September Incomes And Outlays Echoes September CPI, Ignores 3rd Quarter GDP

All Narratives Are Once Again Derailed By September Data

It’s just as well that Jay “Too Late” Powell doesn’t really pay attention to the inflation data. Even after yesterday’s update of the September Personal Income and Outlays Report, the data remains a muddled mess effective only at derailing narratives.

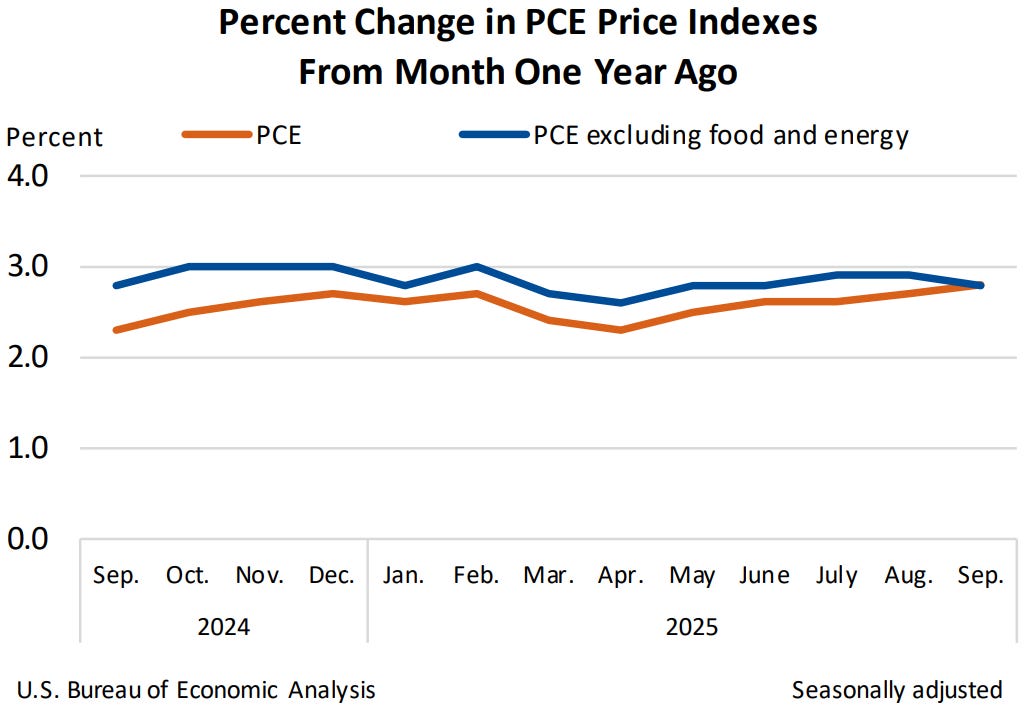

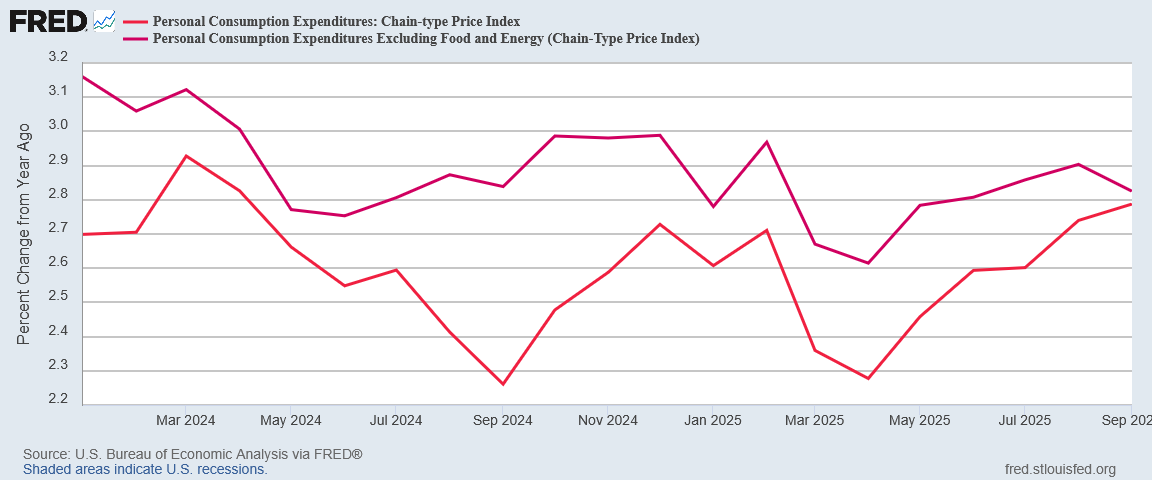

While the Bureau of Economic Analysis revised much of the internal data yesterday, the headline numbers did not move move much. They are still where they are earlier this month. Where they are, they show headline inflation ticking up and core inflation ticking down.

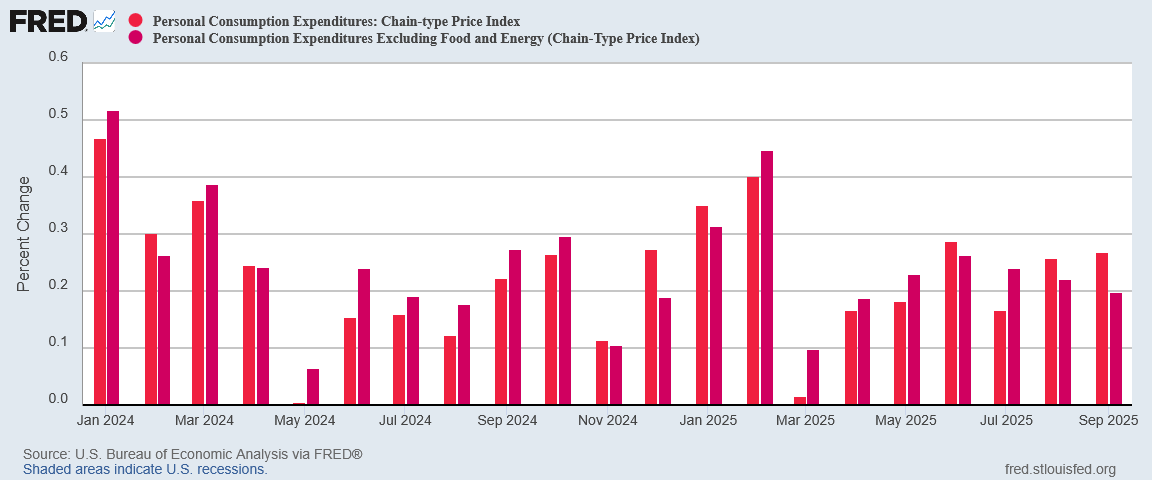

From the preceding month, the PCE price index for September increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

From the same month one year ago, the PCE price index for September increased 2.8 percent. Excluding food and energy, the PCE price index increased 2.8 percent from one year ago.

Inflation is rising or not rising, depending on where you stand and how you squint at the data.

While the BEA’s Third Quarter GDP data suggests the US economy did well, the PCE data reminds us that such conclusions are yet another narrative ready to be derailed by the data.

Certainly peeling back the layers of PCE data does little to support a narrative of robust GDP growth.

The only narrative which does not get challenged by the September Personal Incomes and Outlays data is November’s “Winter Is Coming” narrative on consumer price inflation.

Even with updates, the PCE Price Index still shows headline and core inflation converging, with headline inflation moving up and core inflation moving down year on year.

Month on month shows the same trends—headline is moving up and core inflation is moving down.

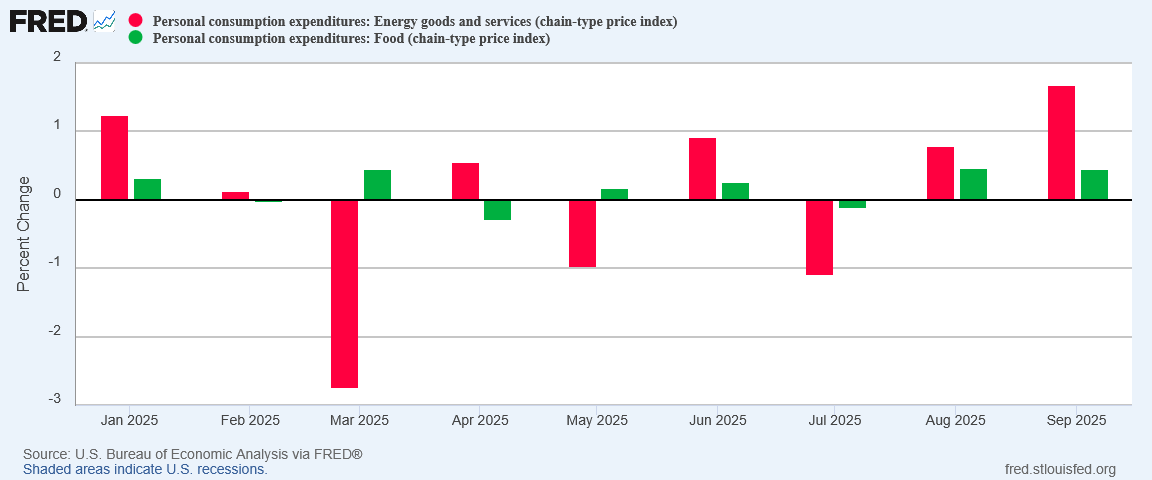

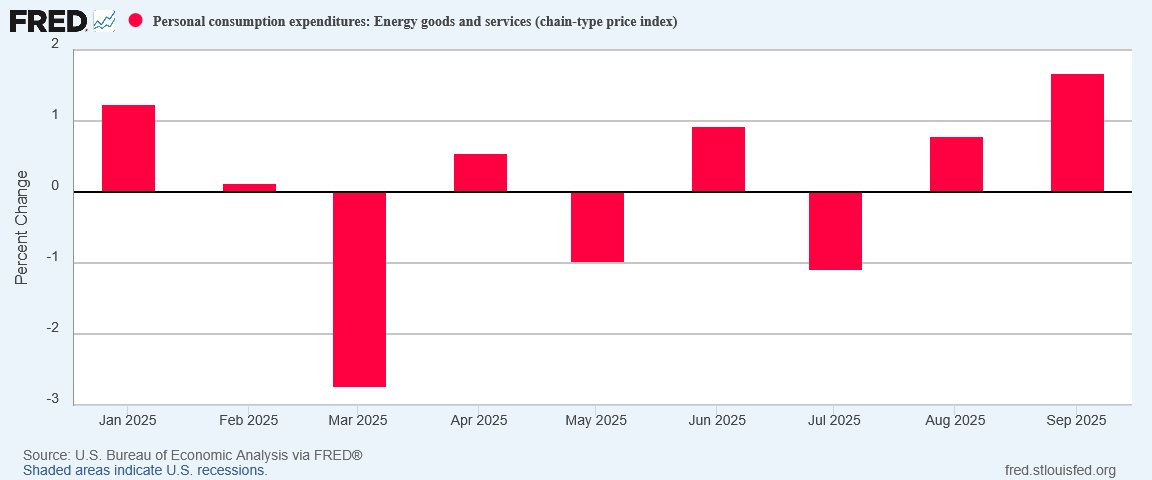

The month on month numbers have maintained this contrarian trend for the past few months. The more volatile elements of the PCE Price Index pushed up in September, particularly energy.

Outside of the volatile headline components, however, inflation cooled in September.

Is this a stagflation warning sign? That remains a possibility, and the longer the possibility hangs out there the more likely that possibility will become.

Is this a replay of the September CPI data? Certainly the top level numbers give that impression.

Energy price inflation rose significantly in September within the PCEPI. While energy prices are trending down this winter, in September the trend was still moving up, echoing the CPI trend.

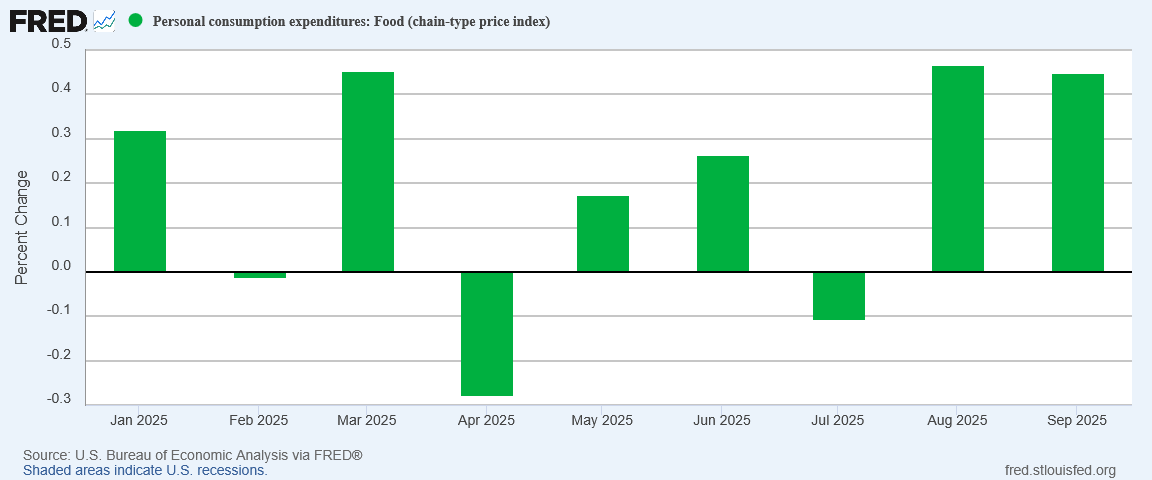

Food prices also rose again in September, by roughly the same percentage points the food PCE Price Index moved in August.

It is not hard to see why Democrats were been pushing “affordability” before the Silly Schumer Shutdown. With food price inflation rising, “affordability” becomes all about voters’ grocery bills.

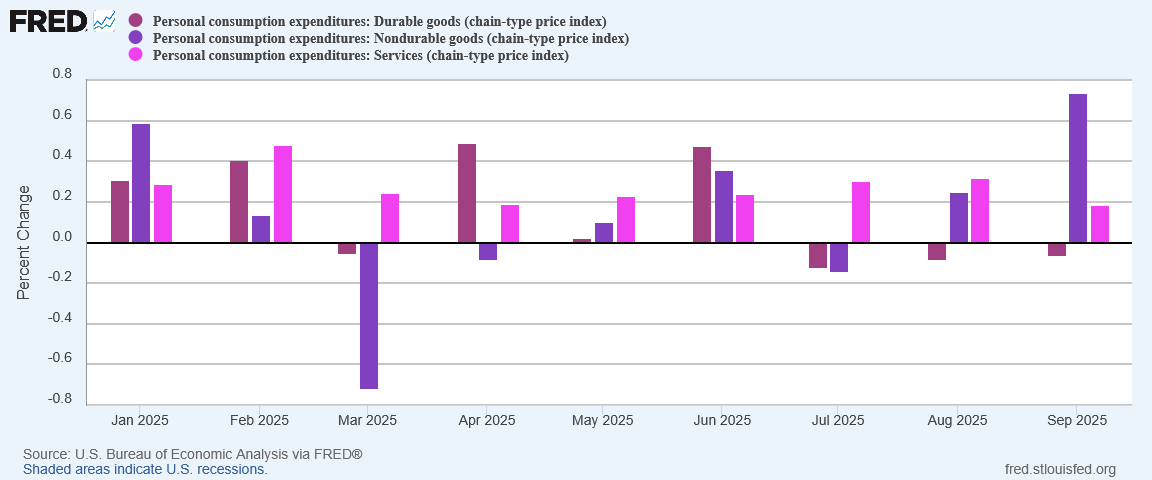

Yet durable goods prices moved down in September, even as non-durable goods prices surged.

The lack of inflationary prices on durable goods means, once again, the data mocks “Too Late” Powell’s paranoia that Donald Trump’s Liberation Data tariffs are contributing to inflation. Tariffs are an inflationary price pressure, but other deflationary pressures are holding prices back.

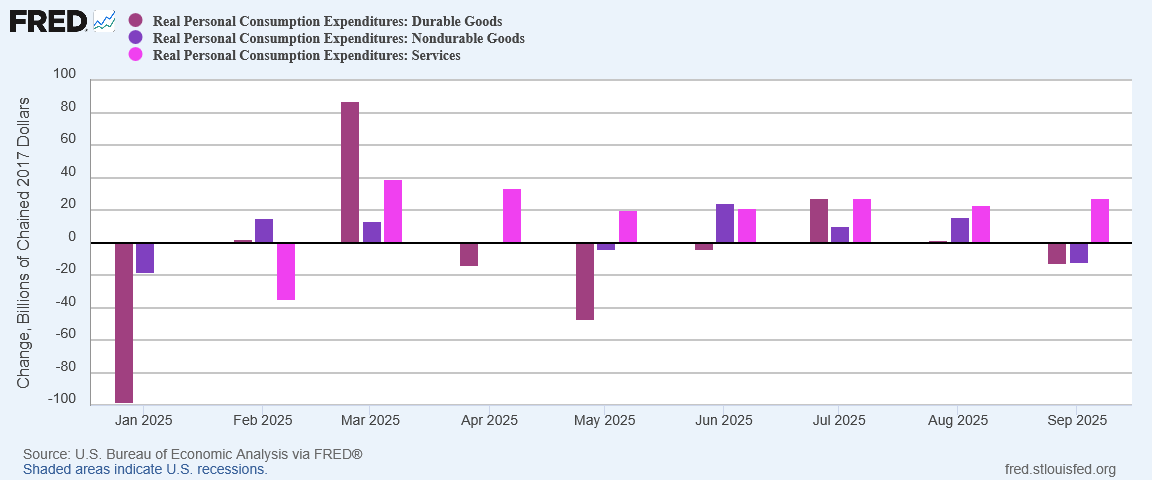

One such deflationary pressure: Decline in real spending on goods, even as services consumption continued to expand.

With people spending less on goods, there will not be much opportunity for tariffs to push prices up, much to the discomfiture of “Too Late”.

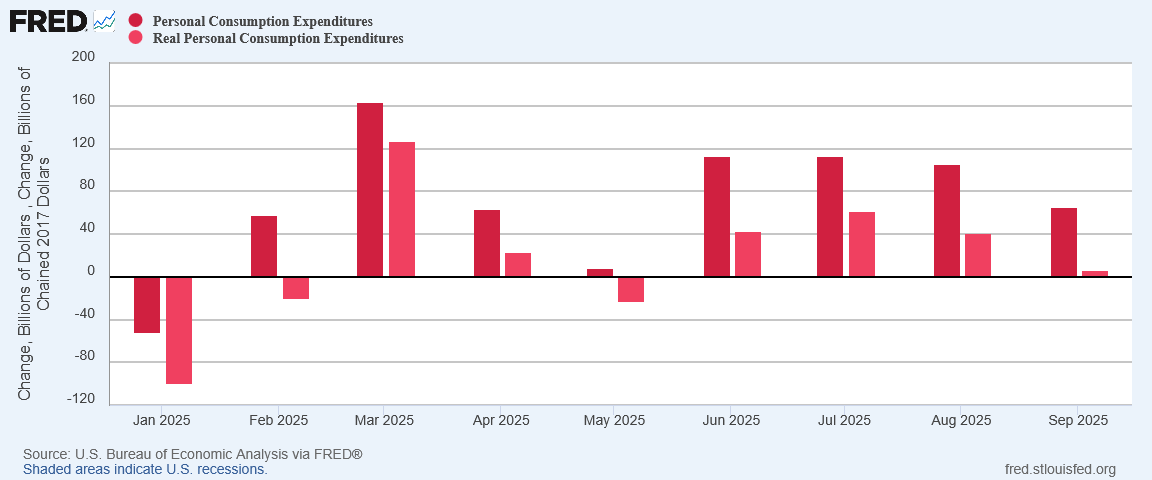

The most disturbing aspect of the PCE data was the lack of growth in real expenditures, while nominal spending continued to grow.

Vanishing growth in real expenditures with continued growth in nominal expenditures is one of the stagflation red flags the PCE data revealed for September.

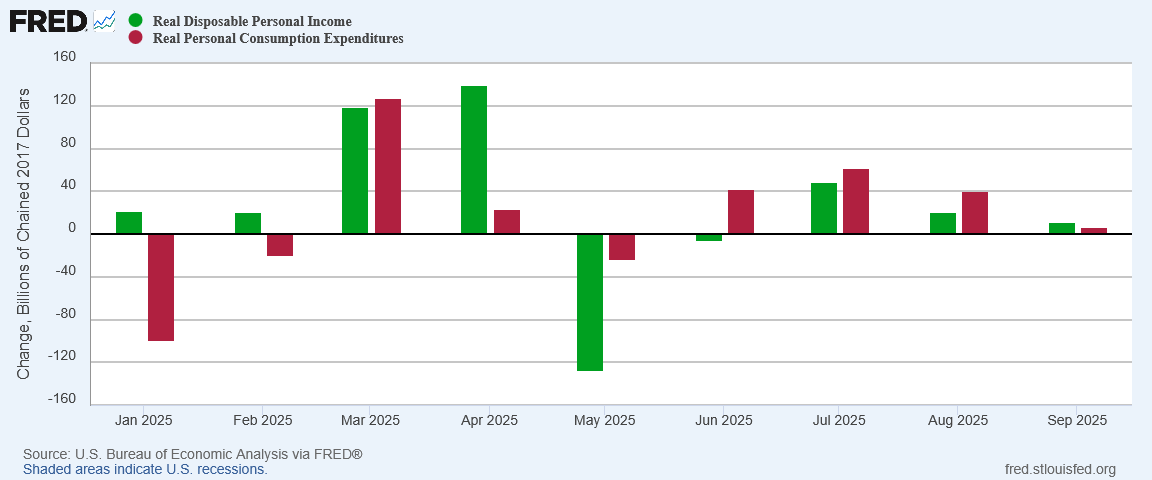

Lack of growth in real personal disposable income is another red flag.

While disposable income exceeded expenditures in September, both real expenditures and real personal disposable income have been growing in smaller and smaller increments over the past few months. The most obvious explanation for such growth declines is that the US economy is slowing down—a conclusion which runs directly counter to the BEA’s most recent estimate of GDP growth in the US.

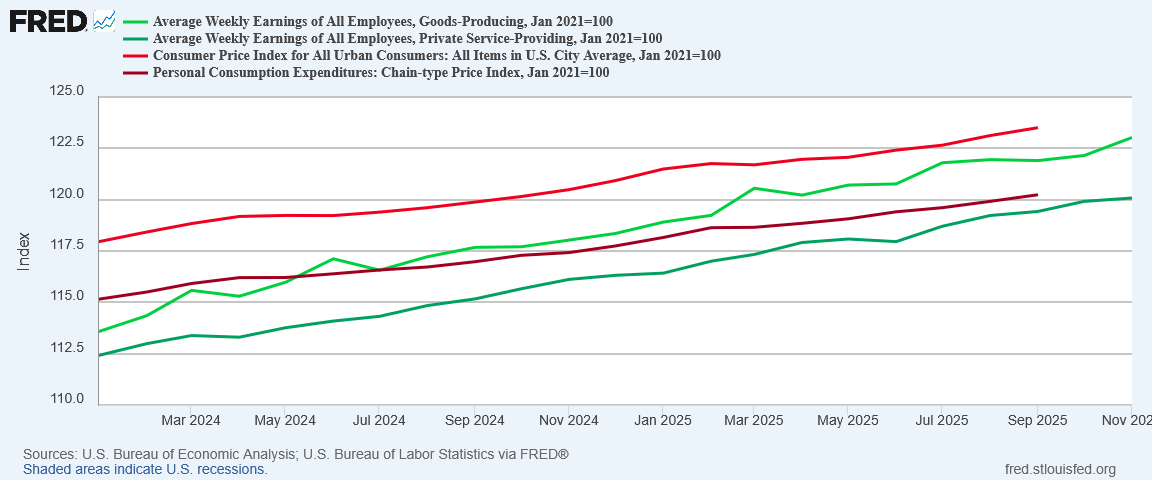

That lack of growth also highlights another disquieting shift over the past few months: wages are not necessarily growing faster than inflation.

One of the conclusive indicators that the jobs recession is over is that wages will grow above the index curve for both the CPI and the PCEPI. One of the conclusive indicators that the jobs recession is not over is that wages are still below the CPI and PCEPI curves.

As with the CPI data, the Personal Income and Outlays data does nothing half so well as derail everyone’s favorite narrative.

Powell loses on tariffs and inflation.

Donald Trump loses on his “Golden Age” rhetoric—whatever else the state of the US economy is, being within a “Golden Age” or prosperity is clearly not that state.

The media loses on their anti-Trump propaganda. Inflation broadly is trending down, even if food price inflation is pushing up, and the divergent trends make “affordability” narratives largely a matter of propaganda.

Readers will note that I have said little about the Third Quarter GDP data, which presumably showed the US having robust economic growth. Certainly the muddled PCE data does not fit that narrative either—which suggests that the GDP “growth” being celebrated in the media may not withstand close scrutiny, making it another narrative derailed by the PCE data. After the Christmas holiday I shall explore the GDP data in detail, and we shall see what to make of the growth narrative.

When all narratives are derailed by the data, the one thing that is certain is that the US economy is not firing on all cylinders. For every part that is doing well, there is another part that is not, a reality which is also driven home by this country’s ongoing jobs recession.

While the September PCE data is, at this point, a bit on the stale side, that this data echoes the CPI data for September provides more confirmation on the state of inflation in this economy. With the November CPI data showing a distinct shift towards cooling prices and diminished inflation, the September PCE data aligning with where the CPI was for September provides confirmation that winter is indeed coming for inflation. If we see similar cooling trends when the November PCE data emerges after the holidays, we will know that inflation has shifted down significantly.

Until then, the updated September PCE data reminds us that, prior to the Silly Schumer Shutdown, the US economy was largely “stuck”. The lack of clear trends for September may be an indicator of an inflection during that month.

The September PCE data was as much a muddled mess as the September CPI data. Perversely, that may be its best quality.

We’re sure going into the new year with a muddled picture. Some hopeful signs, some more ominous signs. I’m not even clear on what the net effect will be from some of Trump’s proposed policies.For example, he is calling for an entire new class of warships to be built. That would be good for national strength, but terrible for the national debt. It would be good for manufacturing jobs and wages, but possibly harmful to the Republicans in the midterm elections if they are consequently painted as warmongers. Peter, I hope you will keep us updated on the actual effects as data becomes available. You’re just the BEST at this!

Strong analysis on how real disposable income flatlined while nominal kept climbing, that's textbook stagflation risk. The divergence between goods deflation and services inflation is something I've been tracking in regional markets too. What's particuarly telling is wages not outpacing PCE anymore,that undermines the whole consumer strength narrative that GDP supposedly reflects.