Is Wall Street Wising Up About Inflation?

Treasury Yields Have Decided To Move To The Upside

Even corporate media admits that inflation is rising, and that the Fed has not succeeded in slaying the inflation dragon.

Not that corporate media has much choice. When Treasury yields make a move to the upside, there are not too many ways to explain that, and all of them reflect either inflation or the Federal Reserve’s rate hike strategy for corralling inflation.

Thus we have gotten the new corporate media narrative that yields are moving up because inflation is not cooperating with the Fed.

Yields on U.S. government debt jumped by the most in more than a month on Monday on signs of persistent inflation in the Institute for Supply Management’s manufacturing index and last Friday’s PCE report.

In data released on Monday, a barometer of business conditions at U.S. manufacturers turned positive in March for the first time in 17 months, a sign that the industrial side of the economy is on the mend. The ISM’s data also showed that the prices-paid component, a measure of inflation, rose 3.3 points to 55.8%.

Inflation risks appear to be growing, some analysts said — which could throw the Fed’s expectations for three quarter-point rate cuts this year into disarray.

Inflation is rising and the Fed won’t be able to make its cherished rate cuts later this year. Now where have we seen that conclusion before?

Oh…right….I said the other day that reality was about to set in for the Fed.

The Fed has had less influence on consumer price inflation than its preferred narrative would have you believe. The Fed will have even less influence on the rising consumer price inflation we are likely to see over the next few months.

Reality is likely about to set in at the Fed, thanks to rising oil prices.

Corporate media has apparently decided to agree with me!

One thing to note here is that while interest rates have jumped significantly this past week, they have been trending up since the beginning of the year.

This has perhaps not gotten the attention it deserves, because the equity side of Wall Street has also been trending up since the start of the year.

This is a shift from last fall, when rising yields were matched by falling stock indices.

Not until this January did rising stock indices again get matched by rising yields.

While the broad trend for both yields and equities has been up, after last Friday’s PCE report came out, equities and yields moved in opposite directions.

Monday’s movements were effectively what would have transpired last Friday when the PCE report came out, were it not for the markets being closed for Good Friday.

Wall Street’s take on what has been happening to both yields and equities this week is that it is a classic “reflation trade”—a shift in financial assets to reflect either the reality of rising inflation or the prediction of imminent rising inflation.

A so-called reflation trade, triggered by signs of persistent U.S. inflation, gripped financial markets — prompting investors to sell off stocks and government debt in tandem, sending oil above $85 a barrel for the first time since October, and sparking a rally in gold and silver. The U.S. Dollar Index also touched a 4.5-month high.

Gregory Faranello, head of U.S. rates for AmeriVet Securities in New York, said he sees a “higher yield story from here,’’ with the 10-year rate possibly reaching 4.5%-5% in the next month or so. A 5% Treasury yield is the level that others in the financial market have associated with a likely stock-market correction.

“It definitely feels to me that yields want to move higher more than they want to move lower,” Faranello said via phone on Tuesday. “The higher-for-longer narrative is en vogue and Friday’s jobs number, which should turn out to be fine, is likely to add fuel to the fire.”

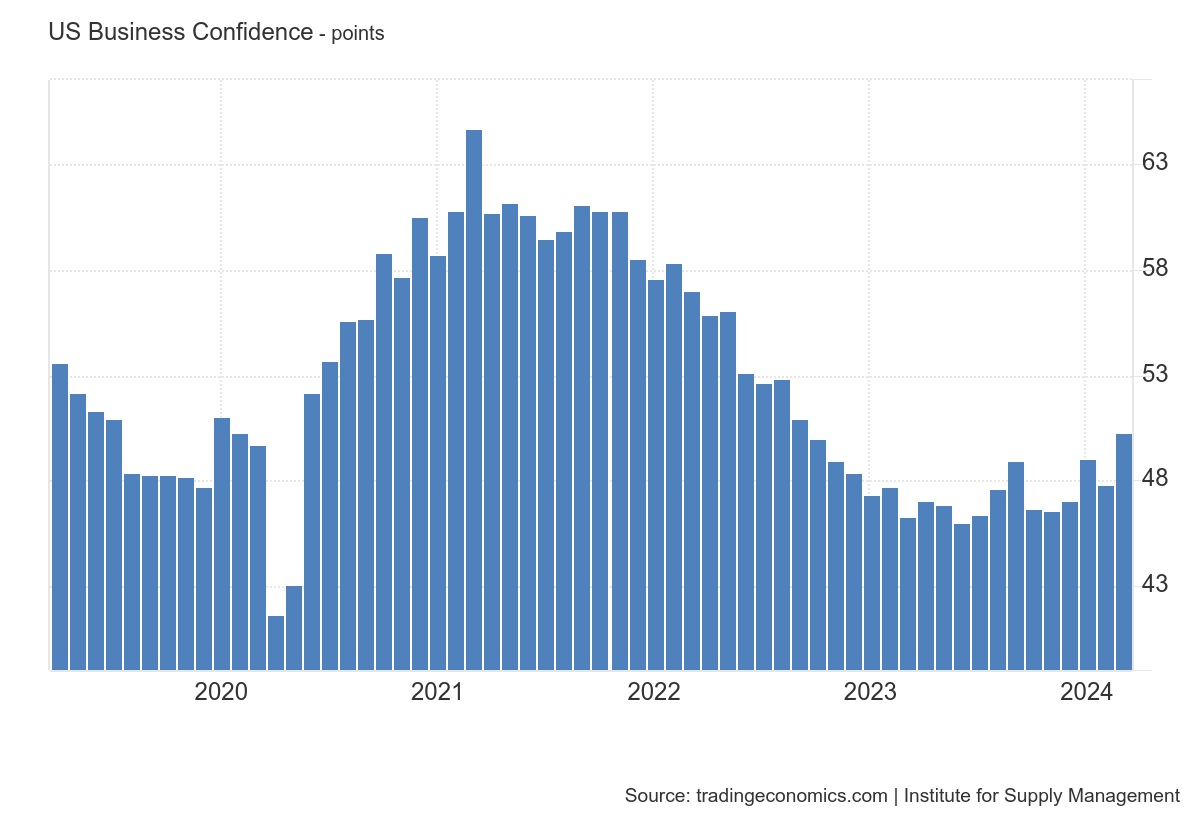

What prompted the “reflation trade”? In part it was the PCE report confirming that inflation is on the rise again throughout the US economy. It is also due to the apparent resurgence of US manufacturing, according to the latest ISM PMI data, which also came out on Monday.

Monday’s PMI data was the first time the PMI had printed positive for manufacturing in 17 months.

Even the New Orders PMI showed expansion again.

Manufacturing—at least according to the data—is having a bit of a recovery right now!

The “experts” are looking for confirmation in that when the BLS Employment Situation Survey comes out tomorrow.

Economists expect Friday’s nonfarm payrolls to reflect 200,000 jobs created in March, a number that would suggest the labor market remains relatively healthy despite interest rates staying between 5.25% and 5% since last July.

This is what the “experts” expect. As I have discussed many times previously the jobs report always has to be taken with several grains of salt.

Still, if the BLS jobs data shows what Wall Street “experts” believe it will show, regardless of its actual accuracy it would be another data point to bolster a narrative of expanding manufacturing contributing to a still-robust economy.

That the US economy might even put on a pretense of economic health, despite interest rates having risen and the federal funds rate at 5.25-5.5%, is an ironic and even perverse problem for the Federal Reserve. Simply put, data such as the ISM PMI data and strong job numbers are not supposed to be happening. Instead of seeing data which charts economic growth,

What Jay Powell wants to see in the US economy is “below-trend” growth. He made that clear a year and a half ago in his annual Jackson Hole address.

Readers might recall that “below trend” growth was the explicit goal of the Federal Reserve when the rate hike strategy began.

However, further on down, Barkin said the quiet part out loud about what “whatever it takes” really means (emphasis mine).

Barring an unanticipated event, I see rising rates stabilizing any drift in inflation expectations and in so doing, increasing real interest rates and quieting demand. Companies will slow down their hiring. Revenge spending will settle. Savings will be held a little tighter. At the same time, supply chains will ease; you have to believe chips will get back into cars at some point. That means inflation should come down over time — but it will take time.

Let that bit sink in. The reason rate hikes “work” to cure inflation is that rising interest rates make the cost of credit (aka, the “cost” of money) too high for consumers to utilize. Consumers are forced to spend less. Along the way, a few jobs are wiped out, a few workers are laid off, and eventually prices come down.

What is showing up right now is hardly “below trend growth”.

The media narrative to explain the lack of “below trend growth” that Powell presumably wants to see has been the fiction of a “soft landing” for the US economy, with some even believing in a “no landing” scenario.

Only one thing disrupts all of these quaint rationalizations of Fed policy: inflation has been stubborn about not going back below the Holy Grail number of 2%.

Now inflation is rising again, before it ever even reached 2%. Moreover, if oil prices keep rising, then inflation will also keep rising, and thus 2% will never be reached.

One could make the argument that the Fed rate hike strategy worked and was the reason inflation came down as far as it did. The obvious rebuttal to that is that the Fed needed to keep raising the federal funds rate instead of stopping at 5.25%-5.5%. If the Fed rate hike strategy worked then Jay Powell made the same blunder in the fall of 2023 when the rate hikes stopped as he did throughout 2021 when the party line at the Fed was that inflation was “transitory”.

If the rate hike strategy did work then the Federal Reserve absolutely made that mistake again at the most recent FOMC meeting where it decided to stand pat on the federal funds rate, despite having evidence of rising inflation as well as evidence inflation would continue to rise.

If, as I have argued repeatedly, the rate hike strategy did not work, and that the declines in consumer price inflation have largely been the result of declining energy prices, then the strategy itself was the mistake and one that Powell has persisted in down to today.

There is no scenario where the Fed has not made significant policy errors and is continuing to make policy errors.

That interest rates have been rising again could very well indicate that Wall Street is beginning to accept that the Fed policies have failed, that inflation is not tamed, and is repricing interest rates (which, we must remember are at their foundation the cost of capital) to take into account structural inflation that will not go away any time soon.

It may be Wall Street realizes that the Fed is painted into a corner where it can’t lower rates because inflation can’t reach 2%—that the policy forecast on interest rates is not just “higher for longer” but quite possibly “higher forever.”

I will not speculate that Wall Street has lost faith in Jay Powell and the Fed, because I highly doubt that Wall Street ever had faith in the Fed. It has long been my belief that Wall Street has always seen the economy substantially along the same lines that I do, but that they believe there is profit in attempting to “game” inflation and the Fed’s policies to contain that inflation.

The recent rises in market interest rates and bond yields suggest Wall Street has concluded that game has ended, and that the Fed cannot be relied upon to deliver the low rates and cheap/free money Wall Street craves.

The data makes this much clear: the current trend for interest rates is up, just as the current trend for inflation is up, and both trends are likely to continue into the foreseeable future.

This is the new economic reality. They know that. This is an election year game of pretending things will go back to the way they were pre-Covid stimulus because that's what voters want to hear. The good ole days! This is the new monetary policy, much more intervention than even before to prevent a recession and keep money moving. Maybe some of them in our government don't understand, I don't know. I don't have the excellent graphs and data that you do, but this game of 'just keep saying it' seems evident to me.

Since price inflation is de facto currency devaluation, the Fed's second mandate of "full employment" (established in the '40s?) which puts downward political pressure on the fed funds rate, is contradictory to its primary mandate of maintaining the value of the fiat reserve currency.

Isn't this right, Peter?

And isn't this the root problem the Fed has in slaying price inflation?