There are few potions more detrimental to the little grey cells than Wall Street’s “robust economy” flavor of Kool-Aid.

How else to explain presumably intelligent and savvy economists and analysts believing the US Census Bureau’s latest flight of fancy about the US economy and consumer spending?

The consumer roared back last month with a 3% increase in retail spending that was the largest monthly gain in nearly two years, adding to evidence that U.S. economic growth picked up at the start of the year.

The seasonally adjusted jump in U.S. retail sales in January from December, which the Commerce Department reported on Wednesday, followed declines in the final two months of 2022 as shoppers spent more on vehicles, furniture, clothing and dining out.

It’s a nice thought, that the US economy grew so much that retail sales grew by 3% in January. It’s a very nice thought. It’s just not true. That “roaring customer” is more like a kitten meowing because it’s hungry.

To be sure, the Census Bureau did assert that retail sales rose 3% month on month from December.

Advance estimates of U.S. retail and food services sales for January 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $697.0 billion, up 3.0 percent (±0.5 percent) from the previous month, and up 6.4 percent (±0.7 percent) above January 2022. Total sales for the November 2022 through January 2023 period were up 6.1 percent (±0.5 percent) from the same period a year ago. The November 2022 to December 2022 percent change was unrevised at down 1.1 percent (±0.3 percent).

The year on year retail sales gains sound even better than that: 6.4% from January 2022…woo hoo! Happy days are here again….right? (Well….no. Sad face.)

Between January 2022 and January 2023 there was this small phenomenon known as consumer price inflation. For 2022, rising consumer prices account for one hundred percent of those retail sales gains.

In other words, retail sales did not improve at all in 2022. The data proves it.

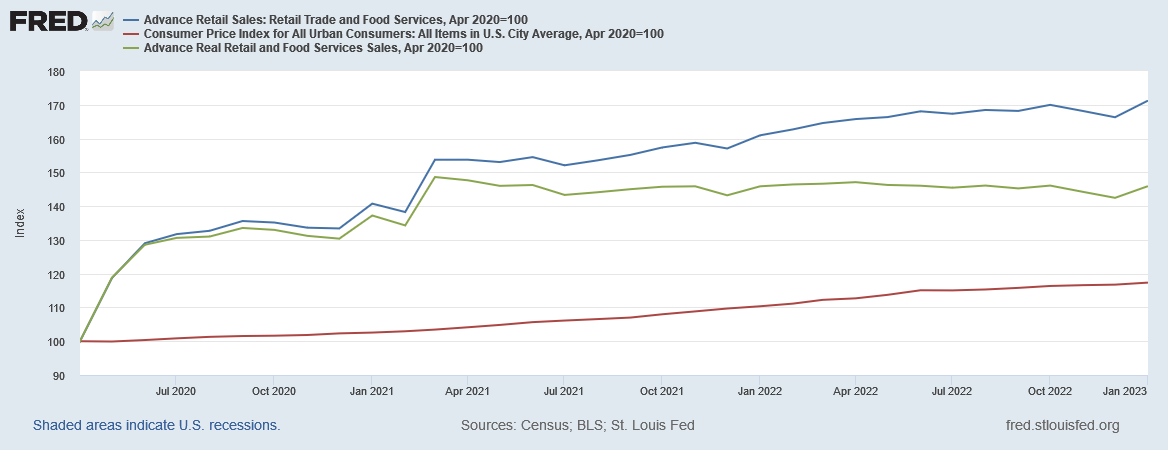

The disappearance of the red and green bars as you work towards the right of this chart (courtesy of the St Louis Federal Reserve) means that inflation is eating up every dollar of retail sales growth shown by the blue bar. The red is retail sales restated in 1984 dollars—“real” sales growth, and the green is the nominal retail sales growth (blue bar) minus inflation per the Consumer Price Index1. In this chart, the inflation figure is the year on year percentage.

No red or green visible at the January 2023 mark (far right) means real sales growth was effectively zero.

The monthly figures are slightly better for last month, but the totality of the year’s sales figures conveys largely the same message: inflation eats up most if not all of retail sales growth in the US.

The corrosive impact of consumer price inflation is evident no matter how one looks at the data. If we index retail sales growth to the end of the 2020 pandemic-induced recession, we quickly see that retail sales jumped up bigly in 2020—a true recession-caused “bounce”, but that initial boost of growth slowed very quickly.

More crucially, we can see that the “real” sales (green line, 1984 dollars) more or less flattens out in March of 2021, after which real sales gains are minimal at best.

Bring the index forward to January 2021 and we see the same phenomenon.

Bring the index forward to January 2022, and we see that, in real terms, retail sales declined for most of 2022, and all that happened last month is retail sales barely got back to January 2022 levels.

Barely breaking even is not how I envision an economy “roaring back”.

Nor is retail sales the only example of Wall Street’s mind erasing Kool-Aid. The myth of rapidly rising wages simply refuses to die, not unlike the zombies in the Resident Evil movies.

The U.S. economy started the year with surprising vigor, thanks partly to rising household incomes and consumer resilience.

Slowing inflation, pay raises negotiated last year, cost-of-living adjustments for retirees and state tax cuts have lined up to lift consumer purchasing power, fortifying spending and economic growth at a time when many analysts were predicting a slowdown or even recession. This marks a turnabout for households that were squeezed last year by high inflation, climbing interest rates and the end of Covid-related federal relief programs.

There is, however, one teeny tiny problem with this thesis: Even the BLS is not claiming household incomes are rising—not in real terms, and not in January (emphasis mine).

Real average hourly earnings for all employees decreased 0.2 percent from December to January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.3 percent in average hourly earnings combined with an increase of 0.5 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

Someone might want to inform the “experts” on Wall Street that “decrease” does not mean getting larger.

to grow progressively less (as in size, amount, number, or intensity)

In actuality, real wages have been decreasing since March of 2021.

When nominal wage growth as a percentage less consumer price inflation as a percentage is negative, real wages are shrinking (“growing progressively less”, for any “expert” that might be reading), not growing.

Even on a monthly basis, real wage growth was negative in 2022 more than it was positive.

Looking farther back, to include 2021, and the real wage “growth” picture is even worse.

In truth, wages have been getting jackhammered since the 2020 recession by consumer price inflation—the one part of the economy that has been “roaring”, and the one part of the economy we wish was completely silent (not even a kitten’s meow).

When inflation outpaces nominal wage growth, workers get to buy less, and less, and less. Folks getting to buy less is not my idea of economic growth, “roaring” or otherwise.

Inflation has been doing this ever since the 2020 recession. Wages started out in 2021 keeping pace with consumer price inflation, but fell off the pace in March of 2021.

In 2022, wages didn’t stand a chance, posting little nominal growth for the first couple months of 2022, and never catching up to consumer price inflation afterwards.

It was not always like this. If we roll the index back to January 2017, wage growth was actually exceeding inflation back then.

The ongoing damage from the 2020 pandemic-induced, government-ordered recession is largely this: the steady destruction of real wages. People are losing money to consumer price inflation, and have been since April 2020. If last month’s consumer price inflation report is any harbinger of things to come, the losses will get much worse before they get any better.

This is what Wall Street calls “surprising vigor” in the economy. This is what Wall Street considers a consumer “roaring back.”

This is what sane folk call “recession”. It’s what we’ve been in for some time, and it’s what we’ve got some ways to go before we get to climb out of it.

Word to the wise: don’t drink Wall Street’s Kool-Aid. It will rot your brain.

Ideally, “real” economic data is always going to be nominal figures ex inflation. However, very often simply restating the nominal current-dollar figures into 1984 dollars, which is the basic method used by government economists to arrive at “real” numbers, does not fully account for inflation’s impact. That can be shown by comparing the “real” data to the manual calculation of nominal data less consumer price inflation. Using the manual calculation is frequently a good sanity check to make sure the analysis remains cogent.