Previously, I have said that the inflation signals in the Consumer Price Index were sufficiently unclear as to make the Liberation Day tariffs the deciding factor in whether we would see increased consumer price inflation or not.

What we can say is that the inflation and price data itself is sufficiently mixed that the tariffs are likely to be the deciding factor in whether we get rising consumer price inflation or consumer price disinflation. The “normal” consumer price data genuinely has no clear inflation signal, and that makes the tariffs themselves all the more determinative.

The Producer Price Index Summary data released by the Bureau of Labor Statistics does not alter that ultimate conclusion, but it does offer further hints at some deflationary impulses which will be moving through the economy in April and May.

The Producer Price Index for final demand decreased 0.4 percent in March, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices increased 0.1 percent in February and 0.6 percent in January.

The 0.4% month on month drop in the PPI for Final Demand comes, folks will recall, on top of the 0.1% month on month drop in consumer prices per the Consumer Price Index. As the Producer Price Index is generally a leading indicator for the Consumer Price Index, a decrease in producer prices suggests there is a deflationary impulse which will be moving through the US economy over the next couple of months.

While the Liberation Day tariffs are still poised to be the deciding factor regarding immediate pricing trends within the US economy, the presence of additional forces both inflationary and deflationary still influence the magnitude of any pricing shifts up or down.

A quick survey of what the Producer Price Index data holds is therefore in order.

PPI Printed Deflation Across The Board

While the Consumer Price Index showed a strong disinflationary trend within core prices, the Producer Price Index showed a far stronger deflationary impulse, with deflation printing almost across the board. As noted by the BLS, PPI for Final Demand showed 0.4% deflation month on month, although “core” producer prices (PPI for Final Demand less Food and Energy) remained in disinflation.

Producer energy prices were down 1.6% month on month.

Producer food prices also dropped 1.6% month on month.

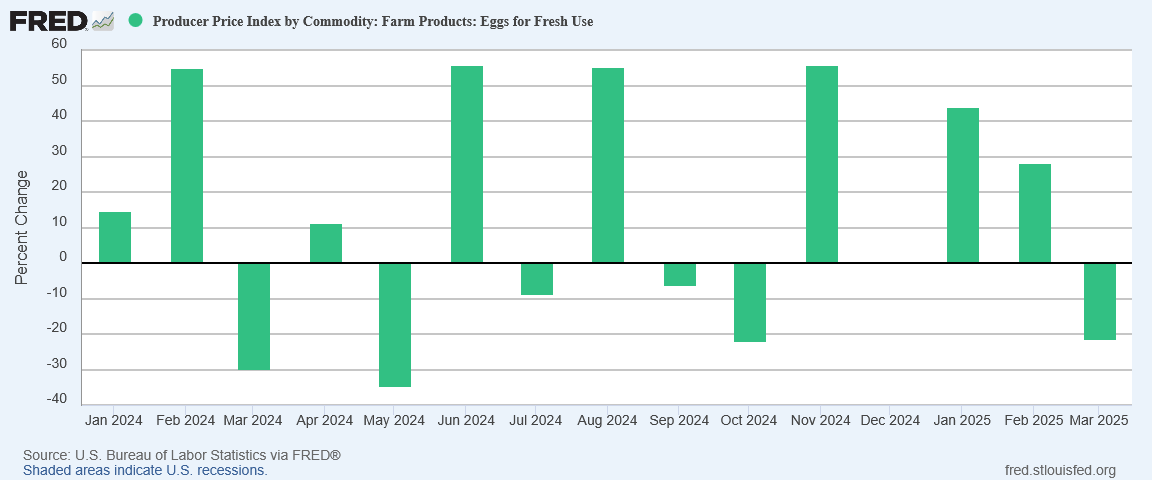

Much to the chagrin of the corporate media, which yesterday had focused on egg prices as the only real negative point they could emphasize in the Consumer Price Index report, producer prices for eggs fell 21% month on month.

Goods prices came down 0.4% month on month.

Service prices slipped just barely into deflation at 0.02% month on month.

Of the major producer price categories, only construction showed any rising demand, with a 0.4% month on month increase.

All of these deflationary impulses in producer prices will move through the economy to consumer prices over the next couple of months. The breadth of producer price deflation for March alone suggests that deflationary impulse is likely to be significant.

Intermediate Demand Implies More Deflation To Come

Perhaps more intriguing than the final demand data, however, is the intermediate demand data. Intermediate demand goods and services are those which are consumed at various stages of a supply chain, with the various stages of intermediate demand giving us a price outlook on the various stages of product and service supply chains.

All four stages of Intermediate Demand are showing either outright deflation or disinflation for March.

If we look at the breakdown for Intermediate Demand in terms of goods and services, we again see the cooling trend cutting across all categories.

Processed goods are printing disinflation rather than outright deflation, but the downward trend is unmistakable.

If we break Intermediate Demand down by service category, the cooling trend is still broadly maintained.

Only Transportation and Warehousing for Intermediate Demand is showing any rising price inflation.

While this data does not necessarily indicate the start of a broader deflationary or disinflationary trend, it does indicate that the deflationary impulse will extend past April and into May, possibly even June. While we cannot determine the magnitude of that impulse, the producer price data does indicate that the impulse may be extended over time.

Tariffs Remain The Wild Card

The Producer Price Index Summary does not mean the tariffs will be any less impactful on consumer prices or the US economy overall.

Nor does the producer price data mean that the US economy is on the verge of major deflation such as what is unfolding in China currently.

The United States would have to experience many months of producer price deflation for that to be the case.

However, what the producer price data does show is that there are some significant downward pressures on prices that have yet to fully resolve themselves within the US economy. These are downward pressures that did not present themselves last month, and there is no reason at present to presume that they will present themselves again next month. These downward pressures are going to reduce any inflationary impact of the Liberation Day tariffs still in effect, including the punitive tariffs being applied against China.

The punitive rates on China suggests that the immediate impact of the Liberation Day tariffs will be inflationary. With tariffs of up to 145% being applied to Chinese goods, there seems little chance for those tariffs not to cause an increase in some prices. A 145% price increase is far too much for any vendor to be able to absorb entirely.

However, the producer price data indicates that at least some of the base prices even before the tariffs are applied might be reduced. That would limit the magnitude of the increase on consumer prices from March. This is one more example of the myriad of inflationary and deflationary forces which must be resolved each month to ascertain whether the net effect of all such forces is inflation or deflation.

The Producer Price Index Summary for March indicates there are a number of forces that will be pushing consumer prices down in April. These forces necessarily will mitigate tariffs pushing consumer prices up.

The tariffs are still likely the prime determinant of April consumer price levels. At the same time, we are seeing a number of forces emerge which will tend to reduce and minimize the tariffs’ ultimate impact.

The tariffs are still very much the wild card regarding what happens next with consumer prices in the US. The producer price data, however, suggests that whatever does happen next may not be as wild as corporate media has been suggesting.

Great work, Peter! And more good news for Trump! He’ll have a few months with good economic data to counter the opposition. If all goes well, the disinflation and deflation will go on just long enough to offset any undesirable effects from tariffs - but not long enough to mire the U.S. economy in the quicksand of persistent deflation.

The net effect may be that Trump’s team will be able to smirk into the opposition’s faces saying, “See? The tariffs worked!”

The one caveat here, Peter: are there plausible ways that the opposition can sabotage these deflationary trends?