With the publication by the Bureau of Economic Analysis (BEA) last Thursday and Friday of the Advance Estimate of the 2024 4th Quarter GDP and the Personal Income and Outlays Report for December, the curtain draws to a close on the (Biden-)Harris Administration’s economic track record.

If you believe the corporate media, it is a good track record.

If you believe your wallet, calling it the Reign of Error is being kind.

If you peel back the layers on the data beneath both reports, the wallet wins. The (Biden-)Harris Administration closes on a sour note after four years of sour notes.

Corporate media of course does not see it that way. Corporate media is still pushing the narrative that the economy is healthy and doing well.

Corporate media of course is wrong.

Most folk already know this. Their wallets tell them this. Their bills tell them this. Their paychecks tell them this.

The data tells them this as well.

Corporate Media Never Looks Beneath The Hood

If we take the BEA at face value, the economy slowed in the 4th Quarter but still notched some growth.

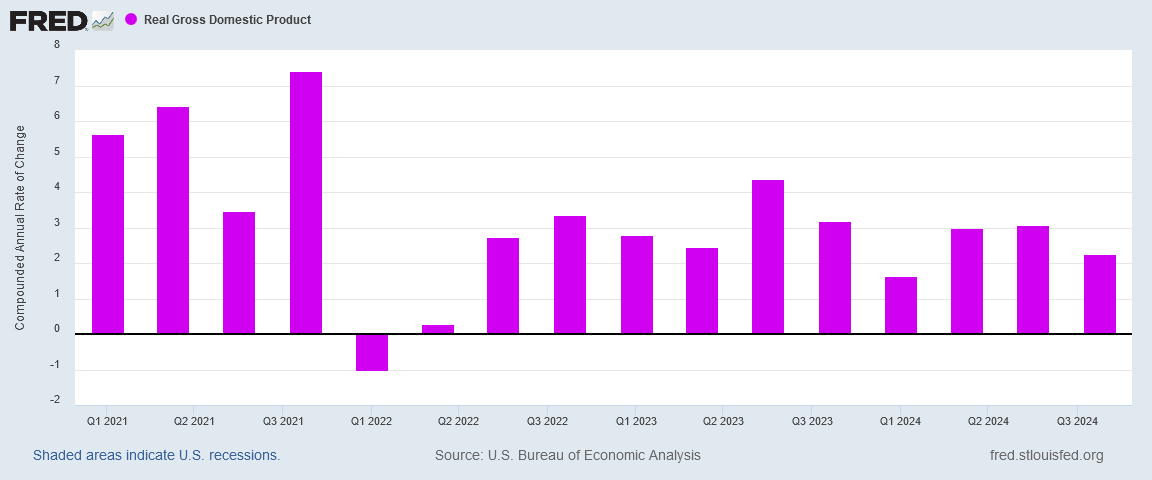

Real gross domestic product (GDP) increased at an annual rate of 2.3 percent in the fourth quarter of 2024 (October, November, and December), according to the advance estimate released by the U.S. Bureau of Economic Analysis. In the third quarter, real GDP increased 3.1 percent.

Corporate media, of course, always takes the BEA at face value.

Consumer spending kept the U.S. economy humming in the final months of 2024.

The nation's gross domestic product grew at an annual rate of 2.3% in October, November and December, according to a report from the Commerce Department Thursday. That's down slightly from the previous quarter when GDP grew at a 3.1% annual pace.

While this is an accurate restatement of the BEA news release on Q4 GDP, it fails to look beneath the headline numbers. NPR, as is true of the all of corporate media, does not bother to question if the growth being touted is solid, sustainable, wealth-building growth, or if it is just a game of numbers by the BEA.

Corporate media makes the same mistake with the Personal Income and Outlays Report, which gave a year on year consumer price inflation print of 2.6%.

From the same month one year ago, the PCE price index for December increased 2.6 percent. Excluding food and energy, the PCE price index increased 2.8 percent from one year ago.

CNBC’s approach to the inflation data was to talk up the Fed’s deluded belief that their “Holy Grail” of 2% year on year inflation is almost here.

Chicago Fed President Austan Goolsbee told CNBC that the PCE data was “even a little better than expected.”

“I don’t make too much of any one month, but you know, I’ve been saying that I felt like we are on path to 2%,” he said during a “Squawk on the Street” interview. “I have comfort, I won’t say overconfidence, but I have comfort that we’re on that path.”

CNN concluded that the inflation data meant that the US economy would actually achieve the mythical “soft landing”.

Inflation has cooled substantially since peaking in the summer of 2022, and that progress continued through 2024 to the point where an elusive “soft landing”— price stability without having the economy tank into a recession — remained achievable as Joe Biden wrapped up his presidency.

By now you probably have noticed that I am quite unimpressed by how corporate media has portrayed both of the BEA reports—which I am.

Let’s explore some of the ways corporate media missed the mark.

Economy Is Slowing Down

What the BEA Advance Estimate fails to articulate—and what corporate media failed to note, is that not only was the 4th Quarter GDP estimate a noticeable reduction from the 3rd Quarter, but 2024 was weaker than 2023, and a major climb down from 2021’s growth numbers.

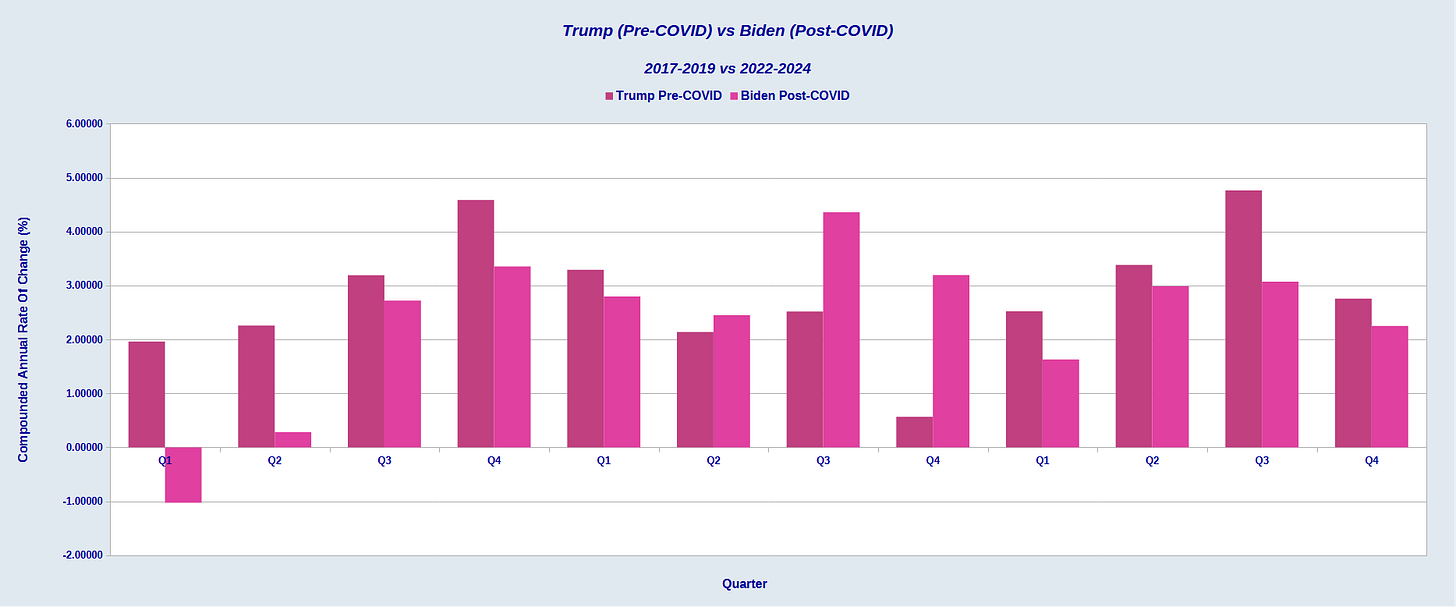

Biden’s GDP results are also a climb down from Donald Trump’s first term. Exact comparisons are somewhat tricky because of the extreme economic dislocations of the COVID Pandemic Panic—the rebound from which also produced a significant portion of the heady 2021 percentage GDP gains for Joe Biden.

However, if we set aside 2020 and 2021 as “pandemic years” we can compare President Trump’s three pre-COVID years with Joe Biden’s three post-COVID years.

On a quarter by quarter basis, President Trump before the COVID lunacy turned in better economic results than Joe Biden did after the COVID lunacy.

As a general rule of thumb, more economic growth is preferable to less economic growth. Under Donald Trump pre-COVID there was more economic growth than there was under Joe Biden post-COVID.

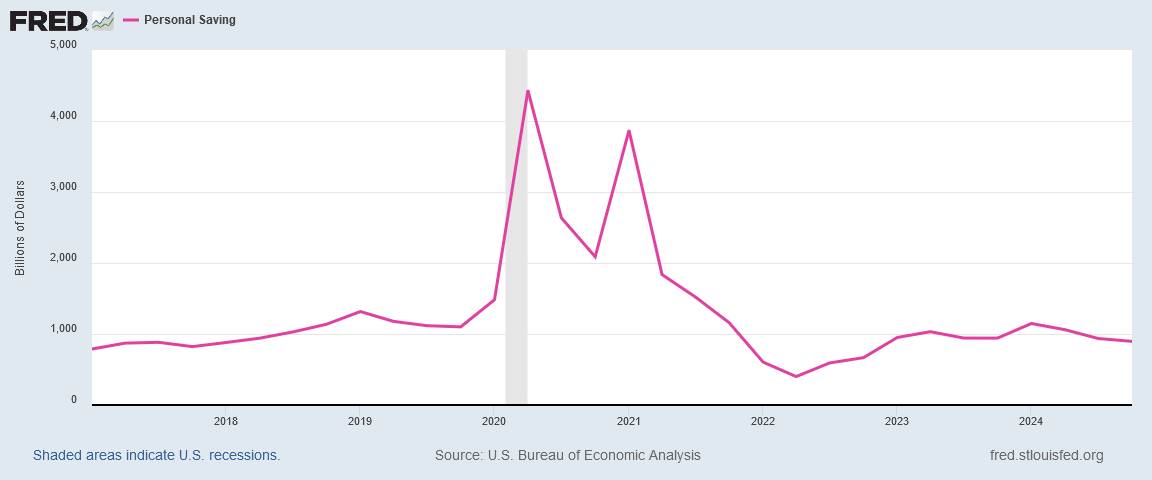

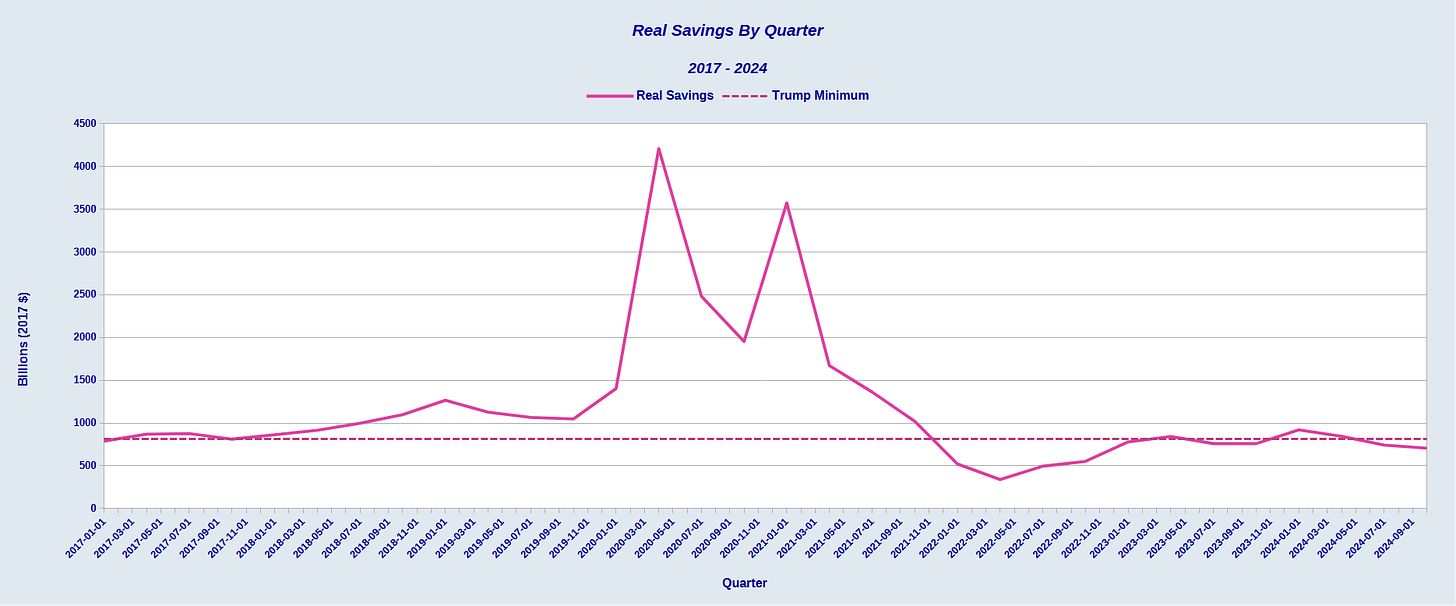

Underscoring the growing economic weakness in this country, during the (Biden-)Harris Administration, savings in this country sank below levels recorded during President Trump’s first term pre-COVID.

If one restates the savings in 2017 dollars, the drop is even more pronounced.

After the dislocations of the COVID Pandemic Panic were digested in 2020-2021, real savings during the (Biden-)Harris years rarely reached as high as the lowest savings figures for Trump’s first term pre-COVID.

When we look at the inflation data, we can easily divine the reason for the deterioration in savings: income erosion.

Inflation Has Not Been Vanquished

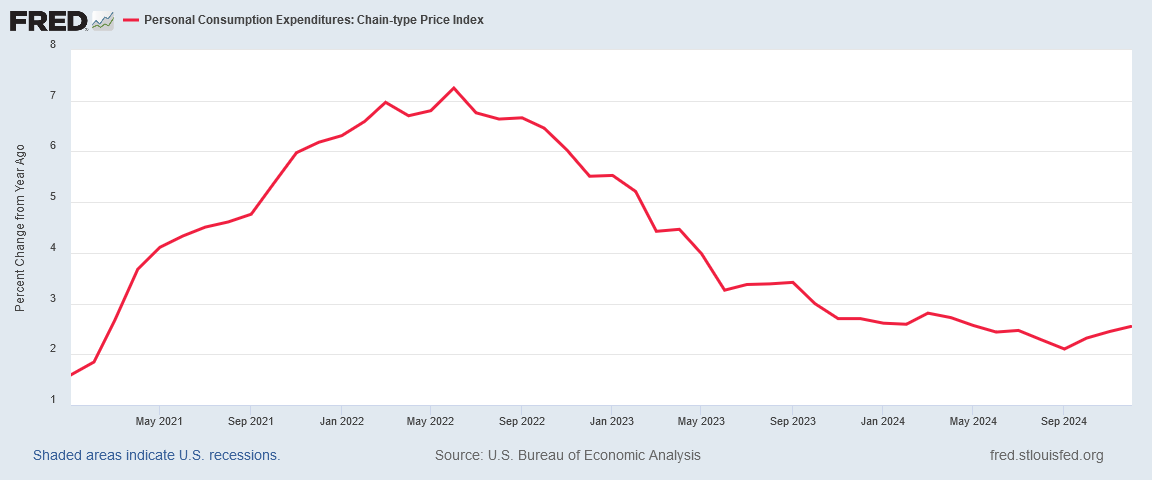

For all the corporate media blather about a “soft landing”, within the Personal Income and Outlays report lies the grim confirmation that consumer price inflation has not been vanquished and is not heading towards the Fed’s “Holy Grail” of 2%.

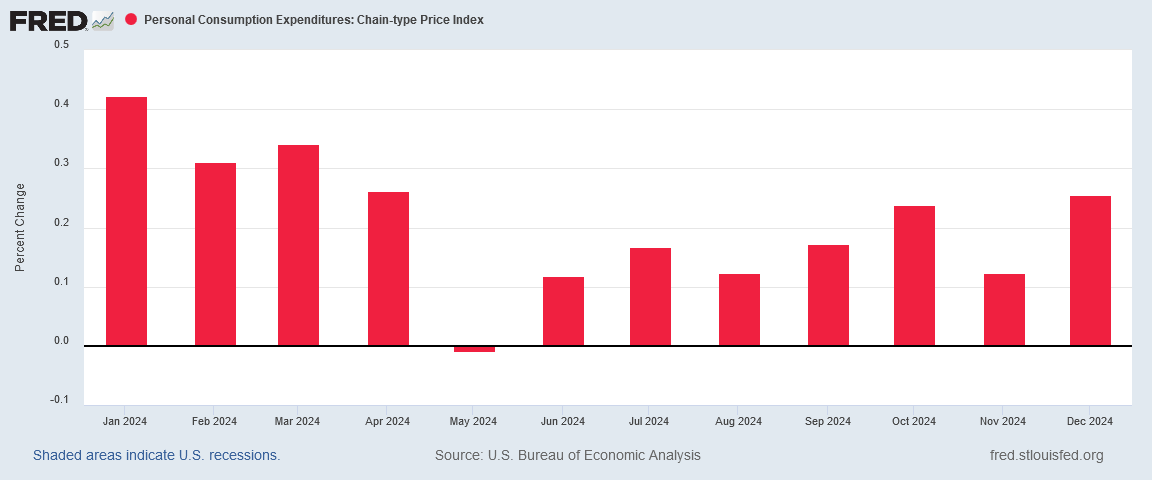

Quite the contrary, headline consumer price inflation per the PCE Price Index—the Fed’s preferred inflation metric—has been heating up in recent months.

Even the year on year numbers have been ticking up during the 4th quarter.

Bear in mind that a lower inflation rate merely means prices are rising more slowly than before. So long as there is inflation price levels are rising.

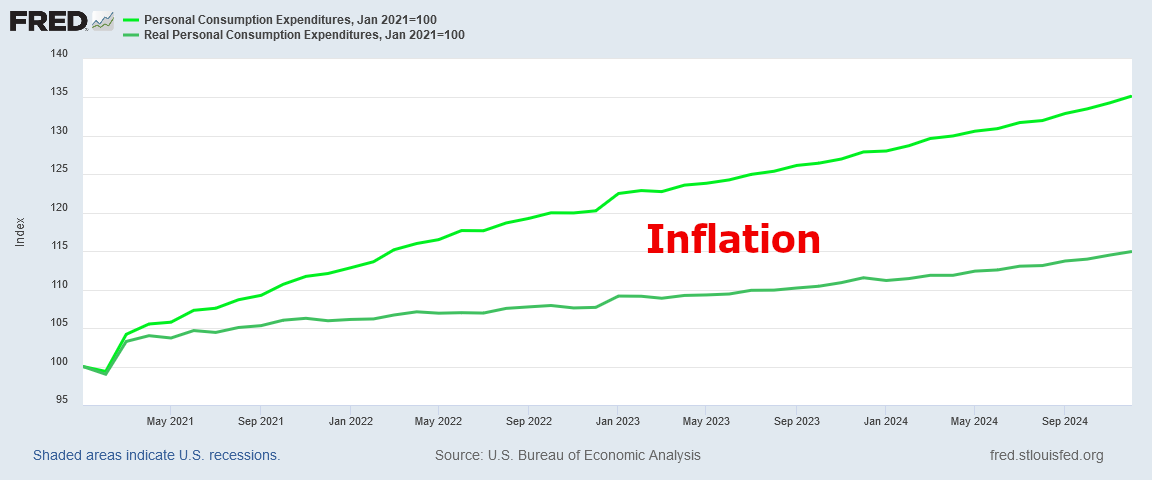

That matters because the price rises during the (Biden-)Harris years have been nothing short of extreme.

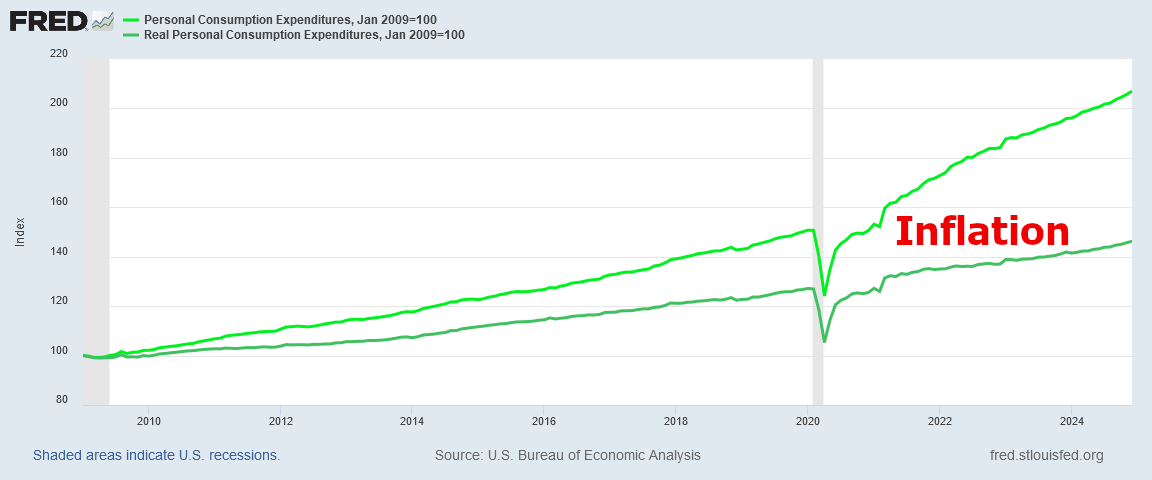

The difference between nominal and real personal consumption expenditures is the impact inflation has had on prices.

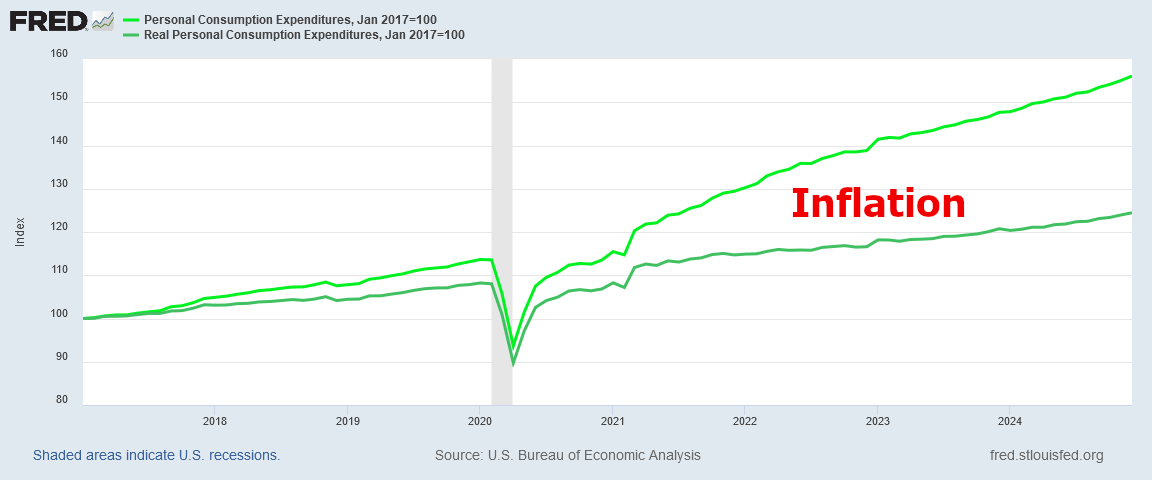

The impact of inflation over the past four years is an order of magnitude greater than it was during President Trump’s first term.

While personal consumption expenditures have increased at more or less a steady rate since 2017, the COVID years excepted, nominal expenditure increases accelerated since 2021 and have remained elevated. That acceleration is Bidenflation.

Even during the Obama years inflation did not take as big a bite out of household budgets as it has under Biden.

How big a bite has inflation taken out of the household budget?

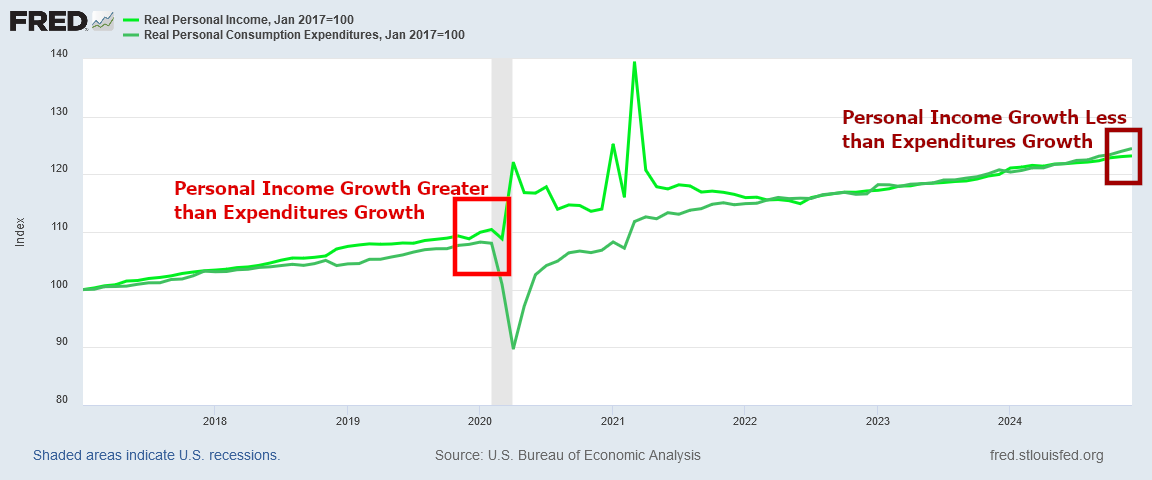

Consider the growth in Personal Income vs that of Personal Consumption Expenditures since the start of the first Trump Administration.

Right before the COVID Pandemic Panic, under President Trump’s economic stewardship, Personal Income growth outpaced Expenditures growth.

By the end of 2024, it was clear that Expenditures growth had outpaced Personal Income growth.

When people’s incomes grow less than their expenses, that’s not a sign of economic health—not for a society, not for an economy, and certainly not for the person.

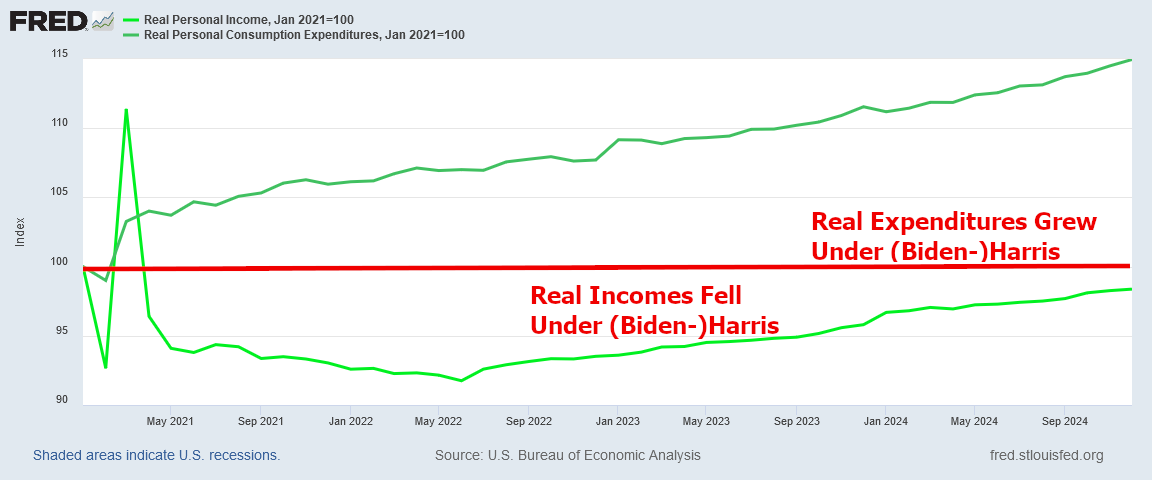

If we zoom in to 2021 and the (Biden-)Harris Administration, that disparity between incomes and expenditures becomes even more apparent.

The overall trend for the (Biden-)Harris Administration is one of declining real personal income in this country coupled with rising real personal consumption expenditures. That’s not a good trend.

In real terms, the average American is demonstrably worse off now than at the start of the (Biden-)Harris Administration, and a primary cause has been the inflation that has occurred during that time.

If the prerequisite for a “soft landing” for the US economy is having inflation under control, the talk about a soft landing is not only premature, but is downright delusional.

Consumption Patterns Are Distorted

As I have argued many times in the past, the real damage from consumer price inflation lies in its distortion of price patterns.

The inflation report gives us yet another example of that distortion.

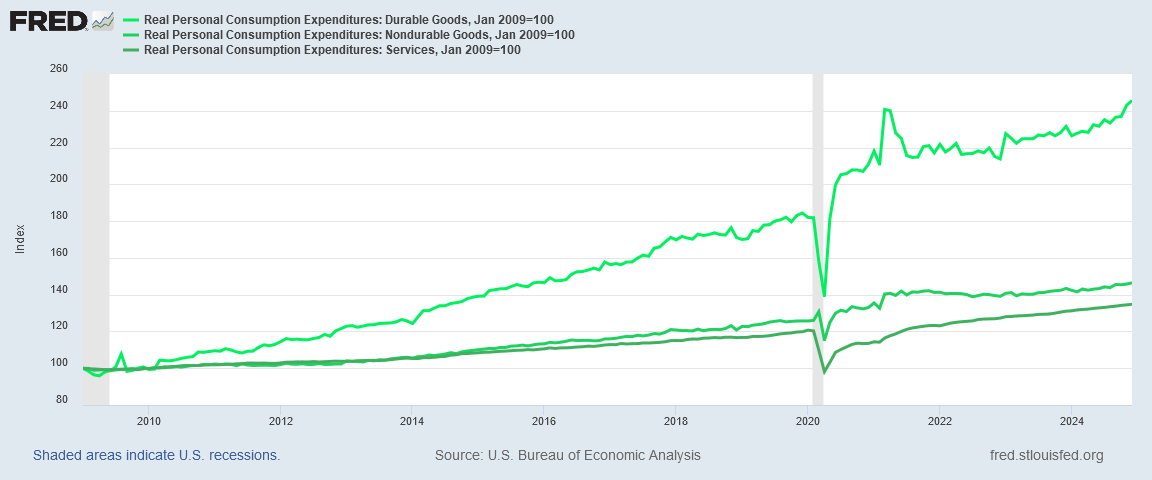

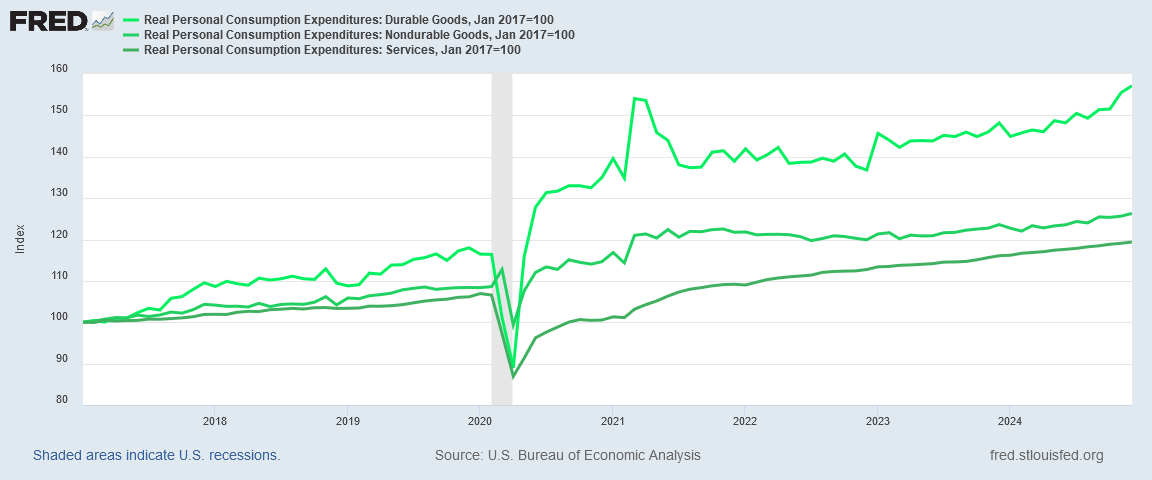

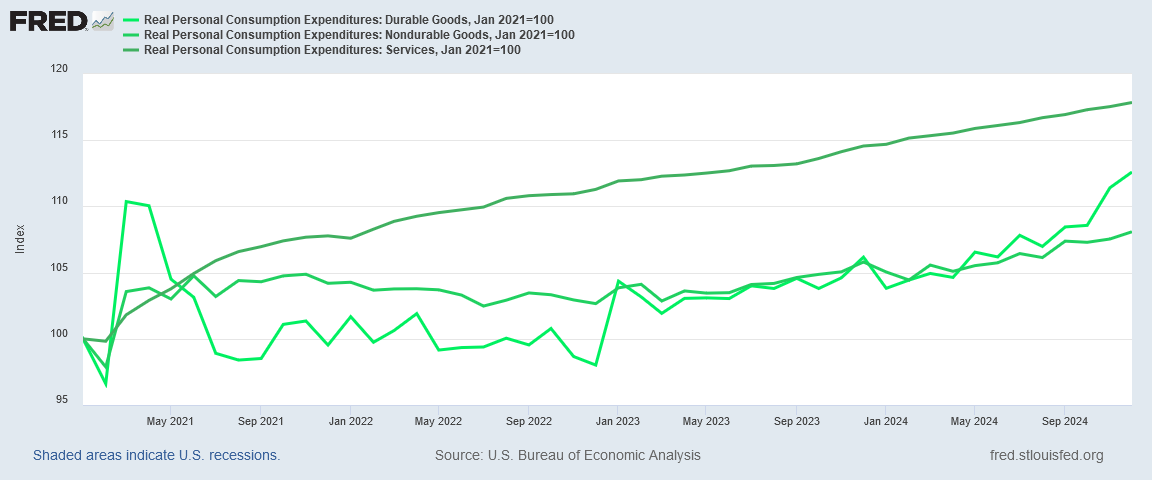

If we track the breakdown of personal consumption expenditures among durable goods, non-durable goods, and services from 2009, we see that durable goods were where the bulk of expenditure growth has historically occurred.

Even if we look from Trump’s first term forward, that pattern still holds up.

During the (Biden-)Harris Administration, however, that pattern was scrambled, with services being the primary source of expenditures growth.

Why is this significant? Bear in mind that service expenditures have no lasting presence. Once a service is consumed it and the money with which it was purchased are gone. There is no residual “wealth effect” to be derived from service consumption. Durable goods are, to varying degrees, assets. They last, which means they have residual value.

In the last four years, consumption patterns in this country have moved away from buying things which last, things which have residual value, to spending on services with no residual value whatsoever.

One does not need a PhD in economics to see the flaw in moving away from spending with residual value to spending with no residual value. America is getting less bang for its consumption buck than it was pre-COVID.

Wages Are Distorted

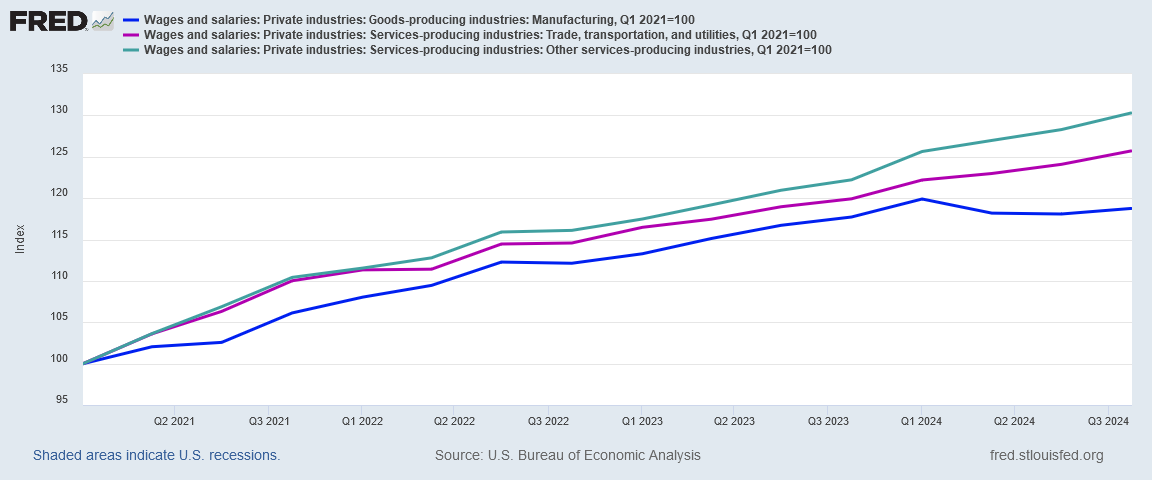

The distortions of the (Biden-)Harris Reign of Error are not limited to the consumption side of the ledger. Wages have been bent as well.

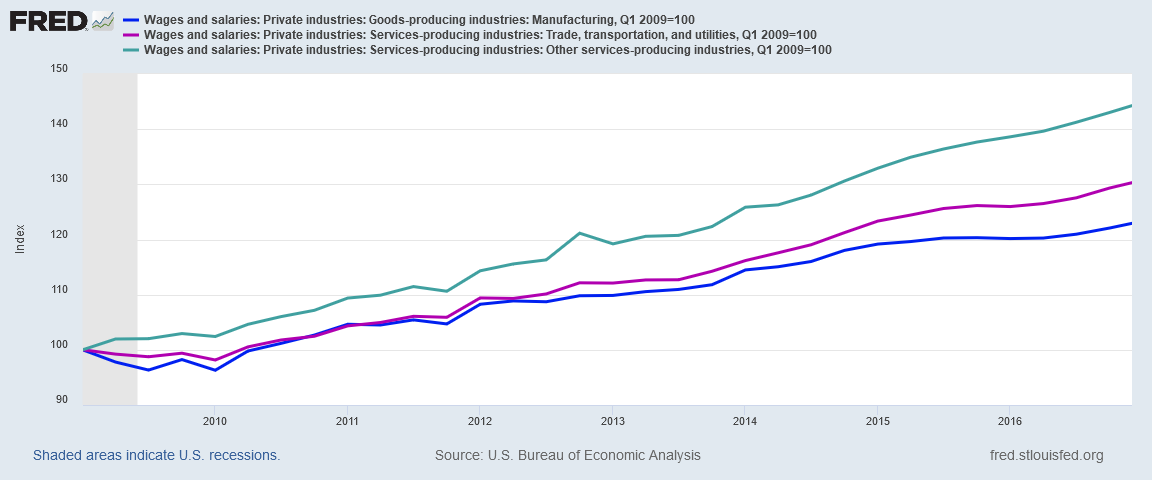

During the Obama years, manufacturing wages and wages in trade, transportation, and utilities very nearly kept pace with each other, even as other services outpaced them both.

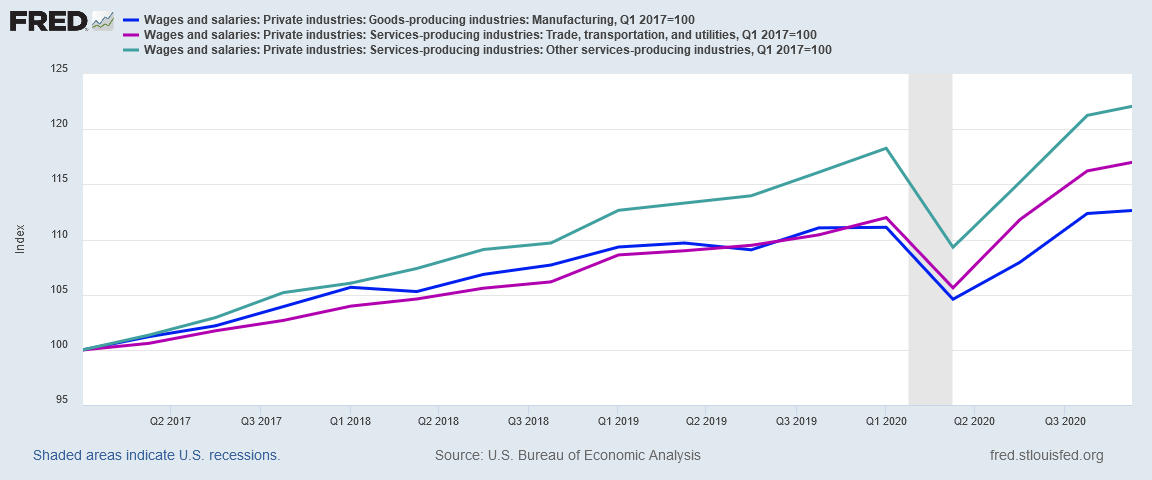

During the Trump years pre-COVID, manufacturing wages and wages in trade, transportation, and utilities fared better.

Not until the COVID Pandemic Panic did manufacturing wage growth fall relative to other wage categories.

Since 2021, however, manufacturing wage growth has been dead last from the start.

Not only have manufacturing wages languished behind other wage categories, during the past year, manufacturing wages have in fact declined.

Having the worst wage growth means manufacturing wages have been hit the hardest by inflation. Having manufacturing wages fall only compounds that problem.

Headline Numbers Are Not Enough

The inanity of corporate media propaganda on the economy comes from their dogged refusal to look beyond the headline numbers.

Corporate media analysts simply will not look at the inflation breakdowns by category of expenditure. With the same studied indifference to the details that has become the hallmark of the “experts” at the Federal Reserve, they do not look at the details within the consumption data, nor do they look at the details within the wage data.

Neither will they look at the longer term trends in GDP growth. They will refuse to look farther than the most recent quarter or the most recent year. 2022 is as far removed from the corporate media consciousness as 1992 or 1932.

They do not pause to consider the extreme disparity between nominal consumption levels and real consumption levels—with the difference between the two being the impact of consumer price inflation.

They do not pause to consider the impact of declining real personal income coupled with rising real personal consumption expenditures.

They do not pause to consider the impact of manufacturing wages lagging other sectors.

Yet that impact is what consumers feel whenever they are at the store.

The impact of shrinking real incomes is that consumers have less money with which to buy things.

The impact of rising real expenditures is that consumers have to spend more money to buy things.

The impact of lagging manufacturing wages is that workers are being shunted out of higher-income jobs into lower-income jobs. Workers are seeing prosperity slip away from them.

That consumers are feeling these impacts puts the lie to the notion that the US economy is at all healthy and in a good place. It is not in a good place, and it has not been a good place for quite some time. The economic data beneath the headline numbers makes that absolutely certain.

When corporate media argues that the economy is “holding up”, they are either embarrassingly ignorant or they are lying to you.

When Never Trumpers argue the economy did better during the (Biden-)Harris Administration that during the first Trump Administration, they are either embarrassingly ignorant or they are lying to you.

This is not an economy that is doing at all well. You know that because your paycheck and your grocery bill tells you that on a regular basis.

The data agrees with you.

So many valid points! What is wrong with corporate media that they cannot see ANY of these? I’m torn between thinking that they are deliberately lying, spinning, and hiding data, and thinking they are just plain stupid. I suspect that a large part of the problem is that college journalism courses no longer teach HOW to think, and are just indoctrinating students with WHAT to think.

Every day, the corporate media writers look like unprincipled morons compared to you, Peter. Thanks once again for your superior quality in all you do!

Biden “presidency” will go down as the worst in US history. No legacy whatsoever.