Reality may be overtaking the government’s sketchy employment numbers.

When the June Employment Situation Report came out, I outlined the problems with the numbers, and how the report was yet another example of Lou Costello Labor Math1.

With recent upticks in first time jobless benefits, as well as signs of an increasing number of layoffs, the labor situation in the US may be deteriorating enough that even Lou Costello’s vaudevillian legerdemain can no longer obscure the reality.

The number of Americans enrolling for unemployment benefits rose for a third straight week last week to the highest in eight months and a closely watched gauge of factory activity slumped this month, the newest indications the U.S. economy is slowing under the weight of rising interest rates and high inflation.

As more Americans report losing their jobs, has the “demand destruction” for labor sought after by the Federal Reserve through their interest rate hikes finally arrived?

An increasing amount of data suggests this may be the case.

Layoffs Everywhere

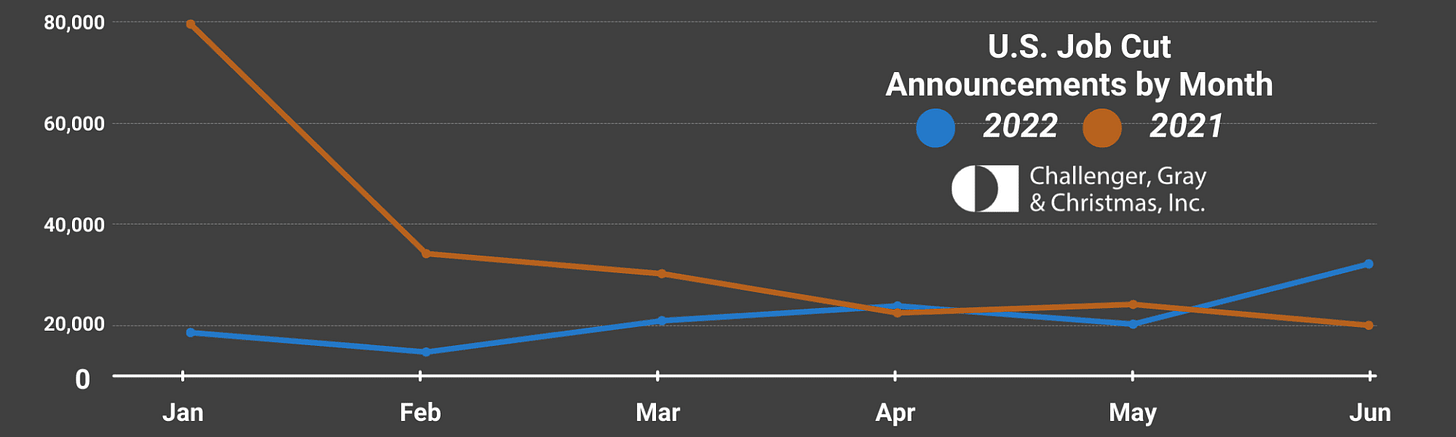

As detailed in the June Job Cuts Report by recruiting firm Challenger, Gray, and Christmas, job cuts and layoffs soared last month.

U.S.-based employers announced 32,517 cuts in June, a 58.8% increase from the 20,476 cuts announced in the same month last year. It is 57% higher than the 20,712 cuts announced in May, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

For the quarter, job cuts were the highest since the first quarter of 2021, with 77,515 announced job cuts and layoffs.

The Job Cuts Report data is being confirmed anecdotally, as companies across a variety of sectors are trimming their payrolls.

Convenience store chain 7-Eleven laid off 880 corporate workers in Texas and Ohio, following its purchase of a rival chain, a company spokesperson said an email. Ford is planning to cut 8,000 positions in the coming weeks, Bloomberg News reported. Meanwhile, electric carmaker Rivian is cutting 700 positions, delivery start-up Gopuff is laying off 1,500, and mortgage lender LoanDepot is slashing 4,800 jobs this year, according to reports.

Some firms, such as Ford Motor Company, are framing the cuts as cost-cutting measures to achieve optimum profitability.

Farley has said cutting staff is a key to boosting profits, which have evaporated on its electric Mustang Mach-E and other plug-in models amid rising commodity and warranty costs.

“We have too many people,” Farley said at a Wolfe Research auto conference in February. “This management team firmly believes that our ICE and BEV portfolios are under-earning.”

Regardless of the rationale, however, the end result is the same: a reduction in jobs, and a reduction in employed Americans.

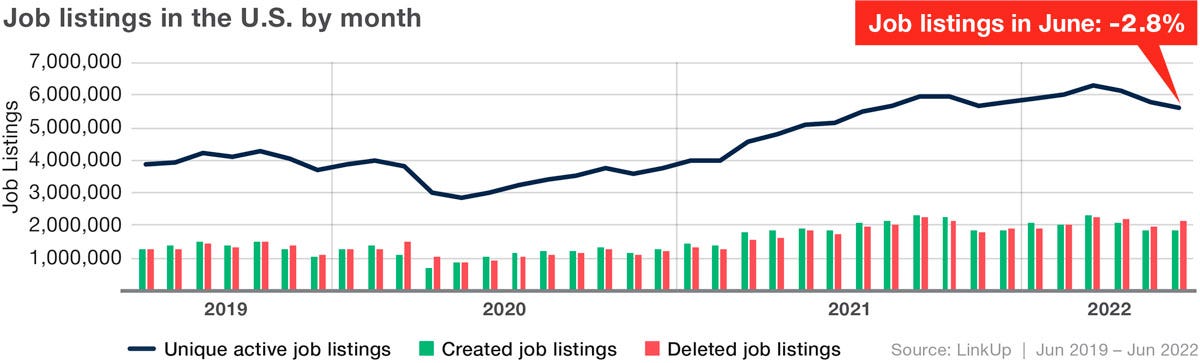

At the same time, high-frequency data from places such as job market analytics firm LinkUp’s jobs recap report shows a decline in new job postings, suggesting that a slowdown in hiring is already underway, and will soon show up in the government figures.

Job listings in the U.S. were down 2.8% in June, with 94% of states seeing jobs drop. The states with the highest rates of decline include South Dakota (-10.1%), Maryland (-7.9%), and Missouri (-5.7%). The only states seeing job listings grow: Hawaii (+4.1%) and Alaska (+1.9%).

According to the LinkUp data, job listings have declined in 86% of occupations. Broken down by NAICS industry code, only two industries saw an increase in job listings in June: Transportation/Warehousing and Educational Services.

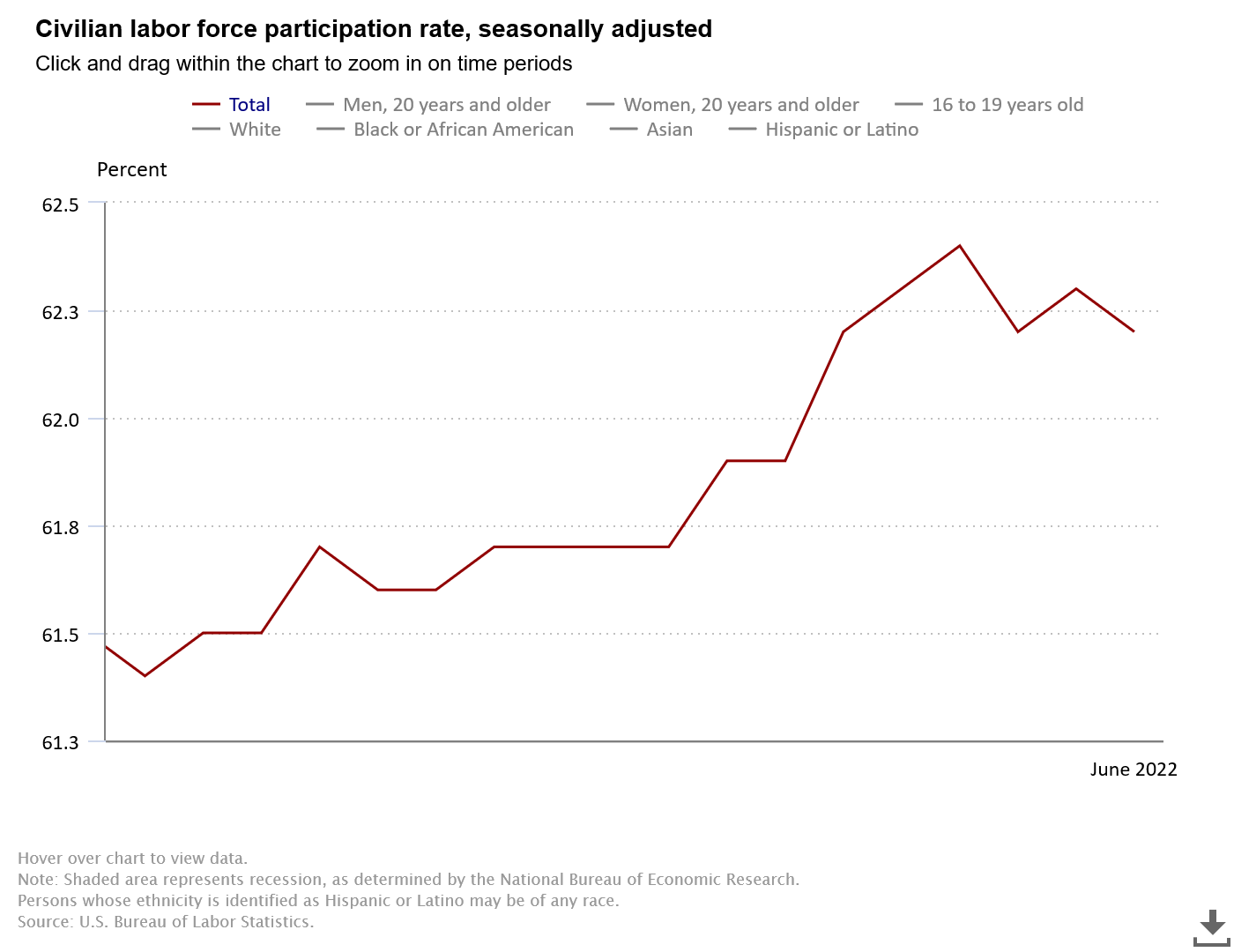

Such data is very much at odds with the government’s claim on the Employment Situation Report that June saw 372,000 jobs created in this country, as is the report’s own acknowledged 0.2% decline in labor force participation since March.

No New Workers Since March?

The recent reports on job losses and layoffs are even more ominous when one realizes that the Household Survey portion of the BLS Employment Situation report shows no significant increase in the number of employed individuals since March.

The red area at the far right of the graph represents the differential between the number of employed individuals per the Household survey on the BLS report and where it would be (should be?) had actual employment hewed to the 3-month moving average as of March. That differential in June amounted to 1.3 million workers—that’s the number of additional employed persons the economy “should” have at this juncture.

How is it that 372,000 jobs were created in June without an increase of 372,000 in the number of employed persons in the Household summary part of the Employment Situation Report? A big part of the answer is a rise in the number of workers holding down multiple jobs, which rose by 239,000 individuals on an unadjusted basis during the month of June. More people are taking second jobs even as substantial numbers of people are without a first job—a fact which by itself should put an end to any nonsense about the economy being “strong”.

On that basis alone the actual reduction in overall unemployment for the month of June is a mere 133,000.

Jobs Destruction Is The Goal

If the Federal Reserve is aware of these nuances in the jobs data, they are hiding it well.

In the June minutes of the Federal Open Market Committee, the assessment of the Fed was that “The labor market remained very tight, but there were some signs that momentum was slowing.” Additionally, they assessed the state of nonfarm payroll employment in favorable terms.

Total nonfarm payroll employment rose solidly in April and May, though the pace of increase was slower than in the first quarter, and the unemployment rate remained unchanged at 3.6 percent. The unemployment rates for African Americans and for Hispanics were little changed, on net, though both rates remained noticeably higher than the national average. On net, the labor force participation rate edged down between March and May, while the employment-to-population ratio was unchanged. The private-sector job openings rate, as measured by the Job Openings and Labor Turnover Survey, edged lower in April but remained at a high level.

In the Fed’s eyes, a “tight” labor market is inflationary. One of their objectives with interest rate hikes is to soften up the labor market—effectively forcing unemployment up, just not “too much”. As I have pointed out multiple times, they say this explicitly in their public rhetoric.

Unfortunately—both for the Fed and for everyone else—the labor markets are nowhere near as “tight” as the federal data makes them out to be. A rise in the number of multiple jobholders, a decline in the labor force participation, a deficit of 1.3 million workers in the Household Survey portion of the Employment Situation Report do not add up to either a tight labor market or a strong jobs situation overall.

In their June 6 discount rate meeting, the members of the Federal Reserve Board of Governors articulated the concern that the cost of labor was pushing prices up.

Overall, Federal Reserve Bank directors continued to report strong demand and elevated inflation. In most Districts, consumer spending, particularly on services, was solid, but several directors noted that increases in food, energy, and other prices were starting to constrain spending by lower-income households. Some directors commented that the effect of increasing prices falls disproportionately on those at the lower end of the income distribution. Many directors cited supply chain disruptions and the availability and cost of labor as ongoing concerns, though hiring challenges had eased recently in some Districts. Several Directors noted persistent inflationary pressures across sectors, and some directors expressed uncertainty about the outlook.

“Cost of labor” is what workers call a paycheck. Substantively, the Federal Reserve is worried workers are earning “too much”.

The Fed’s solution is to step on the economy through higher interest rates enough to choke off new hiring and to dissuade workers from seeking higher wages. The Fed thinks workers are earning too much, so they intend to throw some workers out of their jobs. Unemployment is a real, foreseeable, and intented consequence of their monetary policy.

Is The Volcker Approach The Only One?

While the Fed is sure to persist in its disingenuous dishonesty about trying to avoid a recession when that is the direct and deliberate result of rapid interest rate hikes, people should be under no illusion that suppressing demand and suppressing employment are the benchmarks that tell the Fed if the rate hikes are “working”. Raising rates increases the cost of both credit and capital, which inhibits economic activity on all sides.

This means of overcoming inflation, used so famously—or infamously, depending on your perspective—by Paul Volcker to tame the hyperinflation of the 1970s, does lead to greatly reduced inflation, but only by inflicting a recession and economic contraction on everyone. The cost of this means of combating high inflation is paid by workers who lose their jobs and businesses who close their doors for good; high interest rates may stop high inflation, but only at a high price in human terms.

The Volcker approach might be a proven way to combat inflation, but is it the only approach? Given all the disruptions and dislocations inflicted upon global supply chains as a result of the pandemic-era lockdowns, would untangling the snarled supply chain mess achieve the same end without the high human cost?

There is, of course, no way to answer such questions definitively. Yet that does not mean people should not ask the questions. A lack of definitive answers does not preclude there being meaningful public debate on the topic. The Federal Reserve could—and should—defend its position The government could—and should—articulate why there are no alternatives likely to be effective. People deserve that much respect just out of common decency.

However, to have that debate the Federal Reserve must first admit that recession is not merely a potential consequence of its monetary policy, but is in fact the overarching objective. The Fed needs to come clean and admit that recession is their ultimate goal. The Fed needs to explain why they consider recession necessary, why economic contraction is the only means to achieve economic reset and eliminate the distorting impacts of consumer price inflation.

The Fed needs to level with the American people. Unfortunately, that is not likely to happen. Add increasing dishonesty and distrust to the societal price tag for the Fed’s plan to combat high inflation.

An homage to the classic Abbott and Costello skit where Lou shows Bud how 7 goes into 28 13 times.

“While the State exists there can be no freedom; when there is freedom there will be no State.”

Vladimir Lenin

PNK, I think I'm starting to catch on, thanks to your superb columns.

These are really excellent, congratulations.