Even Wall Street realizes that today’s jobs numbers were weak.

From the opening bell, stocks headed south, and no one on Wall Street is pretending the catalyst was anything but an underperforming Employment Situation Summary Report from the Bureau of Labor Statistics.

US stocks erased earlier gains on Friday as investors digested a crucial jobs report that provided clues to the size of this month's expected interest rate cut and the resilience of the US economy.

Tech stocks led the morning's declines, with the Nasdaq Composite (^IXIC) plunging 2.3% in afternoon trading. The S&P 500 (^GSPC) and Dow Jones Industrial Average (^DJI) dropped around 1.5% and 0.9%, respectively.

Even the BLS’ incomparable fudge factor team, masters of Lou Costello Labor Math, were unable to rescue this month’s numbers.

According to the BLS, the US economy added all of 142,000 jobs during the month of August, with unemployment described as “little changed.”

Total nonfarm payroll employment increased by 142,000 in August, and the unemployment rate changed little at 4.2 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in construction and health care.

That’s if you believe the BLS numbers. As it turns out we have good reason to be skeptical the jobs numbers are even that good.

We already know that 818,000 jobs from 2023 are set to evaporate from the BLS dataset.

In addition, buried in the current Employment Situation Summary are the BLS’ usual “corrections” from previous months.

The change in total nonfarm payroll employment for June was revised down by 61,000, from +179,000 to +118,000, and the change for July was revised down by 25,000, from +114,000 to+89,000. With these revisions, employment in June and July combined is 86,000 lower than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.)

In fact, the BLS has been revising the jobs numbers down most of the year.

So in addition to the 818,000 jobs that never existed in 2023, there are thus far in 2024 another 365,000 jobs that never existed.

Month after month, the BLS numbers just don’t stand up.

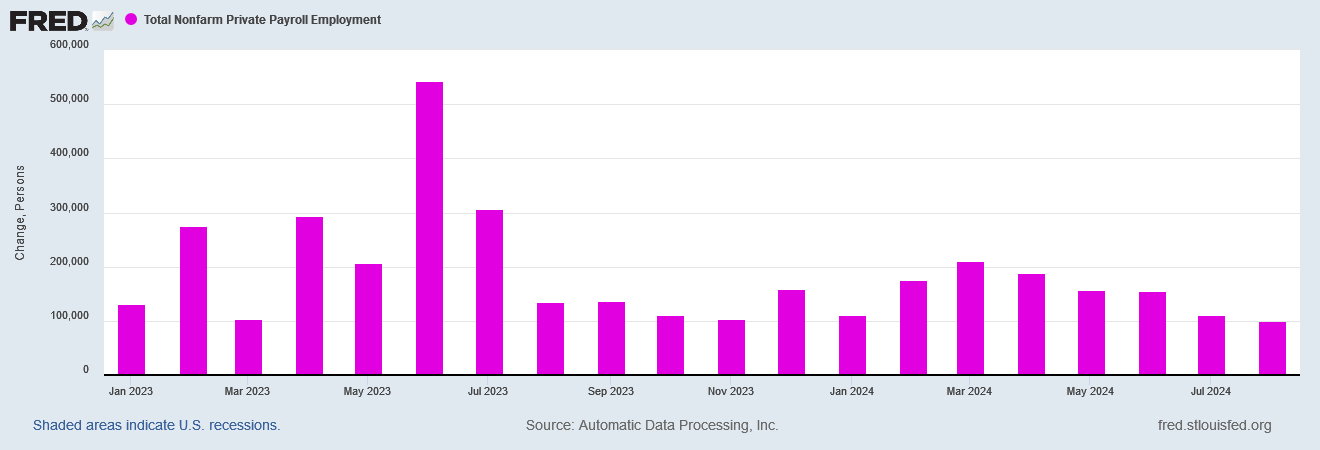

On top of the BLS’ usual admission that it can’t do simple math, ADP’s National Employment Report yesterday indicated only 99,000 jobs were created in August.

The ADP press release also sounded a warning on wages.

The job market's downward drift brought us to slower-than-normal hiring after two years of outsized growth. The next indicator to watch is wage growth, which is stabilizing after a dramatic post-pandemic slowdown.

With jobs numbers looking weak and likely to get weaker, it is unsurprising Wall Street puked on the numbers.

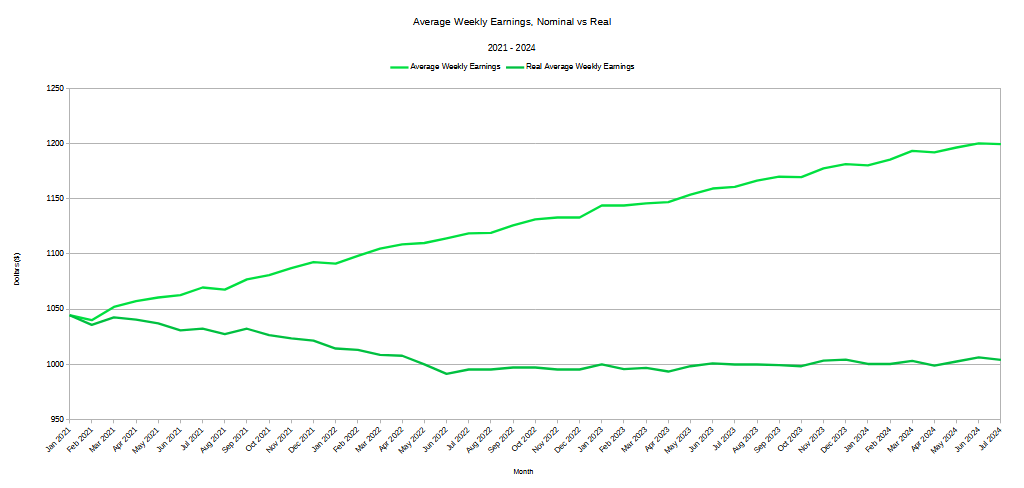

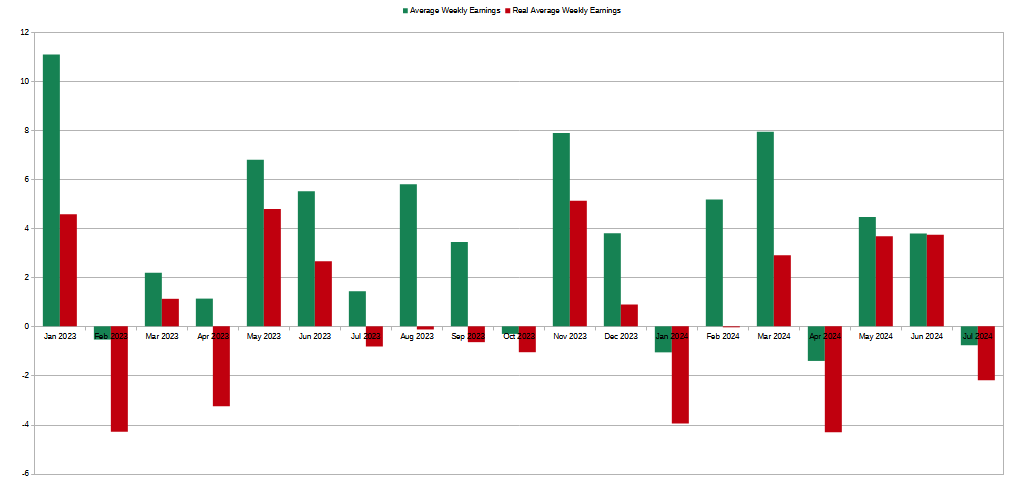

There is little joy on the wage front either, as inflation continues to erase nominal wage gains.

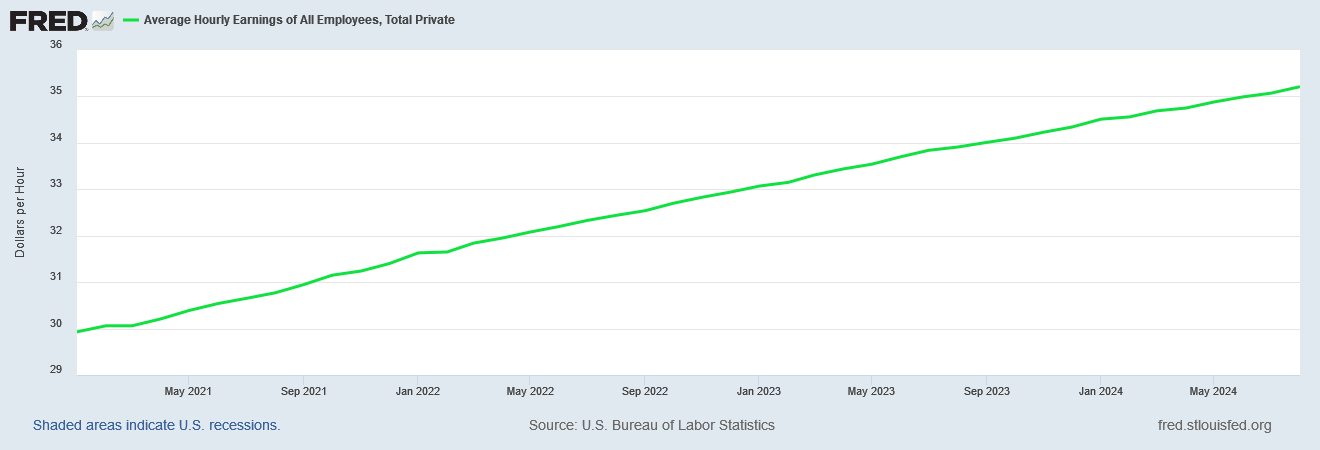

On paper people are making more per hour.

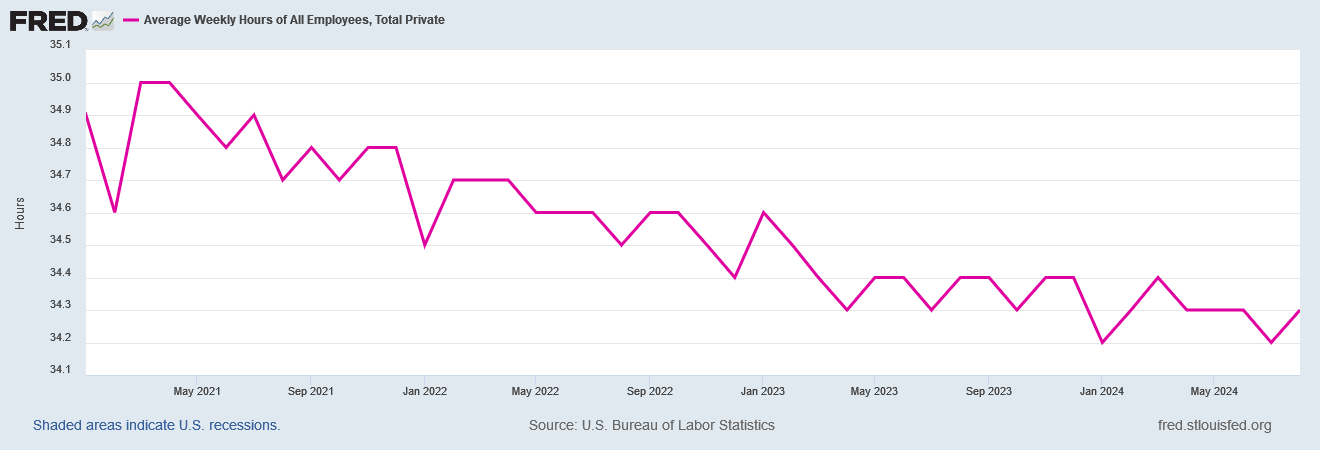

However, they are working fewer hours.

What the declining work hours doesn’t take away from the paycheck, inflation still has, as a comparison of the nominal average weeky earnings to the CPI-adjusted real average weekly earnings illustrates1.

ADP said to look out on wages—they were right. Folks’ paychecks are still evaporating into Bidenflation.

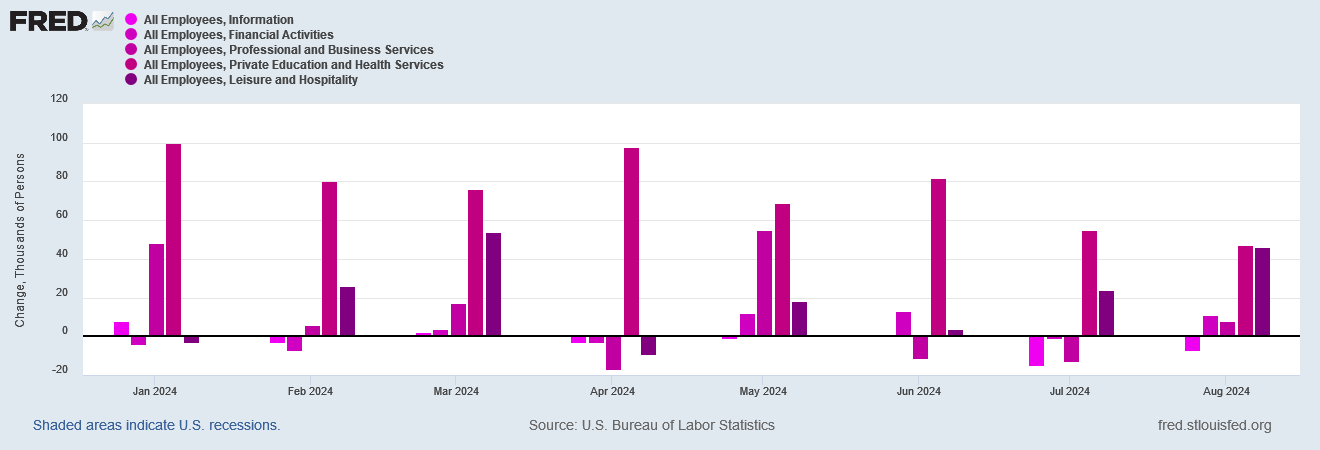

While the jobs report showed net job gains overall, it is important to note where the jobs were not—they were not in goods producing sectors such as mining and manufacturing.

Nor were they in trade, transporation, and utilities.

The only sector to show any real strengthening was leisure and hospitality. Other services lost steam or lost jobs.

Once the “corrections” get applied in the coming months, these numbers are highly likely to get even worse.

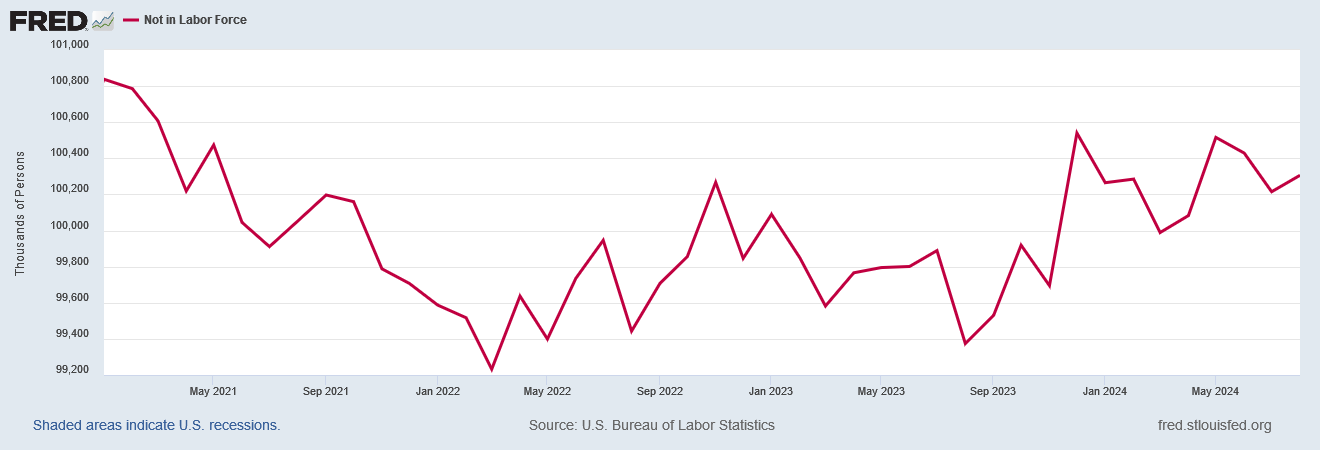

All of which serves to underscore the reality that employment levels began declining last year and have yet to recover.

As if to drive home the point, the number of workers who have left the labor force rose again last month.

Which means that the reason unemployment fell last month is not because people found jobs, but because they gave up.

The US economy generated 142,000 jobs last month? Only if people are very lucky—and lately people have not been that lucky!

Not only is the jobs data weak, it is confirmation that the United States is still in a jobs recession.

Labor markets are not getting “weaker”, they’re shrinking.

Employment is declining in this country.

These are the results Kamala Harris has in mind when she cackles “Bidenomics is working!”.

This is the “successful” foundation on which she thinks she can build an “opportunity economy” with Nixonian price controls and more government regulation.

Except she’s completely wrong. This is not a successful economy. This is not a healthy economy. This is not an economy that is presenting much at all in the way of opportunity, and it is not an economy that is on track to provide any sort of opportunity.

This is an economy that is highly vulnerable. Any major shock will be felt everywhere and quickly. If oil prices spike (always a risk with endless war in the Middle East and in Ukraine), or if a financial crisis emerges, there is not any resiliency within the overall economy to withstand such reversals.

Right now the US economy is one bad blip away from a major recession if not outright depression. Any politician posturing and preening over this data has lost what little sense she ever had.

As I’ve illustrated before, it is feasible and perfectly valid to use the Consumer Price Index as a deflator to arrive at a computation of real dollar values—in this case, January 2021 dollars.

Excellent report, but devastating article.

Thanks you, Mr. Kust.

Today's jobs report is pure garbage. Manufacturing jobs are shrinking. Nearly 1 million more unemployed in August this year compared to August 2023. And missing the overall target by 18,000 from an already low 160,000 goal is pathetic. Our economy is wrecked.

But it's a good thing Kamala wants to tax us into prosperity!