PCE Report Shows Inflation Rising, And The "Experts" Say That's Okay

Spoiler Alert: It's Not Okay

Going by the usual anodyne and bloodless language typical in the Bureau of Economic Analysis’ Personal Income and Outlays Report, January was exactly the sort of month the “experts” anticipated.

Personal income increased $233.7 billion (1.0 percent at a monthly rate) in January, according to estimates released today by the Bureau of Economic Analysis (tables 2 and 3). Disposable personal income (DPI), personal income less personal current taxes, increased $67.6 billion (0.3 percent) and personal consumption expenditures (PCE) increased $43.9 billion (0.2 percent).

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.4 percent (table 5). Real DPI decreased less than 0.1 percent in January and real PCE decreased 0.1 percent; goods decreased 1.1 percent and services increased 0.4 percent (tables 3 and 4).

Corporate media has dutifully played along with the narrative, highlighting the “expectations” of the “experts.”

Inflation rose in line with expectations in January, according to an important gauge the Federal Reserve uses as it deliberates cutting interest rates.

The personal consumption expenditures price index excluding food and energy costs increased 0.4% for the month and 2.8% from a year ago, as expected according to the Dow Jones consensus estimates. The monthly gain was just 0.1% in December and 2.9% from the year prior.

Unfortunately for the lay people who actually are the economy, the “experts” expectations are that inflation is rising, the economy is getting weaker—whether or not they understand that—and that Main Street is likely to experience more pain and not less in the weeks and months and years to come.

The “experts” want to pretend that everything is okay. Spoiler alert: No, the economy is not “okay”. It’s not even close.

It is a measure of how much corporate media wants to promote a narrative of economic good news that they were quick to tout the initial market rises on the day.

US stocks opened higher on Thursday as investors digested a crucial inflation reading key to assessing how quickly the Federal Reserve will start cutting interest rates and whether equities' recent rally will revive.

The Dow Jones Industrial Average (^DJI) hugged the flatline, while the S&P 500 (^GSPC) gained 0.3%. The tech-heavy Nasdaq Composite (^IXIC) was up about 0.5% after all three gauges closed Wednesday's session with losses.

However, by mid-day, equities had surrendered much of that initial burst of energy, with the Dow even exploring negative territory on the day.

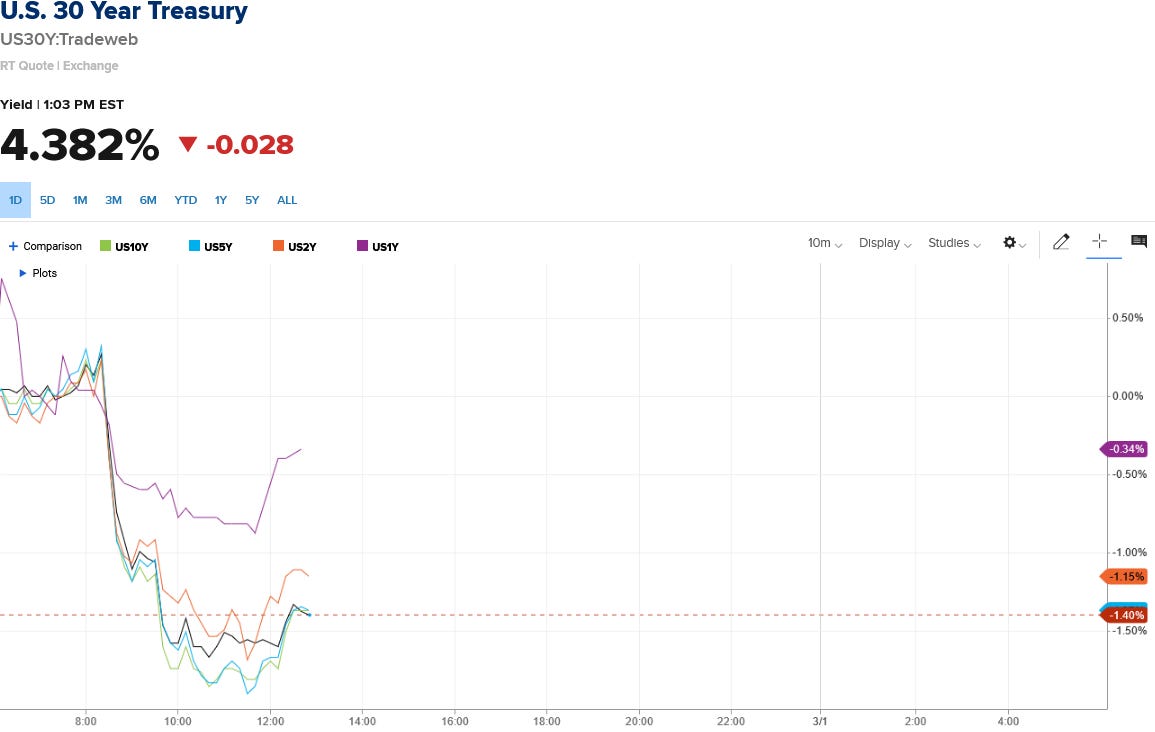

Treasury yields by mid-day were proving more optimistic, having dropped right after the starting bell and trending down until noon before marginally moving back up again.

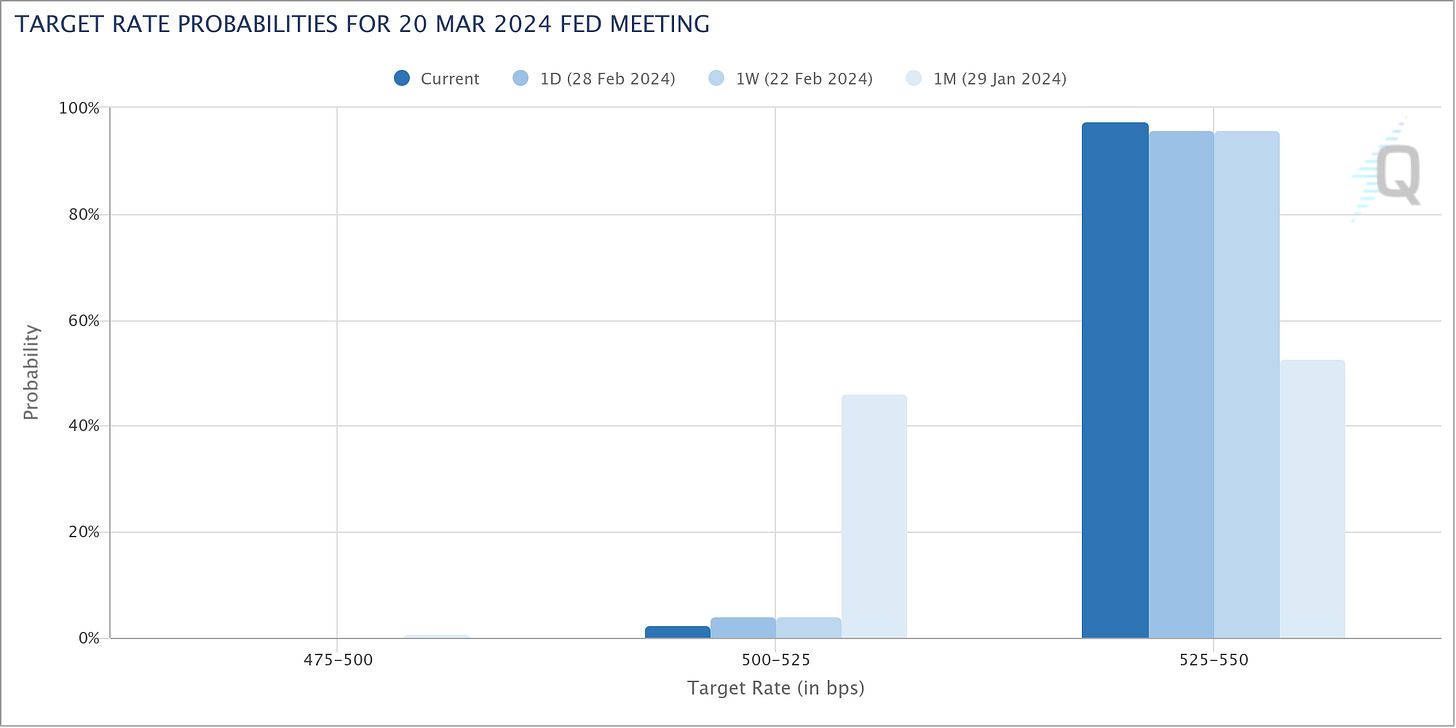

Treasury yields are responding to inflation moving in accordance with expectations, which the markets are taking to mean the Fed is not likely to cut the federal funds rate at the next FOMC meeting in three weeks’ time. Indeed, the markets are currently pricing in the Fed standing pat yet again on rates, neither raising nor lowering the federal funds rate.

Superficially, this would appear to be in line with what the “experts” have prognosticated, with economist, Nobel Laureate, and master of economic error Paul Krugman striving to dismiss both the BEA report and the Wall Street reaction with a single distracted wave of his hand.

Is that in fact what the markets are showing—a “lack of panic”? Or are the markets simply inured to the reality that the Fed intends to hold interest rates “higher for longer” no matter what, thus reducing the intensity of reaction to individual inflation-related events?

Let us consider what the data shows beneath the headline numbers.

There is no denying that the BEA shows year on year consumer price inflation (inflation per the PCE Price Index) still declining in January.

With headline inflation at 2.4% year on year, and core inflation at 2.8% year on year, the 12-month trend is definitely moving in the right direction.

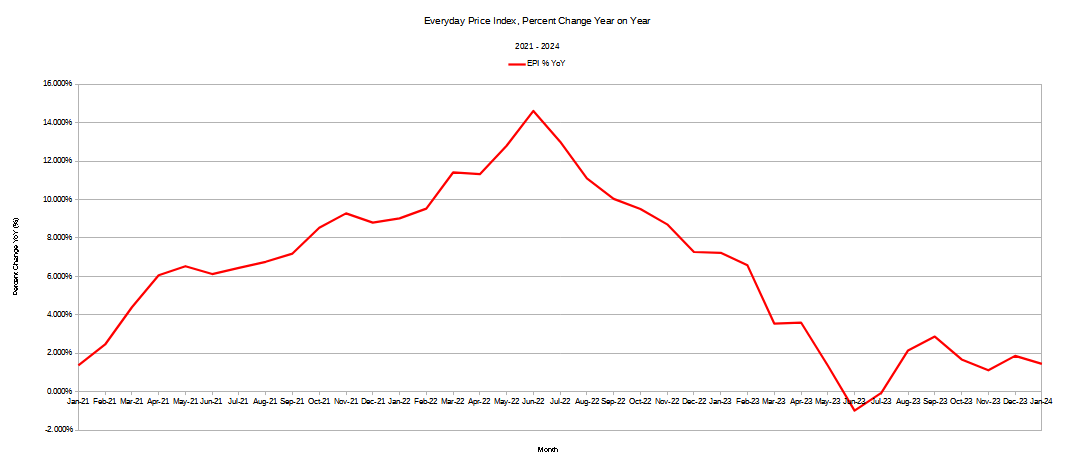

Even the independently generated Everyday Price Index from the American Institute of Economic Research confirms year on year inflation is decreasing.

Unfortunately for the average consumer, the month on month trend shows inflation is moving in the exact opposite direction—trending higher and not lower.

The EPI month on month trend confirms the broad macroeconomic trend in prices.

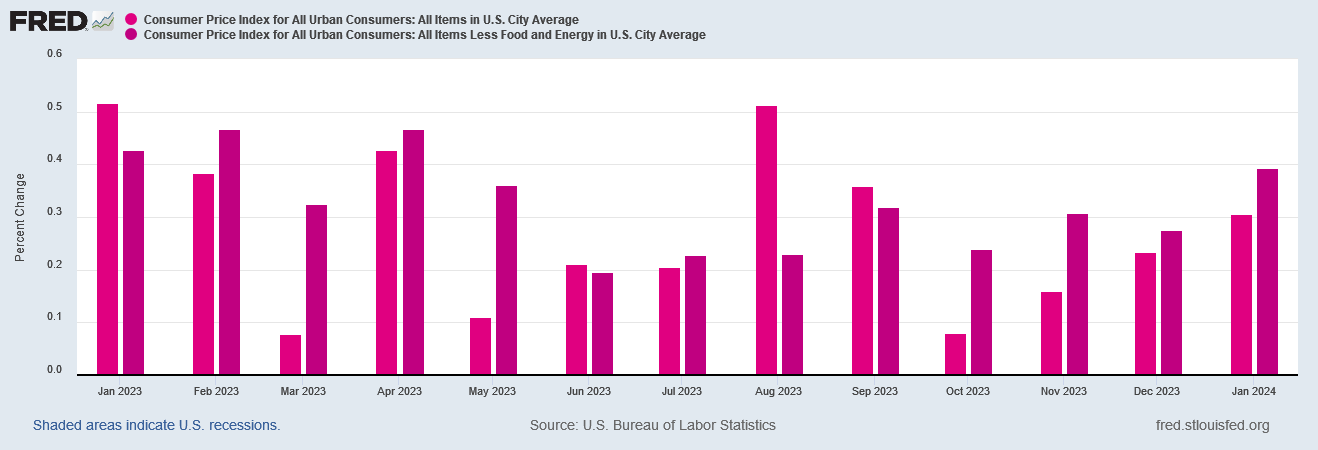

Even the Consumer Price Index confirms that the trend over the past few months has been one of rising inflation rather than decreasing inflation.

This is further underscored by the admission in the BEA’s second estimate of Q4 2023 GDP that inflation was up for the quarter as well.

Rising inflation may be what the “experts” have expected, but it most assuredly is not what ordinary consumers and wage earners want! There has been more than enough erosion of the average worker’s paycheck over the past few years.

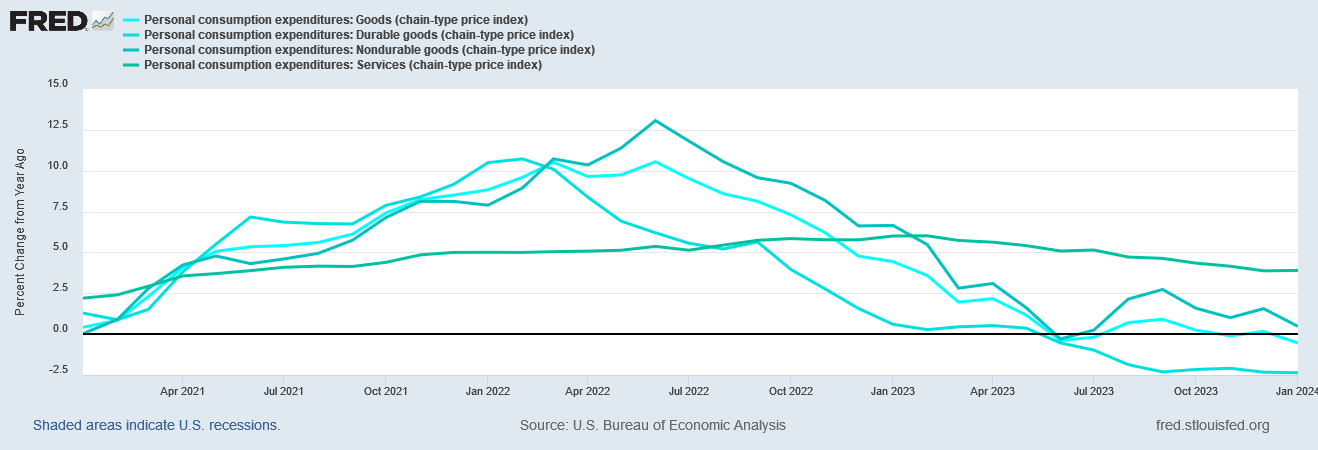

Within the PCE Price Index itself, it is important to note that rising inflation continues to be a toxic mix of goods price deflation and service price inflation.

It is equally important to note that the trend in service price inflation has not been altered much if at all throughout the Fed’s “inflation fighting” strategy of raising the federal funds rate. The imperviousness of service price inflation to the Fed’s rate hikes is a constant rebuke to the notion that the Fed’s strategy has been at all impactful in consumer price inflation.

This continues to be confirmed when we look at the year on year percent changes in goods and service pricing in the US.

Goods prices have varied from hyperinflation during the summer of 2022 to outright deflation beginning as early as the spring of 2023. Service prices, on the other hand, have displayed far less inflation and far less disinflation.

Neither the “experts” nor corporate media has cared to expend much virtual ink discussing this disparity between goods prices and service prices.

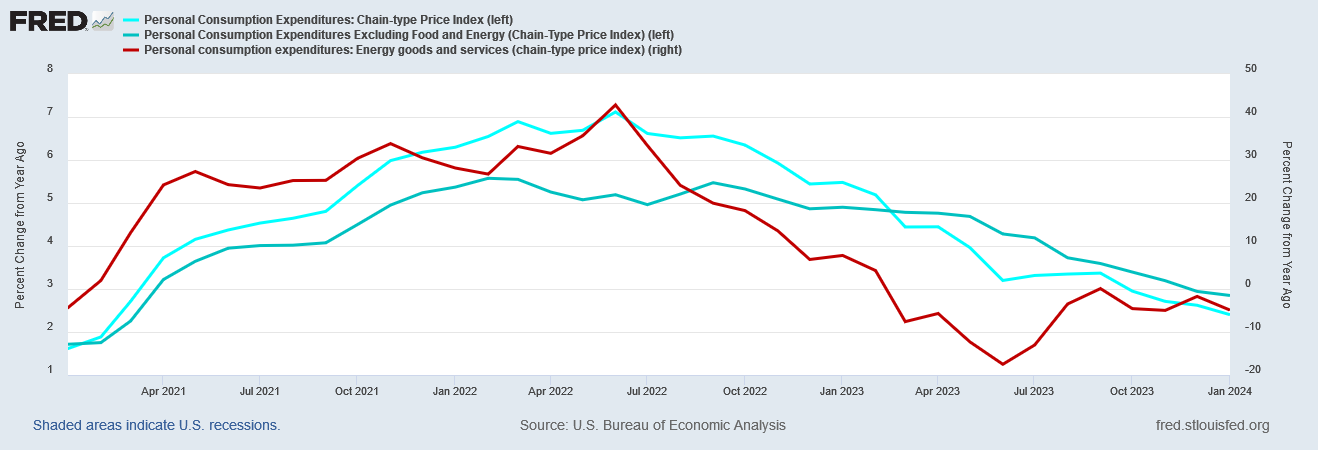

One clear factor in this disparity has been the role energy price inflation has played in the headline numbers, as well as in the underlying cost pressures within goods manufacture itself. We must not overlook that energy price inflation and energy price disinflation tracks very closely with overall consumer price inflation and consumer price disinflation since the start of 2021.

Energy price disinflation and deflation correlate quite strongly to overall consumer price disinflation, and only somewhat less so to core price disinflation. Significantly where energy prices trends have reversed and showed much less deflation, as during last sumer, we see the immediate impact on overall consumer price inflation, just as we see the impact of a renewed downard trend in energy price inflation towards the fall.

We should also note that energy price deflation is not likely to last much longer, and may already have ceased, given the upward price trends in benchmark crude oil prices through the end of January.

While crude oil prices are during the month of February moving largely horizontally, the broad equilibrium price range for Brent crude in February has been significantly higher than in prior months.

Even gasoline futures have trended up through January as well as February.

None of this augurs well for the future of consumer price inflation. With energy price inflation by far the most significant driver for overall consumer price inflation, and with energy prices trending up, expectations of consumer price inflation trending down are simply not realistic.

What the PCE data shows is that consumer price inflation, far from being on a continued downward trend, is far more likely to have “bottomed out”, and the near term expectation for consumer price inflation should be for rising prices and more inflation, not less.

Not only is 2% inflation not likely to be attained in the near future, but we should not be shocked to see the headline PCE inflation number move back above 3%. With energy price trends reversing in the marketplace, it is only a matter of time before we see those trends similarly reverse themselves within the price indices as well.

Until we see a renewed downward trend in energy prices, the future expectation must be for more inflation and not more disinflation, for higher and not lower prices.

No matter what the “experts” think is going to happen, the future of inflation is that we will have more and not less of it.

(Robert Reich was another one like Krugman. I’d read a fairly reasonable argument of his, then get to his conclusion that the answer to the problem is ‘more labor unions’ or some other recommendation that showed no understanding of cause and effect. I’d be left sputtering, “Huh? No!”)

Have you been to the grocery store lately, well of course you have Mr. Kust. but have you Paul Krugman? He probably has, and smiled at the $48.96 price on 2 ribeyes. That''s just 2, for 4 of us, Tam cuts them in two, to make 4. Once, standing at the meat counter, I remarked "I knew I should have been a cattleman." This lady stopped, and asked me what I did do. "I sold drugs, but don't worry, I was licensed in 3 different states." Not mentioning I was a community pharmacist.

"The cattlemen aren't doing so well either" she said, "I was listening to Glenn Beck on the radio."

"Yes" I said, "I heard that too, guess we all can't be middlemen."