"Too Late" Powell Has Too Little Clue, And Wall Street Knows It

The Rate Cut Was Good. Powell's Pontificating Presser Was Not

Once again, Jay Powell and the Federal Open Market Committee managed to surprise exactly no one, doing exactly what Wall Street had priced in weeks ago by trimming the federal funds rate 25 basis points.

In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4 to 4‑1/4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In the run-up to the FOMC announcement at 2PM Eastern yesterday afternoon, Wall Street was cautiously optimistic, with the major equity indices all rising in anticipation.

Then came Powell’s usual post-announcement press conference, and Wall Street immediately handed back those gains and then some, before rebounding to end the day very near where it began.

For all the media attention the rate cut has received over recent days, Wall Street’s collective reaction was “meh”. As long as Powell isn’t talking, Wall Street seems to think he is not likely to do too much damage.

It is certain Wall Street does not expect Powell to do any great good. Neither do I.

Readers already know I am of the opinion that a far larger rate cut than a piddling 25 basis points is needed at this point.

It does not take an extraordinary leap of logic to conclude from the Dow Jones ending the day almost exactly where it began that Wall Street was similarly unimpressed by Powell and the FOMC.

Treasuries also revealed Wall Street’s state of mind. Prior to the FOMC announcement, the yield on the 10-Year Treasury had been moving up. Right around the FOMC’s announcement, yields dropped dramatically. Then came Powell’s presser and yields soared again, ending up almost exactly on the same trend line that had emerged prior to the FOMC announcement.

As far as Treasuries are concerned, Powell’s mouth overcomes a mere 25bps rate cut by the FOMC.

That should tell you exactly what Wall Street thinks of Jay “Too Late” Powell. Unsurprisingly, this is one point where I agree with Wall Street wholeheartedly. “Too Late” has too little clue about the US economy and Wall Street knows it.

It’s not as if Powell ever had a reputation for brilliance or even competence. Readers will do well to remember that Powell singlehandedly caused the 2018 bear market by raising the federal funds rate repeatedly.

Seven years on and Powell remains as clueless and befuddled as ever.

Nor is it hard to fathom why Wall Street gets spooked whenever Powell starts talking. What is anyone to make of a Fed Chairman who casually drops such foolishly false (and factually wrong) talking points as this one about service disinflation?

Estimates based on the Consumer Price Index and other data indicate that total PCE prices rose 2.7 percent over the 12 months ending in August, and that, excluding the volatile food and energy categories, core PCE prices rose 2.9 percent. These readings are higher than earlier in the year, as inflation for goods has picked up.

In contrast, disinflation appears to be continuing for services.

Remember, the term “disinflation” is used to describe a situation where the inflation rate, while still positive, is getting smaller. This distinguishes disinflation from “deflation”, where the inflation rate turns negative and prices drop in an absolute context.

Since the spring, however, the inflation rate for services month on month has been increasing.

The inflation rate for services has been increasing year on year as well.

When the lines are going up, that’s not “disinflation”, but rising inflation.

How does one have any confidence in a Fed chair who cannot tell the difference between rising inflation and disinflation?

Powell also stuck to the corporate media canard that Trump’s Liberation day tariffs are driving inflation’s recent rise.

Higher tariffs have begun to push up prices in some categories of goods, but their overall effects on economic activity and inflation remain to be seen. A reasonable base case is that the effects on inflation will be relatively short-lived, a one-time shift in the price level.

This is nonsense, as I have argued multiple times. With services showing the greatest level of price growth and not goods, tariffs simply cannot be a primary driver of rising prices.

With consumption rising in both nominal and real terms in recent months, tariffs might be applying some inflationary price pressure, but prices are up in large measure because consumption is up.

We should not conflate this with the notion that tariffs are the primary driver of inflation in this economy. Tariffs are almost certainly a factor in the recent prices hikes, but they are not the only factor or even a primary factor.

Powell also remains befuddled on the pace of job creation in this country. He believes that job growth was robust up until just recently.

In the labor market, the unemployment rate edged up to 4.3 percent in August, but remains little changed over the past year at a relatively low level. Payroll job gains have slowed significantly to a pace of just 29,000 per month over the past three months.

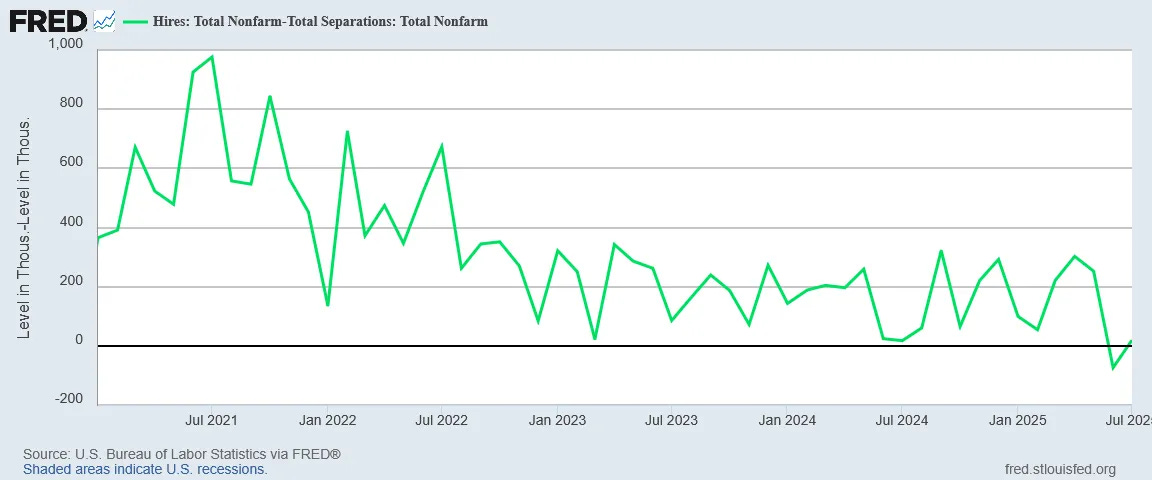

The reality is that net hiring has been slowing in this country since 2021.

When net hiring slows, job creation is going to be anything but robust.

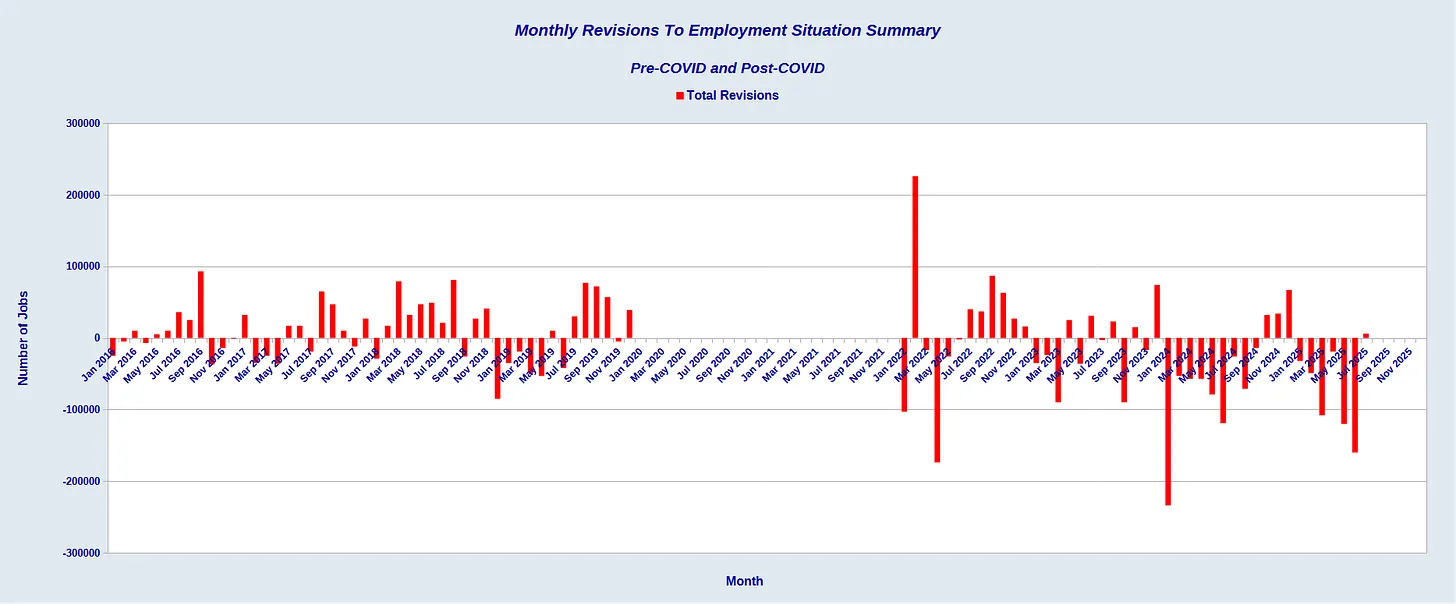

It was equally unsurprising that Powell was completely dismissive of the breakdown in the BLS jobs tracking methodologies in recent years.

So on the QCEW, the provision that we saw was almost exactly what we expected. It was amazing how close the expectation was. And the reason for that is, for the last bunch of quarters, there's been almost a predictable overcount. And I think the Bureau of Labor Statistics really does understand this, and they're working hard to fix it.

Powell decided to toe the corporate line on the jobs data, pushing the debunked narrative that the BLS’ unprecedented preliminary revisions were nothing unusual.

To do that, Powell had to ignore that the latest revision estimate was three times the historical average, and had it not been for last year’s equally ginormous preliminary revision it would have been five or even six times the historical average.

Powell also had to ignore that the BLS jobs estimates became significantly more optimistic during the Biden years than during President Trump’s first term of office.

It’s no wonder Wall Street gets spooked whenever Powell speaks. He can’t read a simple graph well enough to understand how factually wrong he is on the economic fundamentals.

Wall Street was somewhat pleased with the 25bps rate cut. It is not the rate cut the economy needs, but it is better than holding rates steady.

Wall Street is not pleased that Jay Powell is still steering the Fed in a completely wrong direction on interest rates and monetary policy. Just as the Fed misplayed rising inflation in 2021 and 2022, waiting until the hyperinflation cycle had very nearly peaked before taking any sort of action, the Fed is misplaying the growing stagflation cycle we are seeing in 2025.

Powell has neither the good sense to keep the Federal Reserve out of the game of micromanaging both the economy and interest rates nor the intelligence to time Fed interventions so as to act as an economic stimulus and not as an economic suppressant. He reminds the world of this every time he gives his post-FOMC press briefing.

Just as I predicted, the FOMC briefly lifted markets with the rate cut announcement, and Powell squashed them with his addlepated press conference. Wall Street started out happy before being dismayed and ending up at “Meh”.

Just as I predicted the day before, Main Street has been left with a reduction in the federal funds rate that will be both too little and too late to disrupt the steady deterioration in labor markets.

With this 25bps reduction in the Federal Funds rate, “Too Late” Powell proved once again he has too little clue about the US economy to make good decisions on interest rates or anything else. Powell has well and truly earned his Trumpian tag. Until he resigns and slinks away into insignificance, it will remain a part of his name as if he’d been baptized with it.

“Too Late” Powell is too little to do any good at the Fed, and the world knows it.

Boy, I sure wish Trump could read all of your posts on Powell and point out to him that Peter Nayland Kust is doing Powell’s job, and doing it infinitely better! You don’t have to be an economist to see that YOU, Peter, have been getting it right, and Powell is like the “pointy-haired boss” of the Dilbert comic strip: completely clueless and useless.

You should count up all of the times you’ve been proven right, and submit it to the Guinness Book of World Records, Peter. I’d love to see you become famous for beating most economists, on most issues, for the longest stretch of time, on the most diverse topics. Your mind is a gem!

It should have been at least 50 points. End the Fed or fire Powell.