Wall Street Trigger Warnings: Jay Powell Does What Federal Funds Rate Cannot

Narrative Is Beating Fundamentals. This Will Not End Well.

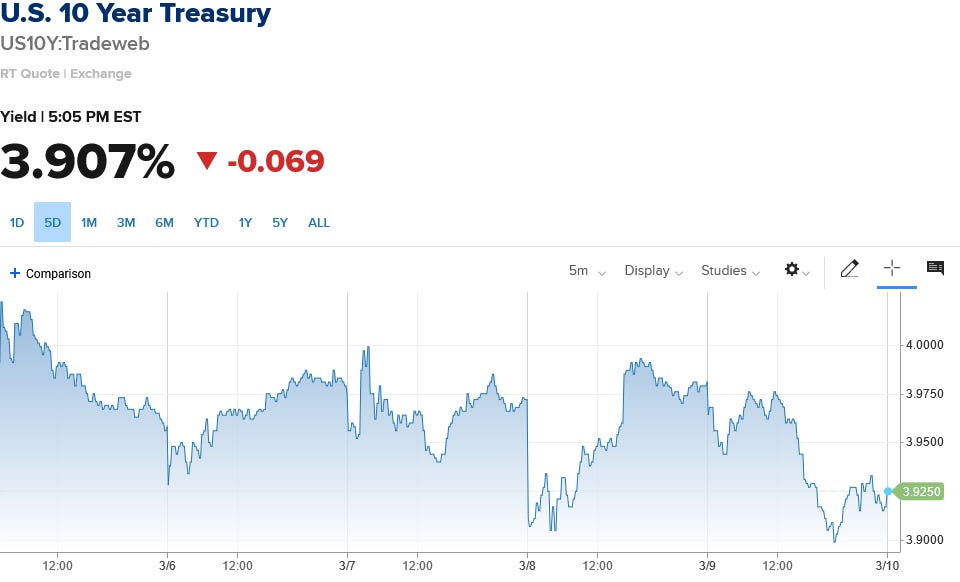

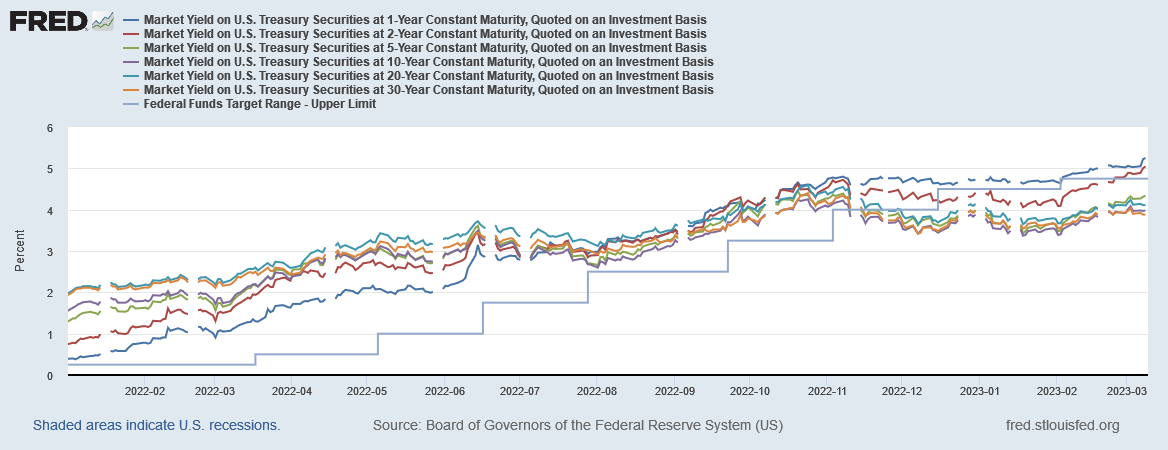

The 2-Year Treasury Yield has had a wild ride the past few days—and none of it had anything to do with any market or economic fundamentals, just Jay Powell’s testimony before Congress.

The Federal Reserve will likely need to raise interest rates more than expected in response to recent strong data and is prepared to move in larger steps if the "totality" of incoming information suggests tougher measures are needed to control inflation, Fed Chair Jerome Powell told U.S. lawmakers on Tuesday.

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated," Powell said in prepared remarks for a hearing before the Senate Banking Committee.

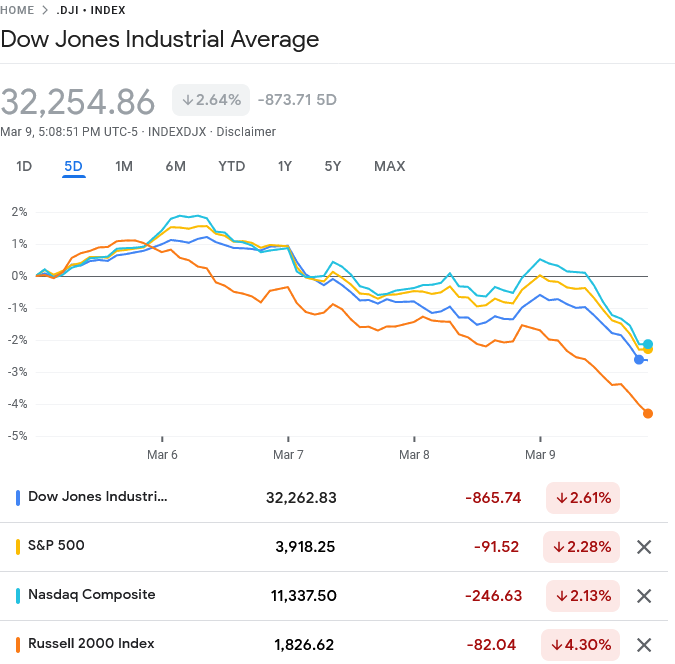

Wall Street’s measured reaction to Jay Powell’s measured (albeit mistaken) words was to spike the 2-Year yield while sending equity markets south, apparently shocked that Jay Powell was sticking to the same inflation mantra and message he’s been repeating for the past year.

The 2-Year yield rose above 5% Tuesday and Wednesday, before falling all the way back to the same 4.8%-4.9% range it enjoyed on Monday (March 6).

The 10-Year Treasury yield, meanwhile, yawned and continued trending down, apparently not having gotten the memo that Jay Powell’s words had the power to reset interest rate expectations.

Stocks were completely spooked and have yet to stop heading south.

That Powell has said largely the same thing after each release of “strong” economic data recently was completely ignored by the markets.

One of the more perverse ironies in Wall Street’s hyperventilations any time Jay Powell utters a word is that what Powell said was demonstrably wrong. The “latest economic data”—i.e., the ADP National Employment Report and the Bureau of Labor Statistics Job Openings and Labor Turnover Summary Report—weren’t strong, but weak.

When one does look critically past the headline numbers, signs of weakness and recession are easily seen:

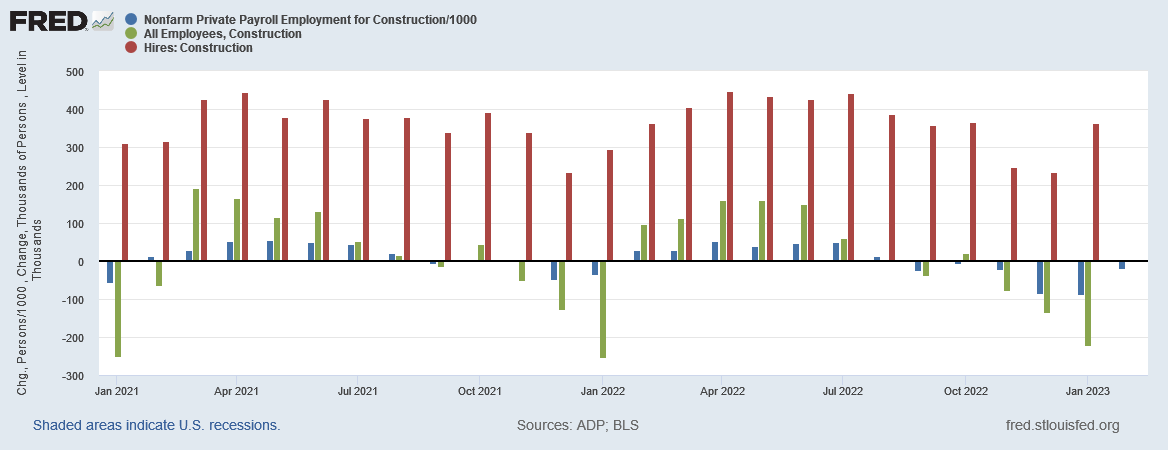

The ADP report shows hiring all but disappearing in the latter half of 2022, with no real improvement in January of 2023.

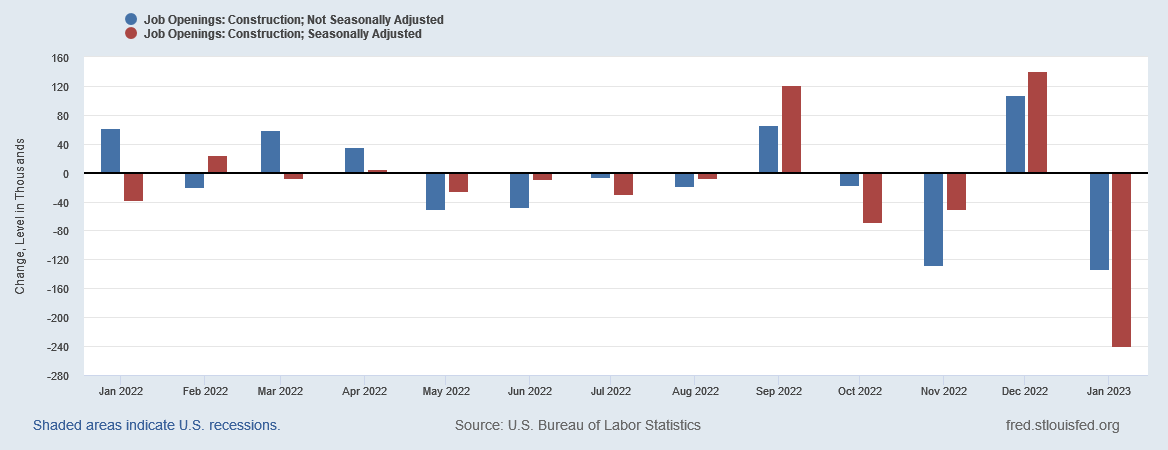

Both the ADP report and the JOLTS report show significant deterioration in the jobs market throughout 2022.

The JOLTS report continues to show a level of job openings that is not merely wildly inconsistent with the pace of hiring but is historically disproportionate to the pace of hiring.

The year-ending surge in layoffs seen in the JOLTS report runs completely counter to any narrative of companies actively looking to fill record numbers of jobs.

Apparently, neither the Fed Chairman nor the Wall Street investment analysts who hang on his every word are capable of reading beyond the first paragraph in either report.

The other perverse irony in Wall Street’s serial panic attacks over interest rates is that several in the business and finance chattering class have been saying for weeks if not months that Powell was going to have to push the Federal Funds rate above 5%.

Federal Reserve Chair Powell's comments to the Senate Banking Committee were seen as hawkish by the market, even though it has been clear to most observers that the 5.10% median terminal rate that the Fed projected in December would be increased.

CME Group’s FedWatch tool has been recording increasing market conviction that the Fed would implement another 50bps rate hike at the next FOMC meeting for most of the past week.

It’s been both known and knowable for quite some time that the Federal Reserve was not giving any indications of “throwing in the towel” in its inflation fight, even as the data showed yet again that the Fed’s strategy is not working, Jay Powell having lost all control over inflation.

All of this is plainly visible if one simply looks past the narrative and focuses on the fundamentals.

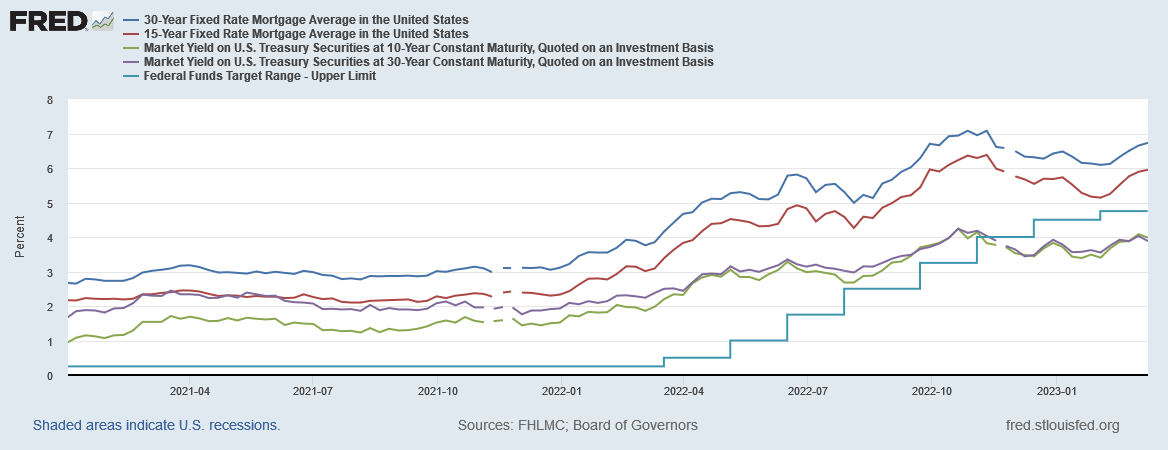

Part of Wall Street’s fear appears to come from the realization that the Fed’s campaign to boost interest rates boosts the costs of mortgages, which in turn boosts the cost of a house, which in turn suppresses sales, which in turn suppresses construction employment. At least, that is how Wall Street chose to interpret the “disappearance” of 240,000 construction job openings (as opposed to actual fulfilled jobs) from the January JOLTS report.

The construction industry reported just 248,000 job openings in January. That is a decrease of a whopping 240,000 jobs from the month before and represents a 37.4% decline from a year ago, according to data released on Wednesday by the Bureau of Labor Statistics. The plunge shows that construction jobs are evaporating as old projects come to a close and aren’t being replaced by new ones, while soaring mortgage rates have led to a dramatic pullback in home sales.

“Today’s construction job openings number was simply shocking,” said Anirban Basu, chief economist for Associated Builders and Contractors.

Wall Street’s fear over construction job loss also serves to illustrate one of the inherent dangers in relying too much on a single jobs metric. While the largely illusory construction job openings did drop significantly in the January JOLTS report, reported actual construction hiring printed at 362,000 (unadjusted)—while the ADP National Employment reported an unadjusted loss of 86,000 construction jobs and January Employment Situation Summary reported an unadjusted loss of 220,000 construction jobs.

Depending on which official government metric you choose, construction employment for January was either fairly good, slightly bad, or horrifically bad. Take your pick.

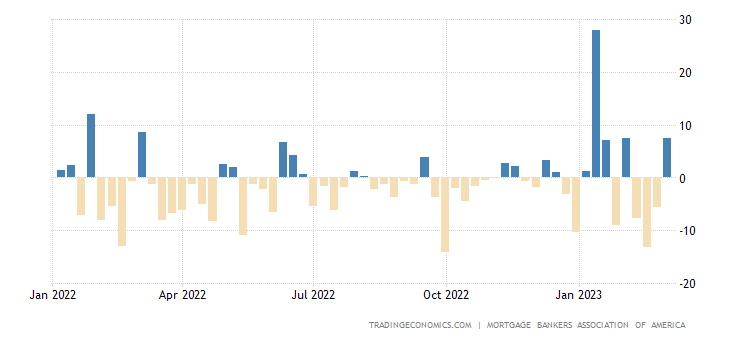

By way of perspective, mortgage application rates declined throughout most of 2022, with January 2023 showing the first significant recovery in application rates in months.

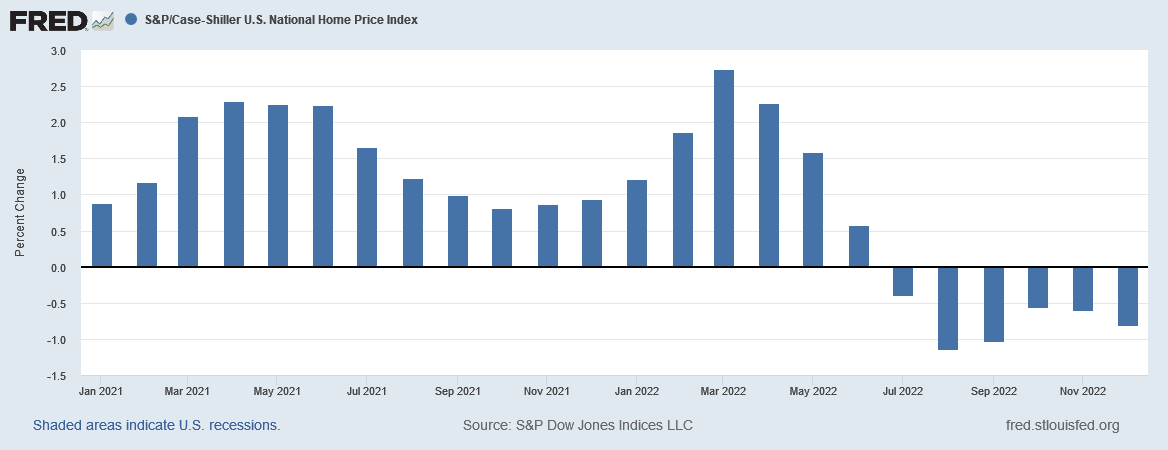

Meanwhile, the Case-Shiller National Home Price Index, the broad metric of housing prices in the US, largely peaked last June and have been trending down ever since, with some indication that the decline may be bottoming out in recent weeks.

It is worth noting the most significant declines in home prices occurred around August and September, nearly two months before mortagage rates peaked near 7% for a 30-year mortgage.

For the corporate media to be fretting about construction jobs now is almost comically late in timing. While current trends are somewhat muddled, if anything housing sales and construction jobs are beginning to recover at least slightly, even at the current elevated mortgage rates. Looking at the totality of the data, the real carnage in construction jobs occurred during the fall and may very well have already been digested.

If anything, the disappearence of 240,000 construction job openings is an economic acknowledgment those jobs never really existed in the first place. Wall Street’s angst over the disappearing construction jobs is more likely a bit of economic reality setting in—i.e., that the Fed really means to stick with the Volcker Interest Rate Shock Therapy playbook on fighting inflation.

Once again, Wall Street is having to contend with Jay Powell’s stubborn refusal to “pivot” back to lower rates and cheaper money, and his equally stubborn refusal to give them any good reason to hope that he might change his mind. Powell was not bluffing at Jackson Hole when he essentially vowed to crush economic demand in this country in order to bring consumer price inflation down, no matter what.

Six months later and Powell seems still just as determined to follow through on that plan.

The abrupt surge in the 2-Year Treasury yield (and it’s equally abrupt return to its previous level) is ultimately not much more than a momentary “Oh, crap, Powell is serious” realization by Wall Street. Yet once the shock of that realization wore off, the fundamentals of credit markets in the US, and their impact on consumer demand, remain largely unchanged.

There is a reason why the 10-Year Treasury yield is “stuck” below the 4% mark after flirting with breaking through that level, just as there is a reason why the 2-Year Treasury yield did not sustain above 5%. That reason is that the decline in overall consumer loan demand simply will not allow yields to rise above those thresholds, at least not yet.

Wall Street is behaving as if Powell and the Fed alone determine interest rates, when the reality is their own marketplaces are currently exerting far more influence over interest rates than Powell can hope to muster—a reality that is very much part and parcel of the Volcker approach to fighting inflation, as the capacity of the Federal Funds rate to influence interest rates overall diminishes the higher rates rise.

The data is unequivocal on this point: The Federal Funds rate’s influence over interest rates more broadly was at its greatest between August and November of last year, as it rose from 2.75% to 4%.

After the Federal Funds rate crossed the 4% threshold, interest rates largely plateaued and even declined.

Even if the Fed opts for another 50bps rate hike when the FOMC meets later this month, it is extremely problematic how much that will move the interest rate needle. It might not move it at all, or any increase along the yield curve might simply be transitory. Market dynamics are working against interest rates moving much higher: as interest rates rise consumer loan defaults rise and consumer loan demand falls, both of which exert downward pressure on interest rates.

The 2-Year Treasury yield’s abrupt rise and subsequent fall back within the space of a few days, triggered almost exclusively by Powell’s Congressional testimony, shows that Wall Street is paying attention to what the Fed does, while not paying any attention at all to what their own markets are doing. Obsessed with the bright shiny object that is Jay Powell’s utterances, they have taken their eyes completely off the path markets are making for them.

There is not a hope in Hell that this lack of attention to the fundamentals is going to end well for anyone on Wall Street—or anywhere else.

Maybe Powell's theory is that if he collapses a sufficient number banks, this will suck enough money out of the economy to tame inflation? ;)

I guess we got the term "jawboning" from what Samson was able to accomplish with the jawbone of a donkey. The story was to make us ponder the power of words. Powell is aware of that power. Trump was aware of his power when he incited the Jan 6 deadly riot.

In summary, depending on the circumstances, words can break our bones just as can sticks and stones.