Oil Prices Signaling More Inflation

Is Reality About To Set In For The Federal Reserve?

We begin by stating the obvious: Oil prices are rising, and have risen significantly. A quick check of the latest price trends for Brent Crude and West Texas Intermediate is all that is needed to know this.

Equally obvious is that rising crude prices have also been pushing gasoline prices up, both in gasoline futures pricing and at the pump. So significant has been the price rise in gasoline that alt-media financial news site Zero Hedge recently forecast that gasoline prices would hit $4/gallon later this year, as supply constraints and geopolitical instability combine to create significant supply disruptions globally.

A combination of issues is pressuring futures and pump prices higher, including the transition to summer-grade gasoline and strained domestic refineries, as well as concerns about shrinking global crude product supplies while Ukraine attacks Russian refineries.

Whether Zero Hedge’s price forecast will prove accurate only time will tell, but the current price movements in today’s futures markets and at the gasoline pump require us to consider the possibility that, unlike previous price surges which peaked quickly and headed down again, this rise in global oil prices might just keep moving up for the near term.

If oil prices and gasoline prices continue to rise, then it is almost a foregone conclusion that inflation will also rise, in spite of the Fed’s rate hike strategy of the past 24 months. If oil prices and gasoline prices continue to rise, then we may soon see the Fed’s rate hike strategy unravel, and the impotency of that strategy laid bare for all to see.

Will we see $4/gallon gasoline? Will we see perhaps $100/bbl oil prices? Is reality about to set in for the Federal Reserve in a big way? Quite possibly

The first thing we should appreciate is the steady upward trend in global oil prices since the start of the year. Both Brent Crude and West Texas Intermediate have risen around $12/bbl since the first of January.

While there have been a few peaks and troughs along the way, aside from February when oil prices hovered within a $3/bbl trading band oil prices have simply kept moving up.

Put another way, global crude oil prices are up between thirteen and fourteen percent in just three months.

That is a pretty significant increase. Global oil prices are up enough that they are on the verge of surpassing last fall’s peaks.

This last point is the most significant. After oil prices peaked last fall they spent the rest of 2023 steadily trending down—even after Hamas’ October 7th attack on Israel, and even after the Houthi militias in Yemen began their missile attacks on Red Sea shipping. Now oil prices have come within $1/bbl of that September peak, and it is not at all certain they will soon reverse and trend down again.

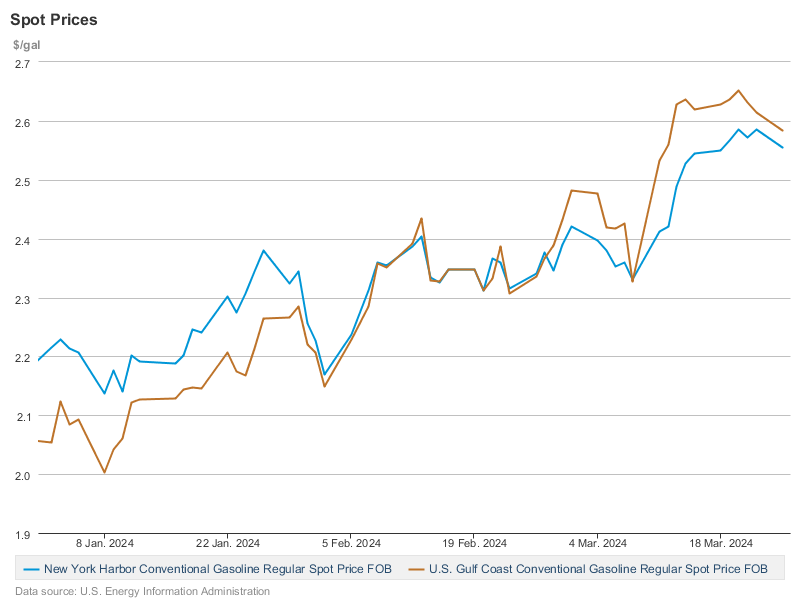

Unsurprisingly, as oil prices go so too go gasoline prices, and that is largely what we have seen, with gasoline futures climbing steadily since the first of the year.

Significantly, gasoline futures prices have already topped their September 2023 peaks, and are continuing to rise—a trend that seaks loudly against the possibilty of prices trending down again in the near term.

Spot prices for gasoline are moving in largely the same patterns and direction

The one major distinction between spot gasoline prices and oil prices: gasoline spot prices are still well below last fall’s peak price.

Oil and gas prices are up, up significantly, and appear to be up for the foreseeable future.

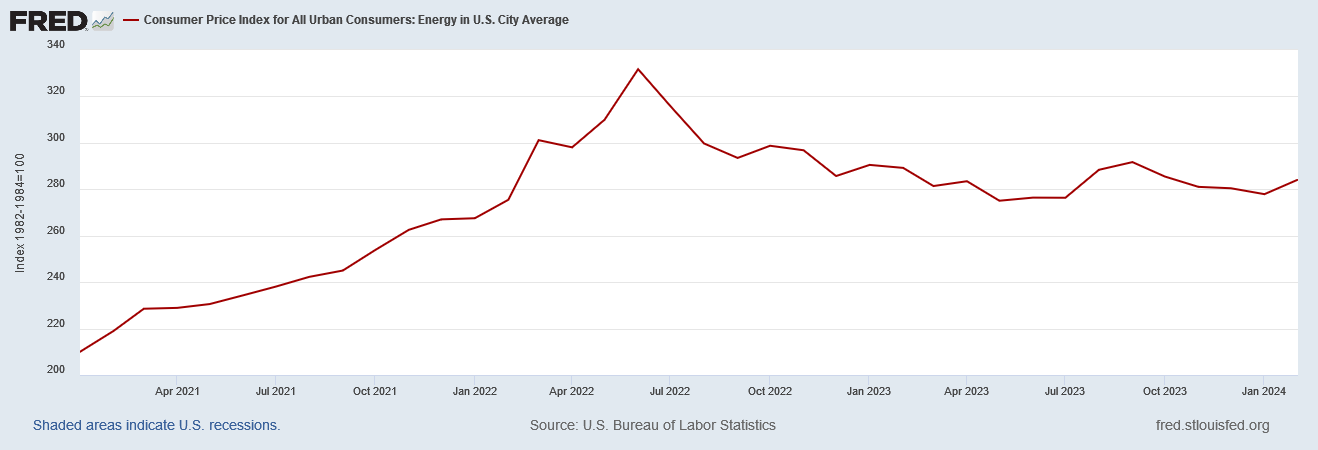

That energy prices have been the primary driver for inflation trends up and down is something I have noted many times before, especially when discussing February’s Consumer Price Index data.

Nor is there any great mystery as to why inflation rates are moving higher: so are energy prices.

Even the raw energy price subindex shows the December inflection point.

This was to be expected, however, as a look at benchmark oil prices reminds us that oil prices bottomed out last summer, trended up until early fall, moved down again until November before trending up.

Energy prices were the primary contributor to factory gate inflation in February—which I also noted then.

Nor is there any great mystery as to why factory gate inflation is moving up: Energy prices are moving up, and especially moving up since the start of 2024.

When we look at the Producer Price Index for Final Demand Energy (indexed to January 2021), we see the chart begins bending back up (rising inflation) beginning last summer, with that trend increasing beginning this year.

Energy prices were the reason consumer price inflation rose in February according to the PCE report.

For there to be a small shift in the headline inflation rate month on month, and a large shift in the core inflation rate at the same time, we can safely conclude that energy prices are pushing the inflation rate up—and there is no denying that energy are in fact rising.

Herein lies the problem for the Federal Reserve. If energy prices continue to rise—and we must concede there is a significant chance they will continue to rise, then inflation is also going to rise. With factory gate prices signaling resurgent inflation, and with the CPI and PCEPI printing renewed inflation, we should anticipate that inflation is going to be moving higher over the next few months at least.

Why are oil prices moving higher? The reasons are fairly simple and straightforward: a combination of reduced supply relative to demand, and increased geopolitical risks to that supply.

In March alone there was a significant reduction in OPEC-related output, as Iraq and Nigeria both produced less, and the cartel as a whole pledge to continue the Saudi-led production cuts from last year through the summer.

Lower exports from both Iraq and Nigeria, in combination with continuing voluntary supply cuts have resulted in reduced oil production for OPEC in March, according to a Reuters survey published on Monday. Based on the survey data, OPEC output for March was at 26.42 million barrels per day on average, compared to 50,000 bpd for February. OPEC+, the expanded cartel including Russia, agreed in early March to prolong voluntary oil output cuts from the first quarter into the second quarter of this year. The initial cuts of 2.2 million barrels per day were endorsed by OPEC+ in November.

OPEC is holding firm on the production cuts in part because of uncertainty regarding oil demand in China.

Oil analysts, for the most part, had expected the extension. While some pundits argued that some OPEC+ members would seek to increase supply with Brent prices above $80, it appears that OPEC+ remains cautious about bringing back additional supply amid ongoing uncertainty surrounding demand in China. Looking ahead, the next OPEC meeting in June will provide insight into how OPEC perceives demand growth in Asia developing in late 2024 and 2025. Thus far, the group of producers has managed to align its interests, but maintaining this unity may become more challenging if the anticipated surge in demand materializes later this year.

Additionally, Russian oil refineries are being increasingly targeted by Ukraine, as the war there drags on into its third year. At this point, some 14% of Russia’s refining capacity is reported to be impacted.

It should be noted that Ukraine is targeting Russian oil refineries, and not the oil pipelines that supply them—at least, not yet. As I noted in December 2022, as the war in Ukraine approached the 1-year mark, Ukraine can inflict a major hammerblow to Russia’s oil infrastructure through carefully targeted drone strikes.

If that pipeline nexus goes offline, much of Russia’s ability to transport oil down to Novorossiisk is compromised, leaving only the Baltic ports of Ust-Luga and Primorsk available to ship oil out to Russia’s new Asian customers. Russia can’t utilize its Pacific ports for anything but its ESPO crude because the pipelines simply do not interconnect.

The Samara refinery is roughly 630 miles from the Ukrainian city of Kharkiv.

That Samara refinery is the Kuibyshev refinery, and it has been shut down, just as I said it could be a year and a half ago. While Ukrainian drones have not (yet) targeted Russia’s pipeline infrastructure, if Ukrainian drones were to succeed in disrupting a major pipeline nexus such as the one near Samara, the impact on Russia’s ability to export oil would be ginormous. Russia needs to export oil in order to generate the funds necessary to keep the war in Ukraine going.

Additionally, even Russia is now sending its navy into the Red Sea, presumably to help protect Russian vessels from Houthi missile attacks.

Russian warships from the Pacific Fleet have crossed the Bab-el-Mandeb Strait and entered the Red Sea, the state-run Tass news agency said, venturing into a maritime region plagued by Houthi attacks and crowded with naval vessels.

The detachment included the missile cruiser Varyag and frigate Marshal Shaposhnikov, Tass reported Thursday, citing the Russian Pacific Fleet’s press service, which said the ships were carrying out “assigned tasks within the framework of the long-range sea campaign.” The ultimate destination of the ships was unclear from the report, as was the reason Russia sent vessels to the area.

Not only is this a reflection of the rising risk of Houthi attack on cargo vessels transiting the Red Sea, it also highlights the indiscriminate nature of the Houthi attacks. Even Russia apparently wants to deter Houthi missile mischief in the Red Sea.

These trends are why we have to consider that oil is going to continue to rise over the near term.

OPEC is not going to ease up on its output restrictions any time soon. Saudi Arabia especially has gone to great lengths to limit oil production and reduce global oil supply in order to prop up the global benchmark prices. By and large, they have succeeded.

The war in Ukraine is also steadily expanding into Russian territory and Russian infrastructure. As it expands, Kyiv is finding more creative ways to attack vital Russian infrastructure—including Russia’s oil refineries. Given that Russia’s strategic vulnerabilities in this regard were patently obvious in 2022, I suspect it is only a matter of time before Ukraine figures out how to target Russian pipelines as well as refineries, which would devastate Russia’s oil economy.

Additionally, the Houthis are not stopping their attacks. Reprisals by the US and UK against their missile launching sites are not having much deterrent effect. It remains to be seen if the presence of Russian ships in the region will persuade the Houthis to dial down the hostilities a bit.

Between supply restrictions via OPEC+ on the one hand, and rising risks for oil shipments in the Red Sea as well from Russian refineries, the immediate future for oil is not a pretty picture. For these reasons, it has become a pricey picture, and so long as the restrictions and the risks remain there is no reason to think it will not continue to become an even pricier picture.

Oil prices are continuing to rise. We may see $100/bbl oil at some point, and ZeroHedge may very well be correct that $4/gal gasoline is in the not-too-distant future.

Yet if oil prices continue to rise, headline consumer price inflation is also going to continue to rise. Factory gate inflation is going to continue to rise, and rising factory gate inflation today means rising consumer price inflation tomorrow.

The Fed’s interest rates play absolutely no role in this. These prices are not the result of the Fed not boosting the federal funds rate enough, nor can they be stopped by more increases in the federal runs rate.

Inflation is coming back, fueled in no small degree by rising oil prices. The Fed has not stopped it. The Fed will not stop it.

The inevitable conclusion is one I have maintained repeatedly on this Substack: the Fed’s policy of hiking the federal funds rate, presumably pushing market interest rates up and inflation down has had little or no influence on price levels.

The Fed has had less influence on consumer price inflation than its preferred narrative would have you believe. The Fed will have even less influence on the rising consumer price inflation we are likely to see over the next few months.

Reality is likely about to set in at the Fed, thanks to rising oil prices.

$4.00 a gallon, good grief they have finally come down to 3.09 after for an eternity at 3.19 to 3.39, or even worse.

"I sure could use some $1.68 gas and a few mean tweets" said John Rich.

I'm not selling my (petro) energy stocks!