Federal Reserve Does The Expected And Hikes Interest Rates 0.75%

The Recession Will Proceed As Intended..But With The Intended Consequences?

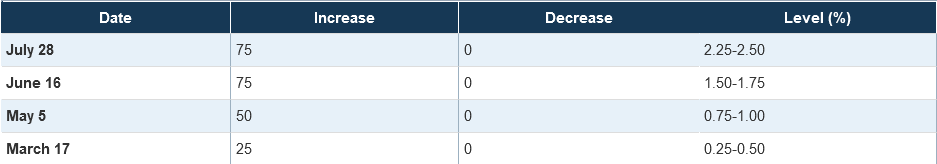

The Federal Open Market Committee concluded its July meeting yesterday with a decision to raise the Federal Funds Rate another 75bps (0.75%), to an effective range of 2.25-2.50%, while promising to continue reducing the Federal Reserve’s balance sheet.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2-1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

The Fed’s actions had been widely anticipated by Wall Street, which reacted positively to having its expectations met.

Having mollified Wall Street for now, the Federal Reserve is now at liberty to continue with its plans for reducing the economy of the United States via interest rate hikes and deliberate demand destruction. The Fed-induced recession will proceed as intended, although the consequences may be not at all what is intended.

Market Expectations And Consensus Were Met Exactly

After June’s Consumer Price Index report showed inflation continuing to rise despite the Fed’s previous rate increases, further rate hikes by the Fed were seen as inevitable. The June Employment Situation Report, sketchy though it is, made a July rate hike inevitable.

However, recent signs of possible labor weakness also began to undermine the case for a full percentage point hike, which for a time had seemed the most likely scenario. Consequently, by this week the market consensus was for a 75bps hike, as the Fed ultimately delivered.

However, prior to the rate hike announcement, the prevailing worry in stock markets around the world was that the Fed would ultimately overtighten and trigger a global recession.

The Fed on Wednesday is expected to announce an increase of up to three-quarters of a percentage point in its benchmark interest rate, triple its usual margin. Investors worry such aggressive action by the Fed and other central banks in Europe and Asia to control inflation that is at multi-decade highs might derail global economic growth.

This concern is, of course, futile, as the global recession is already happening.

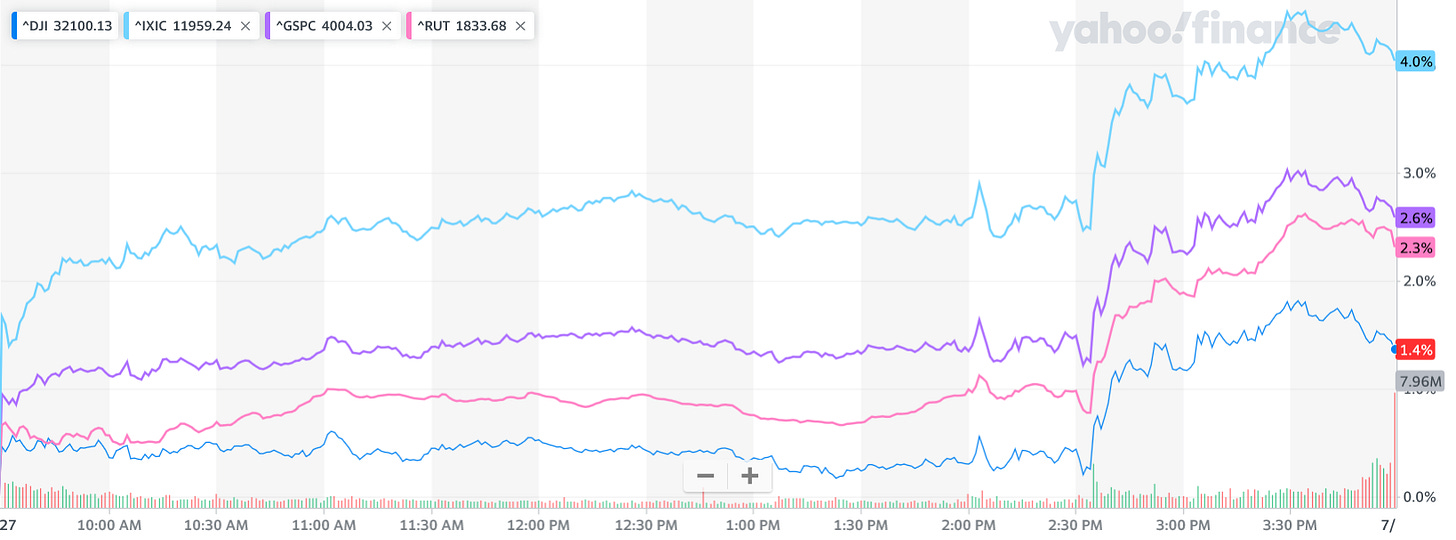

Despite the pessimism, the US stock markets all rose sharply after the Fed’s announcement.

Treasury yields also responded positively at first, dropping dramatically for both 2 Year and 10 Year Treasuries.

Overall, the markets were quite happy with the Fed for having delivered the exact rate hike already priced in.

Recession Red Flags—Are Rate Hikes Doing More Harm Than Good?

While the 10 Year Treasury yield declined less than the 2 Year yield, thus closing slightly the inversion between the two, Treasury yields remained inverted across the entire yield curve, with the 1 Year Treasury yield higher than the 2 Year, which in turn is higher than the 5 Year, which in turn is higher than the 10 Year Treasury yield. This is on its own quite a strong recession signal, as it shows investors are more pessimistic about near term results than the longer term (the general behavior is for yields to rise as one moves out along the yield curve).

Such recession signals pose an ongoing challenge for the Fed, as they complicate making the case for future rate hikes, a reality the Fed all but conceded during its rate hike announcement.

Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

However, Jay Powell, in the press conference that followed the rate hike announcement, repeated the government mantra that the US economy is not in recession (even though it is).

“I do not think the U.S. is currently in a recession and the reason is there are too many areas of the economy that are performing too well,” Powell said at a press conference following the Fed’s decision to raise rates by 0.75 percentage point for a second consecutive time. “This is a very strong labor market ... it doesn’t make sense that the economy would be in a recession with this kind of thing happening.”

As yesterday’s article for paying subscribers detailed, the labor market is only “strong” if one takes the June Employment Situation Report at face value—which is unwise, given its indulgence in Lou Costello Labor Math.

A “strong” labor market would not show a rising trend in first time claims for jobless benefits, nor a rising trend in the 4-week average for jobless claims.

A strong labor market would not show declining numbers of employed persons.

Quite the contrary, the total number of people employed in this country peaked right as the Fed’s rate hikes began, and has been trending down ever since—an indication that jobs destruction is already beginning even as inflation continues to rise.

One key point to note: Employment in 2022 is seemingly far more sensitive to interest rate hikes than in 1979-1980.

If the twin trends of declining employment and rising inflation continue, the current recession—and declining employment is a very strong signal a recession is underway even by NBER standards—is potentially more stagflationary than even the 1980 recession engineered by former Fed Chair Paul Volcker to combat the hyperinflation of the 1970s.

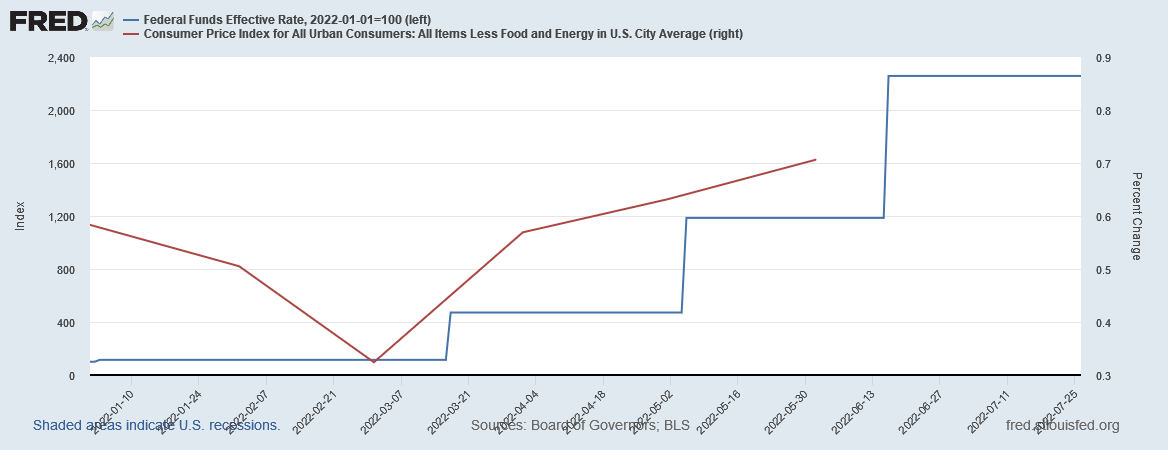

While it is too soon to tell if this is the case, it is certain that the Fed’s rate hikes thus far have had only minimal impact on the money supply (which the interest rate hikes are meant to reduce).

Thus while the current Powell recession is potentially worse than the Volcker Recession, the therapeutic benefit of interest rate hikes has yet to be seen. The probability the rate hikes are doing more harm than good, while still small, is discernible and rising.

Powell More Hawkish Than Volcker?

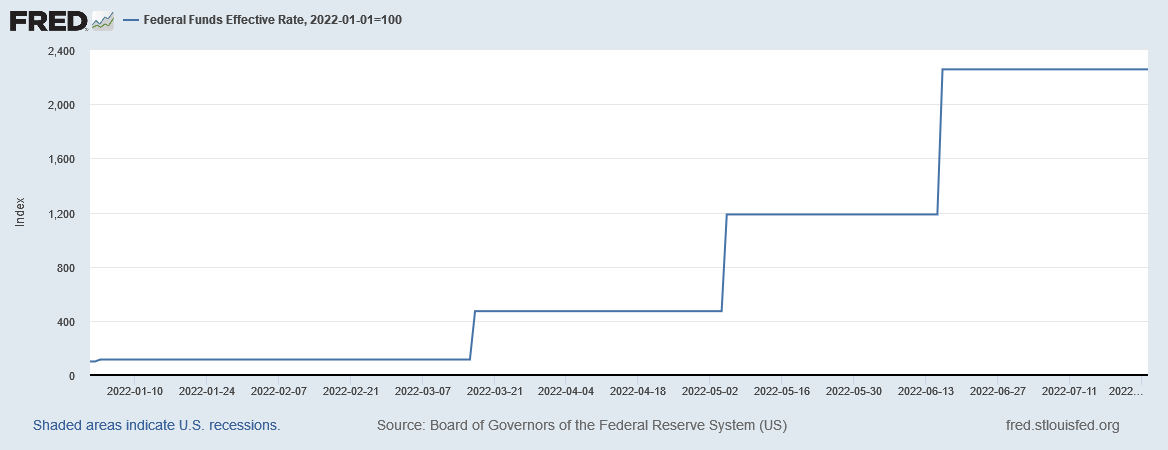

One possible reason the rate hikes might be counterproductive is the paradoxical reality that, while the Fed’s current rate hikes are in absolute terms much smaller than Volcker’s, Volcker started with much higher interest rates, making the current rate hikes are several orders of magnitude greater than anything attempted by Volcker during the early 80s—while Volcker’s rate hikes merely doubled the federal funds rate from where it was at the start of 1979, Powell’s rate hikes represent an increase of over two thousand percent since the beginning of the year.

An additional paradox: Volcker’s relatively smaller rate hikes showed greater impact on consumer price inflation than Powell’s relatively larger ones.

If we consider relative interest rate changes from the beginning of a policy of raising the federal funds rate, Powell is already more hawkish than Volcker ever contemplated, but with virtually nothing to show for it.

Whether the relative magnitude of interest rate changes or their absolute value is the principal determinant of how interest rates will affect the economy is the experiment we are currently living. Given that employment is currently on the decline and inflation is not, it is impossible to state with confidence what the outcome of this experiment will be.

What can be stated with confidence is that Powell himself is blissfully unaware of having launched this economic research project. His artless comments during yesterday’s press conference show that he is not looking seriously at any of the data, but is merely consuming the headline metrics: Inflation is up, so interest rates must go up; the Employment Situation Report states jobs were created, so the labor market must be strong; the NBER has not called a recession yet, so the recession must not be happening.

What Comes Next? Nobody Knows

While it is easily demonstrated that Jay Powell is well nigh clueless on what is happening with the US economy, that Wall Street’s initial response to the Fed’s rate hikes yesterday was favorable makes a case that just about all of the “experts” are in the same situation. Whether on Wall Street or in Washington, the “experts” are all viewing the current situation through an historical lens, without appreciating the significant ways in which the current situation is truly different from the past.

Powell’s inflation is not Volcker’s inflation. Powell’s rate hikes are not Volcker’s rate hikes. Powell’s labor markets are not Volcker’s labor markets.

Powell’s recession will not unfold at all like Volcker’s recession.

That much is certain. What is uncertain is whether Powell’s recession will be milder or worse. We won’t have the answer to that question until it is far too late to do anything about it.

"with virtually nothing to show for it"

You know, if they keep destroying the energy market, this "transition," it won't make a flying EFF what they do.

How did the energy market of the 70-80s compare to today?

Once again, fantastic article.

Impressive how you really have gotten your head wrapped around this, and make these historical comparisons, then put it all down where us non-analyst types can understand.