No Golden Age: Inflation is Back, But Your Paycheck Isn't

Main Street Is Still Waiting For The Boom

In recent months, the official government inflation data has been about as clear as the ancient Greek oracle at Delphi regarding the state of the US economy. August is no exception.

Headline inflation continues to rise, both year on year and month on month, according to the August Personal Income and Outlays Report.

From the preceding month, the PCE price index for August increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

From the same month one year ago, the PCE price index for August increased 2.7 percent. Excluding food and energy, the PCE price index increased 2.9 percent from one year ago.

Yet core inflation eased month on month, while year on year core inflation rose less sharply than headline inflation.

Inflation is rising, but not so dramatically as to warrant fears (yet) of a renewed hyperinflation cycle. Some sectors are even experiencing a bit of consumer price deflation, keeping the possibility of stagflation.

Last month’s PCE report gave no cause for celebration by anyone—not the Trump Administration, not the Fed, not Wall Street, and certainly not Main Street. The August report is more of the same—and that’s the problem. All the subpar trends that have been building in the US economy are continuing to build, with little indication this will change any time soon.

President Trump’s “Golden Age” has yet to start for large swaths of the economy. That is the one clear message within the August data.

Inflation IS Rising

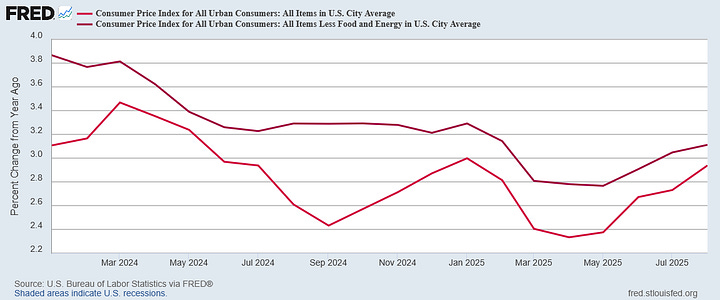

Year on year, consumer price inflation as measured by the PCE Price Index (PCEPI) rose yet again in August, at both the headline and core levels.

Notably, headline inflation experienced a relative surge of 0.15pp, while core inflation underwent a more modest 0.05pp increase.

The cooler core inflation increase year on year stems largely from the disinflation month on month at the core for August, even as headline inflation rose.

These are the same trends we saw earlier in the Consumer Price Index summary.

There is no denying the data: inflation is rising in this country.

Energy And Food The Major Drivers

As is always the case when the increase in headline inflation outpaces core inflation, the primary culprits for August were renewed energy price inflation and food price inflation.

Food prices are especially troubling, as food prices have risen steadily since President Trump was sworn into office.

Month on month, August saw the highest food price increases within the PCEPI data for the year.

When President Trump’s critics complain that food price inflation is getting worse in this country, the data agrees with them.

Energy price inflation is the same muddled mess it has been all year, with no clear trend up or down month on month.

This should come as no surprise, given the market indecisiveness that was the trend for August energy prices.

Even prices at the pump showed little movement in August.

While August saw energy price inflation, September is just as likely to show energy price deflation, as that has been the pattern all summer.

The best that can be said about the longer term trend in energy prices at present is that prices are not getting any worse. They simply are not getting any better.

For August, that lack of improvement in energy prices combined with continued deterioration in food prices to produce a surge in headline inflation. While not an economic apocalypse, this is not good economic news for anyone.

Core Inflation Still Not Driven By Tariffs

Particularly discomfiting to the Federal Reserve, however, has to be the continued rejection by the inflation data of Fed Chairman Jay Powell’s insistence that price rises are the result of President Trump’s Liberation Day tariffs. His TDS-tainted obsession with that well-debunked narrative was a primary factor behind the FOMC’s anemic 25bps rate cut last week.

The August PCE data confirms that Powell is still talking pure hogwash and horse hockey, something he has done so often that it is scarcely newsworthy.

The rejection of the tariff narrative is one of the few areas where the PCE inflation data is crystal clear. The inflation rates for goods and services leave no room for debate on the topic.

While tariffs arguably are having some influence on consumer prices, the continued heating up of service price inflation means it is not possible for tariffs to be a primary driver of inflation.

This is easily confirmed simply by looking at the relative growth rates in service prices vs durable and non-durable goods prices since the start of the year.

Despite recent rises in non-durable goods prices, non-durable goods prices are down on the year, while durable goods prices declined for the second month in a row in August. Services, however, have been getting steadily more expensive all year—and services are not amenable to tariffs.

This is not a scenario where tariffs are playing a significant role in consumer price inflation. Corporate media and Jay Powell continue to insist otherwise, and they continue to be dead wrong about it.

Inflation Is Distorting Spending (Again)

What is more disconcerting than headline inflation’s rise in August is that consumer spending became more distorted in August, with nominal expenditures rising $14.9 Billion month on month and real expenditures falling $5.5 billion.

When nominal expenditures rise and real expenditures fall, that means inflation is having an increasing impact on consumer spending.

Within core consumer spending, the one area that has shown consistent strength as well as growth this year has been services.

While there had been a surge in durable goods spending earlier in the year—a likely front-loading of consumer spending in anticipation of President Trump’s tariffs—since March both durable and non-durable goods have been seen on balance less growth than services.

People are spending their money on services more than they are on goods.

Equally disturbing is the reality that, for the fourth month in a row, real personal consumption expenditures has outpaced real disposable personal income.

People’s paychecks are not matching increased spending habits. That limits the potential economic upside from increased consumer spending, as it is not organically sustainable.

The imbalance between consumer spending and disposable income is reflective of the continued weakness particularly in service wages, which have yet to recover from the 2022 hyperinflation cycle even against the more conservative PCEPI.

While goods-producing wages did finally fully recover around June and July of last year, service wages (which tend to cover more workers than goods-producing paychecks) are still languishing, and made no real progress in August.

Weakness in wage growth will at some point cap growth in real consumption expenditures. While economic “experts” both on Wall Street and in the White House want to posit consumer spending growth as a token of economic strength, without wage growth to match any growth apparently produced by the increased spending is only going to be transitory at best, and illusory at worst.

With real spending growth actually nonexistent for August, the personal consumption expenditures data speaks more to economic weakness than to economic strength.

Stagflation Purgatory?

We should not overstate the many downsides of the August PCE data. The report shows continued economic weakness for the US, but it does not show a major economic contraction and certainly does not show an economic collapse.

A technical recession may or may not be on the horizon, but what is certainly not on the horizon is any semblance of real growth in paychecks, or sustained growth in real expenditures.

With inflation continuing to rise, the uncertainties confronting the US economy speak more to the possibility of a period of stagflation, where distorted prices, distorted spending, and distorted employment pull the economy in divergent directions.

Stagflation is made even more likely given the ongoing and deepening jobs recession in this country, something even corporate media is no longer able to deny.

The risks of stagflation make Karoline Leavitt’s victory lap on Friday regarding the economy particularly out of sync with reality.

That the White House would hype corporate media headlines—the same corporate media that so regularly spreads propaganda nonsense about the Trump Administration—is a remarkable level of irony.

Karoline Leavitt is a forceful and articulate White House Press Secretary, but this time the data does not support her narrative. The data does not support the White House rhetoric about a “Golden Age” for the US economy.

A Golden Age is very much the plan and the ambition the White House has for the United States, but claims that it is already here are at best premature and at worst wholly disconnected from the realities of the US economy.

A stagflationary stupor is a far more apt description of the US economy, at least insofar as the extant data describes the economy from the perspective of Main Street. Wall Street may be enjoying stock market highs, but Main Street is not seeing employment highs or wage growth highs to match.

The rising tide is not lifting all ships. While that may not be a recession red flag, it very much is a red flag for stagflation.

What Next?

What would beat back the possibility of a stagflationary stupor?

Actual job growth would definitely help. So would real rises in real wages and real disposable income. The best path for economic growth via domestic consumption is for real job growth and real wage growth, neither of which is happening at the moment.

With the holiday season fast approaching, we may see a seasonal surge in both jobs and wages, and that might even be enough to begin reawakening the economy from its torpor heading into next year. The onset of the holiday season should bring some increase in real consumption expenditures, and will very likely power some economic growth, even if only of a transitory nature.

While stagflation is very much a possibility, it is by no means a certainty, and may not even be all that much of a probability. That’s the frustration of the August PCE data—the trends are not at all clear in any direction. The current data does not point inexorably towards any sort of economic contraction or expansion, and that makes any real prediction about what the economy will do next not merely difficult, but practically impossible.

What is certain is that we will need to see a significant improvement both jobs and wages for the stagflation scenario to be avoided. Those improvements are quite possible, but as of yet we have not seen them.

What is equally certain is that the Trump Administration’s effervescent rhetoric of a “Golden Age” remains wishful thinking. President Trump’s economic policies, including the tariffs and the trade wars, may yet bring about a true Golden Age of prosperity for the United States, but no one should be under any delusion that it has happened yet.

I’m addicted to your solid analysis of hard data, Peter. Everyone else’s reporting seems shoddy and slapdash compared to yours - not to mention the manipulation from all political sides! Thank you once again for your top-quality work.

The economic fixes, such as huge improvements in domestic manufacturing, are not likely to happen before voters make up their minds for the midterms. Trump is going to need to have highly compelling reasons for people to get on board with his long-term agenda. I’m hoping that he will clean up the crime in enough cities to wow the voters. Peter, is there another issue that you would put as a high priority?