Last Friday’s Employment Situation Summary was largely brushed aside as news of Wall Street’s epic tantrum over President Trump’s “Liberation Day” tariffs dominated corporate media. Ironically, this happened in one of the few times when the Bureau of Labor Statistics genuinely had some good news on jobs, with a jobs print that greatly exceeded Wall Street estimates as well as the privately generated ADP National Employment Report.

At first glance, I looked at the jobs numbers and I immediately suspected Lou Costello Labor Math at work. For the record, I do not rule it out.

However with the ADP report and both surveys within the Employment Situation Summary showing employment gains, we are seeing some jobs gains for the month of March.

We are not seeing nearly enough jobs to call an end to the jobs recession, and there is enough turmoil in the world that we dare not anticipate April to be a repeat of March. Still, the prevailing trends in the jobs report are positive for the month.

While not the great news that President Trump made it out to be, the BLS jobs report is still mostly good news.

Job Numbers Up

In sharp contrast to February’s job numbers, the March Employment Situation Summary was undeniably strong.

Total nonfarm payroll employment rose by 228,000 in March, and the unemployment rate changed little at 4.2 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in social assistance, and in transportation and warehousing. Employment also increased in retail trade, partially reflecting the return of workers from a strike. Federal government employment declined.

At 228,000 jobs, the BLS beat Wall Street’s expectations by very nearly 100,000 jobs.

Even with government employment excluded, the reported private sector jobs gains were still strong, at 209,000 jobs.

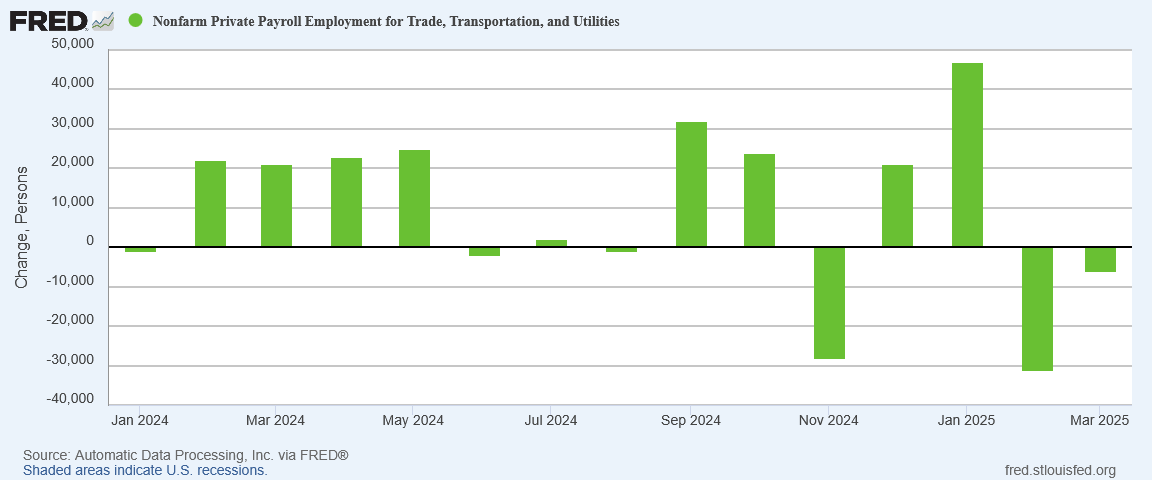

Digging deeper into the report, Trade, Transportation, and Utilities—one of the more significant service categories—delivered 48,000 jobs on the month.

Moreover, the BLS report surpassed ADP’s National Employment Report by roughly 80,000 jobs, with ADP reporting “only” 155,000 jobs created in March.

Yet even with the BLS report coming in significantly stronger than the ADP report, ADP also reported a significant uptick in jobs gains from February.

While the magnitude of the numbers should always be taken with several large grains of salt, we do need to acknowledge that pretty much across the board, job creation ticked up in March. That much is unquestionably good news, and we should acknowledge that.

Trump Takes The Expected “Victory Lap”

For his part, President Trump was naturally quite happy with the jobs numbers, and was equally happy to take a victory lap for it, which he did on both the whitehouse.gov website and on his Truth Social social media account.

Even CNN touted the 228,000 jobs number as a strong economic signal and a sign that the economy is presumably still doing well, in large part because economists had underestimated the report so significantly.

Economists were expecting job growth to slow to 130,000 in March and for the unemployment rate to tick up to 4.2%, according to FactSet.

March’s report marks another solid month of job gains and a continuation of a historic expansion of the labor market.

When even CNN can find little reason to throw shade at President Trump, there is no denying that the jobs report is good news.

Not All The Numbers Are Encouraging

However, while corporate media was once again content to focus only on the top-level numbers, we should note that not all of the data was as positive.

Manufacturing barely added any jobs in March, posting a paltry 1,000 jobs.

This was one area where ADP showed a stronger result, notching some 21,000 jobs created for the month.

Ironically, the ADP report also deviated from the BLS report by reporting a decrease in Trade, Transportation, and Utilities jobs.

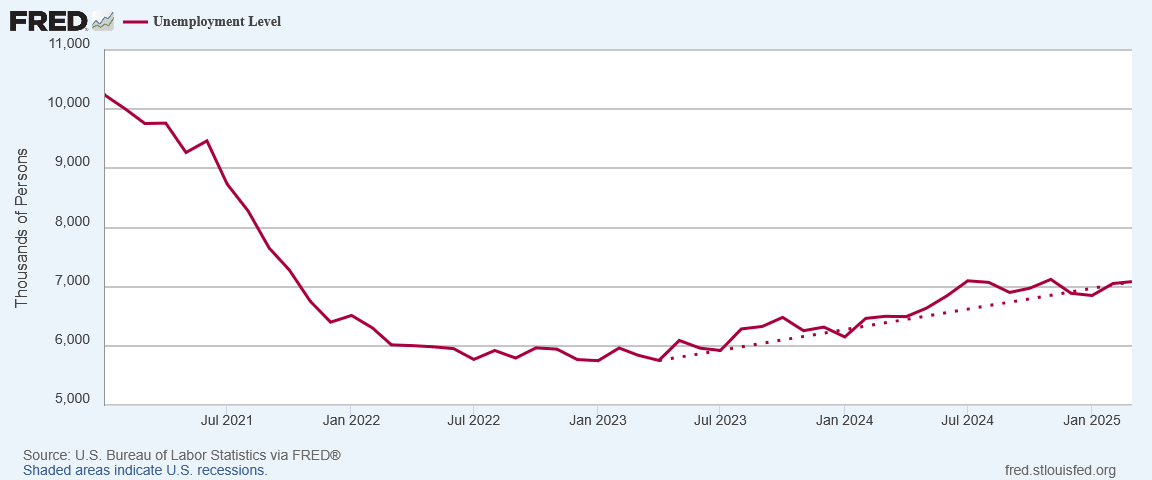

The data from the Household Survey also showed that not everything was upbeat in the report, with part-time employment still very much continuing the overall upward trend over the past two years.

Overall unemployment numbers also continued to rise.

Even more concerning is the continued accelerated rise of those counted as Not In The Labor Force.

While this number did ease slightly in March, since last fall the rate of increase has risen sharply. That is by itself an ominous red flag, as the number of potential workers not in the labor force has been rising steadily since January of 2022.

The rising trend among those counted as Not In The Labor Force is a pointed reminder that the "real" unemployment rate continues to be significantly higher than the “official” rate, which printed at 4.2% for March.

When those not in the labor force but who want a job now are included in the unemployment calculation, the rate of unemployment rises to 7.2%.

Even with 228,000 jobs created, the United States is still contending with continued joblessness and a deepening jobs recession. The positive jobs news for March, while good, is not enough to turn that corner.

Other Red And Green Flags

Nor should we ignore the other economic red flags that appeared in March.

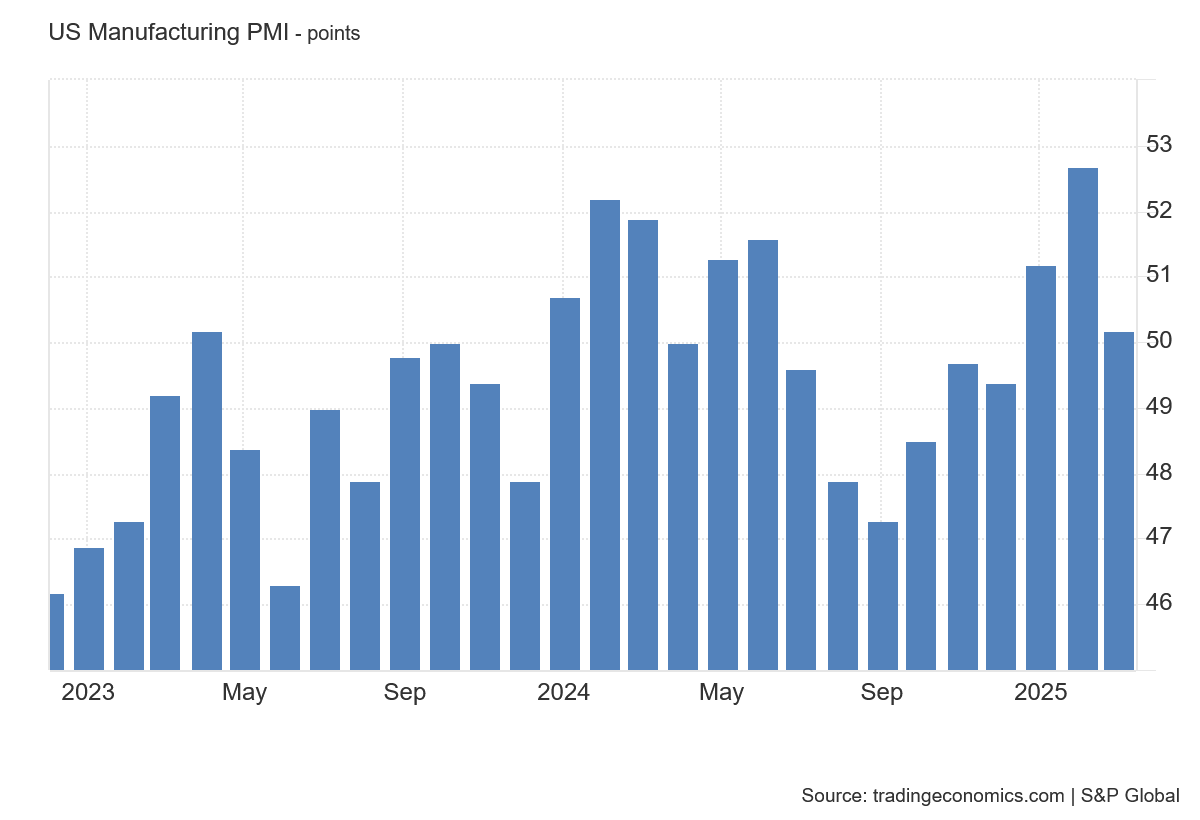

The Institute For Supply Management’s Manufacturing PMI dropped significantly in March, moving into contraction territory once again.

The ISM’s Non-Manufacturing PMI also moved sharply lower for the month.

With the BLS reporting a weak manufacturing jobs print and ADP reporting a decline in Trade, Transportation, and Utilities jobs, these reversals in both manufacturing and services from the ISM are reason to be prudentially skeptical about the top-level jobs numbers. The BLS report may be good, but it is not that good, and it does not overcome the red flags we are seeing elsewhere.

The other PMI data is somewhat mixed. While S&P Global’s Manufacturing PMI data showed a significant drop, at 50.2 it nevertheless remained above the threshold level of 50 where expansion turns into contraction.

The S&P Global Services PMI data provided one of the month’s “green” flags, printing an increase in services expansion.

For its part, the Federal Reserve reported manufacturing production increased 0.9% month on month in March.

That increase was not only the strongest manufacturing output increase since February of 2024, it marked the fourth straight month that manufacturing output rose in the United States. The last time that occurred was in the summer of 2023.

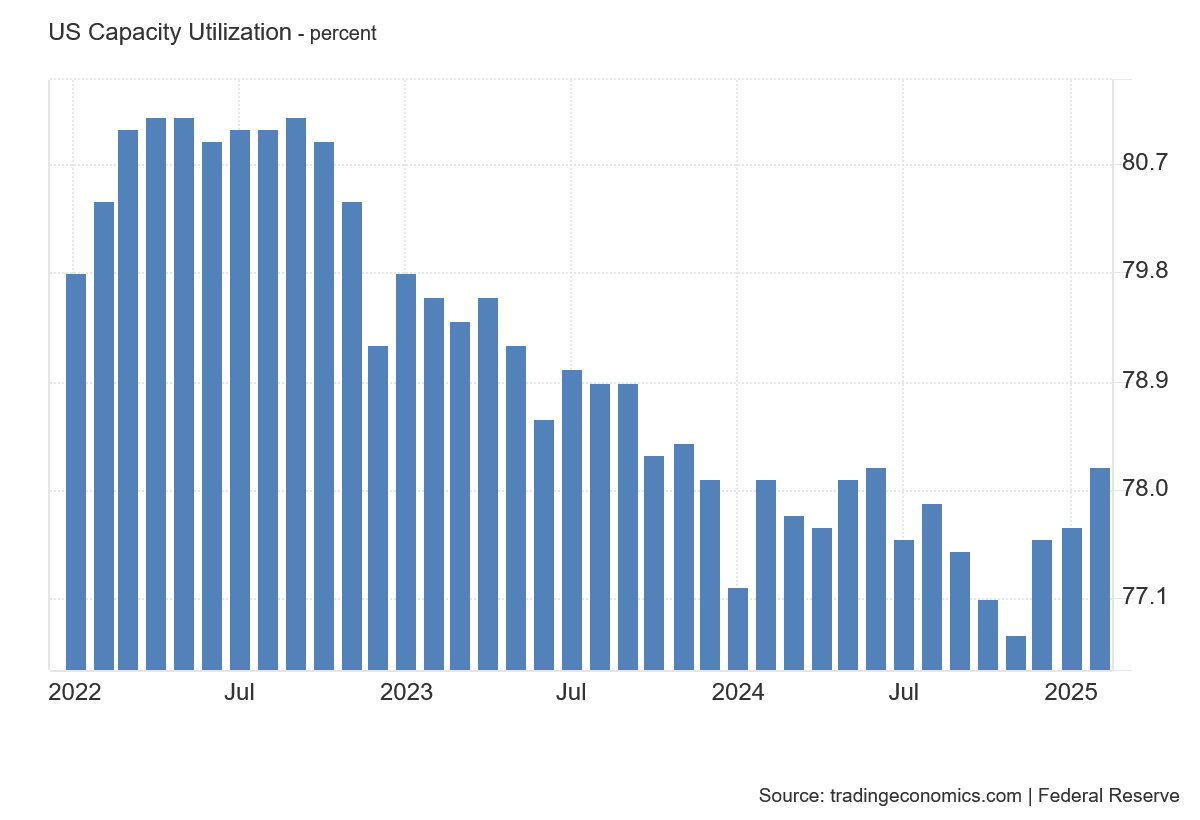

At the same time, the Federal Reserve also reported an increase in plant capacity utilization, rising to 78.2%.

While the overall economic picture for March is far from one of complete positivity, in broad strokes it is one of the stronger months that we have seen recently, and that that does help give credence to the BLS jobs creation totals for the month.

Enjoy The Numbers While They Last

While the March Employment Situation Summary was, on balance, a good jobs report, it still is far short of what is needed to view the jobs recession this country has been enduring since at least November of 2023 as coming to an end.

While President Trump, like President Biden before him, wants to tout good jobs numbers and point to job gains as a sign of a strengthening economy, the March jobs data is not enough to overcome the joblessness this country has seen since well before November of 2023.

With mixed signals on the health of the manufacturing sector, the extremely weak manufacturing jobs gains reported by the BLS gives no confidence that manufacturing is poised for significant expansion. Having endured extended contraction for much of the past two years, quite a bit more positive data is needed before that sector can be said to be on the road to recovery.

Moreover, the red flags within the services sector should not be ignored. Services growth is what has sustained the US economy overall for the past few years, and if that growth falters, the US economy will be heading into some very rough waters indeed.

Still, the March Employment Situation Summary was, overall, a good report. It was not a great report, but it was a good report.

We should enjoy this good report. If the red flags are any guide these numbers might not last. If the red flags have any substance at all behind them not only is the US economy not out of its extended jobs recession, but that recession could very easily get worse in the very near future.

The US economy is still in a parlous state, and may be about to become even more so. For the answer to that question we shall just have to wait and see what unfolds next month.

Looks encouraging, but then come the revisions as usual.

These numbers are certainly better than expected, but it’s a shame about the timing. The media will be so busy freaking out about the stock market today that they won’t even notice the jobs numbers - which, conveniently, means Trump won’t win any points.

The silver lining in the poor manufacturing jobs numbers is that when Trump manages to get manufacturing soaring in growth, the percentage increase will be so huge that even corporate media won’t be able to ignore it. The voters will notice, too!

Thanks once again for your objective analysis, Peter. You earn your readers’ trust and respect,