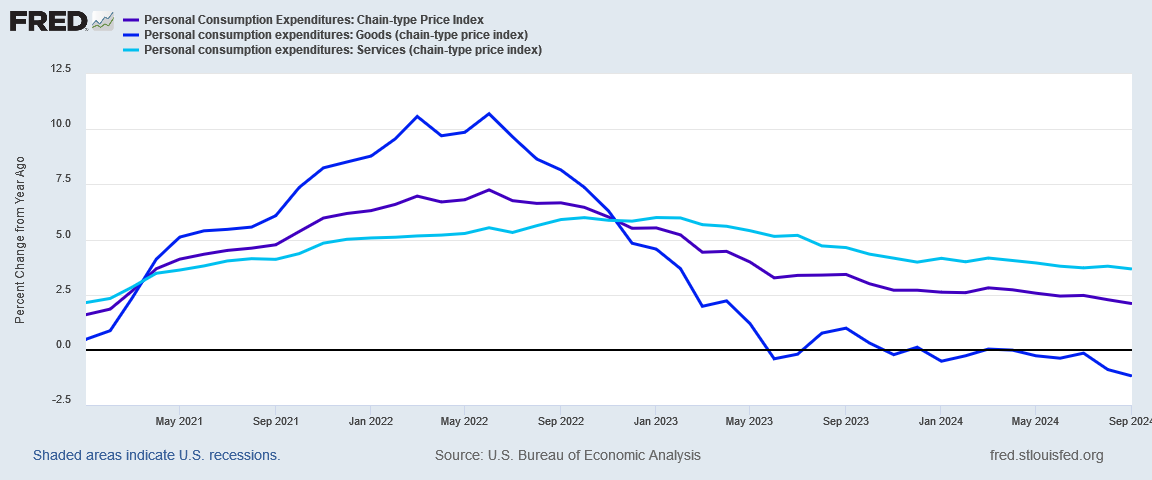

Let us start with the basics—namely, the headline inflation rate per the PCE Price Index and the “Core” inflation rate per the PCE Price Index.

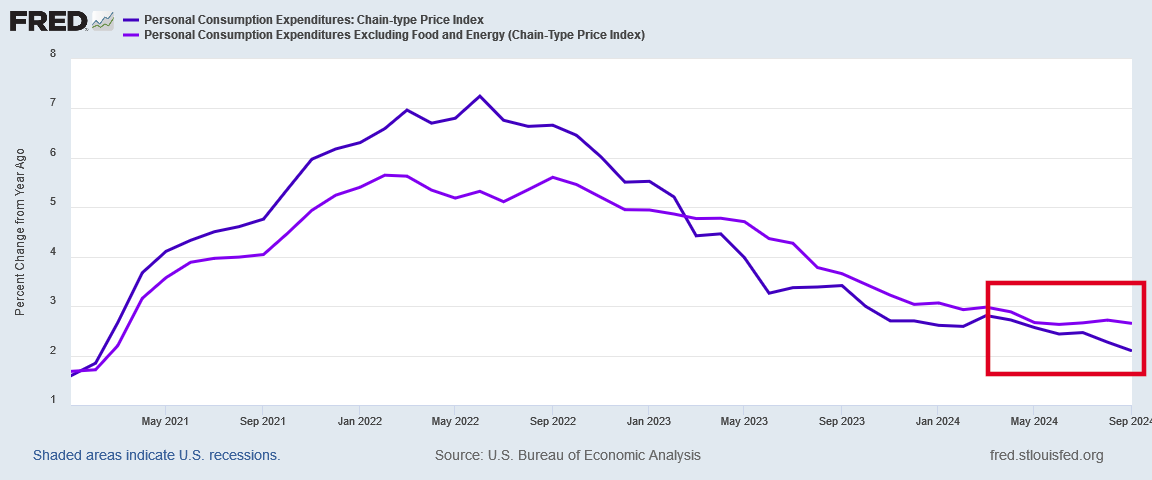

As you can see from the red box on the graphic, September’s month on month inflation rates rose for both headline and core inflation. If we look at the year on year inflation rate at both the headline and core levels, we see that core inflation has been once again moving away from headline inflation, and remains stubbornly well above the headline metric.

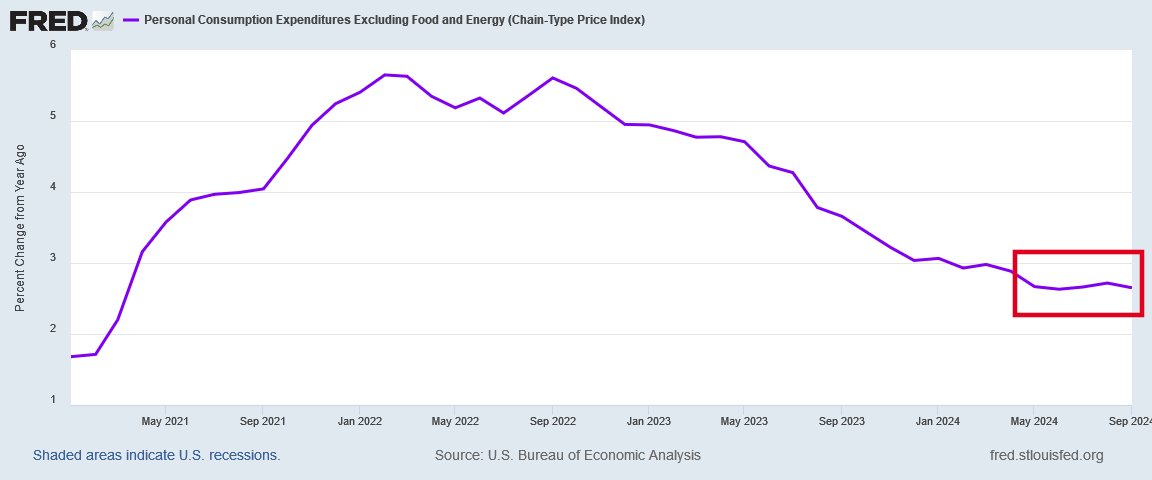

Zeroing in on core inflation, it has not actually moved down since May.

Core inflation is definitely not cooling.

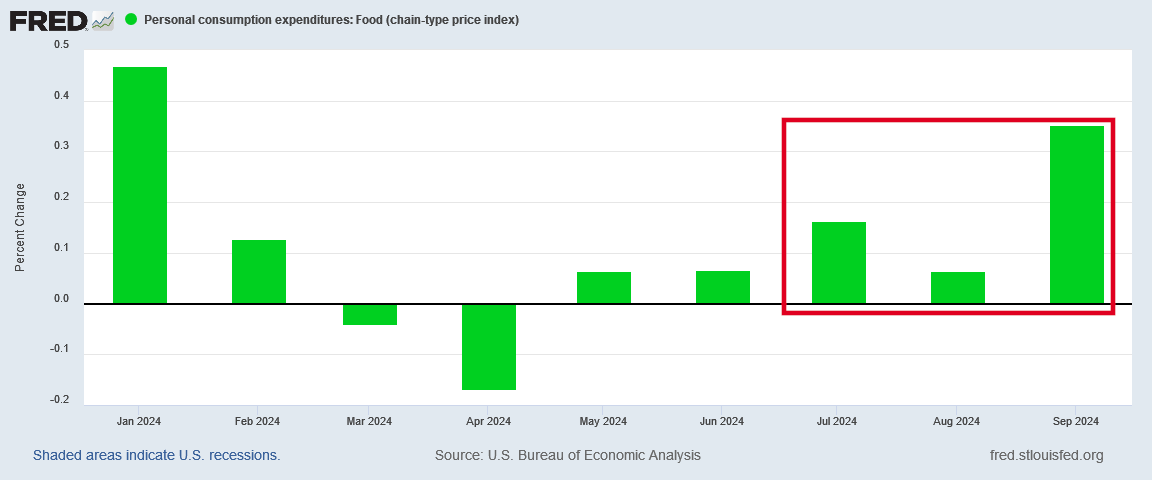

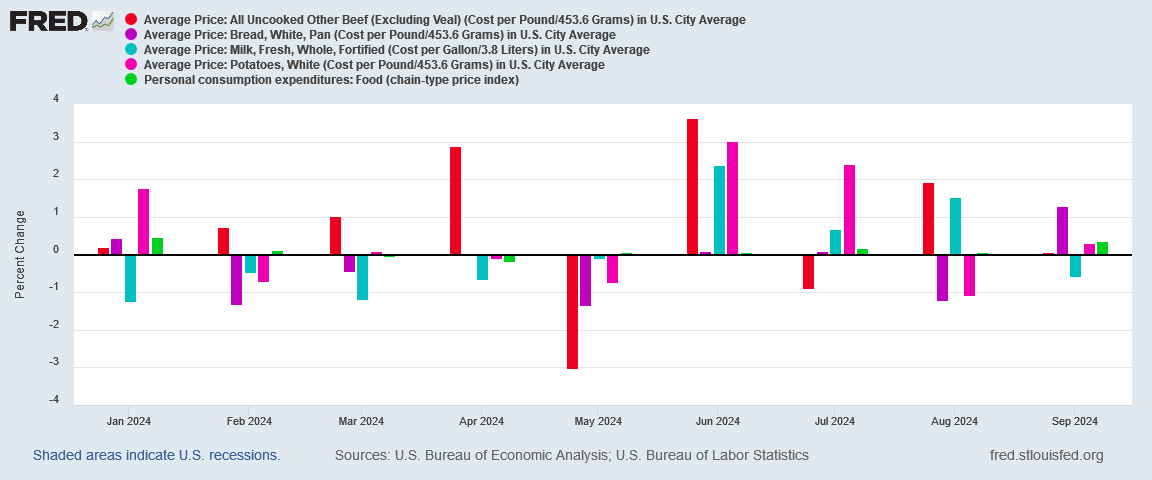

When we drill down further, we see that food prices rose month on month.

Food prices are not cooling.

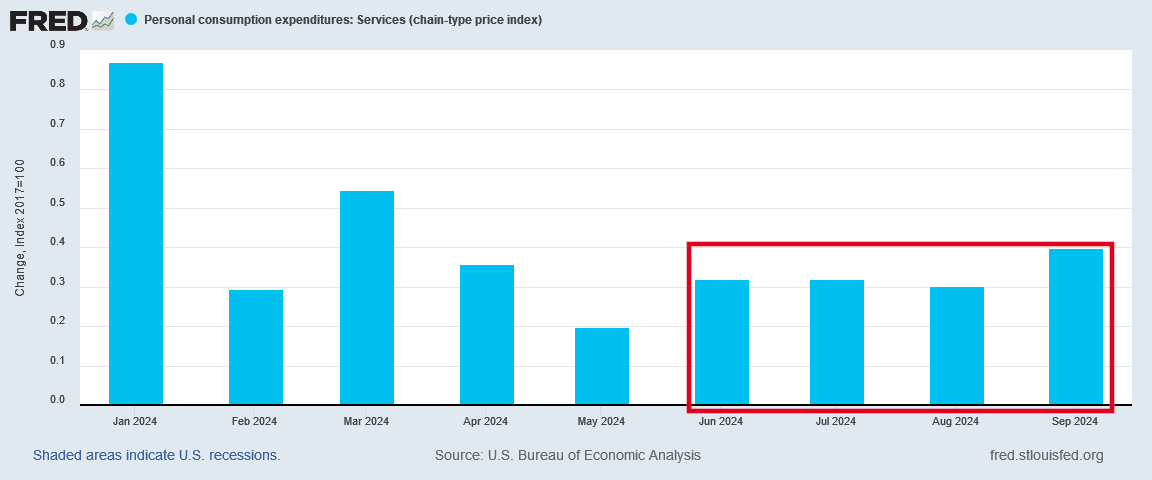

Service prices also rose for the month.

Service prices are not cooling.

Even for corporate media, actual inflation is more than just the headline number, and more than just a cherry-picked year on year headline number. Food prices are important on their own, and not just as a sub-component of overall consumer prices, as are service prices. That these metrics are not cooling down is arguably even more important than having the headline metric moving lower.

Yet time and again, corporate media outlets choose to bury this lede.

One simply cannot properly apprehend the significance of price indices merely by looking at a single dimension of how they change over time. The purpose of an index is to amalgamate into a single rational, comprehensible system the broad shifts of prices within the economy.

Yet that we have two prevalent price indices maintained by the government record-keepers (the Bureau of Labor Statistics and the Bureau of Economic Analysis) illustrates that while we can amalgamate price data into a single indexing structure, we cannot reduce the totality of that data into a single number. The data is simply too vast, too complex, too multivariate for that.

As it is, the price indices are an imperfect proxy for many prices. This is why elements such as the prices for housing end up being trailing markers of inflation rather than current metrics for it. This is also why prices shifts for many individual goods, such as food items, end up being more or less than the shifts recorded by the indices.

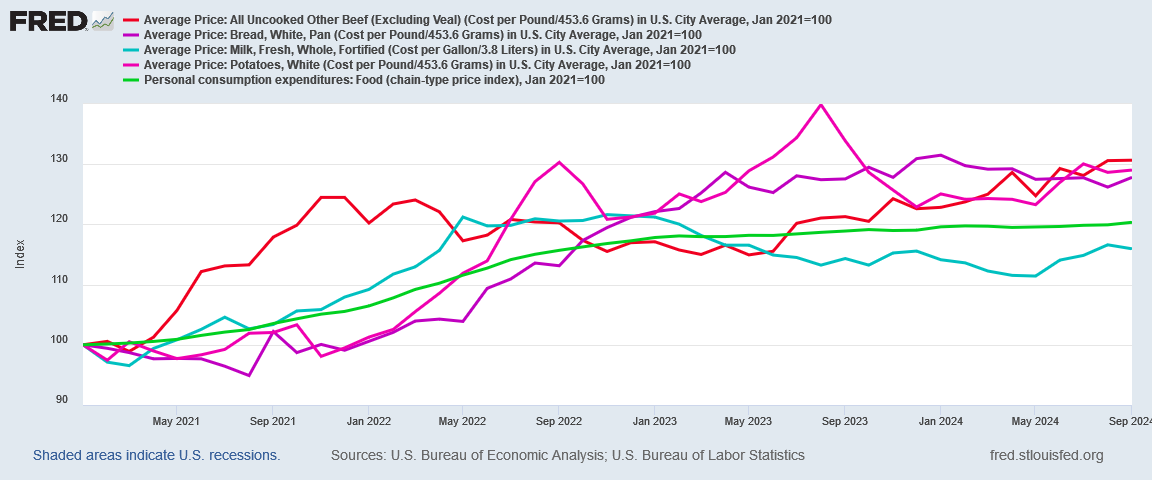

If we take the average prices for the food items I used in my labor cost article a few days ago and index them to January, 2021, we see that only the price of milk has risen less than the food sub-index within the PCE Price Index system.

Mind you, this is with the PCEPI Food sub-index showing an increase in food price inflation.

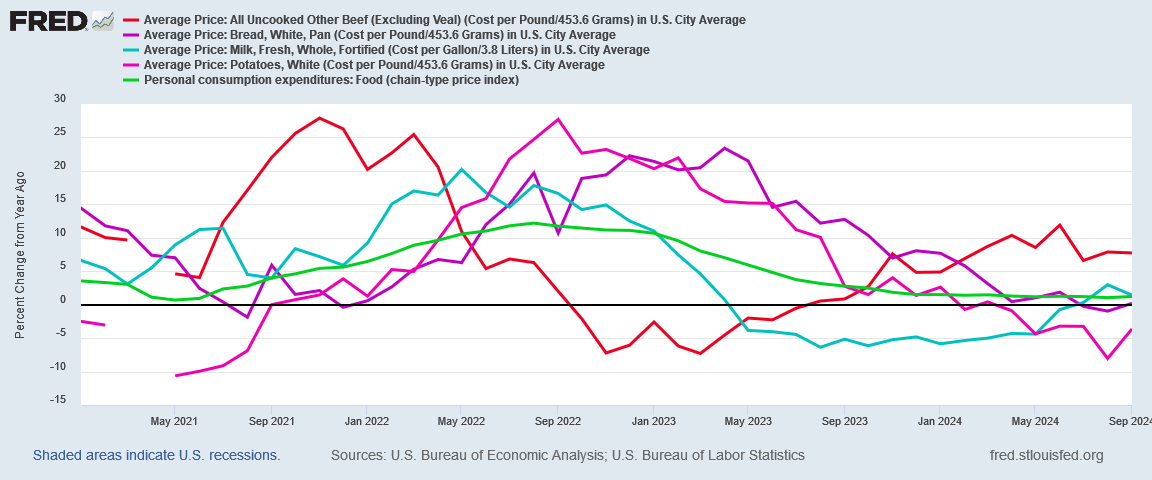

Even when we look at the year on year percentage change in the prices of those food items, we see that the inflation rate for those individual items was considerably higher than that recorded by the food sub-index itself.

Month on month, inflation for individual food items can greatly outpace inflation for the PCEPI Food sub-index.

This is normal price behavior for all individual goods and services, not just food prices. Depending on which items one is purchasing at any given moment will determine whether one broadly experiences rising prices or falling prices.

As I have pointed out many times before, the constant caveat with price indices is “your mileage may vary”.

This is a point that is not merely worth noting, it is essential to both a proper understanding of consumer price indices and to applying that information effectively in daily decision making.

As a side note, it is this elevated degree of price volatility that leads economists to exclude food prices along with energy prices to arrive at “core inflation”. As the year on year chart shows, it can be difficult with food prices to identity a clear pricing trend.

Consumer price inflation is not a singular monolithic quantity to be measured in a single dimension by a single number. This was one of the criticisms originally applied to the Federal Reserve’s policy of implicit inflation rate targeting as far back as the 1990s1.

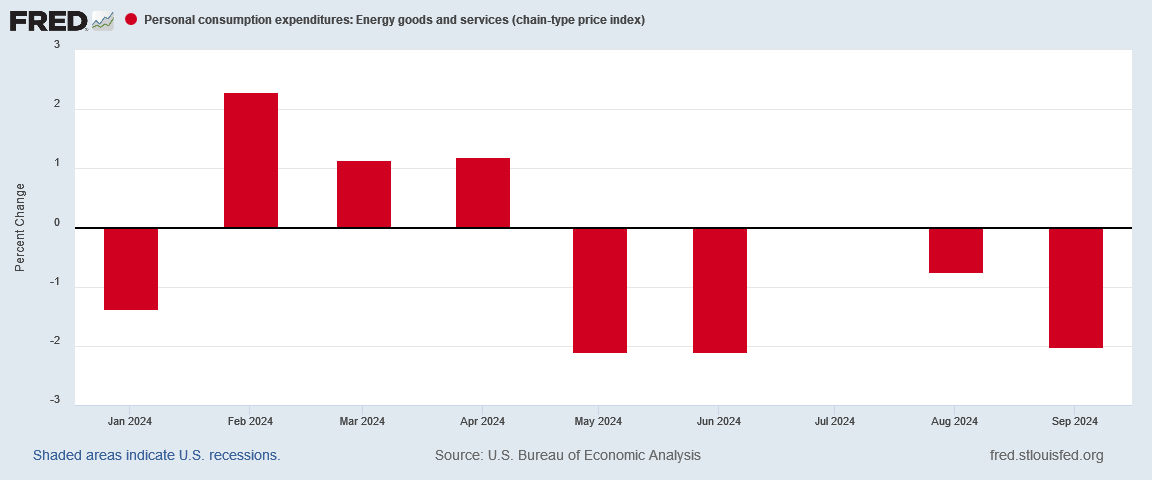

Moreover, as much as we need to understand the ways in which consumer price inflation is heating up in the economy, we also need to understand the ways in which not only are we seeing a declining rate of inflation (“disinflation”), but out right price deflation.

Service prices are rising—and truthfully service price inflation has never really cooled—but goods prices have been in deflation for some time now.

At the same time, energy price deflation is a major reason the headline inflation numbers are as low as they are.

Without energy price deflation month on month especially in recent months, the overall inflation metric would be considerably higher.

These are not mere nuances, but illustrations of the forces of both inflation and deflation, and how they operate simultaneously, which some prices rising and other prices falling.

There is no good reason for anyone to make any single component or measurement of any price index the focus of an assessment on consumer price inflation. It takes little effort to articulate the distinctions and differentiations being made to discuss multiple dimensions of the monthly changes in consumer price levels.

Moreover, focusing on the year on year changes in the headline inflation metric paints an inaccurate picture of what is happening with regards to consumer price inflation. Inflation is not “cooling”, and a fuller interrogation of the data behind the PCEPI shows it.

Energy prices are down. So are goods prices. Service prices, however, are not. Food prices are not.

Service prices have been rising at an elevated pace well above the Fed’s 2% target for inflation literally for years. Service price inflation can hardly be said to be “cooling”.

Food price inflation was measurably worse than overall inflation at its peak during 2022’s hyperinflation cycle, and it is rising again. Food price inflation can hardly be said to be “cooling”.

On balance, prices within these individual sub-indices rose or fell enough so that when the sub-indices are amalgamated into the overall PCE Price Index, the year on year inflation rate has come down. On balance, the core inflation metric stayed the same, year on year. On balance, both inflation metrics rose month on month.

Should energy prices resume a steady rise, however, year on year inflation will rise as well. Should energy prices resume a steady rise, we may also see a rise in the prices of physical goods, as energy is an input cost for all manufactured items. Just that minor shift in overall prices would be enough to cause the overall consumer price inflation rate to start rising again.

Just the fact that we have to care what food prices do separately, and what energy prices do separately, is proof enough that consumer price inflation overall is not “cooling”. Price rises are large enough and widespread enough that consumers are of necessity more price conscious than pre-COVID, and more attuned to fluctuations in prices.

What makes low inflation desirable in the overall economy is that it de-prioritizes consumer estimation of future prices in purchasing decisions. In a low inflation environment we are less motivated to make purchases soon than we would otherwise like strictly on the belief that the price next month will be greater. If consumers are focused on where prices are likely going to be in the future, inflation itself can hardly be said to be “cooling down”.

Inflation is in multiple political opinion polls defined as a leading if not the leading issue in this year’s Presidential election. That fact alone tells us that consumers are extremely price conscious at the moment, and far more likely to be heavily influenced in purchasing decisions by estimations of where prices will be next week or next month.

The PCE Price Index rose in September. It rose by a percentage since September of 2023 that was less than the percentage it rose in August since August of 2023.

It also rose by a greater percentage in September than it did in August.

So did food prices.

So did service prices.

Corporate media ignored the latter three reported results to focus on the first, and portray that as the “true” state of the US economy.

In that, they’re simply wrong—and the media outlets pushing that nonsense are simply gaslighting you.

Wells, M. “The Origins of the 2 Percent Inflation Target.” Econ Focus, First/Second Quarer 2024, https://www.richmondfed.org/publications/research/econ_focus/2024/q1_q2_federal_reserve.

You are so valuable to America to dig into the details and break apart the lies, half-lies, and propaganda, Peter. Thank you always for this!

Now the question is: how severely will this gaslighting affect the election? How annoyed, resentful, and angry are voters at the Biden/Harris administration for the continuing lies and distortion? My guess is that huge numbers of people are feeling, “this is bogus, man - I’m done with them!”

We’ll find out in a few days. I’m planning to vote today, and my vote will be for Trump!

Any family or person who eats could have told you that, no disrespect. I paid $1.30 more for my usual deodorant today than a few months ago. Not okay