As Expected, The Fed Does Nothing On Interest Rates

Reality Check: Jay Powell Does Not Know What To Do

Jay Powell proved once again that Wall Street has him pegged when the Federal Open Market Committee yesterday elected to once again punt on the federal funds rate, neither raising nor reducing it.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

While the FOMC official statement struck that guardedly optimistic tone, Jay Powell was somewhat more tentative in his opening remarks to the post-announcement press conference:

My colleagues and I remain squarely focused on our dual mandate to promote maximum employment and stable prices for the American people. The economy has made considerable progress toward our dual-mandate objectives. Inflation has eased substantially, while the labor market has remained strong. And that is very good news. But inflation is still too high. Ongoing progress in bringing it down is not assured, and the path forward is uncertain.

After more than two years of boosting the federal funds rate and generally trying to jawbone interest rates up, for Powell to be “uncertain” about the Fed’s ability to push inflation down going forward is an underwhelming admission to say the very least.

Wall Street may know Jay Powell backwards and forwards—and probably does—but Jay Powell once again demonstrates that he does not know how to move his chosen inflation strategy forward.

When the head of the Federal Reserve does not know what to do on monetary policy, it is a fair bet that whatever he does will not end well. Jay Powell does not know what to do on monetary policy.

(Note: as I have been moving and attending to a few other personal matters this week, I am somewhat behind on my articles, which is why this one is appearing later than usual today.)

Corporate media, for their part, generally followed the Fed’s tone of guarded optimism:

Federal Reserve officials left interest rates unchanged on Wednesday and continued to forecast that borrowing costs will come down somewhat by the end of the year as inflation eases.

Fed policymakers have been battling rapid inflation for two full years as of this month, and while they have been encouraged by recent progress, they are not yet ready to declare victory over price increases. Given that, they are keeping interest rates at a high level that is expected to weigh on growth and inflation, even as they signal that rate cuts are likely in the months ahead.

Officials held interest rates steady at about 5.3 percent, where they have been set since July 2023, in their March policy decision.

They even highlighted the Fed’s more optimistic GDP projections and general assessment of a strengthening economy.

The previous Summary of Economic Projections (SEP) from December also showed three rate cuts in 2024.

However, the projected change in real GDP for 2024 was 2.1% in the March projection, up from 1.4% in December. Core PCE inflation projections also ticked up, to 2.6% from 2.4%.

The updated projections came after inflation reports for January and February dampened hopes that the Fed has price increases under control. Traders had already been dialing back rate cut projections for this year ahead of Wednesday’s update from the central bank.

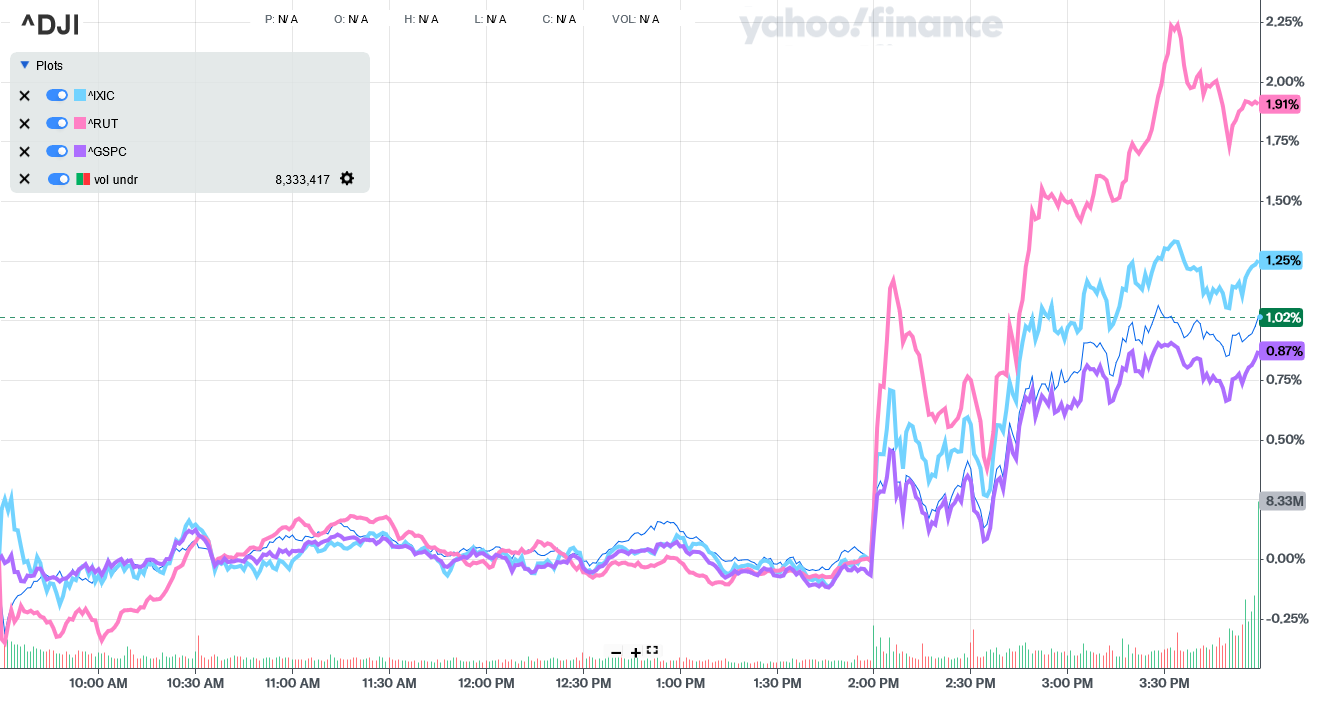

For its part, Wall Street was pleased with the announcement and very supportive of Powell’s post-announcement presser.

All major equity indices closed up, and the Dow closed up a full percentage point—almost all of which occurred after the FOMC announcement and during the press conference.

At the same time, Treasury yields were mostly either neutral or down, after a brief spike post-announcement.

Only the 30 Year Treasury yield moved up on the day.

Overall, Wall Street is quite willing to accept the Fed’s optimism. They have good reason: if the Fed somehow “gets it right”, Wall Street will benefit, but if the Fed gets it wrong (more likely), the Fed is sure to bail them out, as has been done so many times in the past.

Wall Street is happy to play along with the Fed, because by so doing they are literally gambling with house money (which is to say, taxpayer dollars).

Part of why Powell remains utterly clueless about where to take monetary policy is that he is simply refusing to confront some glaring dichotomies in the economic data which he claims drives Fed decision making.

He pushes the narrative of strong economic growth:

Recent indicators suggest that economic activity has been expanding at a solid pace. GDP growth in the fourth quarter of last year came in at 3.2 percent. For 2023 as a whole, GDP expanded 3.1 percent, bolstered by strong consumer demand as well as improving supply conditions.

In the same breath, however, he describes the housing markets as “subdued”.

Activity in the housing sector was subdued over the past year, largely reflecting high mortgage rates. High interest rates also appear to have weighed on business fixed investment. In our Summary of Economic Projections, committee participants generally expect GDP growth to slow from last year’s pace, with a median projection of 2.1 percent this year and 2% over the next two years. Participants generally revised up their growth projections since December, reflecting the strength of incoming data, including data on labor supply.

Moreover, he fails to confront the seeming contradiction between strong economic growth and flagging demand for corporate loans.

During periods of economic growth and prosperity, one would rationally expect to see growing loand demand, for the simple reason that loans are the primary vehicle businesses have for financing the expansions and investments that are the essence of economic growth and prosperity. While the degree to which economic growth is directly driven by actual loan demand growth is somewhat problematic, as a matter of necessity there will always be a strong correlation between economic growth and corporate loan demand growth. With loan demand not growing, one has to question the accuracy of current economic growth estimates.

Powell also ignores the numerous flaws in the BLS jobs figures, and dutifully regurgitates the “official” Establishment Survey numbers:

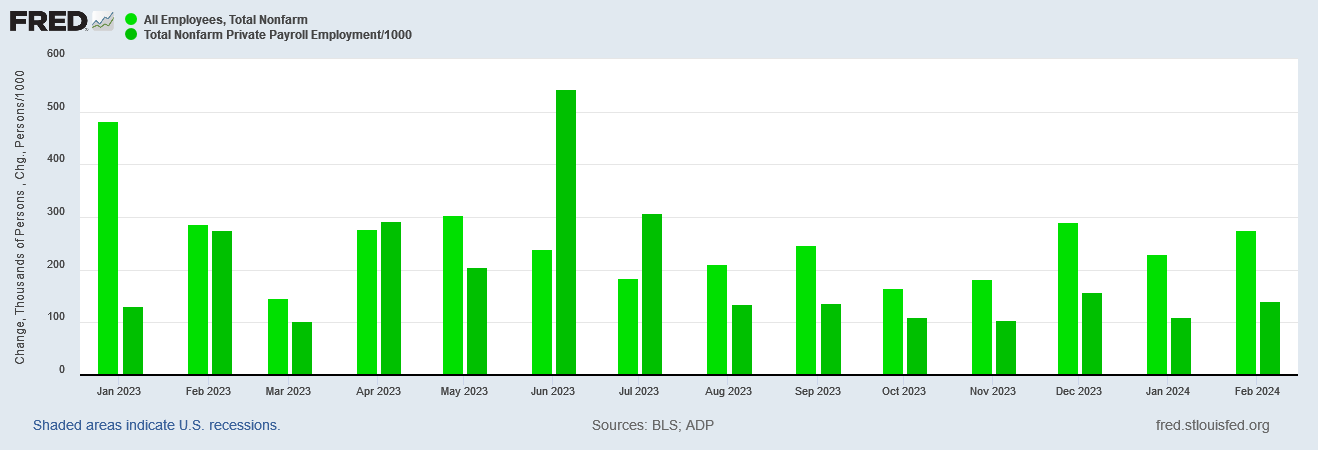

The labor market remains relatively tight, but supply and demand conditions continue to come into better balance. Over the past three months, payroll job gains averaged 265,000 jobs per month. The unemployment rate has edged up but remains low at 3.9 percent. Strong job creation has been accompanied by an increase in the supply of workers, reflecting increases in participation among individuals aged 25 to 54 years, and a continued strong pace of immigration.

Nominal wage growth has been easing and job vacancies have declined. Although the jobs-to-workers gap has narrowed, labor demand still exceeds the supply of available workers. FOMC participants expect the rebalancing in the labor market to continue, easing upward pressure on inflation. The median unemployment-rate projection in the SEP is 4.0 percent at the end of this year and 4.1 percent at the end of next year.

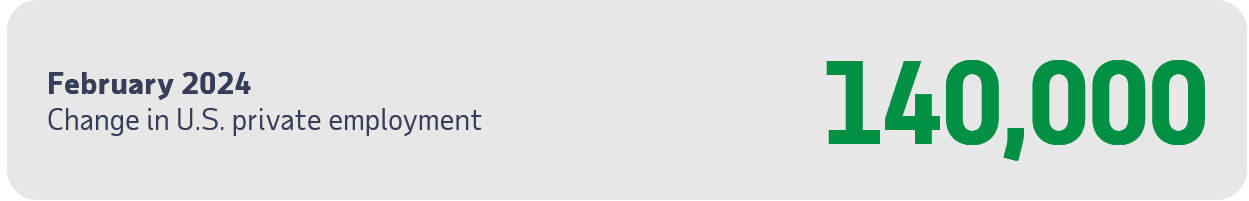

We must remember that for the months for which Powell touted the BLS average of 265,000 jobs created per month, the ADP National Employment Report has calculated a jobs creation figure of roughly half that amount.

One huge reason to question the BLS jobs report: ADP’s National Employment Report reported jobs growth of only half of what the BLS reported.

Private sector employment increased by 140,000 jobs in February and annual pay was up 5.1 percent year-over-year, according to the February ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.

The ADP National Employment Report has been printing well below the BLS revisions since late last summer, and the monthly variance is increasing.

That the Federal Reserve’s own FRED system maintains the data which charts the discrepancies between the two jobs reports makes Powell’s seeming ignorance of those discrepancies no small amount of irony.

Even more galling is Powell’s seeming indifference to the impact of inflation on workers’ paychecks. Nominal wages might be rising, but inflation has reduced real wages since the start of the current regime’s Reign of Error.

Not until May of last year did nominal wage growth outpace inflation.

The Fed Chair is free to apply his own interpretation to the data—and his job requires him to do exactly that. However, interpreting data is never the same as ignoring data, and that is what Jay Powell has done consistently with regards to labor markets in particular.

Powell’s ignorance of the data extends to simply being wrong about what the most current data shows, particularly as regards inflation:

Q: Thank you. A mic for me. Steve Liesman, CNBC.

Mr. Chairman, the projections show somewhat higher core inflation. They also show somewhat stronger growth. What should we infer from this notion that on average rates were kept the same this year but inflation is higher and growth is higher? Does it mean more tolerance for higher inflation and less of a willingness to slow the economy to achieve that target?

MR. POWELL: Well, it doesn’t—no, it doesn’t mean that. What it means is that, you know, we’ve seen incoming—as I pointed out in my opening remarks we did mark up our growth forecast and so have many other forecasters. So the economy is performing well, and the inflation data came in a little bit higher as a separate matter and I think that caused people to write up their inflation.

But, nonetheless, we continue to make good progress on bringing inflation down and so—

The problem with the assertion that the Fed is making progress on bringing inflation down is that for the past several months, month on month consumer price inflation per the CPI has been increasing.

The same trend is observed within consumer price inflation per the PCEPI as well.

Even factory gate inflation—which is a general precursor to consumer price inflation—has been trending up in recent months, which forecasts higher consumer price inflation rates over the next few months at least, not lower.

Moreover, the factory gate inflation data in particular correlates the inflation rise to a recent rise in energy prices—a commodity price category that is generally more volatile than overall prices and is notoriously immune to interest rate manipulations.

The data shows that inflation is rising right now, and is likely to continue to rise over the near term. That same data also shows that the forces driving most of that rise are not impacted by Fed policy.

As a simple matter of forms, it is impossible to fathom how rising consumer price inflation leads to progress towards lower inflation.

And so the press conference went. When Jay Powell was not ignoring the official data he was merely spouting word salad nonsense.

Yet despite Powell both ignoring the data and spouting word salad nonsense, the corporate media “journalists” at the press conference failed to call him out for either. Everyone was content with the current narrative and opted not to challenge it.

However, as the data Jay Powell routinely ignores clearly demonstrates, the prevailing narrative is largely word salad nonsense.

While the “official” GDP data shows economic growth, underneath the headline numbers are numerous unresolved weaknesses.

What the data shows is exactly what I stated yesterday: Federal Reserve monetary policy is now largely impotent.

In an interest rate environment where no one wants to borrow money, where there is little else for banks to do but to buy up treasuries, the Fed’s tight money policies are always going to be counteracted by the unavoidable downward pressures on yields such an interest rate environment produces.

Thus we can see how the Fed has lost control—of inflation, of interest rates, and of the narrative in general.

The Fed’s interest rate strategy has failed to tame and corral the inflation beast. The Fed has also been undone by a weak economy with poor loan demand largely negating the upward pressures on interest rates it sought to produce by raising the federal funds rate.

By far the most disturbing aspect is that Jay Powell does not realize that he has lost control, and that the Fed as a whole has lost control over inflation, over interest rates, and thus over the economy the Fed is supposed to shepherd into full employment, stable prices, and overall prosperity.

At present—and the data has routinely and repeatedly illustrated this—the US economy has neither full employment, nor stable prices, nor overall propserity.

Wall Street is fine with the current economic state of affairs, at least for the moment. For the moment, that state of affairs has not impacted Wall Street’s portfolios much.

However, Main Street is not likely to be nearly as pleased with the current economic state of affairs, and eventually Main Street economic concerns become Wall Street economic crises. That makes both Wall Street and Jay Powell very wrong, very stupid, and very dangerous.

These people in their insulated,cushy Fed jobs are out of touch with America. They seem to be oblivious to how thoroughly the middle class has eroded away, and how painfully half of America is struggling. Thank you once again, Peter, for irrefutable data proving their incompetence.

If you’re in the middle of moving, I will spare you my usual questions, and just wish you much happiness in your new home!

You are correct: Main Street is Not Happy. The price of just about everything is still very high with some prices STILL increasing.

Except for the wealthy elite, Americans are broke. Plain and simple.

If I had one word to describe the Fed/Powell it would be Hapless and that’s me being nice. Abolish it.