The Fed Has A Problem: Inflation Is Making A Comeback

OPEC Heats Up Energy Prices And Inflation

When the August Consumer Price Index Summary comes out on September 13, the Federal Reserve will have exactly one week to decide what to do about a very awkard problem confronting their interest rate strategy for containing inflation: headline inflation will rise for the second straight month.

Core inflation may drop slightly, but overall the August CPI report will stand as a stark rebuttal to the notion that endlessly raising interest rates can bring down consumer price inflation.

The primary reason for inflation’s return is simple: energy prices are moving up again, as OPEC has finally cut production enough to move the needle on crude prices. OPEC, of course, does not give one tinker’s damn about Jay Powell’s rate hikes, nor should they—which is a major reason such rate hikes have negligible effect on supply-side inflation factors.

Without energy price deflation, there is not much downward pressure on consumer prices, and with energy price inflation returning, not much is needed to produce an upward pressure on consumer prices.

While it remains problematic how much of an increase we will see in consumer prices and over what time frame, given the Fed’s commitment to data dependency, the sticking point for the Fed will be that energy prices are moving up, which is pushing headline inflation up, which is not supposed to be happening at this point in the Fed’s inflation fight.

The Cleveland Federal Reserve’s Inflation Nowcast projects August’s headline inflation will be 3.825% year on year, an increase from July’s unadjusted headline rate of 3.1778%. Core inflation is projected to trend a bit lower, falling to 4.461% from a July unadjusted print of 4.653%.

This would have core inflation ticking down just below 0.2% year on year, but headline inflation moving up 0.65%.

Most if not all of the increase in headline inflation will be attributable to rising energy prices, which in turn can be attributed almost entirely to OPEC’s repeated production cuts and extensions of those cuts.

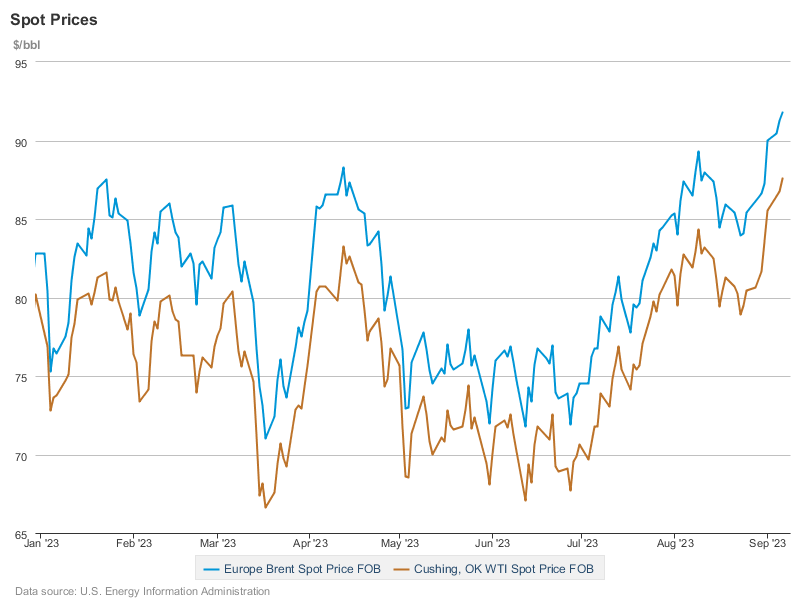

The most recent extension by the OPEC+ nations (OPEC plus Russia) to sustain the production cuts through the end of 2023 succeeded in pushing the market price of Brent Crude north of $90/bbl. However, as the last few trading days have shown, Brent Crude has once again plateaued at that point, with little or no sustainable upward direction or pressure on prices.

Thus while oil prices are higher than they have been, they are still primarily plateaued in the same fashion they have been throughout the year, just at different price ranges.

With crude prices at a high for the year, it comes as no surprise that gasoline and diesel prices are also near highs for the year.

Given where gasoline and diesel prices have been, while price inflation for these two goods is still negative year on year, it has moved positive with a vengeance month on month.

Year on year inflation:

Month on Month Inflation:

Projecting a 0.6% increase in headline inflation year on year is probably an optimistic assessment.

Yet even with energy price inflation (and thus headline inflation) returning, other parts of the economic narrative are point to contraction and recession.

The S&P Global Manufacturing Purchasing Managers’ Index printed below 50 (contraction) for the fourth month in a row.

Driving home the recession message in the PMI is the reality that since last October only the April print was above 50 (expansion).

The ISM Manufacturing PMI is even more pessimistic, as it has been printing contraction for ten straight month.

The ISM Manufacturing Employment Index has also printed contraction for the past three months.

While Services Employment is printing expansion recently, it is rebounding from an extended period of contraction during 2022.

Between the two Employment indices, there is a distinctly recessionary message, which by itself would argue against any further Fed rate hikes.

But wait! There’s more!

ISM’s Manufacturing New Orders Index has been printing contraction for an entire year.

Even the S&P Global Services PMI, while still printing expansion, has weakened significantly in recent months.

As has the Composite PMI.

None of these are signals which, within the Fed’s theory of inflation fighting with interest rates, indicate higher interest rates are advisable.

Consumer prices are showing inflation making a comeback, yet manufacturing is showing contraction and services are weakening and slowing down. On the one hand an interest rate rise is indicated, on the other hand standing pat is the proper path.

Complicating the situation still further is the potential that another banking and liquidity crisis is looming in the not-too-distant future.

Another rate hike at this juncture could open up another liquidity can of worms. Is Powell prepared to take that chance, knowing the Fed will have to deploy some almost certainly inflationary tools to head off the worst of such a crisis?

The reality of the situation is that the FOMC will not have much impact on consumer price inflation with another federal funds rate hike when inflation is driven by constrained oil supplies—which it is. Pushing up interest rates inhibits consumption, both of final consumer goods and intermediate producer goods. Pushing up interest rates can do nothing when the inflationary pressures are on the supply side.

Wall Street hopes the functionally useless Employment Situation Summary for August pretends to show just enough “cooling” in the labor markets that Powell can plausibly argue that the jobs data is just weak enough to rationalize not boosting rates another 25bps just yet.

Certainly the weak PMI indices show additional spots of weakness in the economy, thus adding to the argument against raising the federal funds rate further at this time.

Will the Fed be smart and hold off on raising the federal funds rate yet again? Or is Jay Powell so clueless that he will be unable to help himself when he sees the August inflation print showing inflation moving sharply upward again?

OPEC has succeeded in heating up oil prices, and that is sure to transmit a brief price pulse through the US economy. That price pulse is already showing up as month on month energy price inflation, but it is quite possible that inflation pulse has already come and gone, and while energy prices may be higher than before, they appear to be hitting yet another plateau, which suggests that energy price inflation may be rising again now, but they are also likely to plateau, and could even start trending down again.

If the inflationary pulse from higher oil prices itself flattens out—which at the moment appears likely—even if it leaves prices structurally higher, the argument that such higher prices might otherwise make for further rate hikes disappears. When assessing inflation, it’s not the actual price level that matters but the whether the trend is moving up, down, or sideways.

Inflation is trending up right now. Barring a major economic or geopolitical shift, however, inflation is likely to plateau again within the few months. Energy prices might even revert back to disinflation after a time. Despite the uptick in inflation from energy prices there are still significant disinflationary forces at play in the US economy.

In no inflation scenario is another useless federal funds rate hike indicated at this time.

Biden (or Xiden) has banned drilling in the arctic and banned trains carrying liquified natural gas (where's Frederick R. Smith when you need him) and they talk about the Governor banning the 2cnd. It never ends.

I realize trends and charts may have shown things differently, but to the average person, I don't think inflation ever really eased up all that much or left at all for that matter! Linking as usual @https://nothingnewunderthesun2016.com/