Stagflation: While Inflation Rises The Real Economy Sinks

Also: What Demand Destruction Looks Like

The hits just keep coming.

Yesterday, I outlined the “stagflation” scenario building for the US economy.

Today’s releases of economic indicators confirm that the “worst case” is increasingly the probable case, even as the Fed temporizes about avoiding a recession (too late, it’s already here).

Another Day, Another Fed Manufacturing Survey

Yesterday’s bit of bad news was occasioned by the Dallas Federal Reserve’s Texas Manufacturing Business Survey. Today’s bit of bad news comes courtesy of the Richmond Federal Reserve’s Fifth District Survey of Manufacturing Activity.

(Spoiler alert….the data sucks. Bigly)

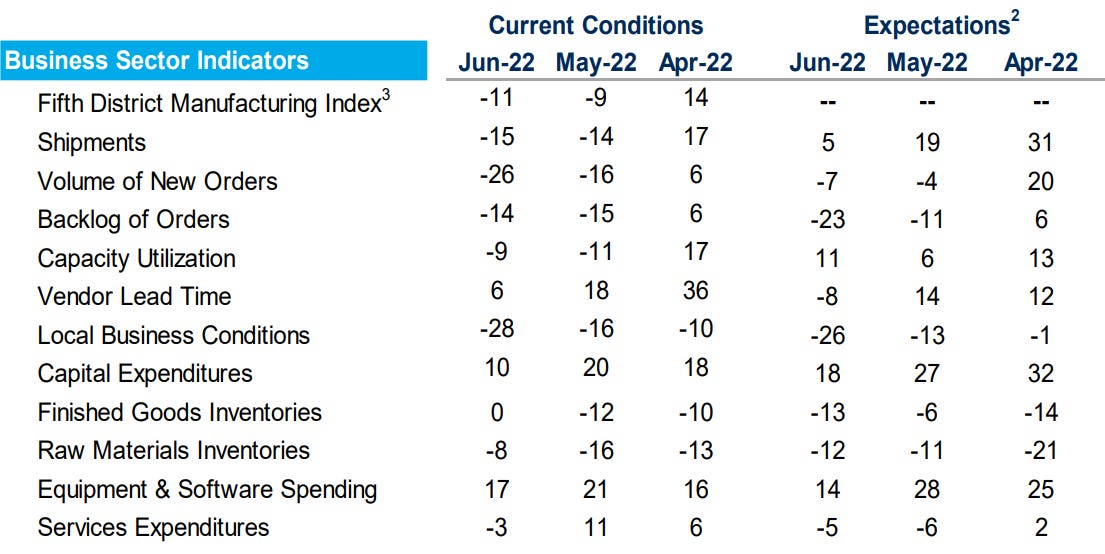

Much like the Dallas Fed’s survey, the Fifth District Survey of Manufacturing Activity polls businesses within the Fifth Federal Reserve District, which encompasses Maryland, North and South Carolina, Virginia, West Virginia and the District of Columbia.

Manufacturing firms report on various aspects of their business, such as shipments, new orders, order backlogs, capacity utilization (usage of equipment), supplier lead times, number of employees, average work week, wages, inventories of finished goods, and capital expenditures. Firms report on change from the previous month and for most of the series, the Richmond Fed then converts responses into diffusion indexes by taking the difference between the contacts who report an increase and those that report a decrease. Firms also report expectations for the next six months. Data is seasonally adjusted each month, and seasonal adjustments are revised each July.

This month’s report showed declines almost across the board.

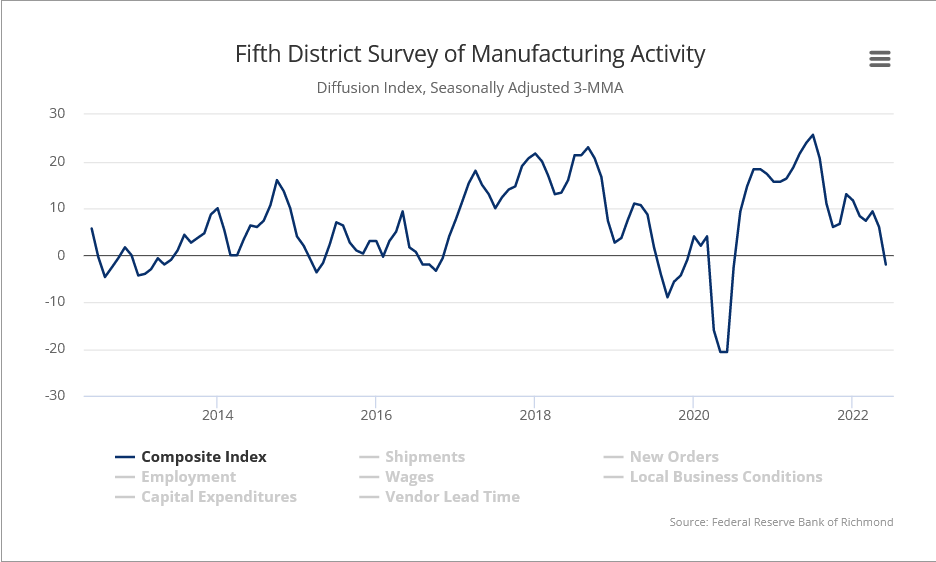

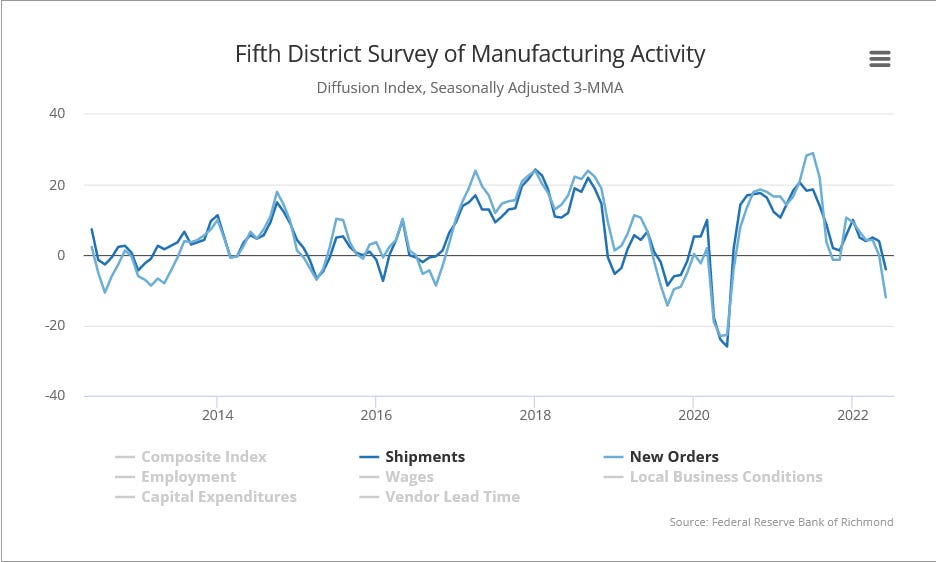

Overall, the seasonally adjusted composite index declined from 6 to -2.

Both the Shipments and News Orders indicators also dropped significantly, highlighting a slowdown in real business activity.

The one bright spot in the report: lead times from vendors declined, further confirmation that the worst of the supply chain dislocations are in the past.

Still, that one bit of silver lining does not change the grim outlook of the report: the real economy within the Fifth Federal Reserve District is declining, like the Texas economy highlighted yesterday.

Inventory Builds Are Slowing

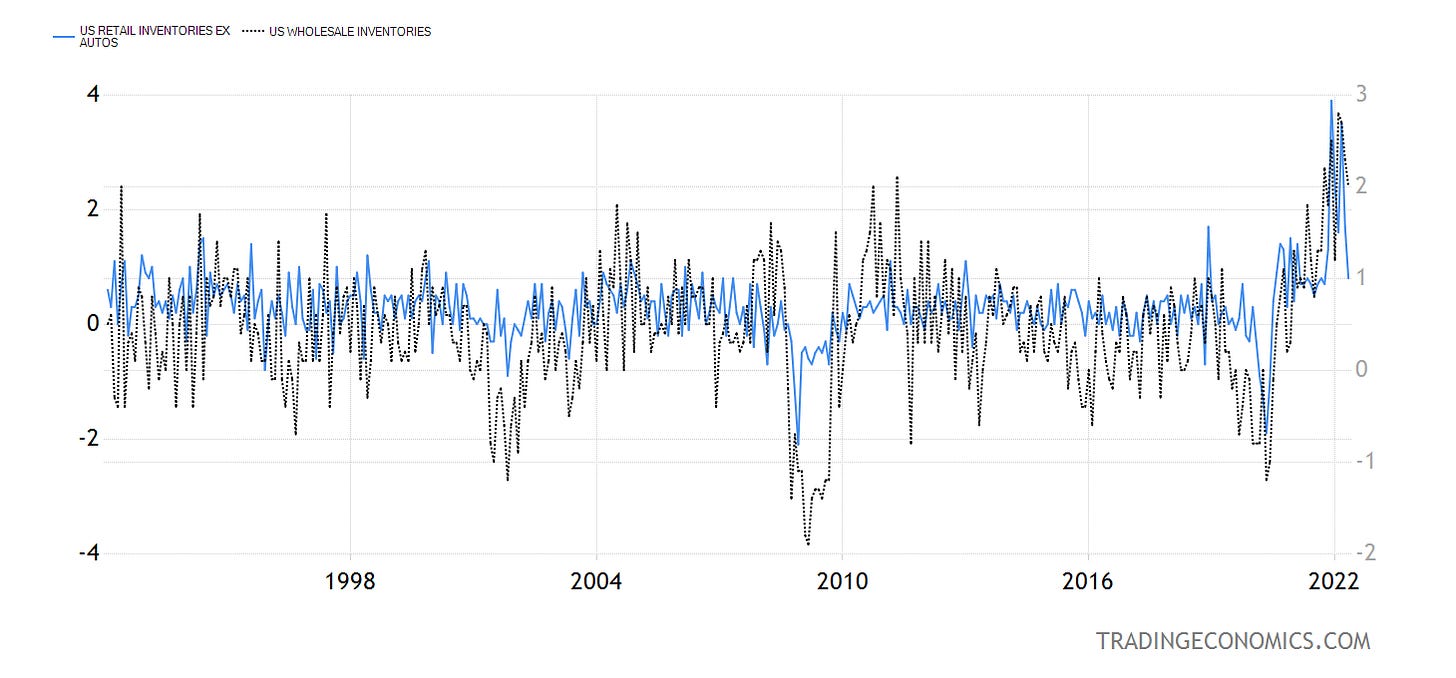

The Richmond Fed’s business survey report is confirmed by the Census Bureau’s Monthly Advance Economic Indicators Report, which reported a modest increase in retail inventories of 1.1%—which is still 17% higher than the year-ago figure.

Retail inventories for May, adjusted for seasonal variations and trading day differences, but not for price changes, were estimated at an end-of-month level of $705.3 billion, up 1.1 percent (±0.2 percent) from April 2022, and were up 17.3 percent (±0.7 percent) from May 2021. The March 2022 to April 2022 percentage change was unrevised from the preliminary estimate of up 0.7 percent (±0.2 percent).

However, wholesale inventories rose 2%, and are up 25% from the year-ago figure.

Wholesale inventories for May, adjusted for seasonal variations and trading day differences, but not for price changes, were estimated at an end-of-month level of $880.6 billion, up 2.0 percent (±0.2 percent) from April 2022, and were up 25.0 percent (±1.4 percent) from May 2021. The March 2022 to April 2022 percentage change was revised from up 2.2 percent (±0.2 percent) to up 2.3 percent (±0.4 percent).

The slowing growth in inventories suggests vendors at both the wholesale and retail level are losing confidence that consumers will continue to buy their goods as inflation pushes prices ever higher.

Demand Destruction In Progress

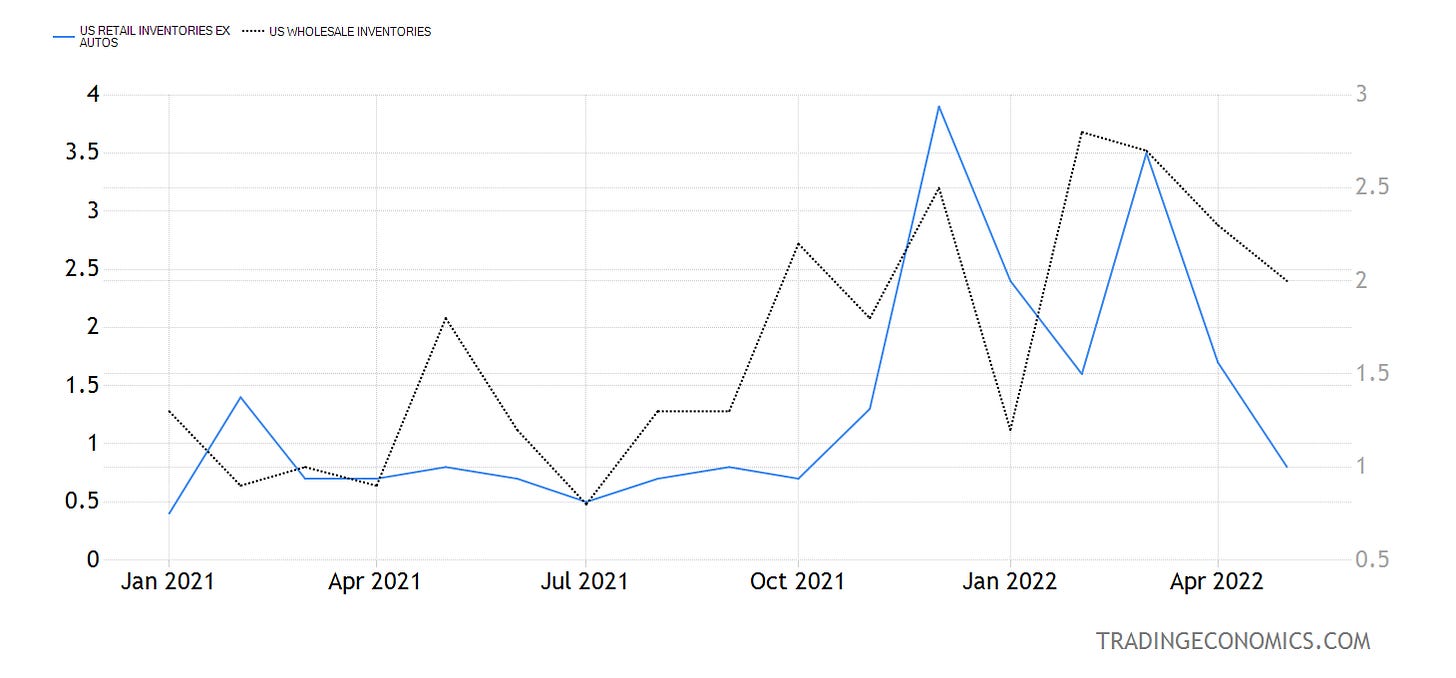

However, the real danger signal comes from rising wholesale inventory “overhang.” Historically, wholesale inventory growth rates are more or less in line with retail inventories, with a tendency to grow slower than retail inventories.

Since January of 2021, however, wholesale inventories have grown faster than retail inventories—most likely as a reaction to supply chain issues and wholesalers’ need to have a greater inventory buffer to address longer lead times.

When economists speak of “demand destruction”, this is what that looks like: inventory “overhangs” that must be cleared through steep price discounts as vendors grow increasingly desperate to move goods.

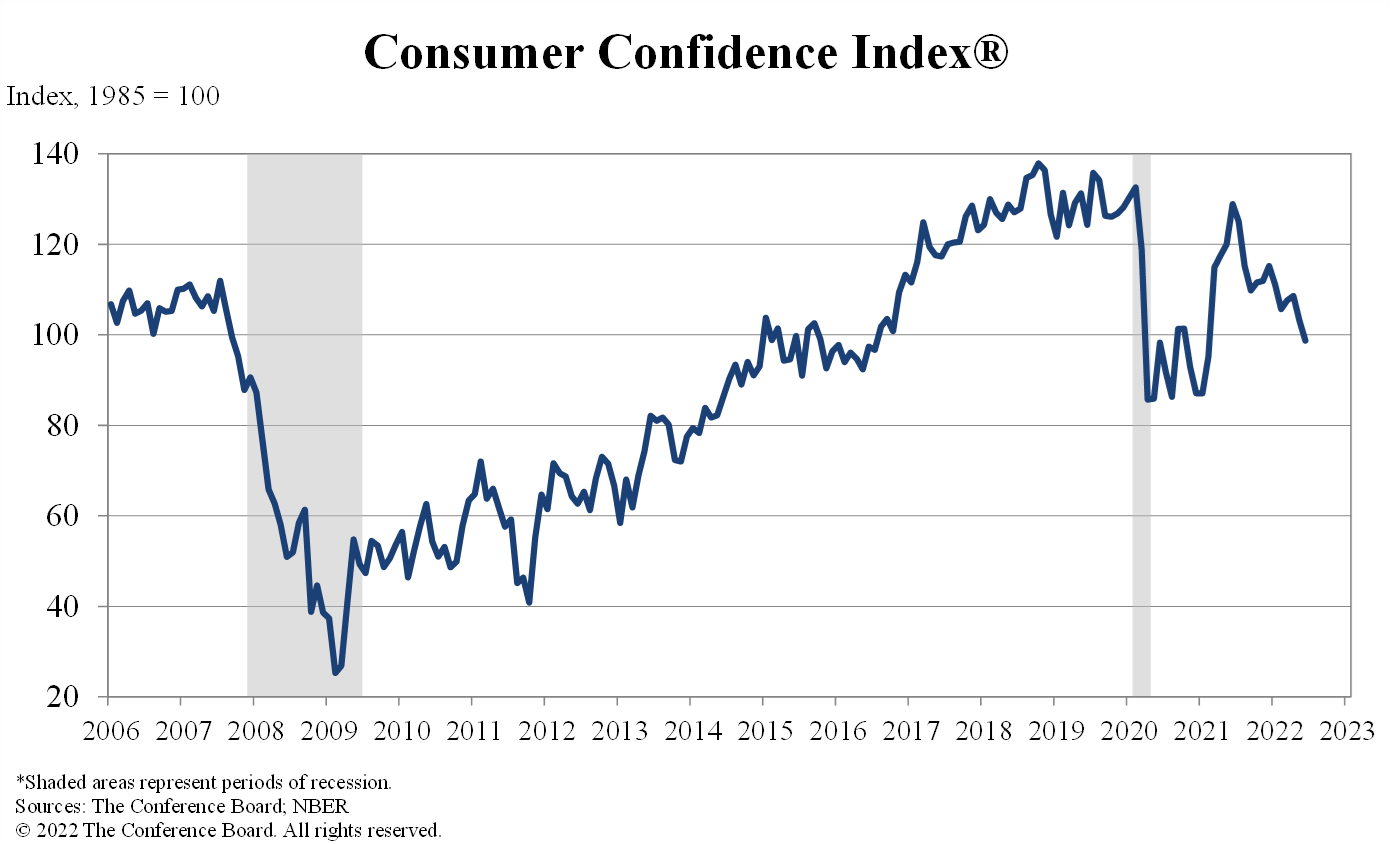

Demand is diminishing because consumer confidence is crashing. The Conference Board’s Consumer Confidence Index for June clocked its lowest reading since February, 2021, with the Expectations Index at its lowest level in a decade.

The Conference Board Consumer Confidence Index® decreased in June, following a decline in May. The Index fell to 98.7 (1985=100)—down 4.5 points from 103.2 in May—and now stands at its lowest level since February 2021 (Index, 95.2). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—declined marginally to 147.1 from 147.4 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased sharply to 66.4 from 73.7 and is at its lowest level since March 2013 (Index, 63.7).

When consumers are pessimistic about the future they tend to consume less. Happy customers are generally good customers; unhappy customers…not so much. And customers are becoming increasingly unhappy.

But Still We Have Inflation

Despite the growing signs of demand destruction and the disappearance of consumer confidence, the Personal Consumption Expenditures index for May (due to come out June 30), is forecast to track higher in line with the already-published CPI figures.

The Personal Consumption Expenditures Price Index (PCE) should follow consumer inflation higher in May, though analysts have predicted a slight moderation in the annual rate. Core PCE prices are forecast to rise 0.4% in the month after a 0.3% gain in April. For the year prices are expected to increase 4.7%, down from April's 4.9%. Overall PCE prices rose 0.2% in April and 6.3% for the year.

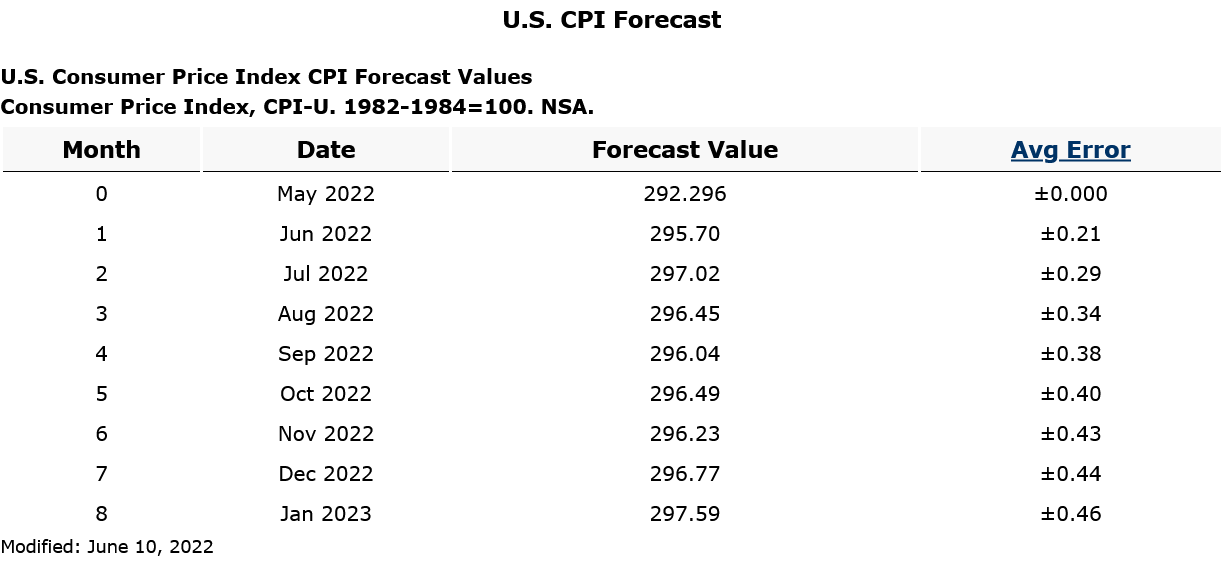

For its part, the CPI is forecast to rise again for June and also July before moderating in August.

This continued expectation of inflation in the face of a declining real economy is why the Fed is still talking about another 75bps rate increase in July, while also delusionally arguing that it can avoid a recession (it can’t because the recession is already here).

New York Fed President John Williams and San Francisco’s Mary Daly both acknowledged on Tuesday they had to cool the hottest inflation in 40 years, but insisted that a soft landing was still possible.

“I see us tapping on the brakes to slow to a more sustainable pace, rather than slamming on the brakes, going over the handlebars and having the proverbial recession,” Daly told an online event hosted by LinkedIn. “I wouldn’t be surprised, and it’s actually in my forecast, that growth will slip below 2%, but it won’t actually pivot down into negative territory for a long period of time.”

The Fed is so persuaded by its own estimation of its own competence (imagine that!) that the same “experts” who pushed the line of “transitory” inflation earlier this year now see nothing but inflation and the need to squelch it as quickly as possible.

Eventually, The Crash

Ironically—and perversely—the inflation expectations are now so ingrained that the Fed seems unable (or unwilling) to consider the possibility of demand destruction triggering a broad collapse in the CPI, leading to disinflation.

Exactly when or even if there will be disinflation is a question that remains open for now. Certainly, without significant recovery in consumer confidence or a drawdown in retail and wholesale inventories, a period of disinflation seems highly likely—inventories have to be flushed through the supply chain to make room for new shipments of goods.

If there is a period of disinflation, the Fed’s logic for continued interest rate rises disappears, and if there is enough disinflation, or if there is enough pain and suffering in financial markets, the pressure to resume Quantitative Easing policies will increase.

However, whichever way the Fed moves in the future—towards further interest rate hikes and eventual Quantitative Tightening or towards interest rate reductions and renewed Quantitative Easing—economic disruption is almost sure to follow.

Continued interest rate hikes mean continued demand destruction and economic contraction.

Quantitative Easing would in all probability bring on renewed inflation.

Yesterday I concluded that neither the Fed nor the government has any control over the ongoing economic decline we are experiencing. Today we have confirmation. The Fed’s hand may be on the wheel, but the economy is on autopilot (insert crass Tesla crash meme here), which makes the crash all but inevitable.

Disinflation, iow deflation. Maybe they'll avoid a recession & skip ahead to depression.

My mother said only one thing about the depression. "At first it was great because everything was so cheap. Then it was awful because there wasn't anything.

Asset mix for impending stag/deflation? Sell or keep total stock index funds?

50E/30B + 20% cash?

10E/30B + 60% cash?