BEA Takes A Small Reality Check

Realizes Economic "Growth" In 2022 Was Smaller Than First Claimed

Quite unintentionally, the Bureau of Economic Analysis conceded I might have been right last month about the true nature of economic “growth” in 2022.

None of the underlying GDP data speaks to an economy that is strong, healthy, or robust. Rather, it all speaks to an economy that is stagnant, distorted, and unbalanced—the epitome of an economy in stagflationary recession.

With the latest estimate of fourth quarter GDP growth for 2022, the BEA trimmed their estimates slightly, and acknowledged that consumer spending was not as great as first anticipated.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.9 percent. The updated estimates primarily reflected a downward revision to consumer spending that was partly offset by an upward revision to nonresidential fixed investment (refer to "Updates to GDP"). Imports, which are a subtraction in the calculation of GDP, were revised up.

As a result of the smaller contribution from consumer spending, GDP growth for 2022 (and for the fourth quarter of 2022) was revised down 0.2%, to 2.7% from the advance estimate of 2.9%.

The 2.7% annual growth rate is still a likely overstatement of actual GDP growth, but at least the BEA is admitting that consumer spending is less than previously presumed. That’s one small step towards economic reality by the BEA.

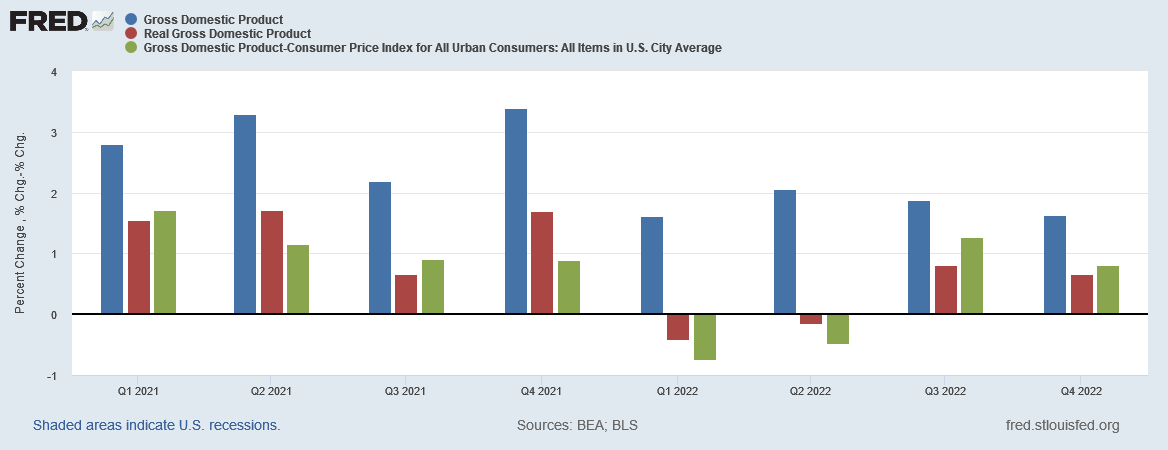

The major drag on the GDP numbers is still consumer price inflation, as a simple comparison between nominal GDP and “real” GDP stated in 2012 dollars illustrates.

Reminder: even the “real” GDP figures must be kept in context, as an alternate calculation of “real” GDP numbers by subtracting the consumer price inflation rate from the nominal GDP growth rate illustrates (green bar). That alternate calculation tracks closely with the “real” GDP numbers for the most part, although there can be significant variance in both directions (i.e., some periods the “real” GDP numbers in 2012 dollars overstates economic growth and some periods it understates it).

Moreover, we must always keep the impact of consumer price inflation on GDP growth in mind. If we index the GDP numbers to 2017, we begin to see the cumulative effects of consumer price inflation, in the form of a real GDP number that is steadily shrinking relative to nominal GDP.

Viewed another way, real GDP has shrunk from 93% of nominal GDP in 2017 to 79% in 2022.

This is the damage consumer price inflation does: it hinders and diminishes economic growth. This is the toxic effect we see from any non-zero level of consumer price inflation. As the inflection point in 2020 indicates, in the aftermath of the 2020 pandemic and government-mandated recession, inflation has been particularly toxic to the economy.

Left unsaid in the BEA economic reports is the reality that in both nominal and real terms, GDP growth in 2022 was significantly weaker than in 2021. This is the immediate takeaway from looking at the quarterly GDP figures for 2021 and 2022.

Without a hint of irony, the identified culprit for this weakening economic outlook is declining consumer spending, particularly as regards the adjustment to the fourth quarter estimates.

Consumer spending, the main engine of the economy, grew at a 1.4% annual clip instead of 2.1% as originally reported. That mostly explained the downgrade in GDP.

The slowdown in spending suggests the new year got off to a weak start. Economists say the U.S. will will be hard-pressed to match even the modest performance of the fourth quarter in the first three months of 2023.

At the same time, corporate media’s economic “experts” claim the American consumer is burning through his store of savings, which will bring on a recession (remember, corporate media is still denying the recession has already started).

Despite high inflation, rising interest rates, and consistent recession predictions from Wall Street, Americans have continued spending at near a record pace over the past year, opting to splurge on Disney vacations and DoorDash deliveries.

Rising wages and a “cash buffer” of savings that was built up during the pandemic—when spending slowed and benefits like stimulus checks and enhanced unemployment boosted incomes—have provided consumers with “unprecedented spending power,” according to Liz Young, head of investment strategy at SoFi, an online bank. But data shows many Americans have begun financing their new spending habits with credit cards and draining their savings in recent months, as the cost of living soars. Some experts fear that means a spending slowdown—or even a recession—could be on the horizon.

How it can be that there can be “near record” consumer spending while declining consumer spending generates a mere 2.7% of real GDP growth is, naturally, a question never explored by the corporate media.

The question takes on added significance given the reported surge in consumer spending in the BEA’s January Personal Income and Outlays Report—which printed at more than two times overall Personal Income.

Personal income increased $131.1 billion (0.6 percent) in January, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $387.4 billion (2.0 percent) and personal consumption expenditures (PCE) increased $312.5 billion (1.8 percent).

The BEA assessed declining consumer spending at the end of 2022 and then reports an explosion of consumer spending in January—all without batting the proverbial eye.

Still, the actual dynamics of consumer spending remains very much a relevant question, and the answer might lie in some of the more disheartening realities surrounding the average American consumer.

Reality check #1: Real retail sales peaked in March, 2021, and have been declining ever since.

In other words, don’t put too much faith in claims of massive consumer consumption. There’s a lot less actual consumption than the experts would like to believe.

Reality check #2: While credit card debt has been rising since early 2021, so, too, have credit card delinquencies.

Moreover, relative growth in credit card debt exceeded relative growth in consumer spending throughout 2022.

Throughout 2022, Americans increasingly used credit rather than income to finance their spending, taking on more credit card debt even as they are less able to finance that debt.

Reality check #3: Americans are less able to finance their debts because, contrary to the media narratives, wage growth has lagged behind consumer price inflation since early 2021.

One reason credit card debt is increasing is because people are having to pay more even as they buy less.

The “experts”, of course, are gloriously oblivious to these mundane economic realities:

Since early 2020, it’s true the consumer has built up a cash buffer, and has benefitted from wage growth. That’s provided unprecedented spending power, and judging by a rebound in retail sales and consumer confidence indicators, people are still spending in a big way.

But the liquidity candy bowl is gone and isn’t coming back any time soon. If we want to go buy our own candy, it’s more expensive than before. My intuition and common sense says there’s not a bottomless pit of savings to support this level of spending, and there’s not a bottomless pit of wage growth to keep it elevated enough to drive GDP indefinitely. I often wonder if the market is simply ignoring this possibility, or if I’m underestimating the strength of the consumer. Time will tell, but I still believe something’s gotta give.

Note how investment “expert” Liz Young stumbles right over the key point: “If we want to go buy our own candy, it’s more expensive than before.”

Um…yeah…that’s pretty much what consumer price inflation means—everything is more expensive. That is why consumer price inflation makes a mockery of any and all claims of “wage growth”. When inflation outpaces nominal wage growth there is no real wage growth.

The data is unequivocal on this point. Real wages are shrinking, and have been since March, 2021.

Declining incomes reduce the consumer’s ability to service debt of any kind.

Reality check #4: people are experiencing longer periods of unemployment, which means their incomes are significantly reduced rather than expanded, and in both nominal and real terms.

Even though initial claims have been trending down, indicating fewer people are losing their jobs, the rise in continuing claims means those who have lost their job are taking longer to find a replacement income.

Moreover, when one looks at the 4-week moving averages, which tend to be a better depiction of the overall trend, one immediately sees that the periods of joblessness began increasing in this same fourth quarter of 2022 the BEA felt obliged to downgrade in terms of economic performance.

Reality Check #5: Inflation does a wonderful job of concealing a lack of growth in real sales—real retail sales have been declining since March of 2021.

If we index nominal and real advance retail sales to March of 2021, we immediately see that, by the end of 2022, real sales declined by more than four percent.

Similarly, the growth in consumer spending is not quite as impactful as the “experts” are wont to believe. If we index real personal consumption expenditures and real GDP numbers to January of 2021, we see that, over the past two years, real GDP has shown more relative increase than the real personal consumption expenditures.

In other words, consumer spending is contributing less to GDP growth at the end of 2022 than it did at the beginning of 2021.

Taken together, these add up to an economy that is steadily getting weaker, not stronger. If these trends continue we are likely to see GDP numbers that are weaker for 2023 than we have seen for 2022.

This is what a stagflationary recession looks like—lingering joblessness, weak growth, uncontrolled (and perhaps uncontrollable) inflation.

This is the recession we have, have had, and will continue to have.

With the downgraded GDP growth estimate for the fourth quarter of last year, this is the recession the BEA numbers are telling us has been worse than the “experts” have understood, and which is going to get worse still before it gets better.

Thanks for this. I agree with you - all the important economic data/statistics are no doubt manipulated to hide the truth. Government officials have done the exact same thing with all the important Covid data and metrics.

I think CPI or "real inflation" plus "unemployment" and GDP are all rigged/manipulated - and have been for many years.