Let’s just cut to the chase here. The July Employment Situation Summary put out by the Bureau of Labor Statistics is an illogical irrational dumpster fire of a statistical report. This is especially true of the Establishment Survey portion of the report.

Total nonfarm payroll employment rose by 187,000 in July, and the unemployment rate changed little at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, social assistance, financial activities, and wholesale trade.

We can safely disregard the fact that the nonfarm payroll employment rose by less than the 200,000 that some “experts” had projected for July.

We can also disregard the corporate media gaslighting that the number is less than the 209,000 jobs ostensibly created in June. We can do this because at the bottom of the Employment Situation Summary is the usual “oops!” admission that the June figures were overstated by some 25,000 jobs.

The change in total nonfarm payroll employment for May was revised down by 25,000, from +306,000 to +281,000, and the change for June was revised down by 24,000, from +209,000 to +185,000. With these revisions, employment in May and June combined is 49,000 lower than previously reported. (Monthly revisions result from additional reports received from businesses and government agenciessince the last published estimates and from the recalculation of seasonal factors.)

At the moment, we don’t know by how much the July numbers have been overstated, and so we are left with a reported jobs number for July that is for now 2,000 jobs higher than for June. Check back next month to find out what the July exaggeration was.

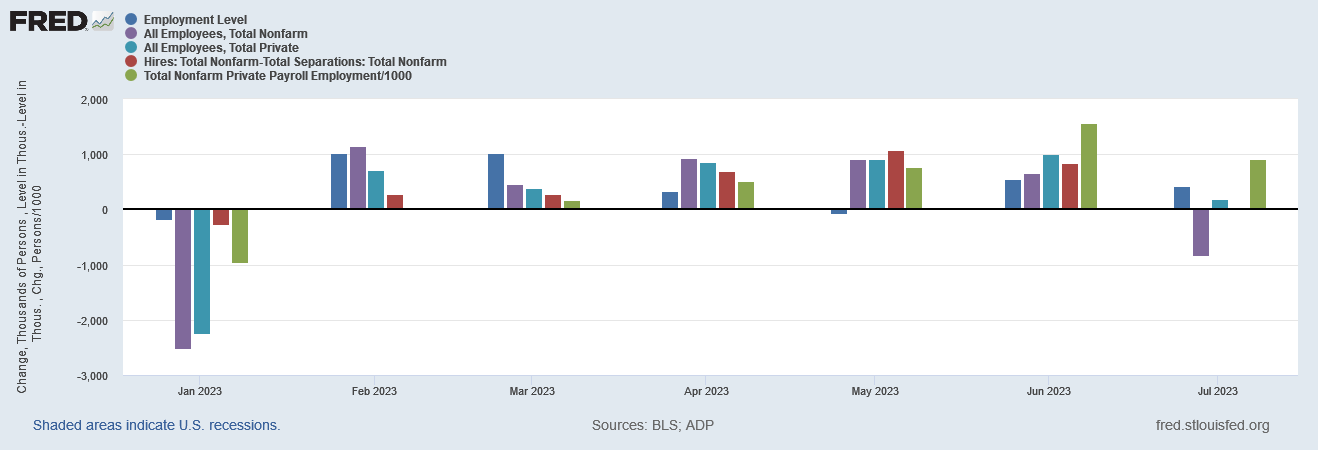

How can I be certain that the jobs numbers are crap? Because they simply do not reconcile. The Household Survey numbers do not align with the Establishment Survey numbers, neither the Household Survey nor the Establishment Survey numbers align with the net Hires and Separations in the JOLTS report, and none of the BLS numbers align with ADP’s National Employment Report.

We saw this last week in the June Job Openings and Labor Turnover Summary report—there the most egregious number was the largely fictional job openings tally.

Notionally, there should be at least some convergence between the various calculations of new employees added to payrolls in June. There isn’t. If the various job reports do not agree with each other than all of them should be taken with a grain of salt until there is sufficient trustworthy data to allow a proper reconciliation of their numbers.

We must repeat this cautionary with the Employment Situation Summary as well. We still do not have any convergence between the various employment metrics.

This is a problem. While we should expect notionally independent metrics to show some variance, these metrics all purport to independently measure the same thing—jobs. If the countings are at all accurate we should see similar trends over time. That we do not indicates one or more of the reports is off kilter in some fashion.

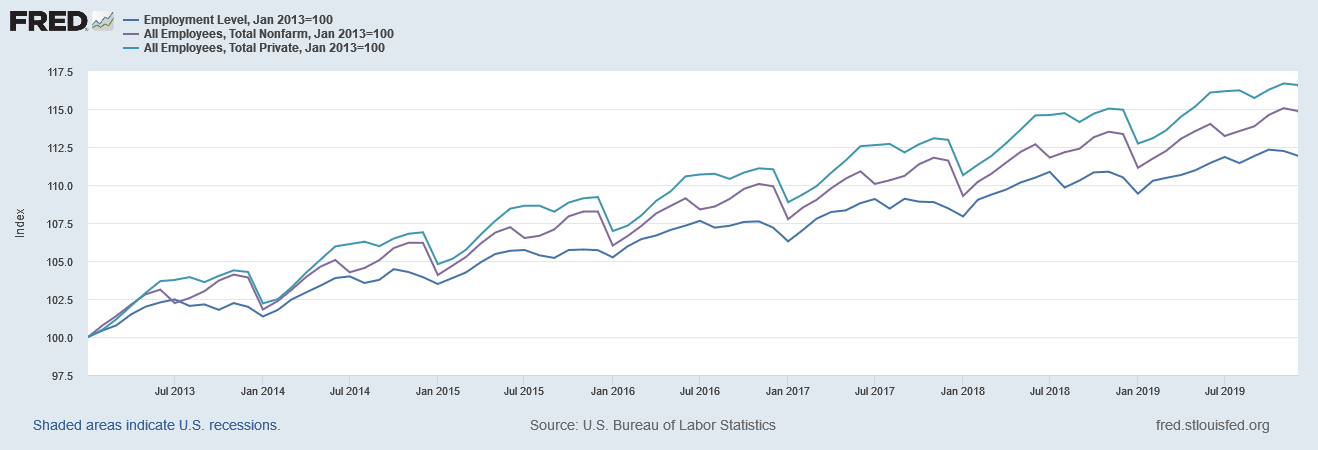

While no statistical report is ever likely to be perfect, the Employment Situation Summary has done better in the past. Prior to the Pandemic Panic Recession, although the Household Survey and Establishment Survey numbers varied during the year, at least they described broadly the same trends.

The relative magnitude of growth over time broadly coincided between the two surveys, with the year on year variations only becoming significant after several years’ passage.

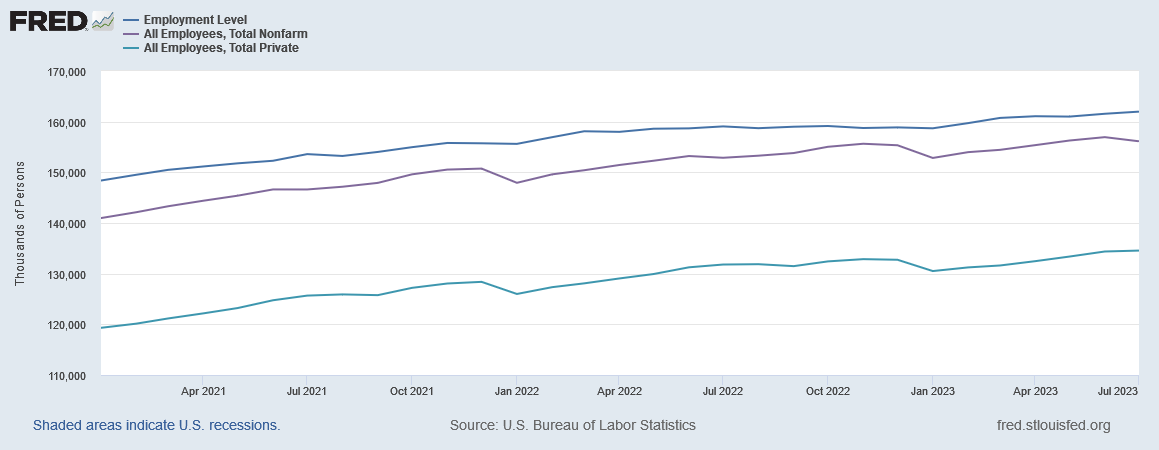

Since the 2021, the two surveys do not describe the same trends.

Indexed, they show significantly different relative growth curves.

It is not merely that the Household Survey shows a different number of jobs created, but that it shows a different rate of change, a different pace of job growth over time from the Establishment Survey. The Establishment Survey completely missed the hiring plateau the Household Survey showed from March until December of last year, and is showing a faster pace of growth than the Household Survey this year.

Readers will recall that last December the Philadelphia Federal Reserve published research that went a long way towards confirming the broad accuracy and utility of the Household Survey numbers, as it confirmed the jobs plateau reported by the Household Survey.

The Establishment Survey, on the other hand, shows the same relative magnitude of growth as the ADP National Employment Report.

However, in recent months the ADP report has deviated significantly from the Establishment Survey report.

If the Establishment Survey data cannot reconcile to either the Household Survey nor the ADP National Employment Report, we immediately run headlong into a crisis of credibility: Which data set is correct? Are any of the data sets correct? Looking at just the data itself, we have precious few means in which to establish which data is the more reliable data.

One thing we can say about the Household Survey is that its data is at least internally consistent: the change in the overall population, the change in the labor force, and the changes in employment and unemployment all reconcile to each other.

If the Household Survey data is wrong, it is at least consistently wrong in the same way, which makes its trends somewhat more credible than the Establishment Survey.

This leads to a disturbing conclusion however. The overall trends since the beginning of 2022 within the Household Survey continue to show a more or less stagnant employment situation, with at best uneven job growth and more likely minimal to no job growth over that period.

On the other hand, the Establishment Survey data continues to show job growth, albeit at a decelerating pace.

The fact that the Establishment Survey has had to be corrected by some 49,000 jobs over the past two months alone suggests that the Establishment Survey is overstating the employment situation, which in turn gives credence to the possibility that, as per the Household Survey, there is at best only minimal job growth in this country.

That the Establishment Survey overstates employment is further confirmed by the reality that, thus far in 2023, the total amount of corrections the BLS has made to the Survey data has been a reduction in jobs created by 245,000.

These are not small revisions relative to the initial numbers of reported jobs created.

Perversely, perhaps the best thing that can be said about the Establishment Survey is that it is unreliable. Being unreliable, we at least have the hope that the reported growth in average weekly earnings, which continues to print below both core inflation and essential indicators such as food price inflation, might be wrong in a good way.

We can try to believe that average hourly wages have not lagged consumer price inflation, core inflation, and food price inflation by at least a percentage point and a half since January of 2021.

We can hope that the Survey, being unreliable, is wrong that workers are working fewer hours per week (thus taking home less money even if nominal hourly wages are increasing).

Unfortunately, since the Household Survey is the somewhat more credible data within the report, we must instead contend with metrics such as an increasing number of multiple job holders in the US.

Not only are the number of multiple job holders increasing, the rate of increase for people who are working two full time jobs is by far the largest rate within this data set.

This is true even if we back our perspective out to January, 2021.

If we take the full Employment Situation Summary at face value (not recommended), then we must acknowledge that people are having to work multiple jobs while steadily earning less and less and steadily continuing to lose ground to inflation—that’s the jobs “growth” story that “Bidenomics” will tell you is a “success.”

Personally, that makes me scared to think what Bidenomics would count as failure.

Of course, we can’t say for certain this is the case—because we absolutely dare not take the Employment Situation Summary at face value. There is at least a slim possibility that in fact everything is much better than what the reported data is saying.

Of course, as Levon Helm said so eloquently in “Shooter”, “they also said that artificial sweeteners were safe, WMDs were in Iraq, and Anna Nicole Smith married for love!”

What we can say—what we need to say—is that this jobs report is functionally useless. As my many mockings of the Employment Situation Summary as “Lou Costello Labor Math” should make clear, the data within the Employment Situation Summary is simply not reliable. This is doubly true for the Establishment Survey data—including the headline jobs number that the corporate media loves to genuflect over.

What is scary to say is that the Federal Reserve, along with the clueless regime in the White House,does not (or will not, take your pick) recognize the multiple flaws within the Employment Situation Summary, and are making monetary and fiscal policy decisions based in part on this report.

There is not one single solitary hope in all the Nine Circles of Hell of such decisions ever ending well.

They’re cooking the numbers, and hoping nobody pays attention to the corrections. What the Fed is using is anybody’s guess, but I suspect they know BLS is cooking the books too.

I’m glad we get to read it here, because the MSM remains in some sort of clown world: “The latest employment report from the Labor Department shows job growth held steady last month, boosting hopes that the Federal Reserve may be able to curb inflation without triggering a sharp jump in unemployment.” https://stocks.apple.com/AofM3fXg9SsKDHPTNUGZajw