The Fed Prepares To Do Nothing With The Federal Funds Rate

Does Wall Street Even Care?

As the Federal Open Market Committee concludes its latest policy meeting, one point should be understood above all else: The Fed is not in control over inflation, which means it is not in control over interest rates, and never was.

Thus we see the somewhat counterintuitive drop in treasury yields yesterday, even though Wall Street is pricing in the Fed standing pat on the federal funds rate.

What happened

The yield on the 2-year Treasury BX:TMUBMUSD02Y slipped 4.2 basis points to 4.692%, from 4.734% on Monday. The yield on the 10-year Treasury BX:TMUBMUSD10Y fell 4.3 basis points to 4.296%, from 4.339% on Monday. Monday's level was the highest since Nov. 30, based on 3 p.m. Eastern time figures from Dow Jones Market Data.The yield on the 30-year Treasury BX:TMUBMUSD30Y dropped 2.5 basis points to 4.440%, from 4.465% on Monday.

What drove markets

The Federal Reserve kicked off its two-day monetary-policy meeting on Tuesday - with markets convinced that officials will leave borrowing costs unchanged at between 5.25% and 5.5% on Wednesday, but wary that they may tweak their median 2024 interest-rate forecast given recent sticky inflation data.

With the FOMC set to do absolutely nothing on the federal funds rate, Wall Street did little to nothing on Treasury yields. Despite the Fed being almost certain to continue a restrictive and tigher money supply policy, Wall Street is not responding with higher debt yields.

Wall Street seems to have reached the same conclusion that I did some time ago: The Fed has no control over inflation and no control over interest rates.

In one regard, we should not be surprised the Fed is likely to stand pat on the federal funds rate. It has been just this week that the Bank of Japan ended its negative interest rate policy, bringing its official bank rate “up” to zero.

The world’s nearly 12-year experiment with negative interest rates is over now that the last holdout, the Bank of Japan, has moved its key policy rate back to at least zero.

Of the many unusual measures central bankers took over the past decade and a half, among the most controversial, with uncertain benefits and potential risks, were negative interest rates, when depositors pay to store money at a bank instead of being paid.

The experiment’s bottom line: Negative rates weren’t enough by themselves to pull economies out of a funk or lift inflation toward central banks’ 2% targets. It took the Covid-19 pandemic and war in Ukraine to accomplish that.

Similarly, the Bank of England is also expected to stand pat on interest rates, having held its bank rate at 5.25% since August of last year.

The Bank of England is expected to keep interest rates at the same level on Thursday as it continues to wait for further evidence that inflation is falling.

Financial markets are predicting that the base rate will remain unchanged at 5.25 per cent for the fifth consecutive time.

Higher interest rates are still very much the norm among central banks.

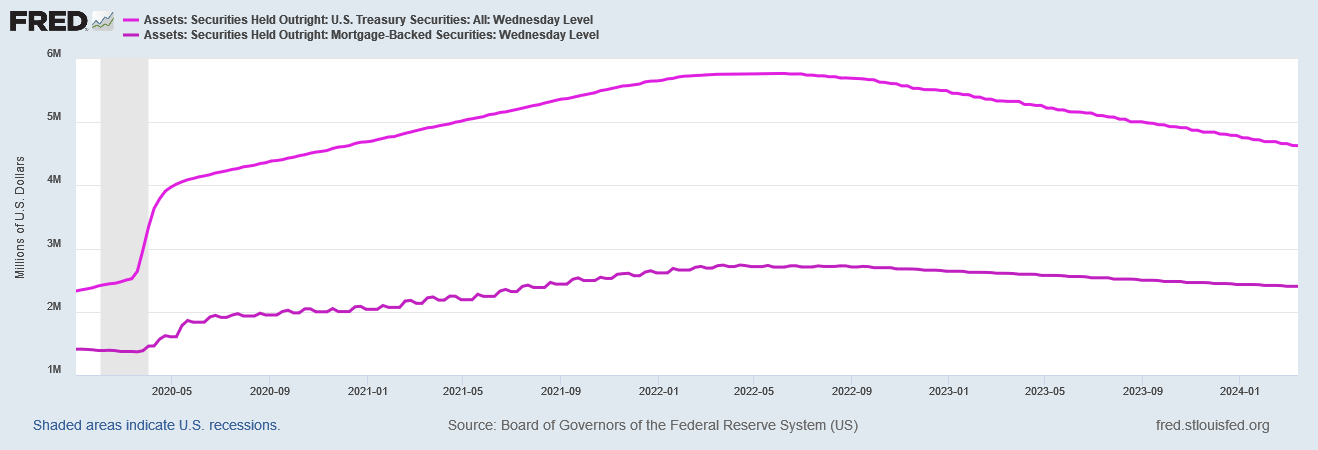

The Fed is also maintaining a restrictive monetary policy in other areas, as it is continuing to shrink its balance sheet.

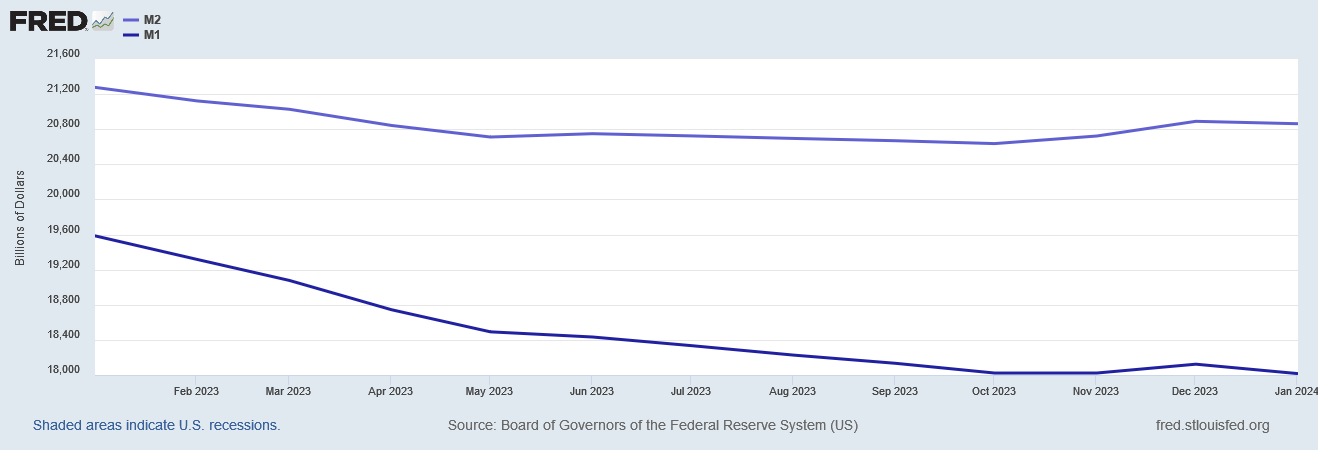

The Fed is also resuming its shrinking of the money supply, after a brief easing last fall.

Even though the Fed is maintaining a steady state on the federal funds rate, in other aspects of monetary policy it is still continuing to tighten. Theoretically, this tightening should be pushing market yields up, but the reality has been slightly more problematic.

Despite market yields rising throughout 2022, from the start of 2023 yields have repeatedly hit a ceiling of ~4.5-5% for the 10-year Treasury.

Even though yields have been rising since the start of the year, they still have shown no sign of pushing through that virtual ceiling.

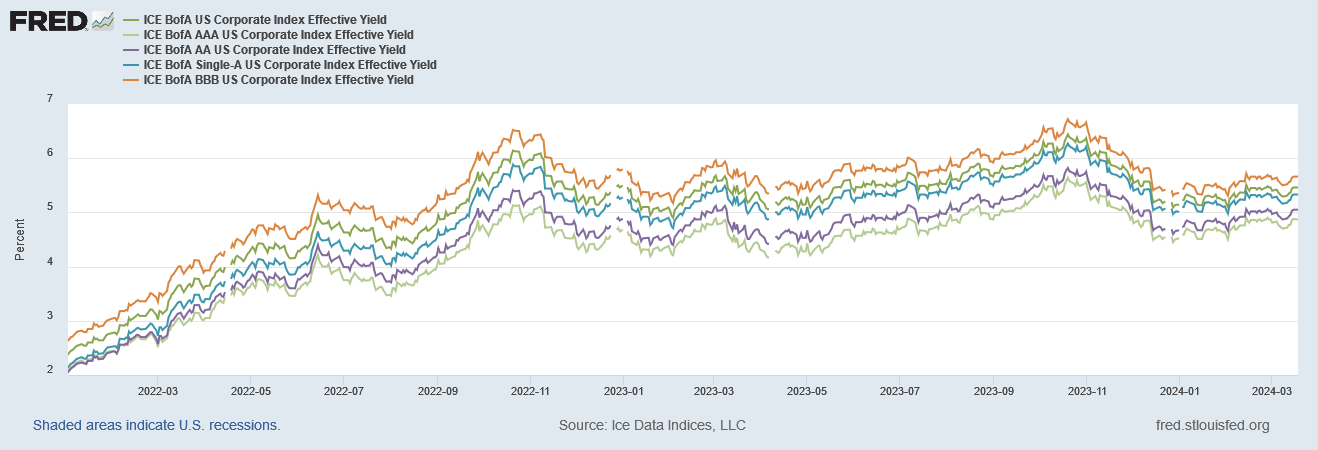

Corporate yields on investment grade debt have largely followed the same overall trends as Treasury yields:

Corporate yields rose in 2022, and moved largely sideways in 2023 before trending down again at the end of the year.

The Fed may want to hold rates “higher for longer”. However, Wall Street has already effectively capped market rates signficantly below where the federal funds rate is situated.

That is rather less than what one would expect from the Fed’s “higher for longer” approach. It is about what one would expect if one presumes that the Fed’s stance on the federal funds rate is largely irrelevant to market yields.

Certainly Wall Street is not expecting rates to fall any time soon. ETFs for government securities have generally lost money in 2024—which they would if interest rates themselves moved higher.

Yet while ETF valuations have declined in the short term, all that decline does is bring the fund valuations down to where they were at the end of 2023, before valuations staged a small comeback.

Clearly, Wall Street is still not fond of higher interest rates and treasury yields.

Why is Wall Street not having a stronger reaction to the probability of the Fed standing pat on rates?

Some of Wall Street’s behavior is no doubt a reflection of how the Fed’s interest rate strategy on inflation is slowly unravelling. Despite pushing the federal funds rate to its highest in years, inflation is still starting to creep back again.

If the Fed’s strategy had been as impactful as many want it to be, inflation would not now be rising again—yet it is.

However, the Fed’s strategy has not been all that impactful, and it has been apparent for some time that it has not been all that impactful. As readers will recall my saying even in 2022, you can’t push a string.

What was true in 2022 is still true. You still cannot push a string.

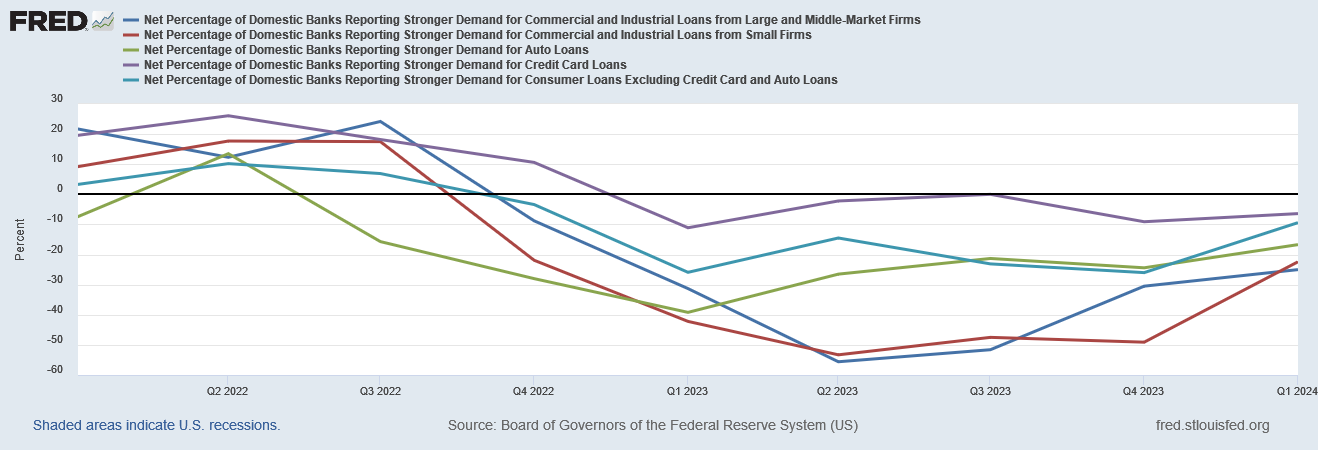

You cannot bid up interest rates (which are the price of borrowing), when loan demand is down, as it is for commercial real estate.

Loan demand is weak for virtually all types of loans.

In an interest rate environment where no one wants to borrow money, where there is little else for banks to do but to buy up treasuries, the Fed’s tight money policies are always going to be counteracted by the unavoidable downward pressures on yields such an interest rate environment produces.

Thus we can see how the Fed has lost control—of inflation, of interest rates, and of the narrative in general.

The Fed’s interest rate strategy has failed to tame and corral the inflation beast. The Fed has also been undone by a weak economy with poor loan demand largely negating the upward pressures on interest rates it sought to produce by raising the federal funds rate.

The Fed’s official narrative on the economy as well as interest rates is no longer sufficient to manipulate interest rates for any length of time. The markets have quite simply fully priced in all of Jay Powell’s nonsense.

When the FOMC announces its decision on the federal funds rate later today, Wall Street is almost certainly not going to respond with much more than a collective yawn. Wall Street believes (with good reason) that it has fully figured out how Jay Powell and the Fed thinks, and so Wall Street really has stopped caring much about what the FOMC does or does not do on interest rates.

Peter, if the commercial real estate market significantly declines further, how would you expect the Fed to respond? Not that it would work, but what would you expect them to try, especially before the Election?