Inflation: Calm Now, Storm Next?

Where Do Consumers Stand On The Cusp Of The Trump Presidency?

Financial journalist Charles Payne said something interesting the other day on Fox News touching on the final Consumer Price Index Summary report for 2024: “Expectations and narrative—that's the game Wall Street plays.”

This is a singular defect of how the media typically reports on economic matters. Corporate media “experts” in particular have a pronounced tendency, a la Wall Street, to interpret the data so as to fit the prevailing expectations and narrative. Lost in the mix is the answer to the one really important question: “what does the data actually tell me?”

The final inflation report of the (Biden-)Harris Administration is sufficiently muddled and perhaps even contradictory that it makes that question seem particularly relevant. What does the December Consumer Price Index Summary actually tell us?

With Donald Trump about to be inaugurated as the 47th President of The United States—and therefore about to take the helm with regards to the Federal Government’s stewardship of the economy—it is worth chewing on that inflation data a bit, to see if there are any answers that we can glean which do not rest on this or that media narrative.

Is inflation calming and cooling down? Is the current calm merely the prelude to a new storm of hyperinflation?

Let’s see if the data is willing to answer these questions for us.

Corporate Media Take: Inflation Is Cooling

By and large, corporate media viewed last week’s Bureau of Labor Statistics inflation report in a positive light, with CNBC calling the data “benign”.

An inflation report Wednesday that seemed to show little movement in prices set off a buying frenzy on Wall Street as investors breathed a collective sigh of relief that inflation was not on a path higher again.

Fox News was somewhat more cynical, noting that energy and food prices drove the bulk of the overall rise in the December CPI data.

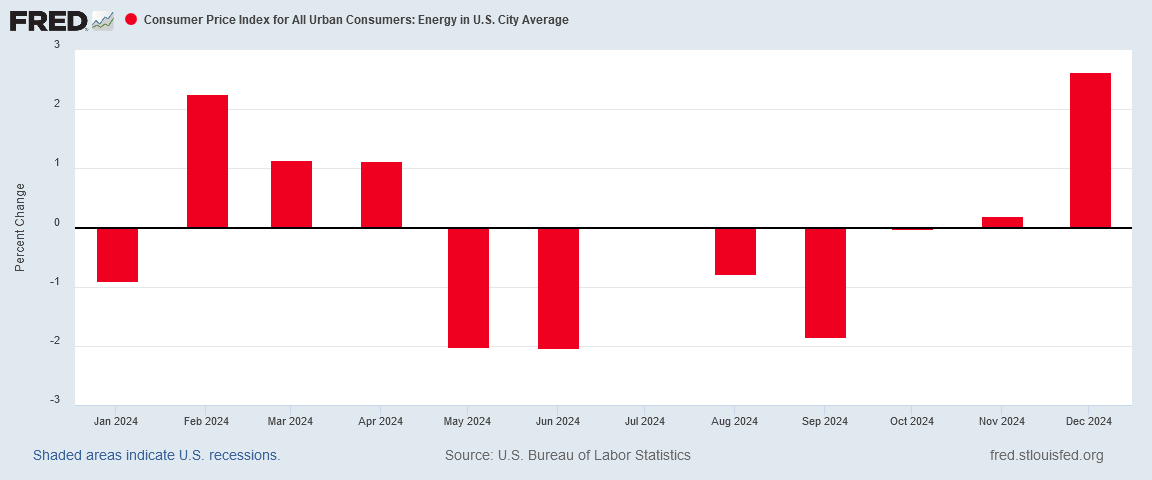

Over 40% of the monthly CPI increase was attributed to rising energy prices, as the Bureau of Labor Statistics' energy index increased 2.6% in December after energy prices had shown little change in the preceding months and were down 0.5% on an annual basis last month.

While the aforementioned Fox News host Charles Payne emphasized how prices were still high for many goods and services, the overall tone of the article was in line with the prevailing corporate media narrative that inflation was, on balance, still getting better.

Alt-Media Take: Inflation Is Still High

If corporate media was guardedly optimistic about the inflation numbers, the alternative media was not. Alternative outlet ZeroHedge focused heavily on the reality that the inflation data in December climbed noticeably upward.

After rising for 5 straight months, analysts expected headline consumer prices to continue accelerating in December (+0.4% MoM exp) and it did exactly that - the highest MoM print since March, leading the YoY CPI to rise 2.9% (the highest since July).

ZeroHedge is taking a longer perspective, and noting accurately that consumer prices rose quite a bit during the soon-to-be-ended (Biden-)Harris Administration.

Is that the same as saying that prices are rising faster now? No, not at all, which is important to remember when assessing the ZeroHedge narrative. Inflation has been not just bad, but extremely bad, and how much of consumers’ current economic circumstances is a residual of earlier out-of-control prices rises will forever be a topic of some conjecture and theorizing.

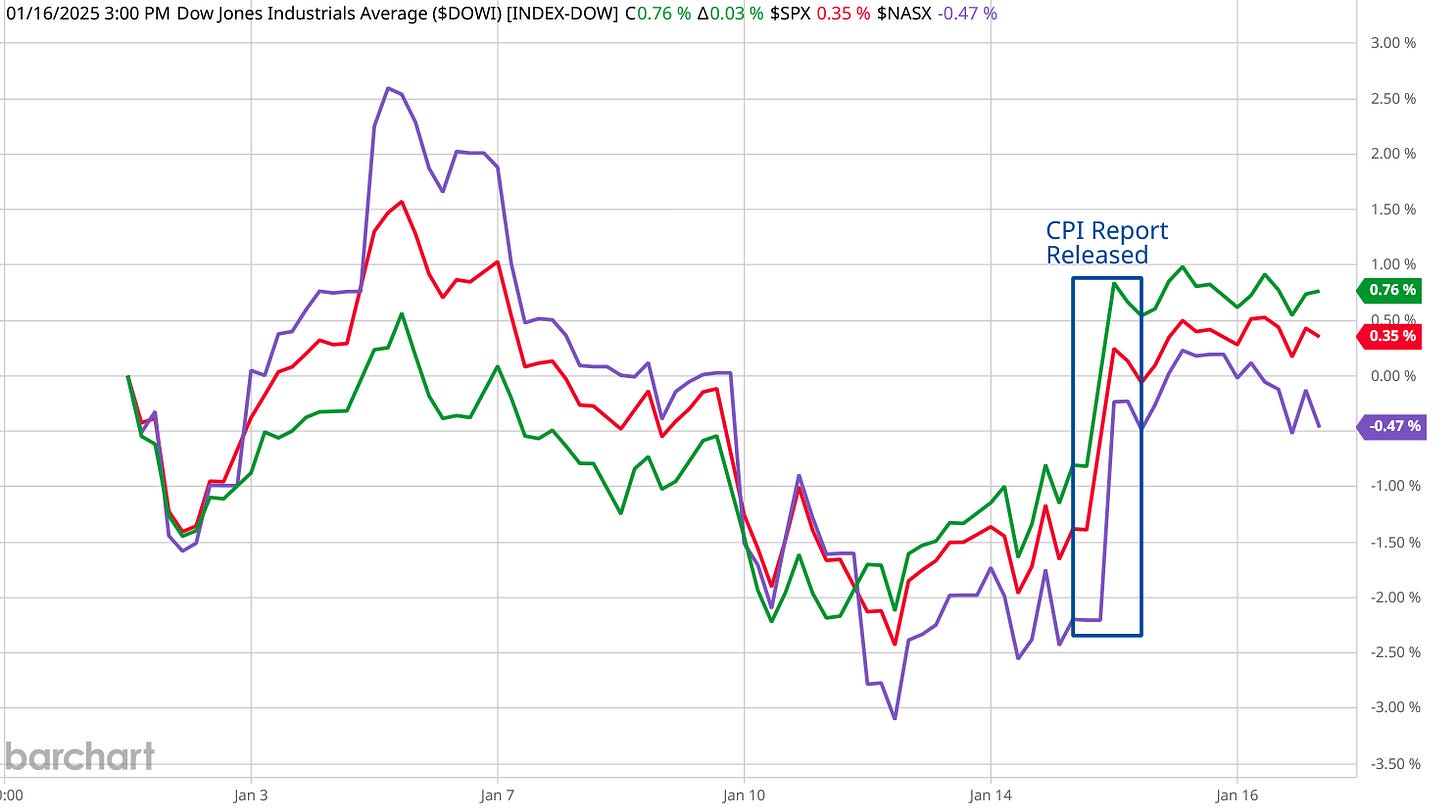

Wall Street: We’re Happy

Wall Street for its part took the data in stride, and was quite pleased with it.

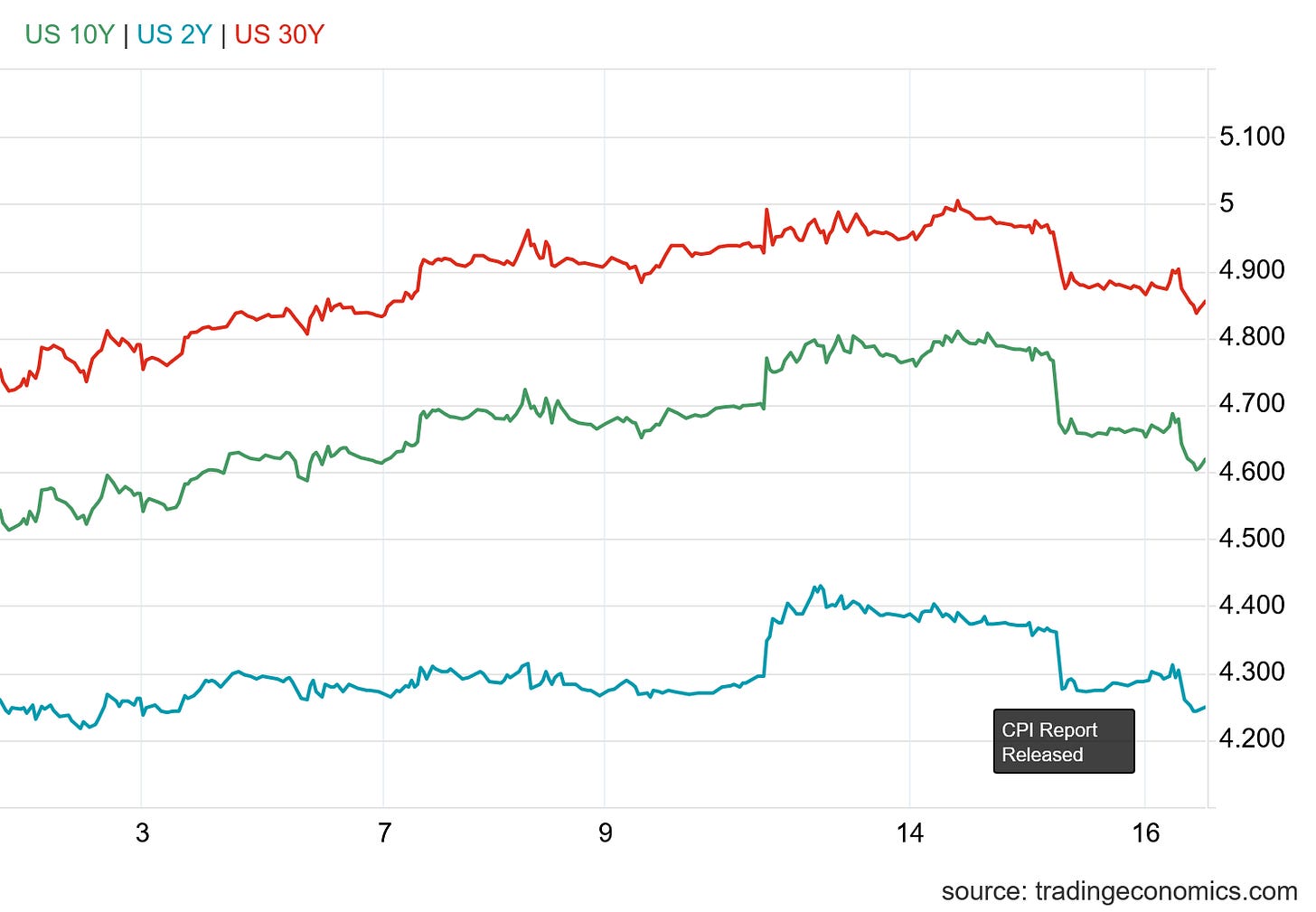

Equities moved sharply higher in response to the report.

At the same time, bond markets bid Treasury yields significantly lower across the yield curve.

The timing for both equities and treasuries leaves little doubt that the moves were in response to the CPI report being released.

The market responses could (and perhaps should) be considered at least somewhat anomalous, because energy in particular has been signalling renewed inflation for most of December. Gas prices at the pump especially moved upward on the month.

Despite the clear pricing signals in the marketplace that energy prices were rising and that energy price deflation was coming to an end, Wall Street managed to respond positively to the report: hence stocks rose and yields fell.

Whether Wall Street looked at the inflation data and concluded that consumer price inflation was actually cooling off or whether Wall Street is pricing in another agenda (leading to the “good bad” news phenomenon we’ve seen in the past) is not clear, but it is clear that Wall Street was rather happy with the report.

Wages Have Not Caught Up After 2022 Hyperinflation

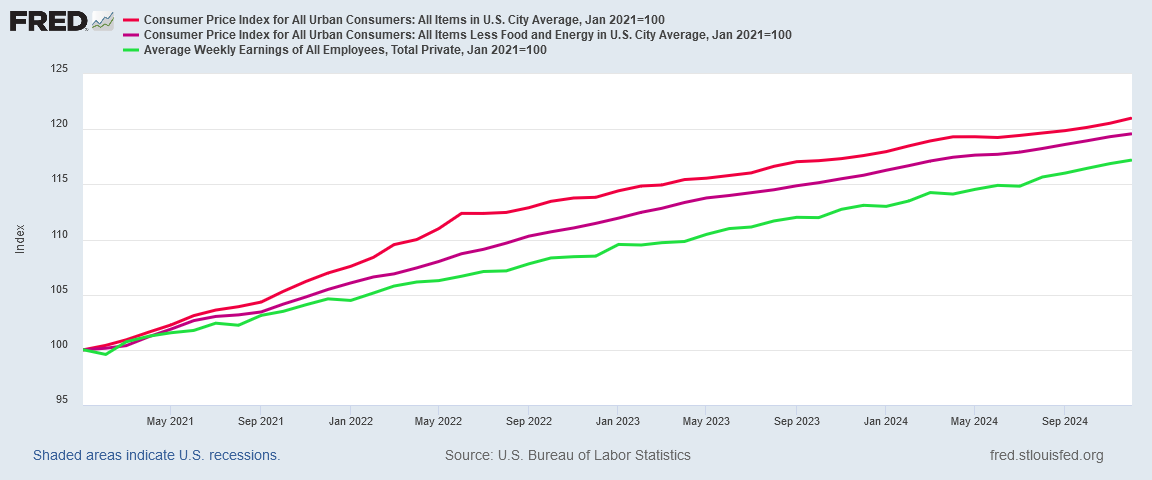

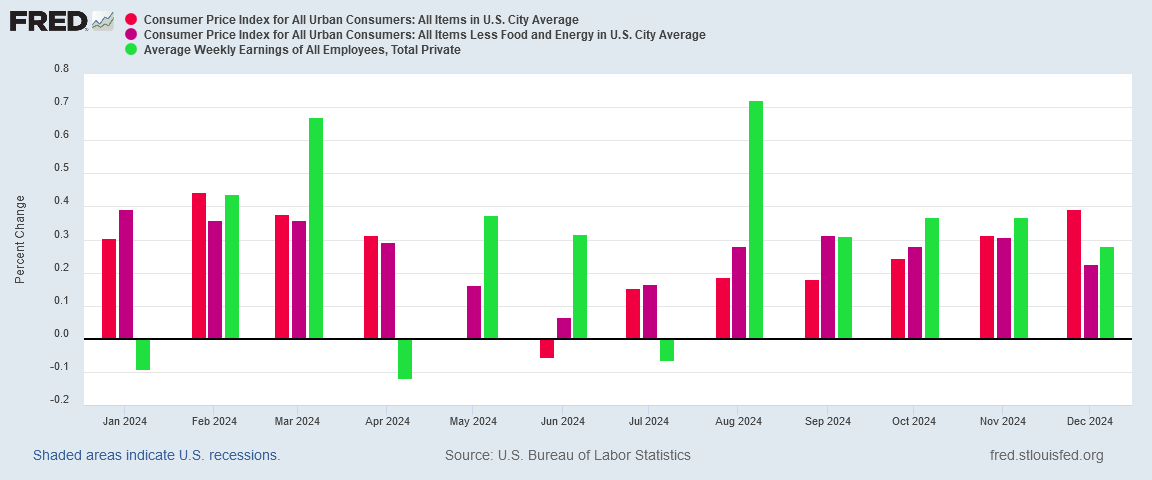

Regardless of whether the CPI print shows consumer price inflation itself getting either hotter or cooler, one reality is crystal clear: wages have not come close to catching up to consumer prices after the 2022 hyperinflation cycle.

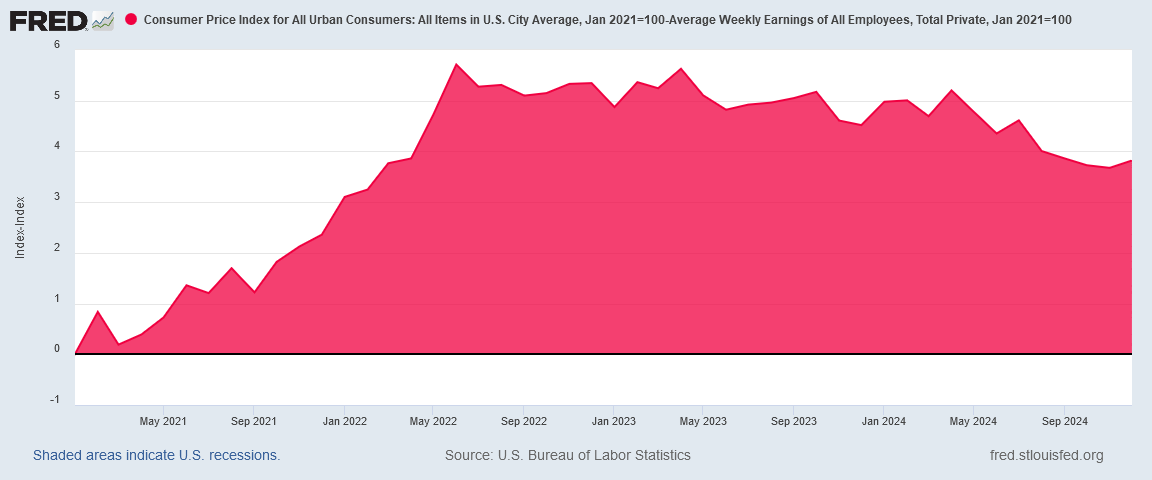

If we index the headline consumer price index, the “core” index (less food and energy), and average wages to January of 2021, it is immediately apparent that wages lost considerable ground to consumer prices during the hyperinflation of 2022, and have yet to make it up.

Wages are still lagging prices even though wages were doing better in 2024.

In most months during 2024, average wages in the United States rose by a larger percentage than consumer prices. From the worker’s perspective, that’s always the desirable trend. Wages rising higher than prices means the worker is getting more money in “real” terms.

This is the point that ZeroHedge was hammering, and with reason. If we index the inflation data and the wage data to January of 2021, and then net the two indexed values against each other, we can see just how much wages need to rise to fully offset the effects of the 2022 hyperinflation.

Until this chart trends back down to zero, wages have not risen enough to offset the relative pricing effects of consumer price inflation. Ominously, in December the variance between the consumer price index and average wages ticked up again, instead of ticking down. While it is too soon to declare a trend reversal, it is not too soon to note that 2024 wound to a close with workers losing money in real terms to consumer price inflation.

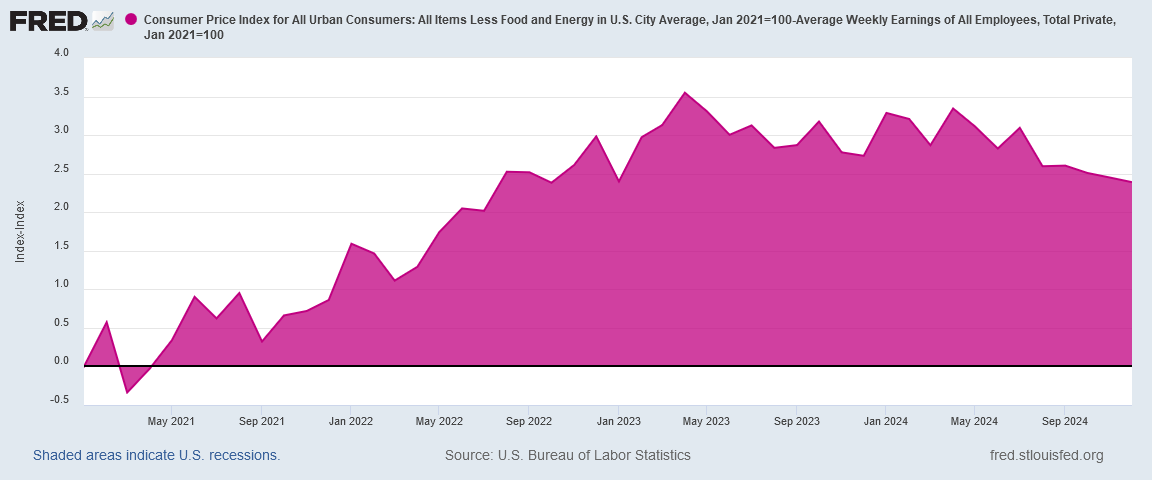

Against core inflation, the story is a little better. There the disinflationary trend continued in December even netted with average wages.

This chart likewise has to move back down to zero before wages will have fully recovered against the effects of the 2022 hyperinflation, but wages are doing better against core inflation than against headline inflation.

Energy And Food Prices Still High

The energy pricing signals themselves were spot on: energy price inflation did heat up significantly in December.

Energy prices rose by a greater month on month percentage in December than they had done so for all of 2024.

If energy prices continue to trend higher, energy prices will soon pull the headline consumer price index significantly higher as well. Energy price inflation invariably leads to elevated consumer price inflation.

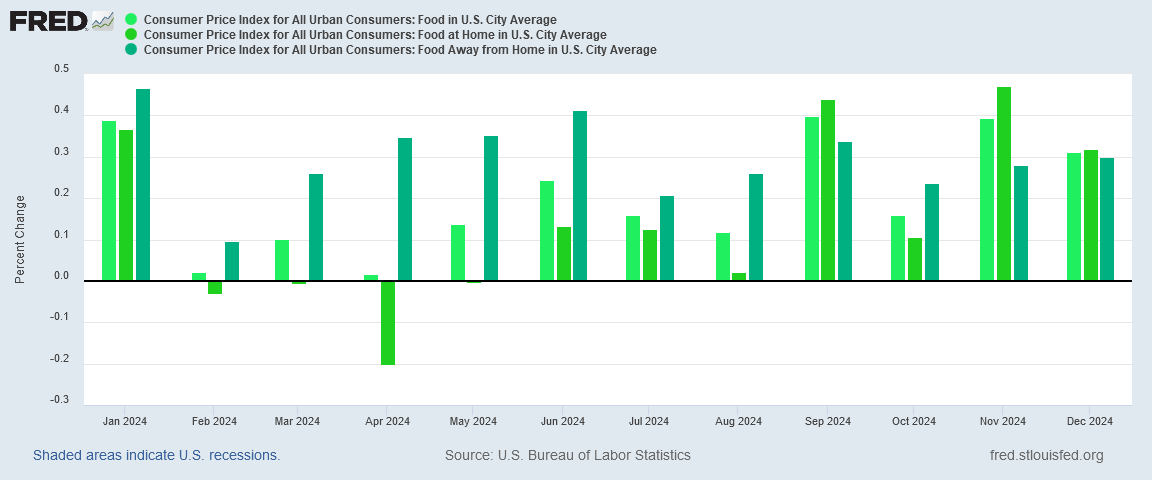

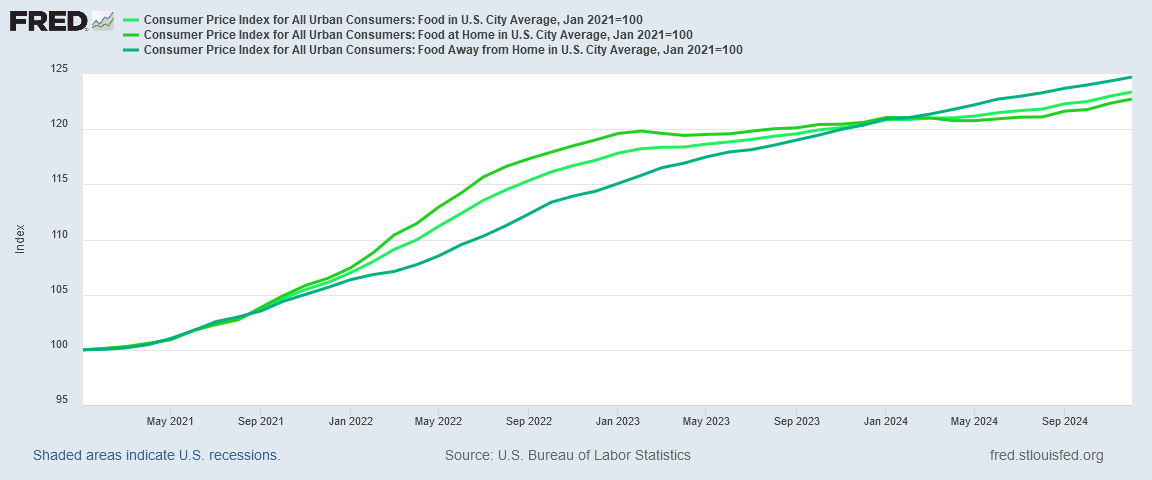

While food prices did not rise by quite as large a percentage month-on-month as they did in November, the rise was still significant. What we are seeing in the last part of 2024 is greater food price inflation than we saw earlier in the spring and summer.

Over the longer term, what makes December’s energy price rise uncomfortable is that it comes while energy prices are still 30% higher than they were in January 2021.

Energy prices underwent a large and relatively sudden increase during the 2022 hyperinflation cycle. They showed the greatest relative price increase of all price categories, and so much so that it is difficult to put them on the same chart as other price categories—the energy price increase dwarfs that of all other prices. While they were relatively quick to surge up, they have been considerably slower to come back down to earth.

Over the longer term, food prices also have been trending higher since April and May of last year.

With food price inflation also having been significantly greater than headline consumer price inflation in 2024, food prices continuing to move upward means that consumers can count on continued pain at the grocery store checkout counter. Food price inflation may not be getting dramatically worse at the moment, but it certainly is not getting any better.

Service Price Inflation Is NOT Coming Down

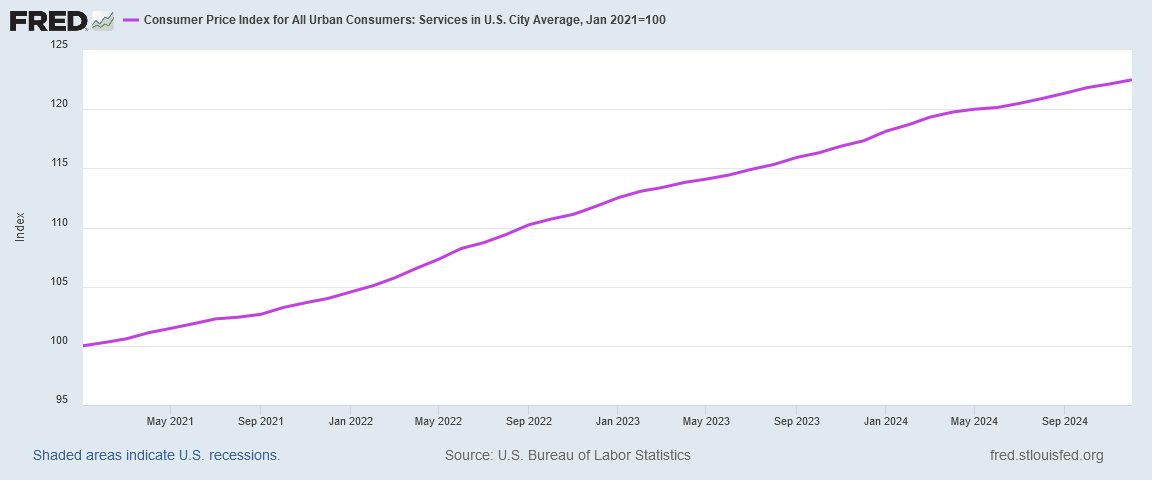

While energy and food have shown at least something of a disinflationary trend, services overall have not had much if any disinflation.

When the indexed chart for service prices approximates a straight line, we may be certain that the rate of inflation has not altered much (if at all).

If we look at service price inflation month on month for 2024, we see that in the last half of the year especially the fluctuations in the inflation rate were minimal.

While not rising as they did during the 2022 hyperinflation cycle, service prices are still not showing much interest in getting back down to the Federal Reserve’s Holy Grail inflation rate of 2% year on year.

If energy prices continue to rise as they have been, and we see energy price inflation return as it is showing that it might, putting that resurgent inflation alongside existing service price inflation suggests headline inflation especially could rise significantly over the near term. We may be starting 2025 with an extended uptick in consumer price inflation.

Food Labor Costs Are Not Surging Higher

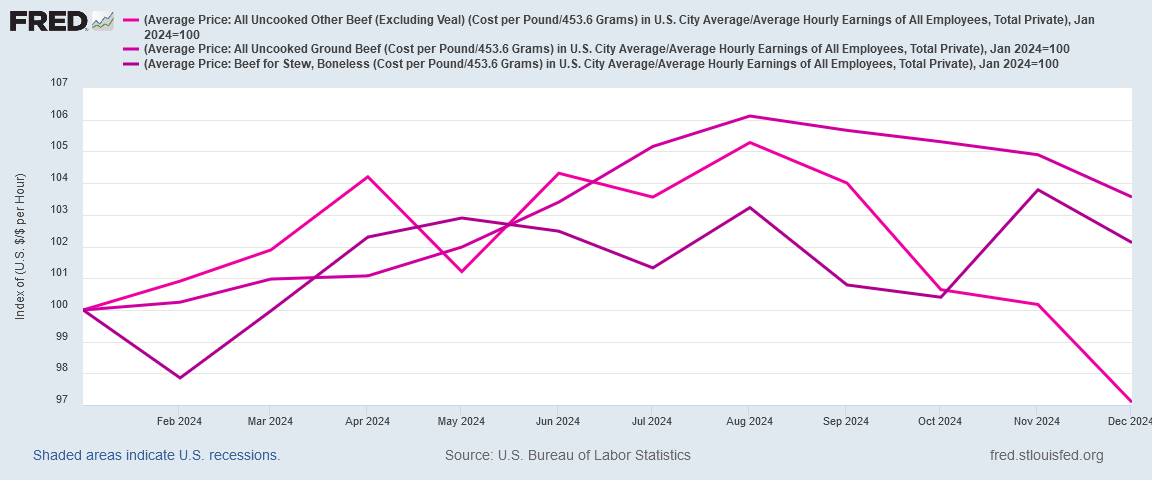

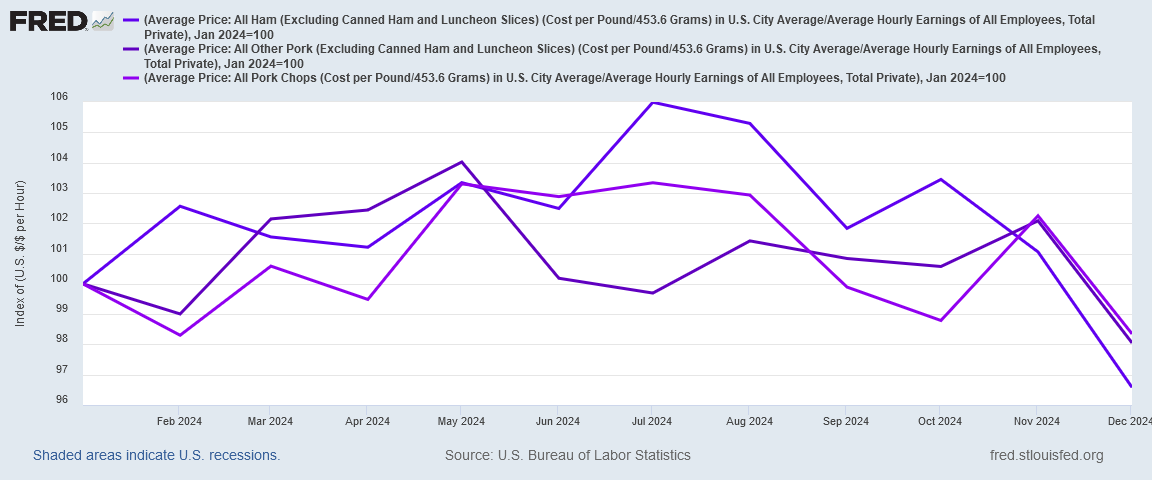

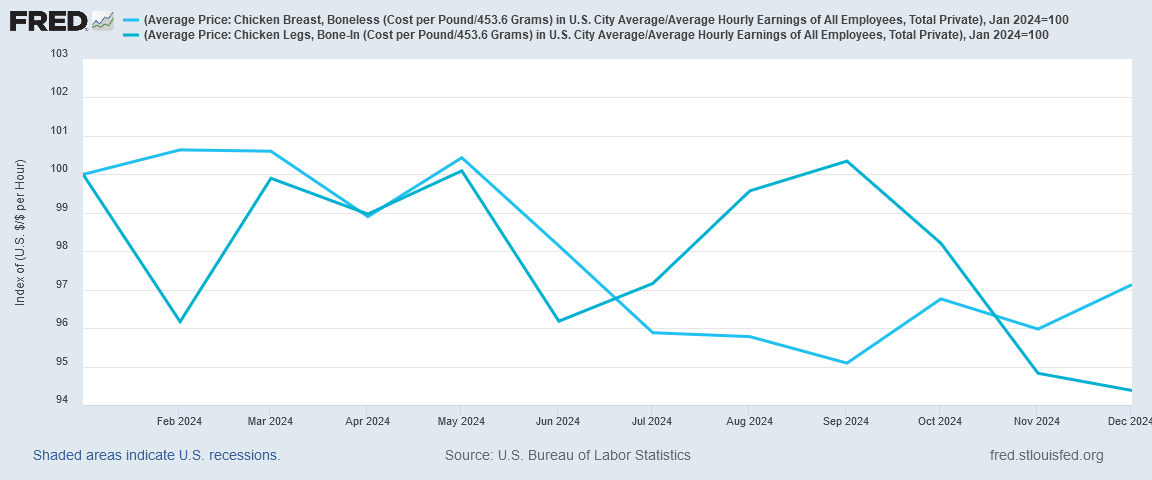

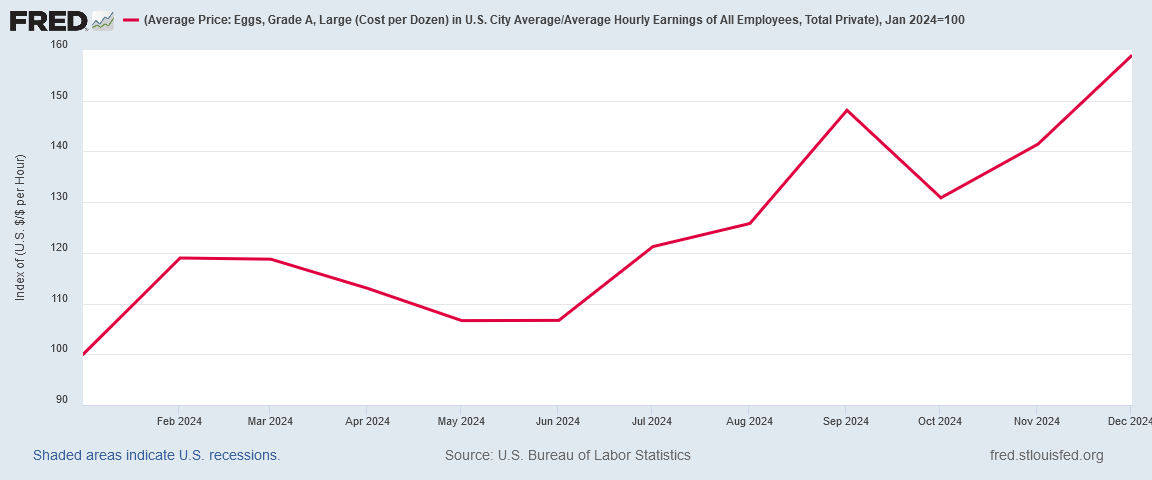

Yet while we are seeing numerous indicators that inflation is trending up, wage trends have mitigated at least some of it. When we look across nearly all food categories, we see the labor cost for food items trending down especially in the last half of 2024.

(The labor cost, readers will remember, is obtained by taking the average price of a food item and dividing it by the average hourly wage, thus indicating how much labor is required to earn enough to purchase a set quantity of that food item).

We see this decline with bread and starches.

Dairy products were a little more volatile in 2024, but for the most part they moved lower during the year.

The labor costs for Beef and pork had risen during the first half of 2024, but began to trend down in the second half.

The labor cost for chicken trended down throughout 2024

Eggs were the major outlier in this trend, as they moved significantly higher during the latter half of the year.

What do these trends mean? They mean that, in broad strokes, people could work less and still buy the same amount of the same types of food as before. Alternatively, these trends indicate that food purchases are taking a declining proportion of the weekly paycheck for most people.

Regardless of what the prices themselves do, if people do not have to work more to purchase the same quantities of the same things, consumer price inflation is not a factor for most people.

That’s a very positive trend!

Inflation Is Smoldering

While corporate media and Wall Street might be taking their usual undeserved victory laps over consumer price inflation, the muddled and mixed trends we are seeing in the CPI data suggests that inflation is not really “cooling”. Quite the contrary, the data suggests that inflation is at best “smoldering”, and at worst on the cusp of flashing over to a renewed period of significant price rises, even hyperinflation.

On balance, the most optimistic conclusion one can reach about prices from the December CPI data is that inflation is not getting significantly worse, while food prices in particular are actually getting a little better relative to wages.

As a percentage of the average paycheck, groceries are taking a smaller slice of the pie.

The same cannot be said of energy prices, which are taking a larger slice of the paycheck pie.

If one goes through the entire consumer price data set, one will find items for which the price rises are significant as well as items for which prices are even falling.

Yet if the more recent trends in energy prices especially persist, consumer price inflation as a whole will quickly head back towards 2022 levels. Were that to happen, wages will lose even more ground to consumer prices just as they did in 2022.

The concern is not merely that hyperinflation could theoretically return. The concern here is equally that inflation could rise sharply within the next few months.

This afternoon, as Trump puts his hand on the Bible and takes the Presidential oath of office for the second time, this is the economic challenge that will confront him: consumer price inflation that may soon start rising—and rising sharply—but is certainly not falling and not trending lower.

Donald Trump has pledged in Agenda 47 to bring inflation further under control—and while it is highly unlikely that any of his policies would prove an immediate “cure” for past inflation, inflation’s current state is raising the stakes. Will Trump even have a chance to begin enacting his economic agenda before an inflation surge takes over and reshapes that same agenda?

Wall Street’s happiness with the December inflation data may prove to be short-lived. No, the December Consumer Price Index Summary does not show inflation surging as it did in 2022. But there are enough potential flashpoints within the data to wonder if such a surge is about to happen.

Some depressing data and forebodings, but nothing’s going to dampen my mood today. Doesn’t it feel like a New Year’s Day? A new era where sanity has the upper hand! I’ve got Dire Straits on the stereo and I’m doin’ the Trumpty Trump dance!

If you are in the mkts, you know that we will get the Dec PCE (Fed's preferred inflation gauge) Friday next week.

This will be an important mkt mover (alongside the FOMC meeting) next week.

Here are my Dec PCE estimates:

https://arkominaresearch.substack.com/p/dec-2024-pce-estimate?r=1r1n6n