May JOLTS Report Hints At More Lou Costello Labor Math

Once Again, The Numbers Do Not Match The Narrative

If one stops at just the headline numbers in the May Job Openings And Labor Turnover Summary Report, one would yet again be left with the presentation of a healthy and robust labor market in the US, albeit one that is cooling suitably for the Federal Reserve’s anti-employment tastes.

The number of job openings decreased to 9.8 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 6.2 million and 5.9 million, respectively. Within separations, quits (4.0 million) increased, while layoffs and discharges (1.6 million) changed little. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

Fewer job openings are good for the Fed, because they can point to that number as “proof” their interest rate hike strategy is bearing fruit (no, it’s not, and no, it isn’t). Meanwhile Dementia Joe gets to take another undeserved victory lap on Twitter, courtesy of whomever pretends to be him on social media.

What the media will gloss over yet again are the words “little changed”, which is, as per usual, is the prevailing theme within the underlying detail.

True to form, the corporate media has focused on that headline “job openings” figure, almost to the exclusion of all else.

The number of job openings on the last business day of May stood at 9.8 million, the US Bureau of Labor Statistics' (BLS) Job Openings and Labor Turnover Survey (JOLTS) revealed on Thursday. This reading followed 10.3 million openings in April (revised from 10.1 million) came in below the market expectation of 9.93 million.

Wall Street, also true to form, somewhat took the bait and received the declining job openings number more or less as “good news” (that is, data which will not create added pressure on the Fed to hike the federal funds rate yet again).

The US Dollar Index extends its daily recovery following this data and was last seen posting small daily gains near 103.50.

However, the markets were not overly euphoric over the JOLTS report, moving mostly sideways on the day, with gains coming later in the day rather than earlier.

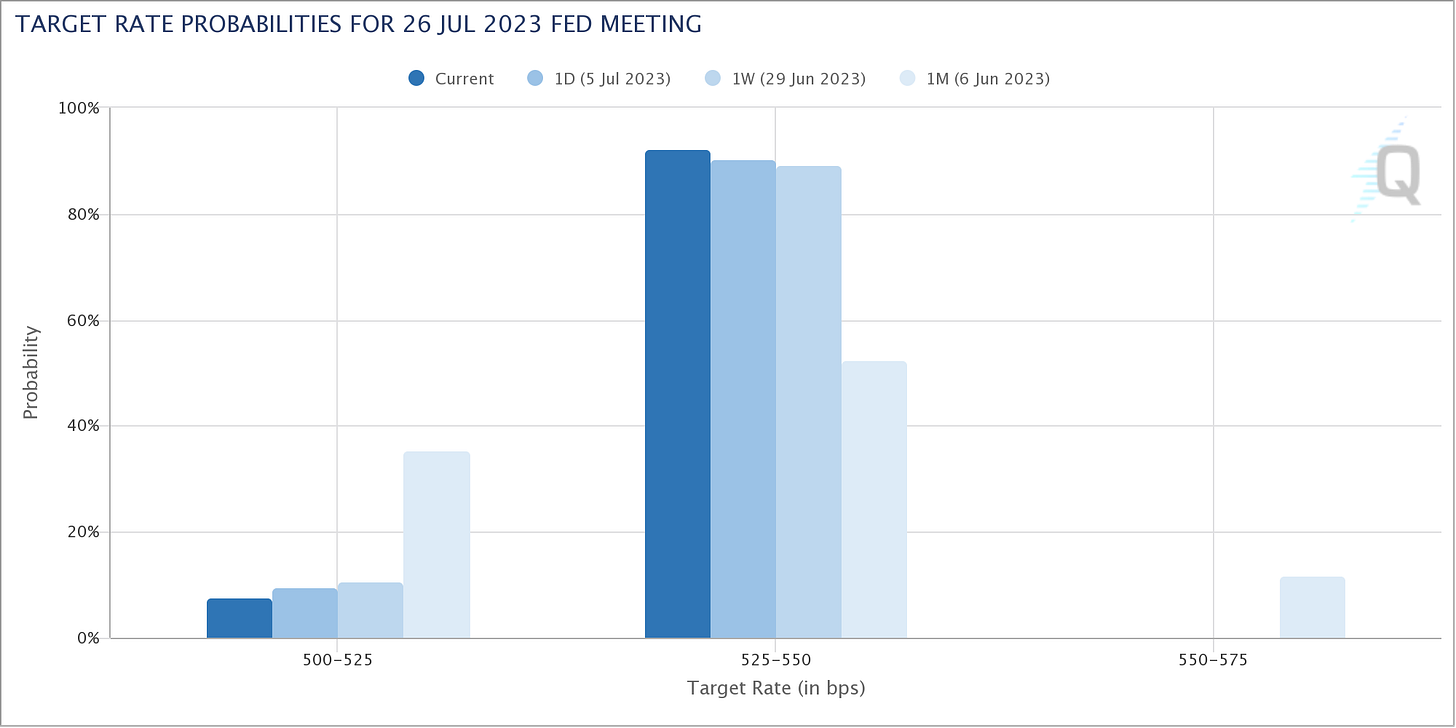

Wall Street also continues to price in a high probability of a 25bps rate hike later this month.

The narrative of the strong labor market being a problem for the Fed’s fight against inflation is also being duly upheld.

Policymakers at the Federal Reserve have worried about the strength of the labor market as they continue to tackle stubbornly high inflation.

The Fed chose to leave interest rates unchanged in its June meeting after 10 consecutive increases. The JOLTS report is one of several factors that will inform Fed’s next decision on rates.

Some economists worry that the Fed will push interest rates too high and set off a recession.

The lower job openings number, therefore, signifies that labor markets are weakening—not so much as to catalyze a recession, but just enough to nudge consumer price inflation. This is undeniably good news, so the theory goes, because strong labor markets are always tantamount to raging inflation (Milton Friedman is no doubt turning over in his grave at this economic illiteracy masquerading as expertise).

Wall Street’s choice to be guardedly optimistic about the numbers was no doubt helped by the realization that the reduction to the job openings number exceeded expectations.

The closely watched Job Openings and Labor Turnover Survey showed that listings fell to 9.82 million, down 496,000 from April and below the 9.9 million consensus estimate from FactSet. Openings outnumbered the available labor pool by 1.6 to 1 for the month, a level that had been closer to 2 to 1 just a few months ago.

The decline would have been even more had there not been an increase of some 61,000 in government-related positions. Openings tumbled in health care and social assistance (-285,000) as well as finance and insurance (-139,000).

There is, however, one problem still within the JOLTS report: the job openings being reported still do not actually exist.

We can tell the job opening numbers are largely illusory for May for the same reason they were illusory for April—and for just about every month since the government-ordered COVID recession in 2020. Hiring patterns simply do not reflect the greater number of job openings.

Even without seasonal adjustments, while the reported number of job openings has risen dramatically post-COVID, actual hiring and separation numbers have remained in the same range they occupied pre-COVID.

The seasonally adjusted data shows hiring and separation patterns to be nearly a constant month to month extending back even before 2020 (making the obvious exception for the spike in separations during the 2020 recession).

To accept the job opening numbers as realistic requires believing that employers have greatly expanded their desired numbers of workers yet are unable to find sufficient workers to show even a little increased hiring post-COVID—despite fully half the number of workers forced out of the labor force by the recession still being on the sidelines.

Since June of 2020 there has not been any meaningful improvement in number of workers currently not in the labor force, yet somehow there is ginormous unfilled demand for workers. These are not two concepts that one typically includes in the same logical space.

Even if we look at just the workers not in the labor force who want a job now, we still have 20% more such workers more than three years after the recession than when the recession began.

The data just does not support a narrative of employers aggressively looking to swell the ranks of their employees.

We also do well to remember that hiring and separation trends are not uniform across the entire labor force.

While trade and transporation jobs have been trending up the past few months, professional and business services have been largely trending horizontally, with neither sustained increase or decrease.

Separations trends for these industries is likewise muddled, with only brief trends either up or down.

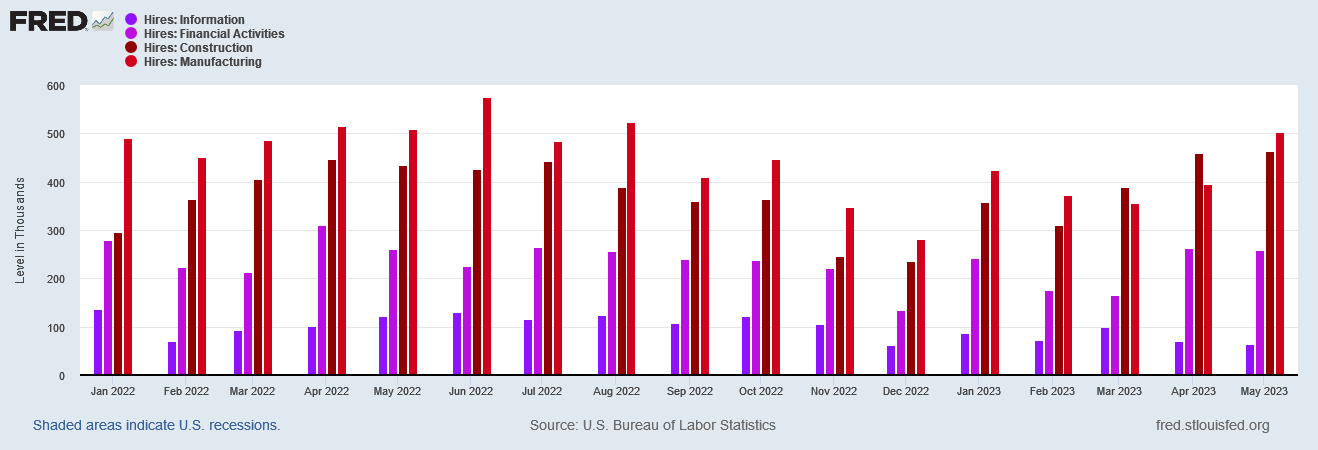

Even though construction and manufacturing jobs are showing some growth in recent months, information and financial activities are, if anything, show a hiring decline.

Paradoxically, manufacturing separations have been trending up the past six months, with construction separations ticking incrementally down over the same period. Financial activities and information separations are marginally down, although the trend is problematic.

These marginal and indistinct trends at an industry level go a long way towards negating each other. Thus the JOLTS report looks at the amalgamated data for the whole of the labor force and sees the overall trend in hiring and separations as “little changed."

What the JOLTS data does show is more evidence that the Fed’s interest rate hikes have had little to know impact on either hires or separations.

Overlaying the Secured Overnight Financing Rate (which is the market presentation of the federal funds rate) with the JOLTS data, while the rate itself has fallen and risen, hiring and separation trends have remained largely horizontal. As has been stated innumerable times by both the Fed and by corporate media’s Fed watchers many times, slowing hiring and increasing unemployment are key objectives in the Fed’s anti-inflation strategy and have been since the beginning.

Even if we look at short- and long-term Treasury yields, we still do not see rising interest rates impacting hiring and separations.

The lack of change of pace in either hiring or separations makes the Fed’s impact on labor markets an even more abysmal failure than its muted impact on long-term yields and interest rates.

The lack of any meaningful shift in hiring or separation trends makes the job opening numbers irrelevant, both to markets directly and to the Federal Reserve as a gauge of its rate hike strategy. The Fed’s rate hikes have simply not produced any change to the labor status quo. There is little reason to expect the next FOMC meeting will produce anything different.

It has by now become almost redundant to discuss the Fed’s near total impotency over the behaviors of both Wall Street and Main Street. Yet this needs be discussed time and again, because the corporate media continues to promote a narrative where the Fed is potent against both the machinations of Wall Street and Main Street.

In no way, shape, or form does the data show the Fed having anywhere near the influence both it and corporate media persistently claim.

What the JOLTS data does tell us, however, is that we should expect more fudging of numbers on the June employment report due out shortly. With the Fed—and by extension, the whole of the government—having nowhere near the influence over either jobs or the overall economy the narrative claims, the only option that remains is to skew the jobs numbers so that the headline results appear to show some influence and efficacy.

What that option does not cover, however, is that jobs details are next to impossible to cover up, and so close scrutiny of the details reveals the fudging of the numbers that has become de rigeur for these reports. Close inspection of the facts and the data is always the best way to inoculate oneself against errant and simply false corporate media narratives.

The ministry of truth is working overtime to create lies. Everyone knows that inflation and unemployment are still critical. The “great reset” is still moving forward.

Brilliant reading of the facts!