One of the frustrating things about attempting to make sense of interest rates and Treasury yields is that they tend to be like the weather—if you don’t like them just wait five minutes.

Yesterday’s 30-Year Treasury Yield was a study in that sort of meteorological chaos.

The precipitating event was one of the US Treasury’s periodic bond sales, which did not go as smoothly as planned. In order to complete the auction on 30-Year bonds, yields had to rise (meaning prices fell) dramatically.

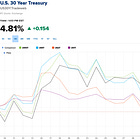

The 30-year U.S. Treasury yield climbed above 4.8% on Thursday, from 4.655% the prior day, after a sale of $24 billion in bonds received far less demand from investors than the government is used to.

Primary dealers, big banks who are obligated to finance whatever portion of a Treasury auction isn't purchased by other investors, bought nearly a quarter of the issuance—more than double their average in recent 30-year auctions, according to BMO Capital Markets.

Yet, as the chart above shows, as soon as the auction completed, yields began falling again (meaning even the primary dealers will likely be able to resell their purchased bonds with little difficulty). Somewhat less than half of the 15bps surge was surrendered after the auction completed.

Some of this is the natural impact of a sudden surge in supply—which by definition any bond auction is: the US Treasury is putting a fresh tranche of US sovereign debt on the market, and the market has to digest it.

As I discussed this morning, there are oppositional pressures on market interest rates, and broadly the downward pressures of recession and weak credit demand have been outweighing the upward pressures of a shrinking money supply and a Fed retreating from asset purchases.

A Treasury auction is, of course, a surge in credit demand by definition. For the duration of that auction, the downward pressures are relieved, and the upward pressures reassert themselves. This is exactly what the US Treasury had to endure in yesterday’s auction.

If yield spikes like this become the norm, then the US government is in a bind on debt issuances. Regardless of what yield gets set by the markets broadly, the US government is unable to issue new debt at the softer market yield. In the case of this 30-Year auction, even though market yields are as of this writing below 4.75%, the government had to issue its debt with a yield of over 4.82%.

Remember, this is what the Federal Reserve and Dementia Joe consider to be a “robust” economy. Rather scary to think of what they figure a non-robust economy looks like.

Thanks, Peter, and they're playing games...and, again, the taxpayers are going to be holding the buck when it comes time to pay up...so sad!

Thank you for this update! I just saw Hakim Jeffries calling for maintaining spending at the Covid levels because that is the “status quo”. He appears to be completely ignorant of the destruction that the unaffordable interest on the escalating national debt (let alone the debt itself) is wreaking, and will increasingly wreak, on the US and world economy.