Oil prices are surging lately. Gas prices are climbing. We only need to look at the financial media to see the first, and we only need to look at the nearest gas pump to see the second.

The surge in oil prices is definitely catching the financial media’s attention, as OPEC has finally found a level of production cut to tighten supply sufficiently to elevate crude prices, and the world geopolitical situation seems to be getting more tense rather than less. The end result: oil prices keep climbing.

Crude oil prices were on track to book their second weekly gain in a row, driven higher by geopolitics and supply concerns.

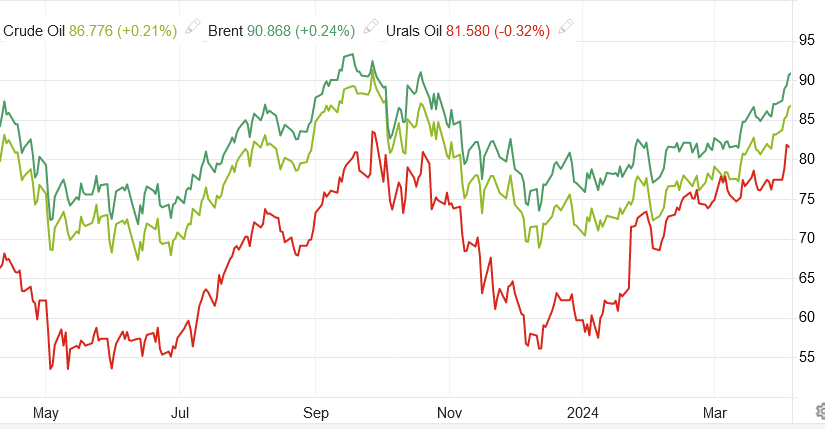

Early on Friday morning, Brent was trading above $91 per barrel and West Texas Intermediate was closing in on $87 per barrel. The rally came amid reports that Russia may have temporarily lost as much as 15% of its refining capacity because of Ukrainian drone attacks and Iran vowed to exact revenge on Israel for the strike of its consulate in Damascus.

"Oil prices look set for further upside in the short term as a more positive economic backdrop is joined by ongoing supply tightness and rising geopolitical risks," analysts from ANZ said, as quoted by Reuters, revising their three-month price forecast for Brent crude to $95 per barrel.

Energy prices have been the driving force behind inflation’s rise and fall over the past two years. With energy prices on the rise, expect consumer price inflation to be significantly on the rise.

More precisely, expect an ugly increase in the CPI when it is released tomorrow.

One reason oil prices are going up is because oil exporters are raising their prices. Specifically, Saudi Arabia’s state oil company Aramco has been boosting the price of its flagship Arab Light blend.

Saudi oil giant Aramco, the world’s top crude oil exporter, hiked on Friday the prices of most of its crude grades for May, as Middle Eastern benchmarks are strengthening in a market that looks increasingly tight.

For a second consecutive month, Saudi Arabia raised the price of Arab Light, its flagship grade selling in Asia, by more than expected.

Aramco set the official selling price (OSP) of Arab Light for Asia for May by $0.30 per barrel to a premium of $2.00 over the Oman/Dubai average, the benchmark off which Middle Eastern crude going to Asia is priced.

It says much that the Saudis have the pricing power to be able to raise the price of their benchmark blends. This is pricing power the OPEC countries did not have one year ago. At that time their production cuts had more of a defensive aspect to them, as OPEC attempted to stabilize oil prices in anticipation of a decline in global oil demand.

Far from flexing their market muscles, OPEC+ is most likely attempting to maintain a solid floor price for oil by reducing output to compensate for a global demand outlook that is quite likely to trend down. While their production cuts may have exerted just enough pressure on global oil prices to break through the Russian price caps—making Russia a clear beneficiary of OPEC’s decision, perhaps moreso than even the Persian Gulf OPEC members—the overall positioning by OPEC of the production cuts is more in line with a defensive effort to prop oil prices up.

It is pricing power that was not obvious at the end of last year even.

With the Chinese economy facing an extended period of consumer price deflation, with the US demonstrably mired in a recessionary stagflation in spite of the increase in oil production, with Europe ever on the brink of recession, the global economy is facing a near perfect storm of recessionary forces from literally all directions. There is not, at present, a major economy that has the upward trajectory necessary to prevent a recession and economic contraction from taking hold globally.

Without economic expansion somewhere within the major economies of the world, the only place for oil prices to go from here is down. Economic contraction worldwide invariably means less oil demand worldwide, which invariably means lower oil prices worldwide.

Now the Saudi’s have that pricing power, and they are using that pricing power.

And oil prices are rising everywhere in direct consequence.

The Saudis gained that pricing power after announcing and then implementing (and then extending) a series of production cuts beginning this time last year.

The first 500,000bpd production cut was announced in March of 2023, and coordinated with Russia, which had earlier announced its own 500,000 production cut.

At the time, the production cuts did not move the needle much on prices, and certainly not in any permanent way—in large part because they only existed on paper.

It is also important to note that a Russian production cut of 500,0000bpd in March never actually showed up in the export volumes.

Shipping data for March indicate that exports are steady despite Moscow’s stated intention of reducing them by 500,000 b/d.

While Russia may be extending the policy, it remains to be seen how much that will translate into actual production cuts. Similarly, other OPEC+nations have been seen exceeding their agreed-upon production quotas, making the Saudi 500,000bpd cut as well as the cuts announced by other OPEC+ nations somewhat problematic.

Elsewhere, Kuwait’s oil ministry said the country will cut 128, 000 barrels a day, while the United Arab Emirates said it would cut its production by 144,000 barrels a day, according to a statement by Energy Minister Suhail Al Mazrouei, reported by Attaqa Breaking News. Oman said it would implement a voluntary cut of 40,000 barrels a day. Kazakhstan said it would cut by 78,000 barrels a day and Algeria said it would cut by 48,000 barrels a day.

The U.A.E., for example, was seen producing around 200,000 barrels a day above its target for a few months, while Russian output in March didn’t see the full 500,000 barrel-a-day reduction announced in February, [Giacomo] Romeo noted.

Thus, while on paper the OPEC+ cartel is announcing production cuts amounting to more than 1,000,000bpd, in reality the actual reduction in production could very well be much less.

By late June, however, the combined Russian and Saudi production cuts began to have an effect.

The production cuts are pushing up oil prices. That much is fairly certain. Everything else remains uncertain. Whether oil demand in the second half of the year will rise as forecast even with significantly higher prices remains very much to be seen. With China slipping into deflation and the US not far behind, forecasting increased oil demand going forward could prove to be mostly wishful thinking.

Yet at first, the cuts did little more than establish a floor price for oil, as we can see.

Throughout the summer, oil prices managed to rise somewhat, only to trend down again in the fall.

As we can see in the chart, prices have been rising since late December, and Brent Crude has now surpassed its highest prices of 2023—and it is still going up.

Even Russian crude has enjoyed a resurgence in price, oil price cap be damned, as their benchmark Urals Blend has shattered that cap beyond all recognition.

In the minds of some analysts, these price increases are driven more by the stark headlines coming out of the Middle East.

"It's headlines, not fundamentals" that lifted WTI, Mizuho's Robert Yawger says, adding the biggest impact by the Middle East conflict has, so far, been to raise the cost of transport and insurance for ships plying the Red Sea. However, he has conceded that the latest strike in Syria "just ticks that much closer to dragging Iranian production into the conflict. Despite a flurry of diplomatic activity meant to turn down the heat on the situation, there is definitely a chance the Iranians response will not be as measured this time," Yawger says.

Granted, when we see headlines about Iran vowing retaliation against Israel for having destroyed the Iranian embassy in Damascus, it is easy to understand why headlines would be driving up oil prices.

Iran has vowed to retaliate after it accused Israel of bombing its embassy complex in Syria on Monday, in a deadly escalation of regional tensions over the war in Gaza that once again appeared to raise the risk of a wider Middle Eastern conflict.

The airstrike destroyed the consulate building in the capital Damascus, killing at least seven officials including Mohammed Reza Zahedi, a top commander in Iran’s elite Revolutionary Guards (IRGC), and senior commander Mohammad Hadi Haji Rahimi, according to Iran’s Foreign Ministry.

At least 6 Syrian citizens were also killed, Iranian state television reported on Tuesday.

Iran rattling its saber against Israel may be just a headline, but it is the latest increase in geopolitical tension and geopolitical risk to oil supplies—and that is going to push prices up.

Regardless of the impetus behind the rise in oil prices, what matters most is that oil prices are rising.

That means inflation, which has been rising, will continue to rise.

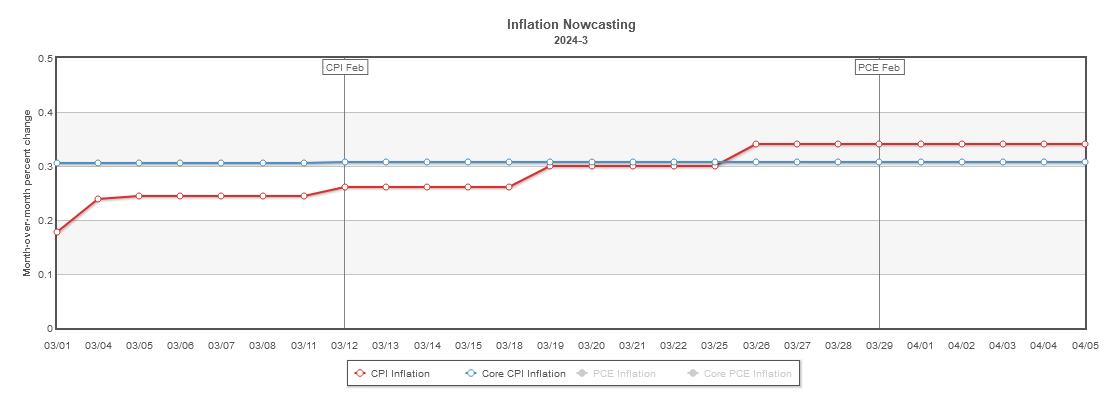

Even the Cleveland Fed’s InflationNow CPI nowcase is anticipating a healthy rise in month on month consumer price inflation for the month of March.

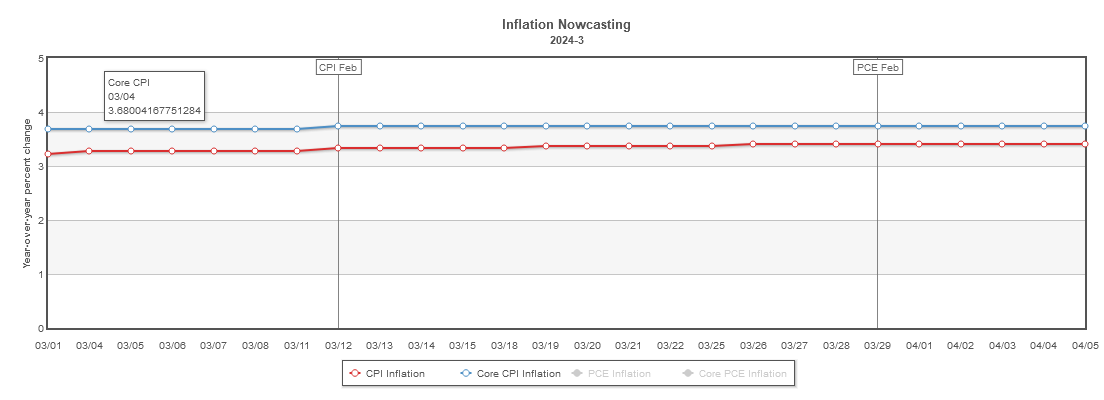

The year on year consumer price inflation nowcast anticipates a similar upward shift.

With inflation already on the rise because of the oil price rises to date, if anything the Cleveland Fed is understating the impact oil prices are about to have on inflation.

Between fears of $4/gal gasoline and $95/bbl oil or even $100/bbl oil, we should also squeeze in fears of 4%, 5%, and even 6% year on year consumer price inflation. Oil prices and inflation both have similar trends already just for January and February.

Oil prices are on the rise, due to tightened oil supplies. Because of that, inflation is also on the rise, Given the pace of recent oil price hikes, I would not expect the Consumer Price Index to escape a similarly accelerated rate of increase when it gets published tomorrow.

Oil prices are getting ugly. Gasoline prices are already ugly. Expect the CPI to be ugly as well.

Peter don’t tell the White House this, you’ll be accused of spreading misinformation, even though your math is correct.