When the Bureau of Labor Statistics released its December Producer Price Index, Wall Street was not pleased.

The Producer Price Index for final demand declined 0.5 percent in December, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.2 percent in November and 0.4 percent in October. (See table A.) On an unadjusted basis, the index for final demand increased 6.2 percent in 2022 after rising 10.0 percent in 2021.

In December, the decrease in the final demand index can be attributed to a 1.6-percent decline in prices for final demand goods. In contrast, the index for final demand services rose 0.1 percent.

Prices for final demand less foods, energy, and trade services edged up 0.1 percent in December after increasing 0.3 percent in November. The index for final demand less foods, energy, and trade services advanced 4.6 percent in 2022 following a 7.0-percent rise in 2021.

While producer price inflation on the decline is notionally a good thing, the decrease was more than Wall Street was expecting, and it decided the greater than expected decrease was not a welcome surprise.

The 0.5% decline month on month beat Wall Street analysts’ expectations of 0.1% by a considerable margin, even though the “core” metric of PPI less food and energy matched Wall Street expectations.

The producer price index, which measures final demand prices across hundreds of categories, declined 0.5% for the month, the Labor Department reported Wednesday. Economists surveyed by Dow Jones had been looking for a 0.1% decline. The decline was the biggest on a monthly basis since April 2020.

Excluding food and energy, the core PPI measure rose 0.1%, matching the estimate.

However, the greater than expected decline in producer price inflation just happened to dovetail with the Census Bureau’s December retail sales numbers, which continued to show contraction after November’s abysmal figures.

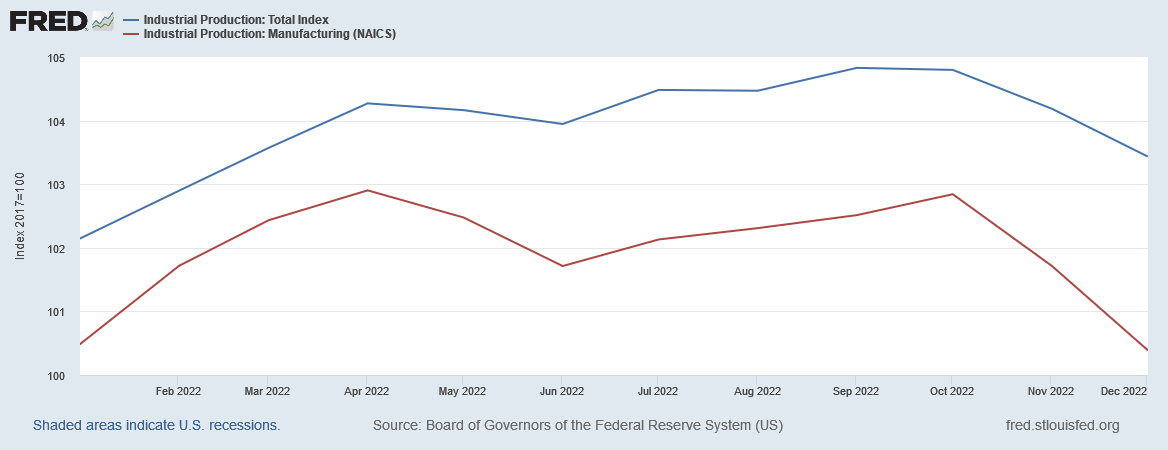

Additionally, the Fed’s Industrial Production and Capacity Utilization summary for December showed steep declines for both numbers, both overall and particularly in manufacturing.

Against this backdrop, Wall Street views easing Producer Price Inflation as the hallmark of the dreaded “R” word—”Recession.” Wall Street fears that recession has in fact arrived, and the Fed’s fantasy of a “soft landing” from its rate hikes has just been shredded.

"Coming on the back of the weakness in retail sales, the steep drop in industrial production and news of more job lay-offs adds to fears the US could already be in recession. This is the third consecutive month of contraction in industrial activity with output declines looking broad-based," ING said.

Of course, as regular readers of this Substack are already aware, a global recession has been ongoing for several months, going back at least to June of last year.

In every case, the OECD consumer price data shows that the global recession has in fact already begun. We are past the point of a “pending” recession and well into the period where recession is a present problem.

The December PPI report confirmed for Wall Street what Main Street has known for months: we’re in a recession and its getting steadily worse.

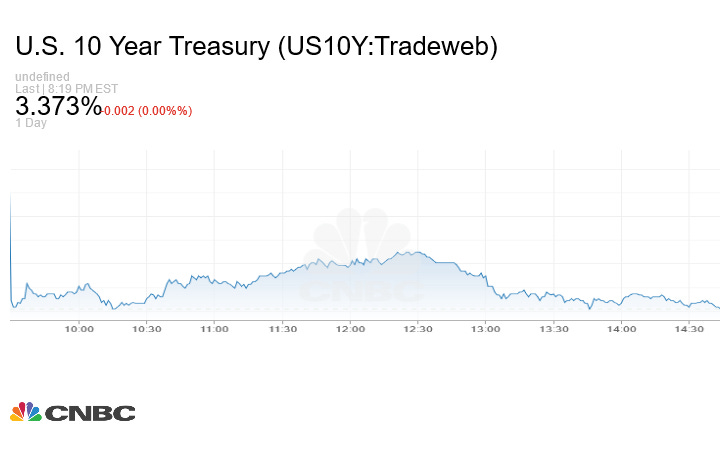

Wall Street responded predictably to the multiple recession signals. Stocks all went down for the day, and so did Treasury yields.

The Dow finished down over 600 points for the day.

At the same time, Treasury yields declined across the board, with both the 2-Year and 10-Year Treasuries dropping significantly.

With clear and unmistakable recession signals detectable even by Wall Street analysts, the market’s firm belief is that the Fed will now ease up on rate hikes and even “pivot” back to a looser monetary policy and rate cuts.

The lower inflation numbers are expected to impact Federal Reserve policy. Markets expect the central bank to raise its benchmark borrowing rate by 0.25 percentage point in February, representing another deceleration from what had been a blistering pace in 2022. The Fed hiked the rate 0.75 percentage point four straight times last year before approving a 0.5 percentage point move in December.

Exactly why Wall Street believes this remains a mystery, as the recession is at least six months old and the Fed has yet “pivot” back to Quantitative Easing and rate cuts.

Wall Street is now certain the Fed will raise the Federal Funds Rate by 25bps when the FOMC meets in two weeks.

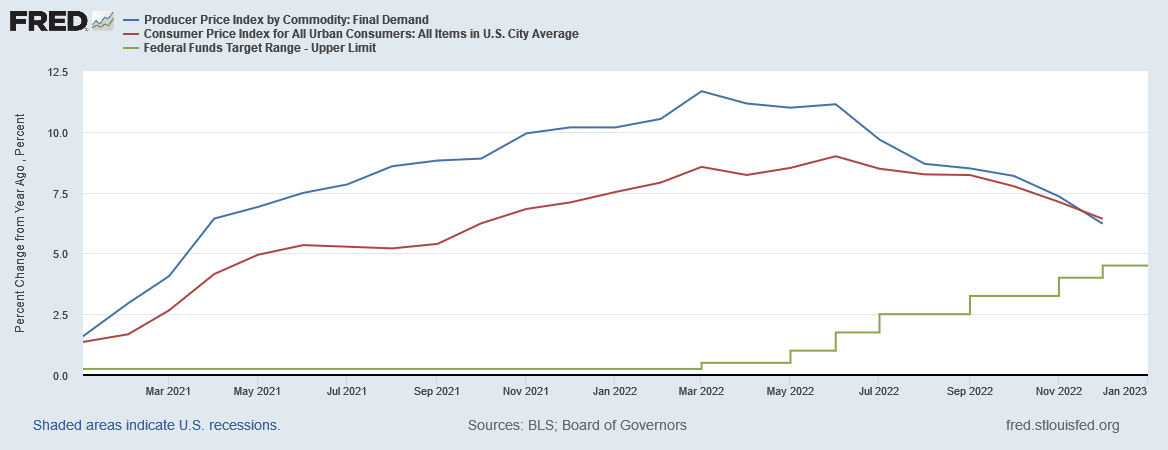

Moreover, the PPI data shows yet again that there was an economic inflection around June of last year. Producer price inflation and consumer price inflation both dropped dramatically between June and July.

After June of last year, both CPI and PPI began to trend downward at an increasingly steep rate of decline.

PPI peaked in March of last year, with CPI following in June—exactly the sort of linkage we should expect between the two, as the PPI is a leading indicator of the CPI.

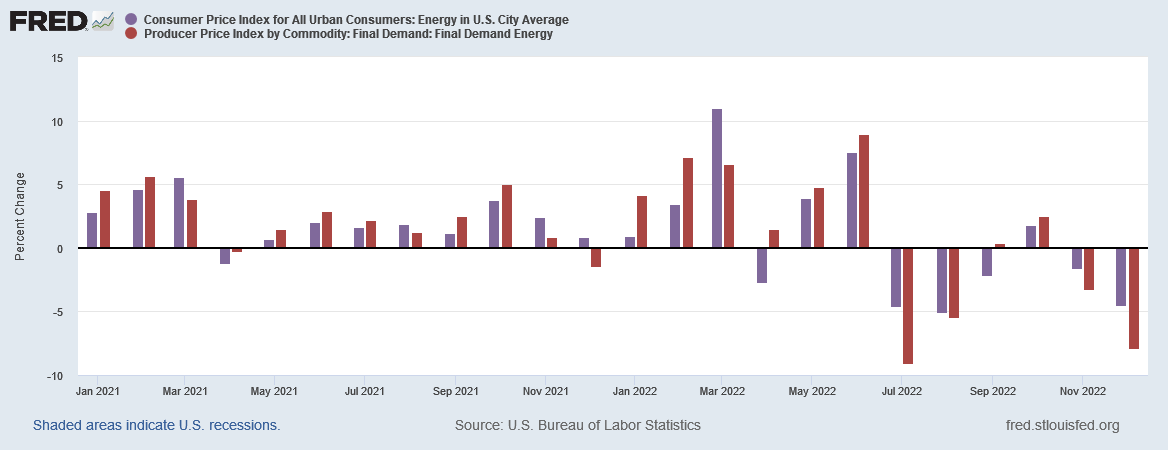

A major reason for the inflection point is that energy prices began to drop significantly after June.

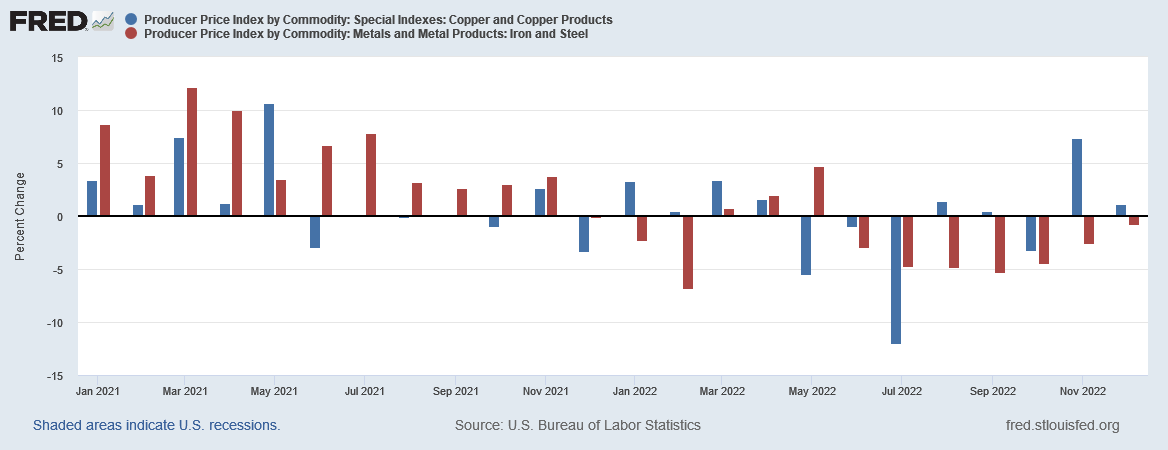

That same time frame also saw copper and iron commodity prices decline.

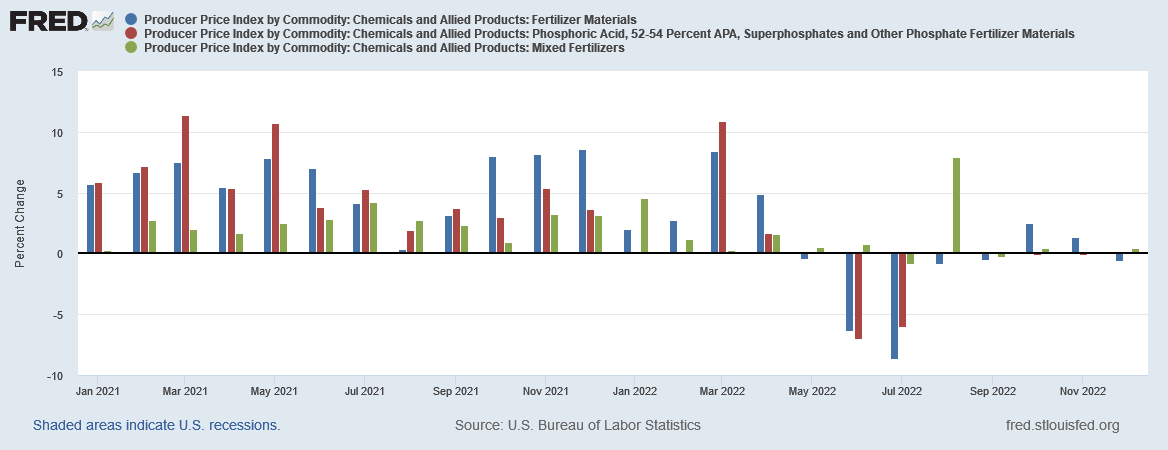

Fertilizer and fertilizer ingredients also showed markedly reduced inflation after June of last year.

This is also good news for farmers, as it confirms fertilizer prices will be cheaper going into the spring planting seasons.

Objectively, there is an argument to be made for the Fed pausing further rate hikes. With both core producer price inflation and core consumer price inflation approaching the upper limit of the Federal Funds rate, the odds that, after the next FOMC meeting and the anticipated 25bps rate hike, core inflation will move below the Federal Funds rate rises significantly. Whatever inflation the rate hikes might have wrung out of the economy (and the jury is still out whether any inflation was eliminated by the rate hikes) may be the extent of what rate hikes can accomplish.

This is particularly true if, as the New York Fed has suggested, 40% of current inflation is attributable to supply side factors not amenable to interest rate hikes.

However, should this prove to be the case, the Fed may find itself trapped in a rate hike dilemma. While inflation is declining now, many commodity prices, most notably copper and iron ore, are rising, and are forecasted to do so over the next few months.

Rising commodity prices are a precursor to renewed supply-side inflation, as commodity price rises move through supply chains, raising the costs of various manufactured goods.

Thus, if 40% of current inflation is attributable to supply side factors, and supply side factors are poised to trigger further price rises both in the PPI and the CPI, the Fed may find inflation heading up again later this spring but be utterly unable to do anything about it. Inflation will increase once more even as the economy contracts—a true stagflationary stew of bad news.

Wall Street is just now figuring all this out, and thus has only just now begun to unwind positions in stocks while staking out new positions in bonds, firmly convinced a Fed pivot is in the offing (based on Jay Powell’s stance to date, no, it isn’t).

Wall Street has finally realized that declining inflation rates are good news only so long as they keep declining, and we are getting close to a potential inflection point where they will not keep declining. The Fed has not articulated its strategy for that scenario—which almost certainly means they have no strategy.

The times continue to get ever more “interesting”…..

Thank you. I'm sitting tight and not rushing into bond funds because the MM settlement fund is paying 4% and waiting. I know Bogleheads.org says being out of the market in cash is not wise and losing due to inflation, but we're nervous after 401k losing 20%. We'll see what happens in 2 weeks...