Spending In The US Just Got “DOGE’d”

Elon Musk's Impact Has Been As Astounding As It Has Been Swift

While last Friday’s Personal Income and Outlays Report for January was completely overshadowed by Ukrainian President Volodomyr Zelenskyy’s epic temper tantrum—on live television in the Oval Office, no less—we should not let Zelenskyy’s regrettable theatrics obscure the latest data points on the state of the US economy.

While most of the report was the usual array of doggedly incurious commentary about the various headline metrics, there was one headline figure that stood out: Personal outlays dropped a fairly substantial $52.7 Billion, even as Personal Incomes rose.

This unsual divergence gave the personal saving rate in this country a welcome shot in the arm.

What was the cause of the unusual divergence? The primary reason can be summed up in one single word: “DOGE”.

The Department Of Government Efficiency has already had a dramatic impact on not just the government, but on the US economy, and it has been on the job barely a month!

Let’s peel back some of the numbers and see how DOGE has managed to make a difference already.

Personal Income Rose But Personal Expenditures Plunged

On the surface, the Personal Income and Outlays Report presented some very strong numbers.

Personal income increased $221.9 billion (0.9 percent at a monthly rate) in January, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI)—personal income less personal current taxes—increased $194.3 billion (0.9 percent) and personal consumption expenditures (PCE) decreased $30.7 billion (0.2 percent).

Personal outlays—the sum of PCE, personal interest payments, and personal current transfer payments—decreased $52.7 billion in January. Personal saving was $1.01 trillion in January and the personal saving rate—personal saving as a percentage of disposable personal income—was 4.6 percent.

Even more encouraging was that what shows first in the current-dollar data was dimiminished only slightly by the conversion to “real” 2017 constant-dollars.

Not only did real personal incomes rise by the largest amount since January of 2024, but Real Personal Consumption Expenditures fell by the largest amount in at least a year.

As a broad rule, incomes rising and expenditures falling is a very good thing, particularly for the consumer!

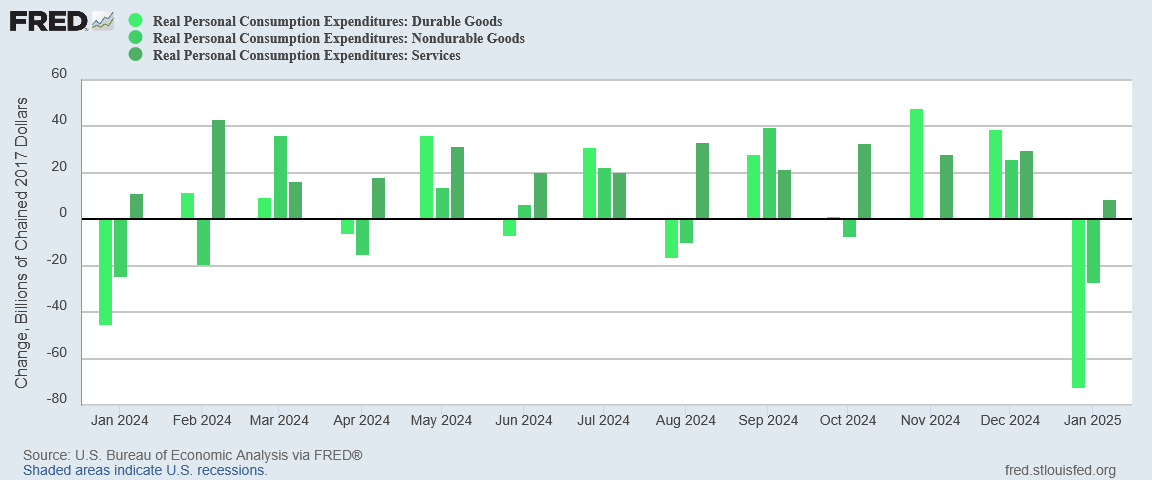

Also significant was the fact that the drop in expenditures covered virtually every physical product within the US economy.

Service incomes rose somewhat, but that increase was completely overwhelmed by the far larger declines in durable and non-durable goods, which ran the gamut of goods and industries.

Motor vehicles, RVs, clothing, transportation….the spending declines were quite literally everywhere in the economy.

We should not be at all surprised, therefore, that personal savings in this country rose dramatically—the largest increase since January of 2024.

After a year of steady declines, Personal Savings came roaring back in January!

To a degree, this is a good thing. More savings increases the capital available for investment, and that helps lay a foundation for future economic growth. An increase in savings can also buffer consumer price inflation, which is likely one reason Consumer Price Inflation per the PCE Price Index was somewhat moderated in January.

Inflation Is Still Going Up But Signs Of Easing

On the surface, consumer price inflation rose month on month, and did so at both the headline and core levels.

Both headline and core consumer price inflation month on month rose for the third straight month. In the short term, inflation is continuing to heat up.

However, the year on year inflation rate reported by the PCEPI shows inflation in this country easing back somewhat.

Prices are still rising in this country, but the drop in personal outlays, and the resultant lack of spending, weakens the upward price pressures acting on prices.

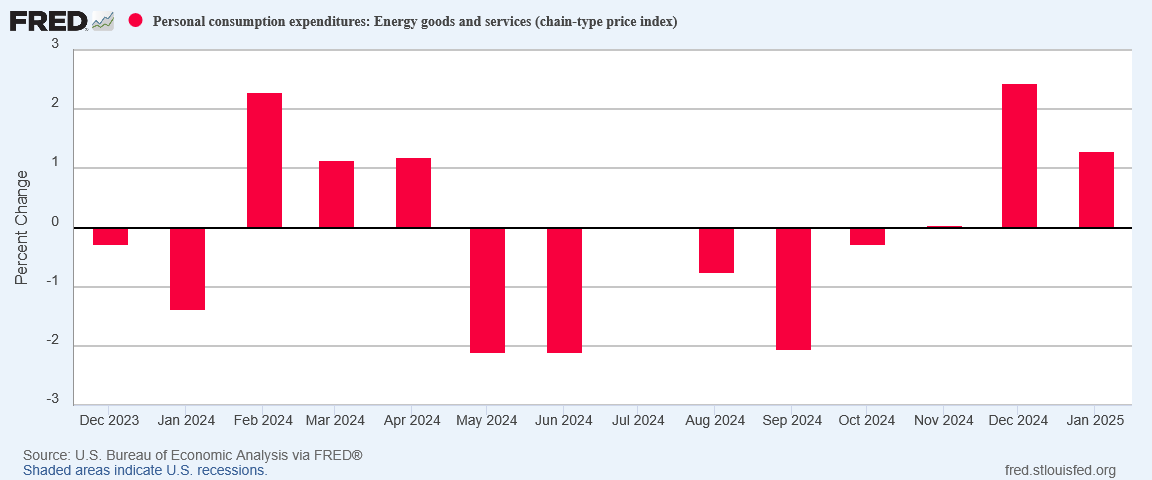

As a result, while we are dealing with energy price inflation for the second month in a row, the month on month inflation rate for energy goods and services did ease back somewhat.

The inflation data is not all good, however, as food price inflation month on month continued to get hotter.

Food price inflation rose for the fourth straight month in January, and remains well above the levels where it had been during the first half of 2024.

Intriguingly, goods price inflation surged in January, even as the spending dropped.

Durable goods went from a significant deflation impulse in December to an inflation impulse, while non-durable goods price inflation edged up month on month a full two-tenths of a percentage point.

Service price inflation, playing against type, eased off a little. Service price inflation continues to oscillate in the same month-on-month percentage point range, with no sustained trend up or down.

Thus, while we are still faced with a situation where inflation is continuing to heat up again in a significant way in 2025, the drop-off in spending has kept the full impact of that inflation from being felt just yet.

“DOGE” Effect

Is all of the drop in personal outlays attributable to the work of the Department Of Government Efficiency?

From a purely economic perspective, the answer is obviously “Of course not!”. However, when we unpack the personal outlay data, we can see a very strong DOGE influence.

If we look at Personal Consumption Expenditures, we see, as was noted above, a drop in January of $30.7 Billion.

If we break that down, that drop in expenditures is comprised of the smallest increase in services expenditures since at least January 2024, coupled with the largest decrease in durable goods expenditures in over a year and a modest decrease in non-durable goods expenditures.

As matter of empirical reality, January was a month where durable goods purchases were either cancelled or postponed.

Were such purchases cancelled or postponed explicitly because of DOGE? Direct causal relationships across the broad data set are inherently problematic, but there is no denying that many of President Trump’s initial Executive Orders—e.g., Executive Order 14151—had direct government funding ramifications, and much of the corporate media reporting at the time presented the Executive Orders as a “funding freeze”.

We should anticipate, therefore, that a lot of spending that might otherwise have occurred did not happen, either because a private DEI program was scuppered or because spending was put on hold until greater clarity on the scope of Donald Trump’s Executive Orders could be obtained.

More importantly, however, within the report category of Personal Outlays there is not only Personal Consumption Expenditures but Personal Current Transfer Payments—which has also seen a dramatic drop in January.

Of that drop, by far the biggest portion ($26.4 Billion) comes from Personal Current Transfer Payments To The Rest Of The World (net).

Transfers are payments that are neither taxes nor payments made in return for goods or services. This would include the funding that various NGOs around the world receive—and all of that funding was shut down, much of it permanently as USAID was tapped for closure.

Whether or not some of these personal current transfers end up being shifted in time to later months as various funding pieces are restored, either by the government or by the courts, there is little doubt that we are seeing in the drop of personal current transfers the same reform mindset that has birthed DOGE.

These spending line items were rising, and then they were down sharply—in the case of payments to the rest of the world, the decline amounted to 20% of December 2024 amounts.

In every circumstance, that is an extraordinary shift in government spending patterns!

Shift Comes Against Weak Economic Backdrop

While the full impact of such a dramatic reduction in personal consumption expenditures will take a few months to be fully realized, one point that bears noting is that this is taking place against the backdrop of an economy that, contrary to corporate media propaganda, has been softening for quite some time.

Over the past several quarters, aggregate personal consumption expenditures are significantly less than what they were in early 2021.

Even more disconcerting has been the persistent weakness in Private Domestic Investment, which printed negative for the sixth time since January 2021.

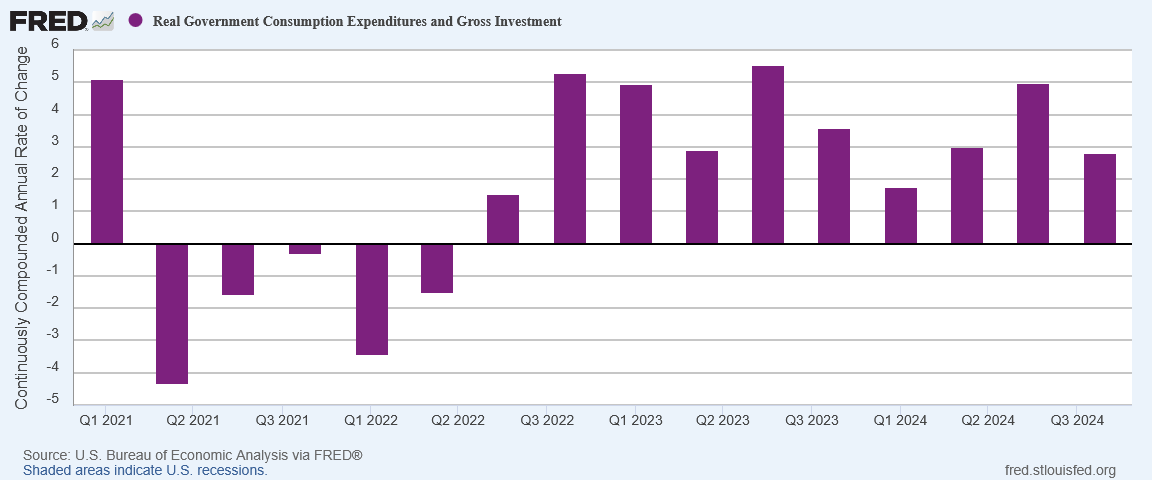

The only portion of the US economy that has shown any robustness has been Government Consumption Expenditures and Gross Investment.

While this was doing fairly well from late 2022 through the end of 2024, the ongoing slash-and-burn cost-cutting of DOGE is a strong signal that government spending levels are likely to reverse, taking on the negative trend of late 2021/early 2022.

This, of course, implies that in subsequent months we could see possibly even larger reductions in personal consumption expenditures.

The economic impact of this will also be hard to fully quantify for at least a few months.

Reductions in expenditures of this magnitude will, if extended across an entire quarter, appear in the government economic data as a reduction in overal Gross Domestic Product for the quarter. Depending on the timing of various events this might even produce two successive quarters of GDP reduction, which is the usual thumbnail benchmark for declaring a recession.

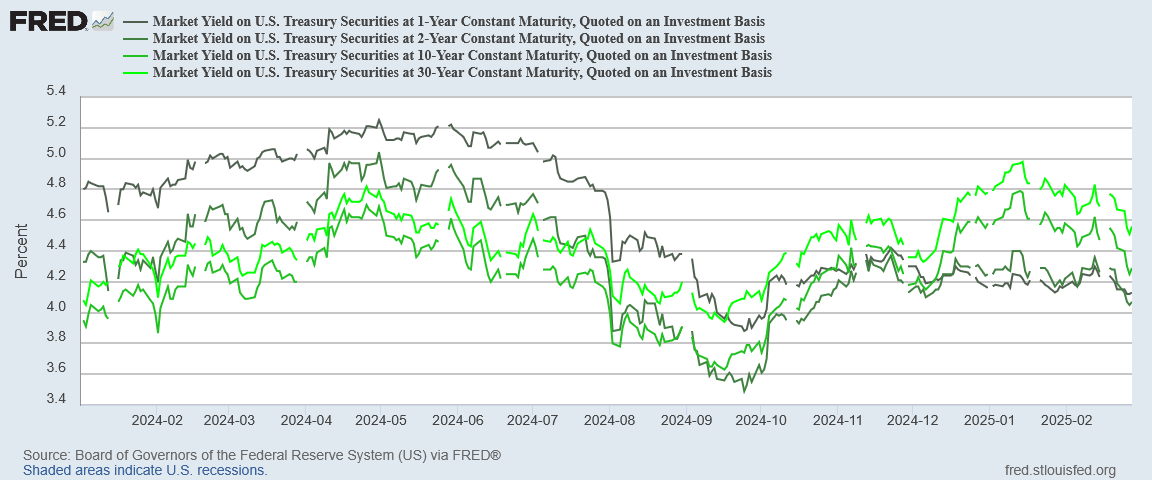

At the same time, reductions in federal spending will reduce pressure for the US government to issue federal debt, and that could help extend the recent downward trend in Treasury yields.

Particularly if the spending trimmed from the Federal budget pursuant to DOGE probing everything is truly wasteful or fraudulent, even if the immediate result is a technical recession, by right sizing federal spending the stage could be set for some significant economic growth through the remainder of Trump’s term of office. The seeming step back now could result in several steps forward later.

These are some of the optimistic scenarios that can arise from DOGE’s impact on federal spending and on the federal bureaucracy. While it is far too soon to know if these are the scenarios that will unfold to delineate the impact of DOGE, what is certain is that DOGE has already had significant impact.

DOGE Impact Is Going To Increase

DOGE is on course to have even larger impacts going forward.

Not only are there likely more impacts based on the timing of contract cancellations and payment suspensions, but DOGE is also poised to venture into the realm of regulation.

As we can see from the DOGE.gov website, almost daily contracts are being cancelled, with various amounts of savings being touted.

In addtion, there are numerous office and building leases that are being declared unnecessary, which could result in tens of millions of dollars in further spending reductions.

The degree to which these claims of savings are accurate will not be fully known for a few months yet—until they have had time to work through the federal payments infrastructure one way or the other—but it is highly unlikely the net effect of these claims will be zero.

In addition, DOGE is laying a foundation for taking a metaphorical chainsaw to government regulation. The DOGE.gov website highlights the reality that there are 18.5 regulations drafted by unelected bureaucrats to every law passed by the Congress.

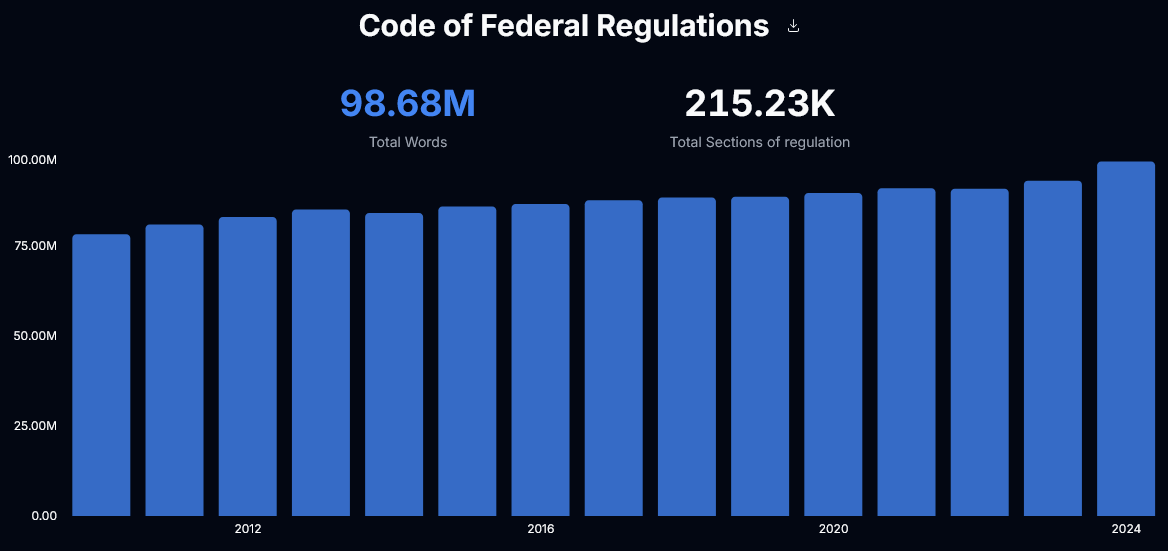

The one part of the federal government that manages to grow regardless of the circumstance is the behemoth known as the Code of Federal Regulations.

Millions of words. Hundreds of thousands of regulatory sections. Thousands upon tens of thousands of regulations.

All of this is demonstrably a millstone around small businesses in particular. If DOGE continues to follow throught on President Trump’s Agenda 47, at some point DOGE is going to start taking a chainsaw to the regulatory apparatus in every government agency or bureaucracy.

Will that go well for DOGE? At present, there is no way to tell for certain.

As a matter of historical trend, reducing the regulatory overhead has a salutary impact on the modern economy. Businesses tend to thrive when government gets out of their way.

Small businesses especially might be prime beneficiaries of this root-and-branch reform of the federal government.

As of now, Donald Trump has been President of the United States for 42 days. He is not yet even halfway through the much-storied “first hundred days” that have been a benchmark for gauging the success or failure of an Administration since FDR and the New Deal.

Despite this, the spending data from January already is indicating Trump and the policies within his Agenda 47 are already having significant impact on how money is being sloshed around. Where DOGE is likely to be headed next suggests that Donald Trump’s immediate impact on the US economy is far from cresting, and even farther from being over.

We do not know yet how all of these spending disruptions are going to play out, particularly against the backdrop of the overall US economy. Based on the very preliminary data we have thus far, however, it is difficult to see the impact of these spending disruptions as being uniformly negative.

As amazing as it is to say, the DC Swamp does appear to be getting drained! Hopefully it continues to get drained.

Hi Peter- Thank you for very interesting & well detailed post (3/3/2025 spending in the US Just Got DOGE’d”).

If the current economy trends noted are being somewhat positively influenced by the DOGE efforts, then it would be important for the Trump administration to send Congress a “rescission package” ASAP (which would rescind any noted wasteful / nonessential prior Federal payment authorization). To pass a rescission package in Congress would only take a simple majority (50% + 1) vs. the typical 60% super majority & debate would be limited per the Budget Act of 1974. In addition, if this passed, the administration could put forth to Congress additional rescission packages in the future as needed (as additional wasteful & nonessential prior Federal payment appropriations are discovered / brought to light).

Of course, every Republican would need to vote “Yes” on any rescission package, unless by a remote chance, a moderate, budget/deficit conscious Democratic had the courage to buck the stonewalling Democrat leadership. Regardless, if there are any Republicans who vote “No”, each one should be called out in public & demanded to explain which specific wasteful / nonessential previously funded appropriated program they are in favor of keeping (& why).

Thanks again & I enjoy your thoughtful writings. Take care.

Excellent information Peter thank you!