Powell Raised The Federal Funds Rate 25bps...And Reduced Treasury Yields By More Than That

How Is This A Rate Increase?

In the wake of three successive bank failures in Silvergate Capital, Silicon Valley Bank, and Signature Bank of New York, plus one near miss in First Republic Bank, the only question on Wall Street’s collective mind was whether or not the Federal Reserve would still attempt to raise interest rates.

That has raised the question of whether the Fed should press ahead with its inflation-fighting rate hikes — or if it should slow down rather than risk tipping over the entire banking system. Goldman Sachs forecasters say they don't expect a rate hike this month, but "few, if any" other Wall Street analysts share that view, CNBC reports. "This is a very tough job," Bloomberg's Michael Mackenzie adds. All eyes will be on the Fed this week, with an eye on how Fed Chairman Jerome Powell tries to find balance "without stirring further concerns — either for financial stability or inflation."

That question was answered yesterday afternoon, when the Federal Reserve Federal Open Market Committee (FOMC) announced a 25bps hike in the federal funds rate.

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-3/4 to 5 percent.

Was that the right decision? We will be several days and weeks learning that answer. What the initial reaction by Wall Street has already confirmed is that the one thing Powell did not do was raise interest rates beyond the federal funds rate. Treasury yields declined after the federal funds rate increases was announced—meaning Powell effectively lowered interest rates, rather than raised them.

To be sure, there were several strong reasons for the Fed to follow through with the much anticipated federal funds rate hike, not least of which was the ECB’s own 50bps rate hike last week.

The European Central Bank raised its key rate by a half point last week despite Credit Suisse’s troubles.

“The fact that markets did not react negatively” to the move “will also provide a measure of reassurance” to the Fed, Barclays says.

Yet Silicon Valley Bank in particular weighed strongly against any hike at all.

A rate hike could compound the conditions that led to the bank runs by further lowering the price of bonds owned by regional banks, threatening their financial health and sparking more runs.

For its part, Wall Street titan Goldman Sachs expected the FOMC to hit “pause” on rate hikes for now.

"Expectations for the March [Federal Open Market Committee] meeting have changed abruptly over the last 10 days," analysts at Goldman Sachs wrote in a note on Monday, referring to the Fed panel that sets interest rates. "We expect the FOMC to pause at its March meeting this week because of stress in the banking system. While policymakers have responded aggressively to shore up the financial system, markets appear to be less than fully convinced that efforts to support small and midsize banks will prove sufficient."

While I generally refrain from making specific predictions, my own take on the Fed’s conundrum was that they should stand pat, saying as little as possible about the rate hike, and let the markets find a new equilibrium before pushing forward with new rate hikes.

To fully untangle the banking mess that years of reckless, feckless, and demonstrably insane Federal Reserve monetary policy has created will take quite some time—years if not decades. Actively triggering further economic instability in the name of pursuing overall price stability does little to further that process, and might even create a worse mess. Pushing rates up or pushing rates down are both likely to risk that further economic instability.

With Wall Street and the banking sector already agitated and disrupted, adding to the agitation and disruption with further interventions is not a move that is likely to end at all well. Doing nothing becomes the best move of the moment.

Apparently, Jay Powell didn’t listen to my very sound advice!

Wall Street’s initial reaction was mostly blase. Equities began rising somewhat immediately after the FOMC announcement.

How are stock indexes trading

However, Treasury yields declined further after the announcement.

The 1-Year Treasury declined slightly during morning trading, and dropped dramatically after the Fed announcement.

The 2-Year yield dropped even more dramatically.

The 10-Year Treasury took the announcement in stride as it moved downward steadily throughout the day’s trading.

Note the Wall Street response across the whole of the yield curve: Jay Powell raised the federal funds rate, and the markets lowered Treasury yields.

For all the talk of “raising rates”, the day ended with interest rates lower than when the day began.

Then Powell gave his customary press conference after the FOMC announcement—and immediately talked equity markets into tanking on the day.

Wall Street's major indexes edged lower on Wednesday in choppy trade after the Federal Reserve raised its benchmark interest rate by 25 basis points as expected and Fed Chair Jerome Powell said there would be no rate cuts this year.

The S&P 500 (SP500) and Dow (DJI) both spiked to their highest level in more than two weeks immediately after the Fed's hike, while Nasdaq (COMP.IND) climbed to an over one-month high.

However, the indexes took a hit after Powell in a press conference said Fed officials don't see rate cuts this year as inflation remains too high. He added that the Fed is willing to raise rates higher than expected if needed.

The S&P Financials Sector and the S&P 500 Banks indices especially took a beating.

Wall Street did not want to hear news of rates staying higher longer. It wanted to hear rates going lower sooner. Powell was not feeling generous and did not give it to them.

Powell’s prepared statement at the start of the press conference made the Fed’s position on the turmoil of the past two weeks plain: these were isolated failures at individual institutions, not harbingers of a general systemic crisis.

In the past two weeks, serious difficulties at a small number of banks have emerged. History has shown that isolated banking problems, if left unaddressed, can undermine confidence in healthy banks and threaten the ability of the banking system as a whole to play its vital role in supporting the savings and credit needs of households and businesses. That is why, in response to these events, the Federal Reserve, working with the Treasury Department and the FDIC, took decisive actions to protect the U.S. economy and to strengthen public confidence in our banking system. These actions demonstrate that all depositors' savings and the banking system are safe.

He gave a quick nod to the Bank Term Funding Program, which is an enhanced version of the Federal Reserve’s discount window, issuing short-term (up to 1 year) loans to banks against qualified collateral valued at par.

The phrase “at par” likely explains why Powell believes the banking turmoil has been handled. Banks taking advantage of BTFP receive loans against their portfolios of debt securities, including legacy low-yielding securities, based on those securities face value, not the bank’s amortized cost to the bank, or even fair market value. Thus, any potential unrealized loss is not a limitation on the size of the loan a bank may take out against whatever is pledged by the bank.

The willingness to accept collateral “at par” as opposed to fair market value undoubtedly played a huge role in the surge of Fed loans to banks during the past week.

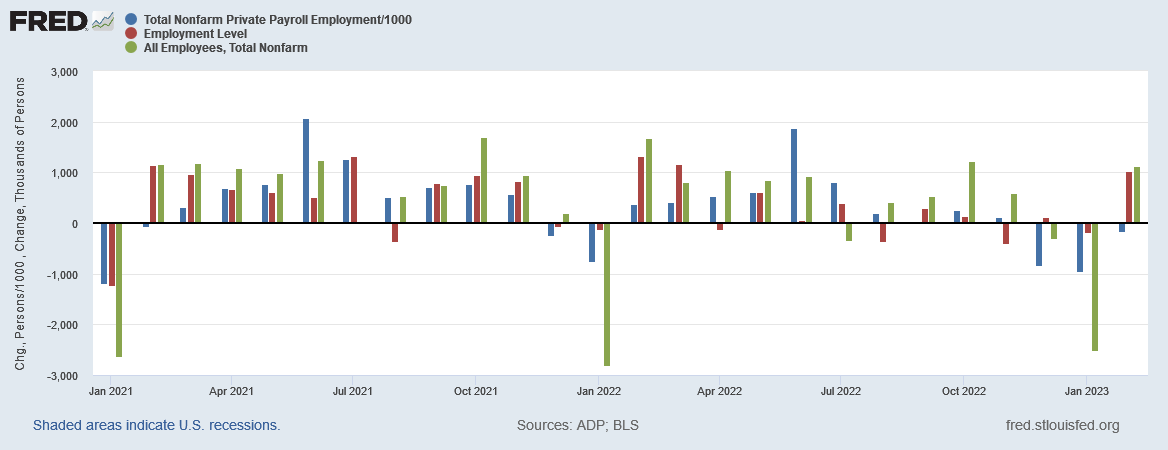

Powell also reiterated the Fed’s willingness to accept at face value the BLS narrative of “tight” labor markets.

Yet the labor market remains extremely tight. Job gains have picked up in recent months, with employment rising by an average of 351 thousand jobs per month over the last three months. The unemployment rate remained low in February, at 3.6 percent. The labor force participation rate has edged up in recent months, and wage growth has shown some signs of easing. However, with job vacancies still very high, labor demand substantially exceeds the supply of available workers. FOMC participants expect supply and demand conditions in the labor market to come into better balance over time, easing upward pressures on wages and prices. The median unemployment rate projection in the SEP rises to 4.5 percent at the end of this year and 4.6 percent at the end of next year.

Powell is choosing to accept the headline BLS data, rather than questioning how that number can be given a clear decline in job creation during the latter half of 2022 which has continued through February’s employment numbers.

Given Powell’s stated view of the state of the economy, it comes as no surprise that the Fed’s economic projections show inflation only returning to the desired <2% range sometime in 2025.

This is why Powell believes holding the line on the interest rate strategy is necessary. With the recent banking crisis merely a one-off event the Fed believes is resolved fully by BTFP, persistent consumer price inflation is still the biggest economic threat in the Fed’s eyes. Consequently, not only will there be at least one more rate hike this year, but the Fed does not anticipate lowering rates this year at all.

While Wall Street had largely already priced in the 25bps rate hike, once again it was expecting (hoping?) that Powell would be more concerned about the recent banking turmoil and pivot back to rate cuts sooner rather than later. When Powell dashed those hopes, stocks went south.

However, Powell is wrong about the banking upheavals. They are not a one-off event among smaller banks, but a systemic issue arising from the steady depletion of both banking deposits and the declining value of debt securities portfolios used to ensure the necessary liquidity to cover those outflows.

Shortly after Powell began raising the federal funds rate, deposits stopped flowing into the banking system and began flowing out.

At the same time, Interest rate increases have made banks’ portfolios of debt securities not only worth less but more difficult to sell, with the inevitable result that more of the banks’ securities’ portfolios are being classified as “held-to-maturity” rather than “available-for-sale”. Awkwardly, this shift is coinciding with a decrease in the amount of cash banks are holding.

Note that the decline in securities classified as “available for sale” began in the fourth quarter of 2021—before Powell began hiking the federal funds rate. This would be consistent with the initial market-driven increases in interest rates in the last quarter of 2021 and the first quarter of 2022, again preceding the hikes to the federal funds rates.

With more of banks’ securities being classified as held-to-maturity, and the more that interest rates rise—and thus the more that the fair market value of those debt securities declines—the greater the liquidity problem of having to take growing losses on a growing segment of banks’ investment portfolios.

These dual trends impact the whole of the banking and finance sector. SVB was merely the first bank to see its liquidity position eviscerated. First Republic Bank nearly became the second.

This liquidity exposure may also explain why Powell’s increases to the federal funds rate have not resulted in higher interest rates as measured by yields on Treasuries since November of last year. While yields did succumb to the upward pressure placed on them by increases in the federal funds rate after the February 1 rate increase, the aftermath of SVB’s failure and the near failure of First Republic Bank has seen those recent increases in Treasury yields reversed and then some. Treasury yields are lower now than they have been since last September, in spite of the federal funds rate increases—and, as noted earlier, yesterday’s boost to the federal funds rate resulted in Treasury yields moving lower still.

There can be no doubt but that there is market resistance to interest rates at or above 4-5%. Both the increases to the federal funds rate and Powell’s own jawboning of rates higher are not bringing sufficient pressure to counter the downward pressures the markets are exerting on interest rates. Based on the initial rate movements after the Fed’s announcement, there is still inadequate upward pressure to push yields higher.

Even if yields should recover from yesterday’s decline, they still have a long way to go to surpass current levels of consumer price inflation, with market forces opposing rises of that magnitude every inch of the way.

Until that dynamic changes, it is foolish to speak of the Federal Reserve raising interest rates. Powell pushed the federal funds rate higher yesterday, and that’s all he pushed higher. Everything else moved lower, either in response to the federal funds increase or his comments afterwards. In a moment of exquisitely perverse irony, yesterday Jay Powell actually lowered the very rates he wants to see increased.

This is why the federal funds rate increase yesterday was a mistake—the markets are rejecting its influence on interest rates and holding them below 4% for the upper end of the yield curve and below 5% for the lower end. Powell holding the line on the Fed’s interest rate strategy by pushing the federal funds rate up 25bps is merely highlighting the reality that the Fed is losing control over interest rates, to the extent that it truly had control.

The initial impact of yesterday’s increase in the federal funds rate is simply this: Jay Powell refused to hit “pause” on interest rate increases, so Wall Street did it for him. Wall Street wants lower rates and means to get them, Jay Powell be damned.

Discount rate 4.75-5.0%

One-year: 4.51%

Two-year: 3.95%

10-year: 3.48%

We sure have a lovely inverted yield curve, don't we?

That was always said to portend something, but I don't recall exactly what. ;)