Not that Dementia Joe’s handlers give a damn, but I get to take a small victory lap over the latest Consumer Price Index data, which for March showed a lot of ugly inflation coming back.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in March on a seasonally adjusted basis, the same increase as in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.5 percent before seasonal adjustment.

The index for shelter rose in March, as did the index for gasoline. Combined, these two indexes contributed over half of the monthly increase in the index for all items. The energy index rose 1.1 percent over the month. The food index rose 0.1 percent in March. The food at home index was unchanged, while the food away from home index rose 0.3 percent over the month.

Readers will note that on Tuesday I predicted an ugly CPI report.

Oil prices are on the rise, due to tightened oil supplies. Because of that, inflation is also on the rise, Given the pace of recent oil price hikes, I would not expect the Consumer Price Index to escape a similarly accelerated rate of increase when it gets published tomorrow.

Oil prices are getting ugly. Gasoline prices are already ugly. Expect the CPI to be ugly as well.

Even the Bureau of Labor Statistics has had to concede that energy prices are a main factor in the energy price increases for the month.

Thus the title of this article: “I told you so.”

Naturally, March’s inflation reading was not what either corporate media nor the “experts” anticipated.

Gas and shelter costs contributed more than half of that monthly increase, but price increases were broad-based, according to the BLS. Aside from prices falling in only a couple of categories — used and new cars as well as fuel oil — or remaining flat (grocery store food), prices rose in pretty much every major category last month.

Economists were expecting a 0.3% monthly increase and an annual rate of 3.4%, according to FactSet consensus estimates.

If that really is the case, then every Wall Street economist and economics reporter working for corporate media deserves to be fired forthwith.

Every hedge fund manager probably should be fired as well, for the sudden sell-side exposures they experienced once the Bureau of Labor Statistics published the CPI report.

All the major indices dropped at the opening bell and stayed down throughout the trading day yesterday.

The 10-Year Treasury yield surged above 4.5%, mirroring the stock market’s very negative reaction to the inflation report.

Corporate media and the Wall Street “experts” would like you to believe this was unexpected and unforeseen. If you have been reading this Substack for a while, you already know to call “BS” on that. They knew, or they should have known. This inflation reading was that foreseeable.

What makes their collective display of shock and disappointment not credible is the reality that inflation has been heating up for quite some time.

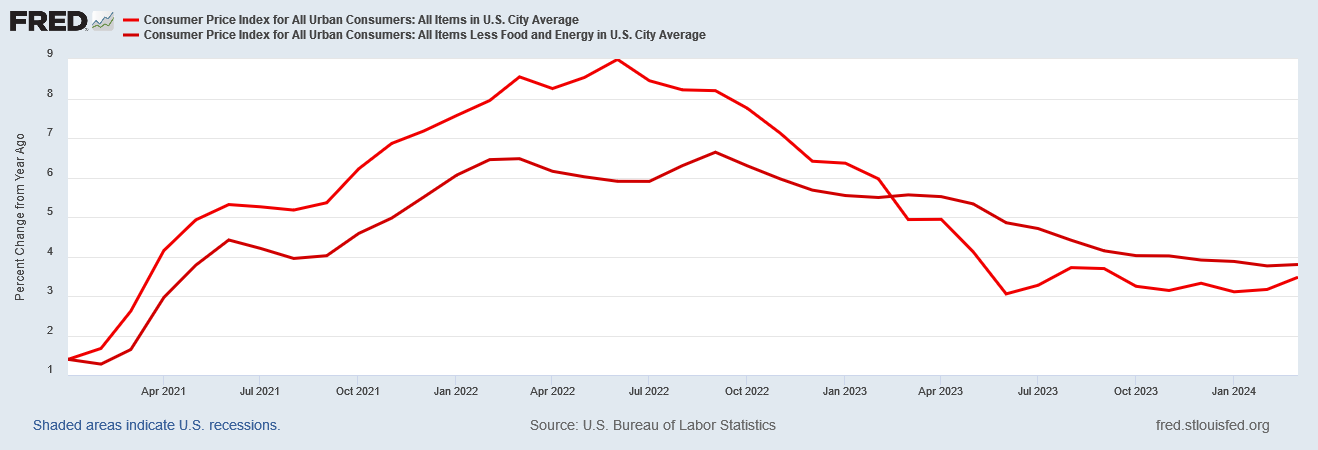

Year on year consumer price inflation per the CPI actually bottomed out in June of last year, and has been working its way upward ever since.

What is notable about the March data is that rising prices finally pushed the “core” inflation metric up as well. This also was inevitable, as factory gate inflation—a prelude to consumer price inflation—has been signalling higher prices.

Even month on month inflation has been moving up in recent months.

Month on month consumer price inflation bottomed out in October 2023 and has been trending up ever since.

Quick note on the data: the FRED data carries the percentages for both month on month out to the fifth decimal place, while the BLS CPI report rounds everything to the nearest tenth of a percentage point. Thus we get the CPI report saying the month on month inflation metric was 0.4% for both February and March, even though the FRED data shows March printing a few basis points below February.

Perversely, this time around there just isn’t much to say about the CPI report, because I have been saying it for some time now: energy prices are causing inflation to come back in a significant way.

A quick look at Brent and West Texas Intermediate prices is all that is needed to see oil rising steadily since the beginning of the year.

More importantly for assessing the probability of future price hikes, these prices exceed the previous high peak in September of last year.

Gasoline prices have also followed the same broad trajectory—up.

With oil prices being pushed up, it was only a matter of time before the Consumer Price Index would capture the prices rises. That is exactly what has been happening with the CPI the past few months.

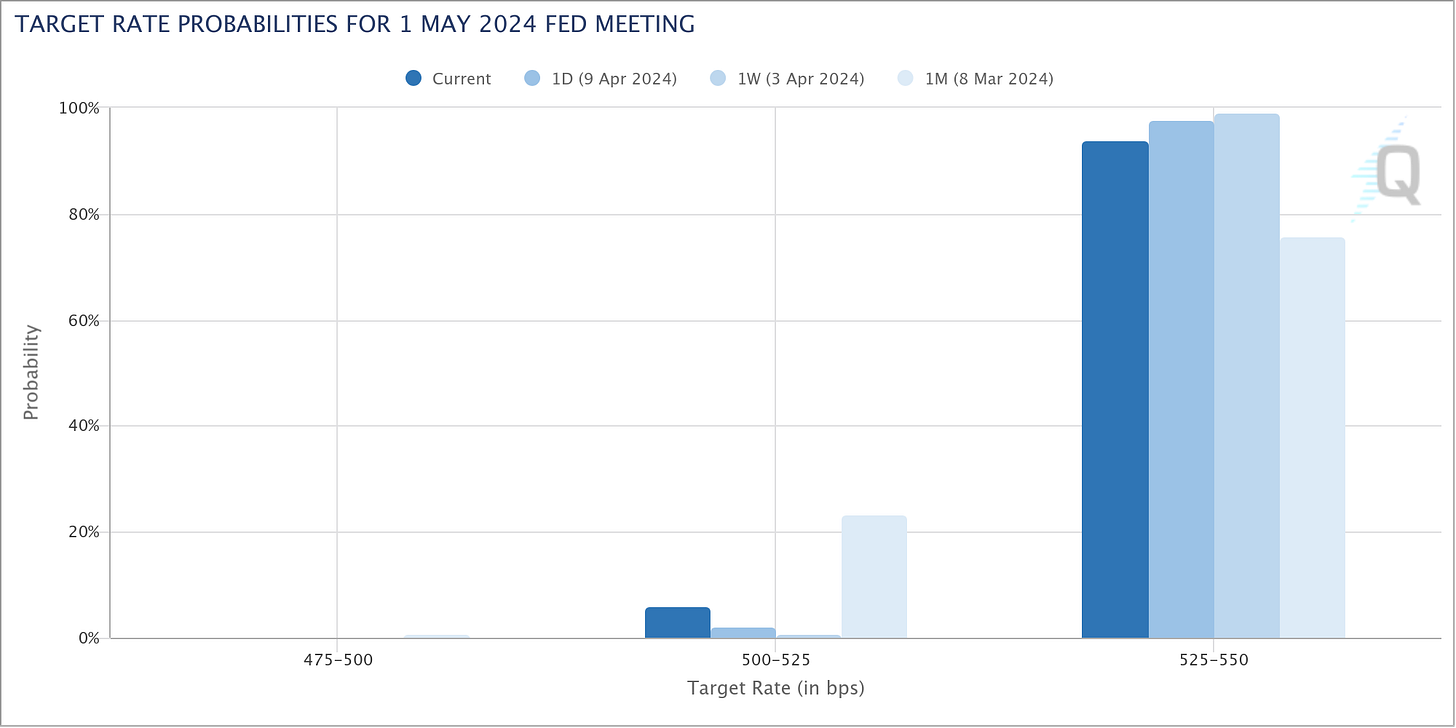

For its part, the Federal Reserve has been steadily walking back any talk of a June rate cut, and Wall Street at this point has priced in the Fed keeping the federal funds rate steady at the next FOMC meeting in three weeks.

The real takeway from the March CPI data is not that inflation climbed sharply—that was a foregone conclusion—but that it reveals the Fed to be completely trapped by its rate hike strategy.

“You can kiss a June interest rate cut goodbye,” Greg McBride, chief financial analyst for Bankrate, wrote in commentary issued Wednesday. Following the report’s release, the markets’ probability of a June rate cut sank to 21%, down from 53% on Tuesday and 73% last month, according to the CME FedWatch tool.

This, of course, comes as no surprise here, for I have long argued that the Fed was not really in control of either interest rates or inflation.

Inflation rose in March. That’s the bad news.

Oil is surpassing its 2023 peaks and shows every indication of moving north of $100/bbl. That’s the even worse news.

But the worst news coming out out of the CPI report is that the Fed has no tools left to use to tame this resurgent inflation. Yes, the Fed could try raising the federal funds rate drastically, but the punitive rate hikes that the Fed would have to utilize would almost certainly trigger another banking and liquidity crisis.

The Fed is powerless to do anything about rising inflation. It can’t even pretend to address inflation with a series of small rate hikes to at least give the illusion of an engaged Fed attempting to corral inflation.

Get used to the higher inflation rate. It is quickly becoming the “new normal”, and at present there is little the Fed can do to change that.

Congratulations, Peter, on being proven right yet again! Your regular readers are not surprised, but we are continually IMPRESSED. I have thought many times, boy, I should have to be paying big money to get economic analysis this good, (And yes, that’s a nudge, nudge to anyone thinking of upgrading to paid subscriber!)

Think how angry this inflation is going to make voters. They have been repeatedly assured that everything’s coming up roses in the Biden Fairyland, but no, it’s more aggravating financial hardship - grrr! Ka-Ching for Trump and Kennedy!

Another topic that you have been correct about, Peter is the ongoing decline of China’s economy. Have you seen the numbers in this:

https://www.theepochtimes.com/china/chinas-economy-is-showing-5-signs-of-major-monetary-shortfalls-experts-5622362?utm_source=ref_share&utm_campaign=copy

China’s M2 has risen from $1.8 trillion at the end of 2000, to $41.5 trillion at the end of Feb, 2024. It’s now 2.3 times it’s GDP, as compared to the M2 of the US being 0.76 times our GDP. You called it, Peter - China is in deep trouble!

So, I’m still left speculating on how China’s problems will affect our own economy. They will probably try to dump more goods on us, which is likely to lead to higher tariffs. But any evolving thoughts on deflation contagion and so on?

If this rate of inflation keeps up, the Cost of Living Adjustment for Federal fixed incomes will have to be generous for the beneficiaries to be able to deal with the consequences. Unfortunately given the government tendency to cheat actual Americans to benefit the various entities infiltrating the US, I have a feeling that the government is going to attempt to defer the adjustment somehow.