August Inflation Proves Powell Has No Control Over Inflation

The Interest Rate Hikes Are All Pain And No Gain

To appreciate what the numbers in August’s Consumer Price Index Summary tell us, we must first review Fed Chairman Jay Powell’s remarks from last month’s Jackson Hole Economic Symposium:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Take note of Powell’s key points:

Reducing inflation requires “sustained” below-trend growth (i.e., “recession”).

Labor markets need to soften to reduce inflation.

Interest rates need to rise to reduce inflation.

August’s inflation numbers shredded each of these points—we have had sustained below-trend growth (we’ve actually had contraction rather than growth), we have softening labor markets, and the Fed has been hiking interest rates, yet inflation rose in every key category except energy.

The August Consumer Price Index Summary showed how little control Jay Powell has over future inflation.

The Consumer Price Index By The Numbers

To be sure, the headline consumer price inflation number showed marginal improvement, decreasing from 8.5% to 8.3%.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in August on a seasonally adjusted basis after being unchanged in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.3 percent before seasonal adjustment.

However, all of the reduction in inflation came from a steep drop in energy price inflation, which fell from 33% Year on Year in July to 24% Year on Year in August.

Food price inflation rose from 10.9% to 11.4%

Shelter price inflation rose from 5.7% in July Year on Year to 6.2% Year on Year in August.

Inflation within the Rent of Primary Residence rose from 6.3% in July Year on Year to 6.7% Year on Year in August.

Worst of all, “core” inflation rose from 5.9% Year on Year in July to 6.3% Year on Year in August.

The only reason headline inflation declined last month is because of the drop-off in energy price inflation. Of the major subcategories within the Consumer Price Index, it was the only one to post a decline.

Interest Rates Have Been On The Rise, Yet Inflation Is Not Coming Down

In a complete rejection of Powell’s inflation-fighting strategy, “core” inflation rose despite the Fed raising and jawboning interest rates up.

According to Jay Powell’s strategic doctrine for fighting inflation, this outcome should not have happened.

Yet it did.

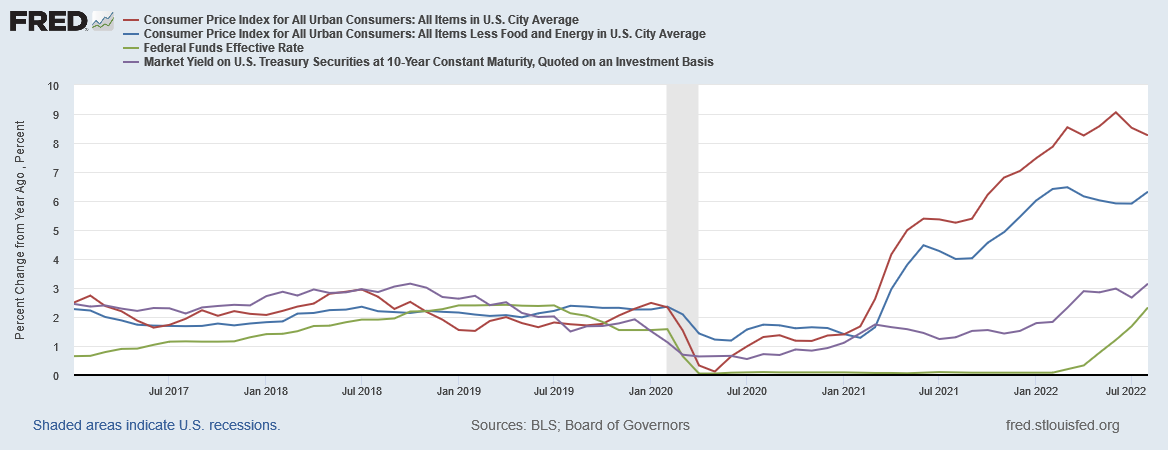

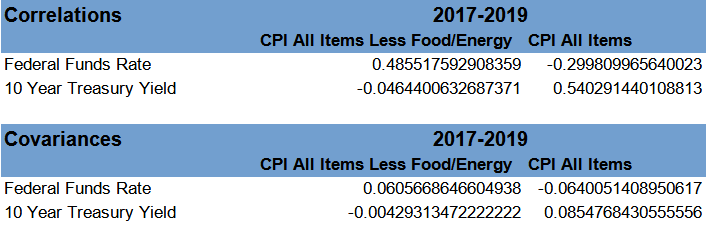

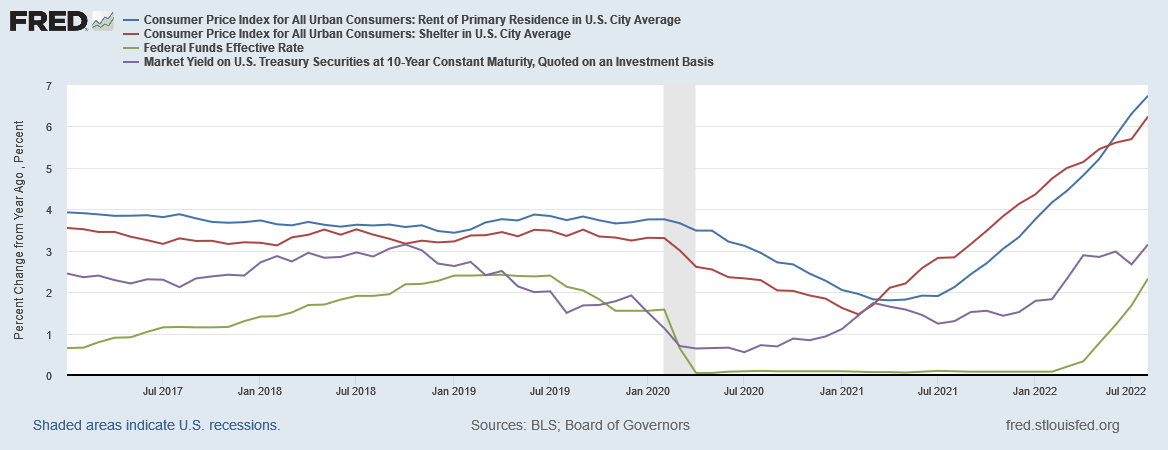

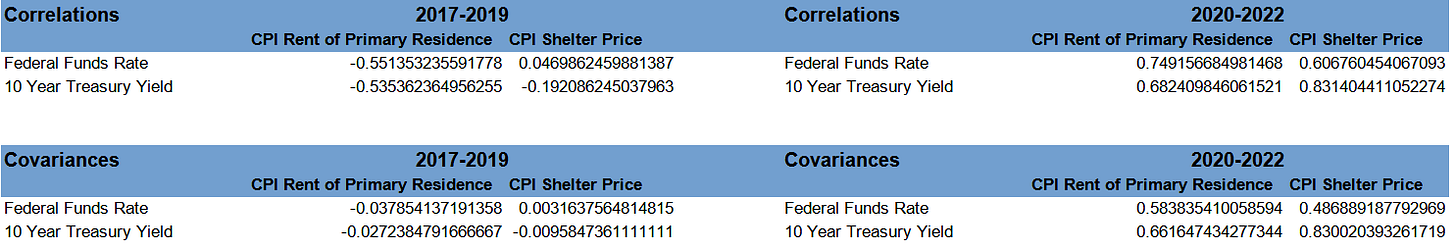

Moreover, basic statistical analysis shows precious little actual relationship between interest rates and inflation. Between 2017 and 2019 the relationships were weak to moderate at best.

From 2020 to the present, the Federal Funds rate was actually less influential on interest rates than before, although the 10 Year Treasury yield showed a significant correlation to the rate of inflation.

The shifting correlations and covariances show that interest rates enjoy at best a problematic relationship with inflation. They do not clearly establish interest rates as an effective and impactful tool for reducing consumer price inflation.

Additionally, taking the correlation coefficients at face value, the positive correlations between consumer price inflation and both the Federal Funds rate and 10 Year Treasury yields implies that as interest rates rise, consumer price inflation gets worse. The correlation we want to see would be negative, so that as interest rates rise, inflation shrinks and trends down. We are not seeing that.

This lack of consistency makes interest rates an extremely unreliable tool for bringing down inflation. Certainly the proposition that interest rate hikes exacerbate inflation would make them the wrong tool for fighting inflation in every scenario.

As for the one inflation metric that did decline last month, just visual inspection of the chart suffices to show a lack of influence of interest rates on energy price inflation.

Interest Rate Hikes Have Not Helped Food Price Inflation

Nor is there any evidence that Jay Powell’s interest rate hikes have had any good impact on food price inflation. Visually, there does not appear to be any impact at all, either good or bad.

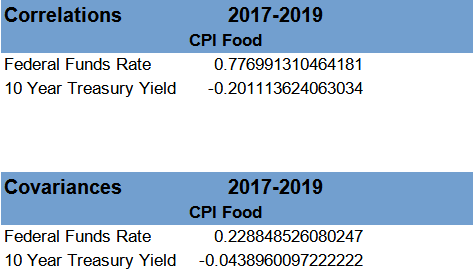

Certainly before the pandemic the relationship between interest rates and food price inflation was at best moderate and overall problematic.

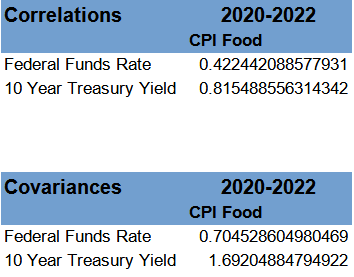

However strong the correlation between interest rates and food price inflation was before 2020, since 2020 the correlation with the Federal Funds Rate in particular has diminished, and the correlation with 10 Year Treasury yields has inverted, from negative to positive—which if anything suggests that hiking interest rates makes food price inflation worse.

With no definable correlation between interest rate relationships and food price inflation, expecting changes in interest rates to have pre-determined effect on food price inflation is simply absurd. Morever, it cannot be denied that, since the Fed started raising interest rates in March, food price inflation has continued its upward movement regardless of what the Fed does on interest rates.

Rents And Shelter Price Inflation Ignore Interest Rates As Well

The most likely reason core inflation rose in August is the continued rise in shelter price inflation. Both the CPI metric for shelter price inflation and that for the rent of one’s primary residence show ongoing increase that began before Powell started raising rates and has not broken stride even with Powell’s rate hikes.

Further, even though interest rates showed the expected negative correlation with shelter price inflation before 2020, from 2020 forward that correlation inverted and became positive.

The correlation coefficients are clearly indicating that interest rates are anything but a good weapon for fighting shelter price inflation post-pandemic.

Powell’s rate hikes are simply not working, not at any level.

The Wrong Weapon For The Fight

If there is no reliable correlation between interest rates and inflation levels, Powell’s thesis that raising interest rates will repair consumer price inflation and push it back down is immediately shown to be absurd. It would be equally absurd to deny the measured increases in inflation across the board in August, even after a full six months of rising interest rates and Treasury yields.

Regardless of what Powell intends for inflation, the data shows Powell’s interest rate hikes have not brought sustained downward pressure on consumer prices.

Even worse, however, is that Powell’s rate hikes have not brought inflation down despite having definite signs of weakness in labor markets—per Powell at Jackson Hole a key predicate for a reduction in inflation.

Even though the economy has been contracting throughout the first half of this year—and sustained “below-trend growth” was another of Powell’s key predicates for inflation reduction at Jackson Hole—inflation has not been responsive to interest rates.

It is one thing for Powell to argue that enduring economic contraction and recession, along with weak labor markets, is necessary to bring inflation down, and that such discomfiture will ultimately be “worth it.” It is quite another for Powell to argue that logic in the face of data showing that enduring recession and weak labor markets even as inflation increases.

After six months of Jay Powell raising interest rates, we have yet to see any indication the sacrifices Powell demands of ordinary Americans are having any good impact on inflation. We have the pain, but we do not have the gain.

The scary takeaway from the August Consumer Price Index Summary is that, despite the Federal Reserve hiking rates for six months, the Fed has no control over inflation. Prices will rise, prices will fall, and Jay Powell is left sitting on the sidelines in either case.

Placing current inflation on an “apples to apples” basis to make historical comparisons: if today’s inflation rate were calculated using the same methodology that was used in the Carter years, today’s inflation rate would be approximately 17%.

http://www.shadowstats.com/alternate_data/inflation-charts

Excluding food and energy from the overall inflation calculation is absolutely ludicrous and disingenuous to say the least! What a scam to fool the mostly unaware masses.