Between Wednesday’s Consumer Price Index Summary and yesterday’s Producer Price Index Summary, one not very pleasant conclusion is unavoidable: inflation is rising once more.

With Donald Trump not even through the first full month of his second term of office, the surge of inflation could not have come at a worst time. Rising consumer prices complicates his economic strategy of using tariffs as a sort of universal cudgel to press other countries to align their policies more with American interests.

This has always been one of the potential vulnerabilities within President Trump’s proposed strategy of negotiating via tariffs. Shifting price levels and in particular a sustained high rate of inflation could very quickly make Trump’s tariffs economically very costly not just to the United States but to the global economy.

Yet the exposure of the global economy to inflationary pressures could make other countries more vulnerable to the pricing consequences of Trump’s tariffs.

The perverse timing of inflation rising now could either push Trump’s tariffs completely off the economic and political stage or make them a primary influence in the shape of the global economy during President Trump’s term of office.

Consumer Price Inflation Is Up Across The Board

What is particularly remarkable about this uptick in consumer price inflation is that nearly all categories of goods and services showed at least some increase in the inflation rate. There was no holdout sector, no bright spot or hopeful area where consumer prices were declining.

Both headline inflation and core inflation rose year on year, with headline inflation rising on an unadjusted basis from 2.8% to 3% year on year, and core inflation ticking up to 3.2%.

Both headline and core inflation rose month on month as well:

In the unadjusted data, the month on month increase was the largest it had been for the past year, for both headline and core inflation.

The increase was to be expected, however, as all major subindices showed an increase, including energy.

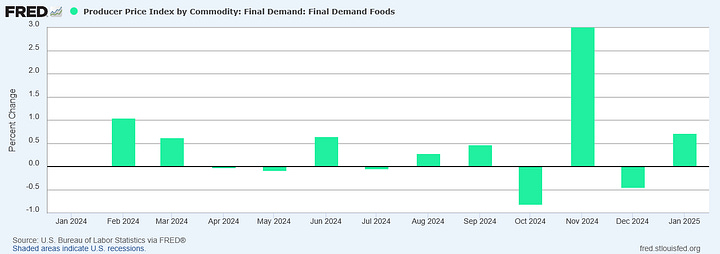

Food price inflation also surged in January.

Food prices rose in January of 2025 very nearly as much as they rose in January of 2024. Given where food price inflation has been in the past, that is not at all a good thing!

Within core inflation, even housing prices took a hit, with rent of shelter posting a fairly substantial increase in month on month inflation to 0.46%.

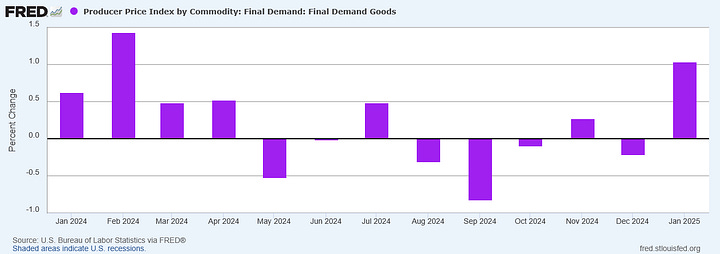

Durable goods flipped from deflation to inflation in January.

So did non-durable goods.

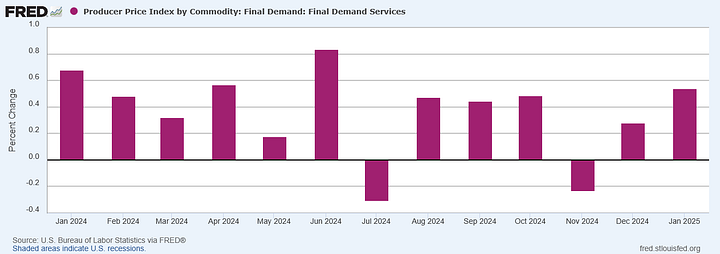

Even services notched a noticeable month on month increase.

It is no exaggeration to say that inflation rose literally everywhere. The breadth of the rise alone makes the uptick difficult to dismiss as a statistical aberration in a larger disinflationary trend. The January data may end up being exactly that, but surely we can be forgiven for thinking that this “feels” like something more.

Media Naturally Focuses On Trump

Corporate media, of course, naturally indulged its eternal obsession with all things Trump, and made the inflation reporting primarily about President Trump.

CNN chose to declare inflation to be President Trump’s problem (rather than, say, America’s problem).

And on Wednesday, as if on cue, the president wrote “BIDEN INFLATION UP!” in a social media post.

The “Biden inflation” he’s referring to is the Consumer Price Index, which went up 3% year-over-year in January — the fastest pace since June. It was an unwelcome surprise in the wrong direction. Investors immediately unloaded stocks, figuring that inflation’s resurgence will almost certainly delay long-awaited interest rate cuts by the Federal Reserve.

Ironically, CNN was so intent on mocking Donald Trump for his overtly political messaging on TruthSocial about “Bidenflation” that they decided not to make him the inflation-causing boogeyman corporate media made him out to be during last year’s election cycle.

The reality is that no single leader or policy can account for monthly price swings across a huge array of goods and services Americans spend money on.

The likeliehood that CNN will still believe this to be true in a few months, when it will want to blame all inflation (and whatever else CNN can dream up) on President Trump, is approximately nil.

Newsweek decided to snark about Donald Trump’s campaign rhetoric regarding bringing inflation down “on day one.”

Inflation quickened in January, according to data released on Wednesday morning, putting pressure on the new administration to honor its key campaign pledge to bring down prices "on day one" amid uncertainty over the anticipated impacts of President Donald Trump's economic policies.

That Donald Trump was not even President for most of January rather takes away from the sarcastic sting Newsweek was no doubt intending.

The inflation numbers are relevant to President Trump, of course, as they will directly impact how well his tariff strategies will work and what domestic impact those strategies will have.

For his part, President Trump has maintained since the election a rhetorical position he had initially staked out during the election: getting inflation under control will take pushing energy prices still lower and making supply chains more resilient.

In his Time magazine interview in late December, President Trump said: "Look, they got [prices] up. I'd like to bring them down. It's hard to bring things down once they're up. You know, it's very hard. But I think that they will. I think that energy is going to bring them down. I think a better supply chain is going to bring them down."

I would claim to be disappointed in corporate media for their Trump-oriented focus when reporting the largest monthly increase in consumer price inflation in months, but that would require expecting better of them. Longtime followers already know I have no such expectations of the corporate media.

Inflation Is Rising Globally

One significant aspect of inflation’s rise in the United States that corporate media has largely glossed over is that it is not an isolated occurrence. Consumer price inflation is rising on a global basis.

Inflation has been rising in Europe for the past few months.

Inflation has risen recently in Asia as well—even in China has seen an uptick in inflation.

China no doubt welcomes the surge in prices, as it is a sign the country may yet avoid a deflationary “lost decade”. Even Japan is ambivalent about inflation’s surge, as it has been grappling with persistent deflation for decades.

Unfortunately for Donald Trump, one place where inflation is not on the rise outside of the US is North America. Both Canada and Mexico have experienced monthly drops in their inflation numbers for the past few months.

While North America remains an economic outlier on inflation (for now) the rest of the world is largely experiencing a significant increase in consumer price inflation.

This global rise in inflation makes corporate media’s fixation on Donald Trump faintly absurd: for a global phenomenon one generally looks for a global cause, not a local one. The American President is quite capable of influencing inflation rates in the United States with spending and economic policies, but even the American President is going to have only limited capacity to influence inflation rates half way around the globe.

Supply Chain Squeeze

Wall Street analysts do see a potential global driver to the current global increase in inflation: global supply chains are once again exhibiting signs of duress.

Global commodity markets are in a “super squeeze” amid supply disruptions and lack of investment — and it’s only going to get worse as geopolitical and climate risks exacerbate the situation, HSBC said.

“For some time now we have described global commodity markets as being in a ‘super-squeeze,’” its chief economist Paul Bloxham told CNBC.

A commodity “super squeeze” is denoted by higher prices driven by supply constraints more than a robust growth in demand, he explained.

This “super squeeze” is, in the eyes of Wall Street, a convergence of forces, including geopolitical risk from the ongoing wars in Ukraine as well as between Israel and Hamas, and the residual shipping disruptions from the Houthis’ year long pattern of attacking cargo ships transiting the Red Sea heading to or from the Suez canal.

The relative scarcity of many commodities is also being blamed on underinvestment in resource development, as demand for several metals is being pushed up by interest in so-called “green” technologies and the desire of many countries to move away from using fossil fuels for energy.

The world’s pursuit of a net-zero carbon future is fueling demand for energy transition metals such as copper and nickel, Bloxham pointed out.

However, there are insufficient investments allocated to procuring these critical minerals, leading to a sharper supply squeeze on energy transition metals — in particular copper, aluminum and nickel, he said.

Given the increased interest in these “energy transition” metals, Wall Street believes that investment levels in developing known deposits of these metals have simply not kept pace with demand. When demand outpaces supply, prices will rise.

If this is part of what is driving inflation currently, then January may be only the beginning of another inflationary cycle. Developing new mineral deposits or expanding extraction of existing deposits can take years to complete. If the level of investment in commodities development has been lagging, even with a remedial level of investment it could be some years before supply can rise enough to meet rising demand.

Large-scale mining projects face a time lag of 15-20 years, and a lack of exploration and production investments in the last decade exacerbates the supply constraints. To meet the growing demand and ensure a steady supply, annual capital investments in these metals need to increase from the current average of $45 billion to approximately $70 billion each year until 2030.

The landscape becomes more complex as the world seeks to triple global renewable energy capacity by 2030, creating additional demand for metals crucial to this transition. Technology could play a role in easing the squeeze if innovations facilitate easier extraction of battery metals. However, the timeline for a resolution remains uncertain, and the potential for a deeper economic downturn globally could be a catalyst for lower commodity prices.

Is the “super squeeze” real? Ultimately, that is Wall Street’s take on what is happening within commodities markets. However, what is happening within commodities markets is that prices are rising.

Copper has been climbing steadily since the beginning of January.

Even non-mineral commodities such as lumber are rising.

Even food price inflation has a global element to it, as the price of wheat and grain futures has been also going up.

This may or may not constitute a “super squeeze”, but commodity prices are unquestionably rising right now—and rising everywhere, as the commodity indices illustrate.

Of course, oil prices surged in early January and by month’s end oil prices still had not dropped back down to January’s opening price.

At a minimum, the “super squeeze” scenario does give a credible explanation for the across-the-board rise in commodities prices, which fundamentally mirrors the rise across-the-board in consumer prices.

Far less certain, however, is the extent to which these price appreciation trends are likely to last. In the “super squeeze” scenario, energy transition metals in particular are likely to command elevated prices for potentially years, which translates into potentially years of elevated consumer price inflation. If peace should at last prevail in Ukraine and in the Middle East, on the other hand, a number of commodity prices might actually come down.

Factory Gate Inflation Confirms Resource Constraints

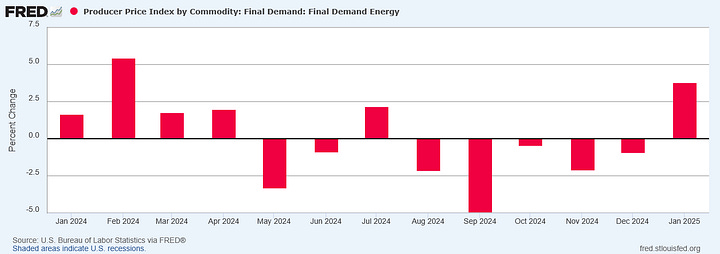

In many respects, yesterday's Producer Price Index Summary goes a long way towards bolstering the “super squeeze” scenario in commodities. As with the Consumer Price Index, the Producer Price Index charted rising factory gate inflation seemingly everywhere.

Energy, food, goods, services….As with the CPI, the PPI rose across the board.

The PPI measures what is often described as “factory gate” inflation. While the CPI looks at the prices actually paid by consumers for various goods and services, the PPI measures the prices actually sought by the producers of various goods and services.

Because the PPI is focused more on the producer side of the economic equation, it is broadly presumed to serve as a leading indicator for the CPI, with price changes as reflected in the PPI often being replicated in the CPI a few months into the future.

As a result, the rises charted within the January PPI are consistent with a view of the global economy where a number of supply constraints are converging to push prices up for nearly all goods and services.

If that is the case, then we could very well be looking at a period of rising prices that will extend for the next several months at least. Perhaps more crucially, if global supply chains are under duress then prices are going to be pushed up globally as well. Inflation will be not just an issue in the United States but worldwide.

At the same time, should Donald Trump be successful in getting Russia and Ukraine to end their war, or if the ceasefire between Israel and Hamas should hold and bring that conflict to an end as well, some of the major causes of supply chain strain might be alleviated within coming months. The “super squeeze” scenario might prove to be the most optimistic scenario for inflation globally over the coming year.

Will Trump’s Tariffs Make Things Worse?

With prices rising more or less globally, perhaps the greatest unknown variables are possible future Trump tariffs.

What seems certain is that President Trump is not giving any indication that a global trend of rising prices is dissuading him from pursuing his tariff agenda. Even as the PPI printed rising factory gate inflation yesterday, Trump signed a presidential memorandum committing to “reciprocal tariffs” on countries which impose tariffs on US goods, or otherwise engage in trade practices the United States considers to be unfair.

The president said that under the plan, the U.S. will treat other countries’ non-tariff policies as unfair trade practices that warrant tariffs in response.

Those include value-added taxes, or VATs, and other practices that the office of the U.S. trade representative deems to be unfair trade limitations.

Trump said that foreign countries will not be allowed to send merchandise or other items to the U.S. through another country.

The concerns of many if not most economists that tariffs are themselves a driver of inflation has not translated into any reluctance on Trump’s part to pursue the tariff strategy he described on the campaign trail last fall. If supply chains are being strained, adding an additional burden of tariffs could quite easily have a dramatic and not at all benign impact on consumer prices. A period of rising prices could give President Trump’s tariffs an inflationary effect that was not observed in 2018, when Trump added a number of tariffs on US trade partners without sparking a major rise in consumer prices.

Despite a rising potential for Trump’s tariffs to produce renewed consumer price inflation, even corporate media is beginning to believe that at least some of the tariffs Trump is proposing or contemplating could be beneficial to the United States at least in the near term.

Perhaps unsurprisingly, the biggest winner of the trade tariffs is likely to be the U.S.

U.S. steel imports have declined substantially over the past decade, official data shows, falling 35% between 2014 and 2024 — despite a 2.5% annual uptick to 26.2 million metric tons last year. Many attribute this to tariffs introduced under President Trump’s first administration.

Some commodity analysts even view Trump’s tariffs as possibly spurring within the United States at least the additional investment needed to mitigate supply chain pain over the longer term.

On Monday, James Campbell, analyst at commodity pricing consultancy CRU, told CNBC that he expected the potential tariffs to have varying effects on the U.S. over time.

“At the start, this could damage demand,” he said. “In the longer term, we can see investment coming through.”

Since Trump’s first wave of tariffs in 2018, CRU’s Campbell said the U.S. had seen investment rise in both the steel and aluminum sectors.

Increased investment in the United States following the imposition of tariffs in 2018 would be one reason why a number of consumer and import prices continued to fall even after the tariffs came into effect.

However, the signature difference between 2018 and the present is that prices were not rising globally in 2018. To the contrary, import prices in the United States remained in a deflationary trend that had started some three or four years earlier and continued until just before the COVID Pandemic Panic nonsense.

That change in the inflationary outlook is almost certain to have significant impact on how any tariffs imposed by President Trump are received by the world.

Inflation could make countries hit with tariffs sufficiently discomfited as to motivate them to negotiate alternative trade relationships with the United States that eliminated or reduced those tariffs.

At the same time, inflation could make Trump's tariffs particularly costly for the United States, and perhaps even disadvantage the US in negotiating better trade relationships globally.

What seems certain is that many of the economic assumptions that lay underneath Trump’s anticipated tariff strategy are being either altered or invalidated by resurgent global price inflation. While inflation is poised to make President Trump’s economic policies even more consequential than before, it is also poised to make those policies even more problematic than they were before.

You maybe don’t have the time to get to my question today, and that’s fine. But before the day got any older, I wanted to add: Happy Valentine’s Day, Peter! And what scandalously flirtatious compliment should I give you this year? Let’s just say, if you were James Bond marrying the glamorous contessa, I’d be Miss Moneypenny, envying her with all my heart.

Very insightful, Peter - thank you. And this data is indeed confounding for Trump’s strategy. If he stays the course of imposing tariffs, thereby raising at least short-term inflation, people are going to be massively ticked off. Discontent about inflation has already been rising for years, and people are in no mood for more of it! So, how will Trump placate the populace? It will need to be a substantial benefit. Trump has teased about several possibilities, such as eliminating federal taxes, or at least taxes on Social Security and tips. Some of these possibilities are (politically) far-fetched, however. Peter, do you see a likely, and feasible, method of soothing the nation’s ire should inflation continue to rise? I’m hoping that Trump’s team has already formulated a Plan B, and maybe you can see what it is likely to be.