It seems the Federal Reserve cannot win for losing.

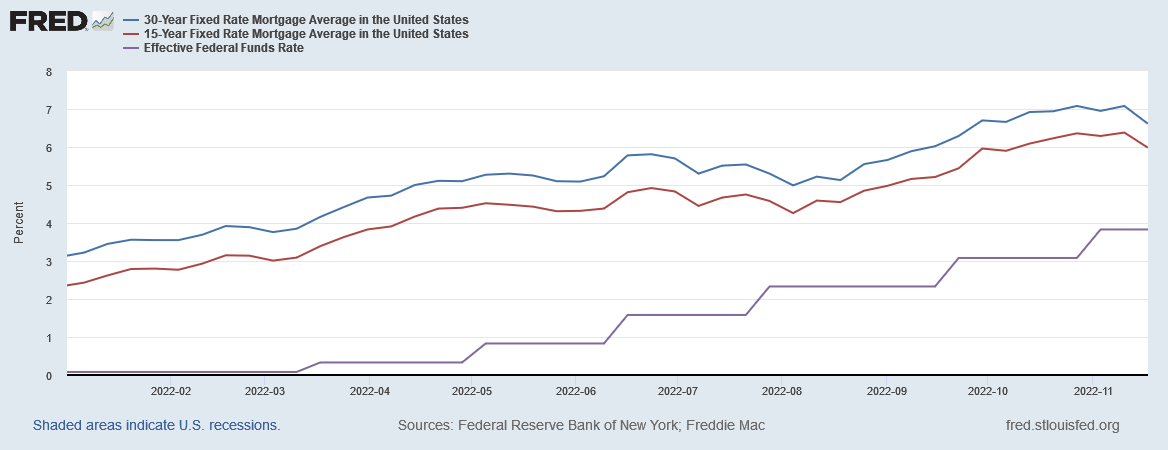

The average 30-year mortgage rate declined last week by nearly 50bps, and the average 15-year mortgage rate declined by almost as much.

Mortgage buyer Freddie Mac reported Thursday that the average on the key 30-year rate fell to 6.61% from 7.08% last week. A year ago the average rate was 3.1%.

The rate for a 15-year mortgage, popular with those refinancing their homes, fell to 5.98% from 6.38% last week. It was 2.39% one year ago.

This abrupt drop in mortgage rates comes just two weeks after the Fed raised the Federal Funds rate by 75bps for the fourth time in a row.

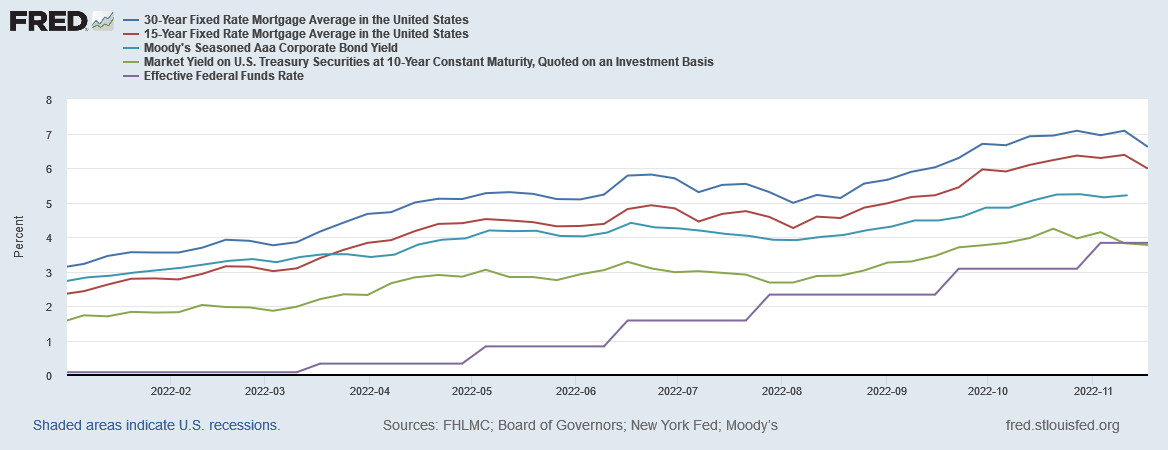

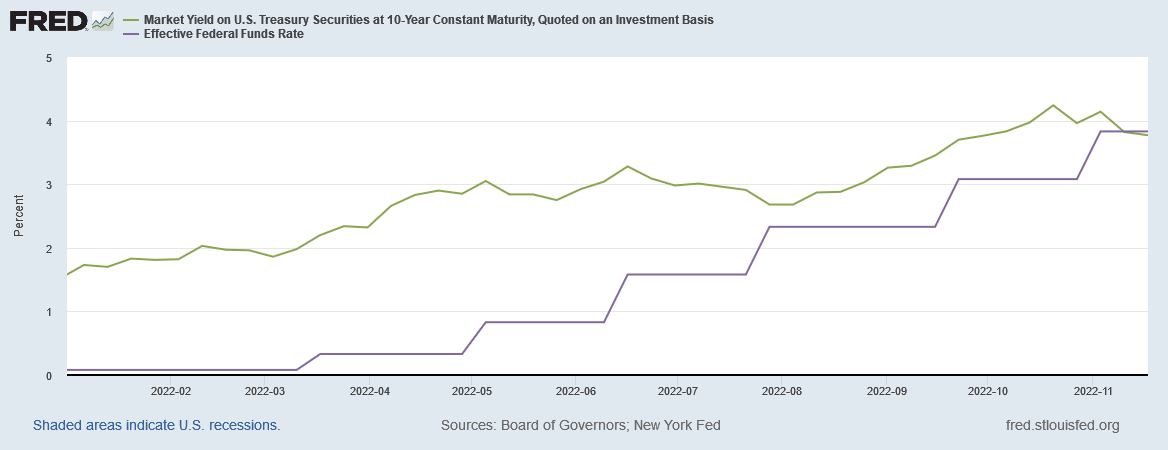

Nor are mortgages alone in their downward shift. Yields on 10-Year Treasuries declined as well, after having risen just after the Federal Reserve announced its hike in the Federal Funds rate. As of this writing yields on 10-year Treasuries are below where they were two weeks prior.

Moreover, this decline is not an isolated phenomenon. As the Fed has hiked the Fed Funds rate, the yields on 10-Year Treasuries have gone up at first, only to retreat over time.

Between the Fed’s June and July rate hikes, Treasury yields declined to levels previously seen during April. While Treasury yields peaked at the end of October at 4.24%, the November rate hike has not kept Treasury yields from declining again, and as of last week the yield on 10-Year Treasuries is less than the Federal Funds rate.

Mortgage rates have shown similar behavior since the Fed began raising the Federal Funds rate. While increases in the Federal Funds rate do result in mortgage rate increases, the mortgage rate hikes have repeatedly failed to hold.

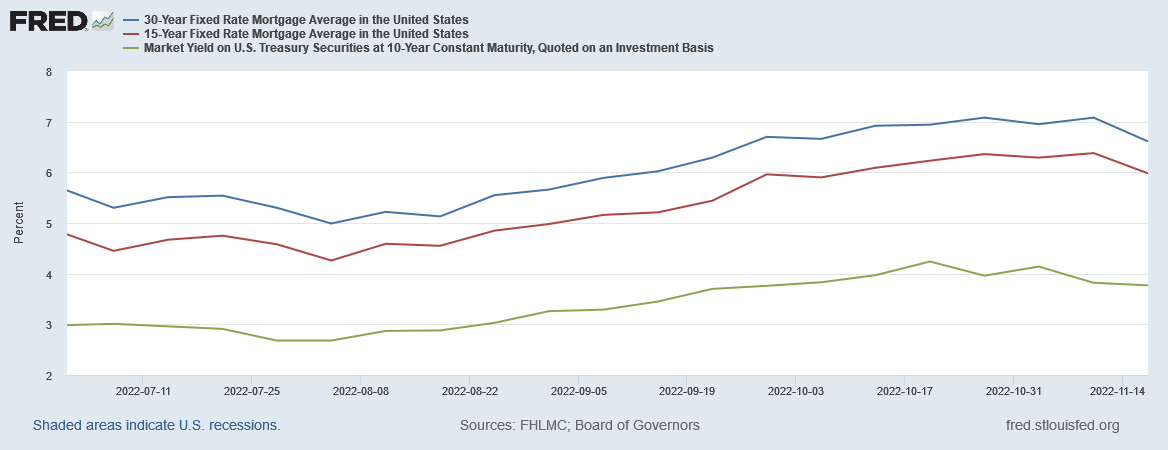

Mortgage rates rose when the Fed hiked in June, but then declined, following the 10-Year Treasury down—with the notable difference that the Fed’s July rate hike failed to produce a rise in mortgage rates until about a week later (Fed hikes prior to July and again in September are matched with mortgage rate rises during that same week).

The decline in mortgage rates does, however, resolve the brief divergence between Treasury yields and mortgage rates observed last week, where mortgage rates were rising even as Treasury yields were falling.

While the spread between mortgage rates and Treasury yields has increased, as of this week the declining Treasury yields are being mirrored by declining mortgage rates—the expected correlation.

All of which serves to reinforce the point I made last week—the Fed cannot push a string.

The Federal Funds rate is proving once again to be a problematic tool for pushing interest rates up—for implementing, in other words, the Fed’s chosen strategy to corral inflation.

In order to squelch and suppress demand, the Federal Reserve needs interest rates to go high and remain high. Only in that way does the Fed’s inflation strategy have any hope of bringing consumer price inflation down at all.

Unfortunately for the Fed, interest rates across the board are refusing to cooperate. That is going to make it very difficult for the Fed’s strategy to come even close to succeeding.

Thank you!

I’m truly dumb to these things so forgive me for asking but are the divergent interest rates a similar puzzle as the drop in oil $ vs supply? I have to read this a couple more times I think 🤔