Asleep At The Wheel?

Neither The Fed Nor Wall Street Is Paying Attention To Employment

The Federal Reserve Open Market Committed once again lived up (down?) to expectations by doing what everyone expected and leaving the federal funds rate unchanged after their January meeting yesterday.

Jerome Powell managed not to put his foot in his mouth in the post-meeting press conference, which was perhaps the most newsworthy aspect of the entire meeting.

However, both Wall Street and the Fed have managed once again to either ignore or completely misread current labor market data, and continue to believe that current job market trends are overall healthy.

That is not the case, but you wouldn’t know it from Wall Street’s reaction. Contrary to what Wall Street and the Fed want to believe, the jobs market in this country is beginning 2025 in the same ongoing deterioration that it has been for a number of months now.

Wall Street Was Content

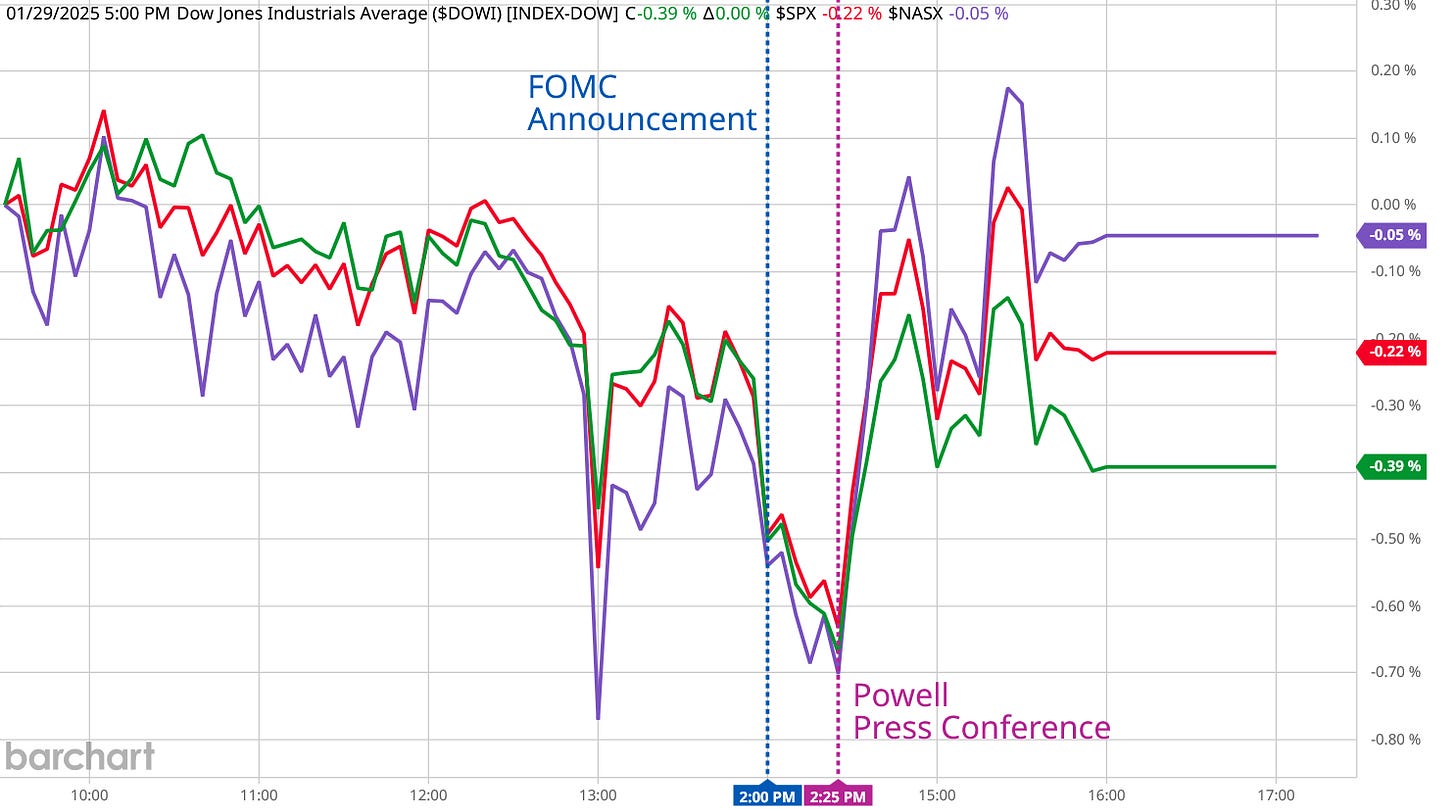

Overall, Wall Street was content with both the FOMC decision to leave interest rates unchanged. After the FOMC announcement yesterday afternoon and the accompanying press conference, the Dow moved significantly higher, along with the S&P 500 and the NASDAQ indices.

At the same time, the 10-Year Treasury ended the morning run-up in its yield, with the market pushing yields down throughout the afternoon.

Nothing Powell said disturbed the markets—which is perhaps the biggest problem with what Powell said: Federal Reserve complacency is being met with Wall Street indifference.

When it comes to the employment situation, the Federal Reserve is absolutely being complacent.

What The FOMC Says: Employment Is Fine

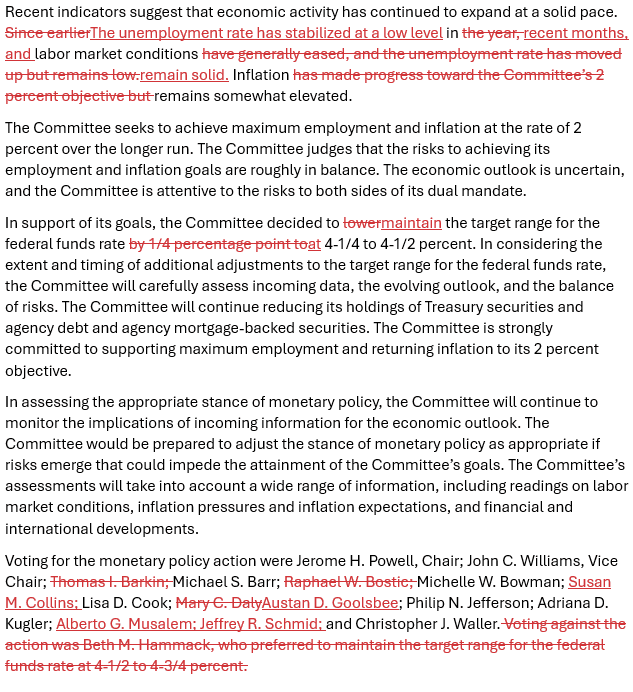

The FOMC’s view of America’s job markets is that everything is fine, and in yesterday’s announcement they said so.

Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Fed has conceded that employment has been getting worse, but, as NBC noted in a comparison of the December and January statements, the official view has shifted from “employment is decreasing” to “employment has stabilized.”

Powell reiterated this during the press conference:

So I think our policy stance is very well calibrated, as I mentioned, to balance the achievement of our two goals. We want policy to be restrictive enough to continue to foster further progress toward a 2 percent inflation goal. We don't need to see further weakening in the labor market to achieve that goal. And that's kind of what we've been getting. The labor market has really been broadly stable. The unemployment rate has been broadly stable now for six months. Conditions seem to be broadly in balance. And I'd say look at the last couple of inflation readings, and you see we don't overreact to two good readings or two bad readings. But nonetheless, the last couple of readings have suggested, you know, more positive readings. So I think we're-I think policy is well-positioned.

Judging by Wall Street’s non-reaction, Wall Street chose to believe him.

What The Data Says: Employment Is Not Fine

That the Fed chair has read the data all wrong is, at this point, scarcely deserving of comment. Powell almost always reads the data wrong.

However, in the case of where US employment is at, Jerome Powell is reading the data very wrong.

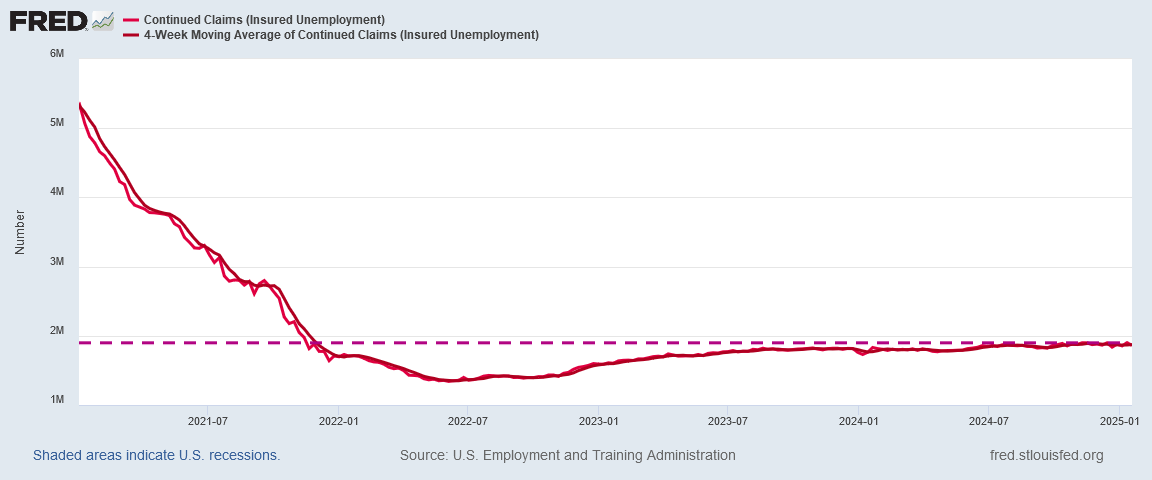

Certainly if one looks at just the seasonally adjusted trend for ongoing unemployment claims, one might well conclude that the job market is stablizing.

While continued claims had trended up on a seasonally adjusted basis during 2023, the seasonal chart does show that the number of continuing claims has stabilized, and at or below where it was at the beginning of 2022, as the US was still emerging from the economic chaos of the COVID Pandemic Panic.

However, we must once again remember that the seasonally adjusted numbers are by definition somewhat manipulated—and that the seasonal adjustments are not necessarily entirely accurate. That is something we can see if we look at the raw data on continuing claims.

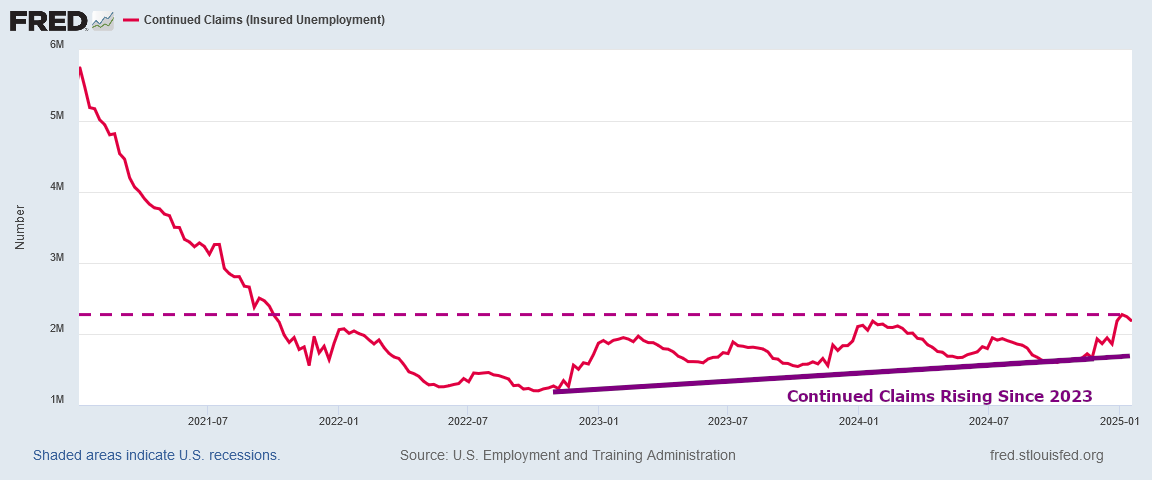

In the raw data, continued claims have trended noticeably higher than the seasonal average reports, matching levels from the fall of 2021.

Also of significance is the reality that there is a clear upward trend in the continued claims data which has been present since the beginning of 2023.

Continued claims are a measure of people who are unemployed for some time and are receiving unemployment compensation. An upward trend in that data means the US has an increasing number of people who are unemployed for an increasing length of time.

Rising and lengthening unemployment is not what “stable employment” typically means.

Contrary to what Powell said in the presser, even the unemployment metrics themselves show unemployment is rising—both in the seasonally adjusted data and in the raw data.

To beat the dead horse yet again: rising unemployment is not what “stable employment” typically means.

Powell Has No Clue. Neither Does Wall Street

We can gauge both the disinterest the Fed as well as Wall Street has in the actual state of the jobs market and the disconnect both have from the jobs data from the blithe acceptance of Powell’s word salad anwers to questions regarding how President Trump’s policies might change the labor markets in this country.

[Reporter]*: You've said that the Fed is in wait-and-see mode based on the policies that come out of this administration. Has the Fed started to model what policies like mass deportations, changes in immigration policies specifically, would look like for the workforce and for inflation?

Jay Powell: So one of the things our staff does is they look at a range of possible outcomes, and they tend to go from really good to really bad, and, you know, it's one of the best things that they do. And in each teal book, you can look at the five-year-old teal books and see, they're alternative simulations. So that's what they do. It'll be a baseline, and then they'll show six or seven alternative scenarios, including really good ones and not so good ones. And what those do is they spark, you know, the policymakers to sort of think and understand about the you know, the uncertainties that surround this. So, yes, we-the staff does that, and we-we're all well aware that there are-that the range of possibilities is always broad, and-not just now, but always. And you have to-it's hard to be open to just how broad the possibilities are for an economy. You know, no one saw the pandemic coming, and it was-you know, it changed everything. So things happen, but yes, we do do that. But it's one thing to do that to make assessments about what might happen and begin to think about what you might do in that case, but you don't act until you see much more than we see now.

* Reporter’s name was indistinct in the auto-transcription

While the reporter’s question about President Trump’s immigration policies was very likely a bit of trolling by the corporate media to generate some anti-Trump sound bites from the Fed chair, Powell’s rambling answer said nothing much of anything. While Powell did slide a “yes, the staff does that” into the answer, he surrounded that statement with so much word salad it is not certain he was speaking of the same thing the reporter was.

Yet corporate media was okay with that, proving once again how unserious corporate media “journalism” has become.

This is a shame, because, corporate media trolling notwithstanding, jobs and employment are an important element of the immigration debate in this country, and immigration’s impact on labor markets makes it an important element of the economic debate.

Moreover, the sobering reality of US manufacturing in particular is one of rising unemployment.

If it should emerge that deporting large numbers of illegal aliens from the United States will produce a significant shift in the demographics of the jobless, that would be quite a compelling argument for stricter immigration enforcement.

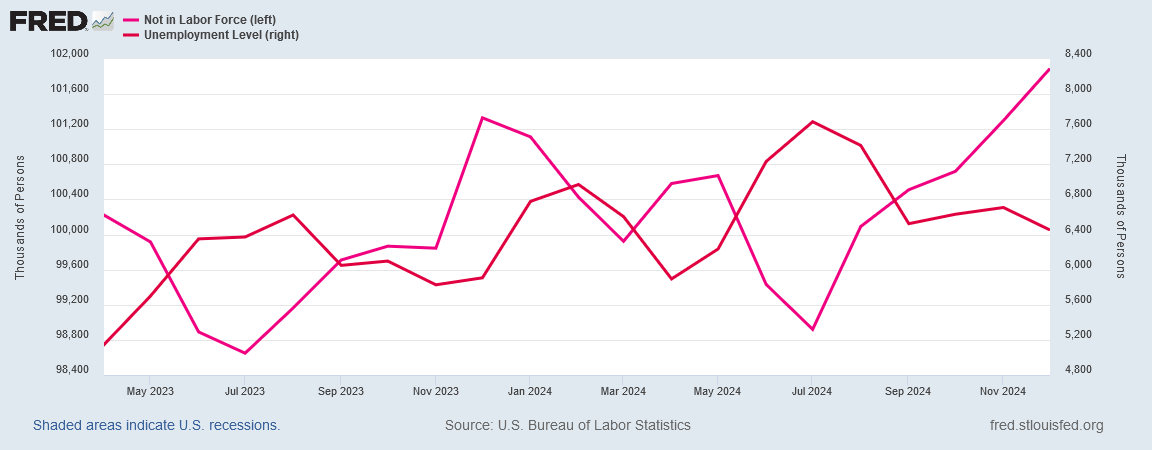

What both Wall Street and Jay Powell ignore is that, to the extent there has been any decline in unemployment, it has by and large occurred not because the unemployed get jobs, but because they give up on looking. We can see that trend absolutely when we overlay the not-in-labor force chart with the unemployment chart—as the one rises the other falls.

Workers giving up on looking for work also is not what “stable employment” typically means.

Jay Powell and Wall Street both seem oblivious to this reality.

When Reality Sets In

Wall Street has, especially in recent years, managed to divorce itself almost completely from the realities of the US economy.

Wall Street is able to ignore a rising number of working-age people in this country who are not working.

Wall Street is able to ignore a rising number of people looking for work and not finding any.

Wall Street is able to ignore the steady erosion of manufacturing jobs in particular in this country.

Jerome Powell’s power of non-observation are equally impressive. So, too, are those of the entire Federal Open Market Committee. They look at the same data I present here—indeed, they get this data before I get this data—and yet remain oblivious to its significance.

The US economy is not creating anywhere near the number of jobs it needs to create for the working-age population we have.

This is impacting workers across the board, but especially younger workers—people who are just entering the workforce and just learning the job skills that will carry them through their adult life.

The data indicates unemployment is getting worse, not better. The data indicates that employment is deteriorating in this country, and thus is destabilizing, not “stabilizing” as the Fed wants you to believe.

Wall Street wants to ignore this. Apparently, so does the Federal Reserve. Yet they cannot ignore this reality forever. At some point the deteriorating economy of this country will destabilize Wall Street as well as Main Street. At some point reality will set in even for Jerome Powell and the Federal Reserve.

I have no crystal ball to predict when reality will set in either for Wall Street or the Federal Reserve. However, I do not need a crystal ball to know that when reality does set in, the result will be a market meltdown that will make this week’s panic attack over Chinese AI seem like a minor fluctuation.

Barring a miracle, both Wall Street and the Federal Reserve will be unprepared for when reality finally sets in. They continue to be as they have been for months and even years—asleep at the wheel, and completely oblivous to the real state of the real economy.

“Wall Street has, especially in recent years, managed to divorce itself almost completely from the realities of the US economy.”

This is the stuff that mystifies me about Wall Street. Why? How? The realities of the US economy should be the absolute bedrock data on which they build their stock evaluations. I realize that the Street has moved far away from simple metrics like P/E ratios, and I’ve watched during my lifetime as it’s become increasingly a casino - but have Wall Streeters truly become this disconnected? What a frightening indicator of future economic disaster!

Thank you, as always, for being grounded in reality and speaking the truth, Peter. It’s priceless!