Inflation, Disinflation, or Deflation?

What Might We Expect in Tomorrow's CPI Release?

I generally refrain from prognosticating on what an upcoming inflation release will contain. My preference is to focus on analyzing what is, rather than speculating upon what might be.

However, with the July Consumer Price Index Summary due out tomorrow, and the Producer Price Index Summary the day after, a quick look at a few recent pricing trends is not inappropriate, with a view towards assessing their potential impact on the Consumer Price Index and its components.

Are we facing renewed inflation, continuing disinflation, or might we even be encountering deflation?

Let’s consider what the data says.

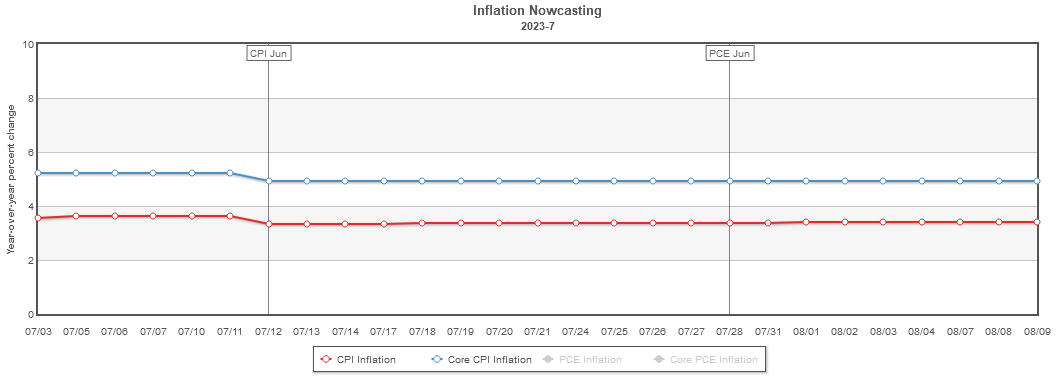

We begin by noting that the Cleveland Federal Reserve’s InflationNow nowcast projects that year on year headline consumer price inflation will come in at 3.42%, with year on year core inflation coming in at 4.92%.

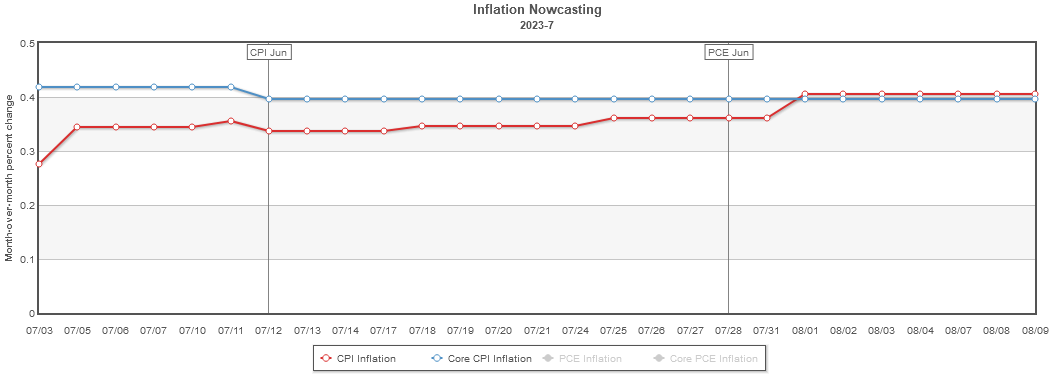

Month on month headline inflation is nowcast to print at 0.41%, with core inflation printing at 0.40%.

In June headline inflation printed at a seasonally adjusted 3% year on year and 0.2% month on month. Core inflation printed at a seasonally adjusted 4.86% year on year and 0.15% month on month.

Without seasonal adjustments headline inflation was 3% year on year and 0.32% month on month. Core inflation printed at 4.82% year on year, and 0.26% month on month.

The Cleveland Fed nowcast is coming in somewhat pessimistic relative to where inflation was reported for June.

On the flip side, Wall Street is projecting headline inflation to print at around 3.3% year on year. Once again, Wall Street is populated with optimists.

Traders of derivatives-like instruments known as fixings expect a 3.2% annual headline CPI rate for last month, just a bit under the 3.3% median estimate of economists polled by The Wall Street Journal and up versus June’s 3% reading. The monthly core CPI rate, which strips out volatile food and energy prices, should either match economists’ 0.2% median estimate or come in slightly less than that, said traders and other analysts, depending on whose calculations are used. The annual core rate is expected to be 4.7% versus 4.8% in June, according to the Wall Street Journal poll.

These estimates appear to be the near universal consensus on Wall Street.

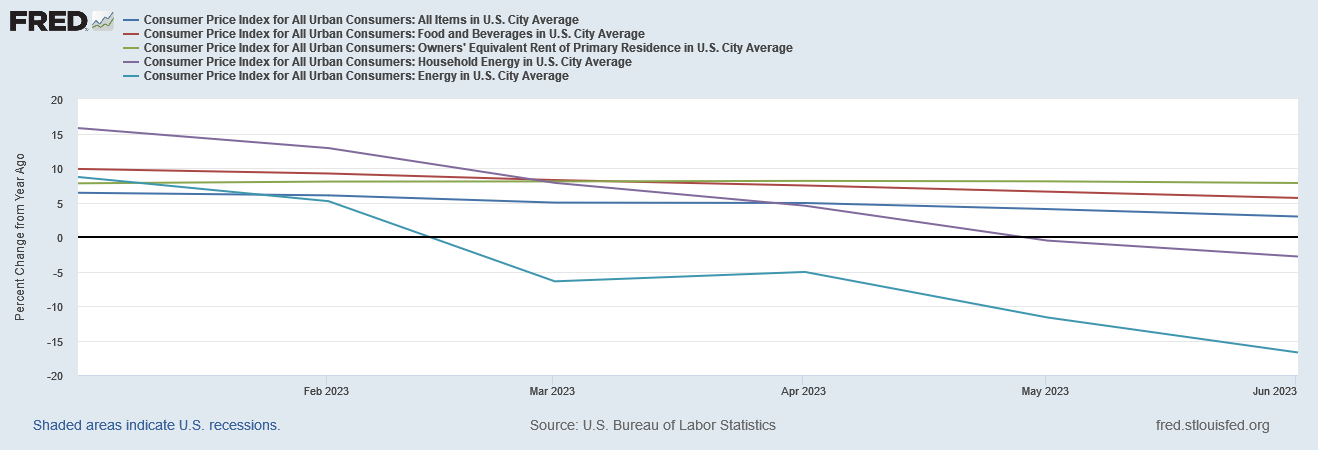

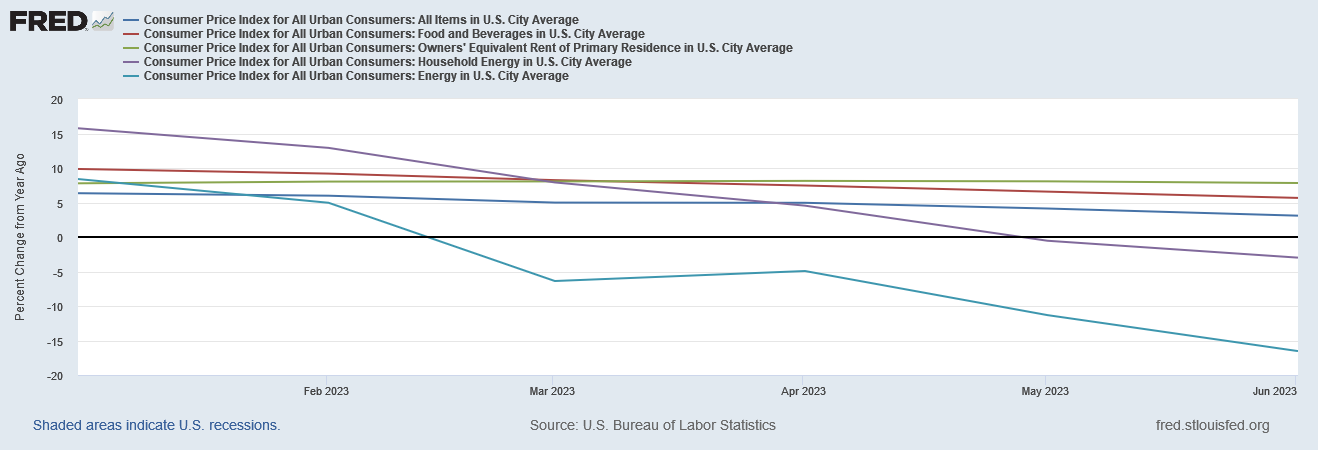

Year to date, the unadjusted CPI and several of the key sub-indices have shown progressing year on year disinflation and even deflation in the case of the energy metrics.

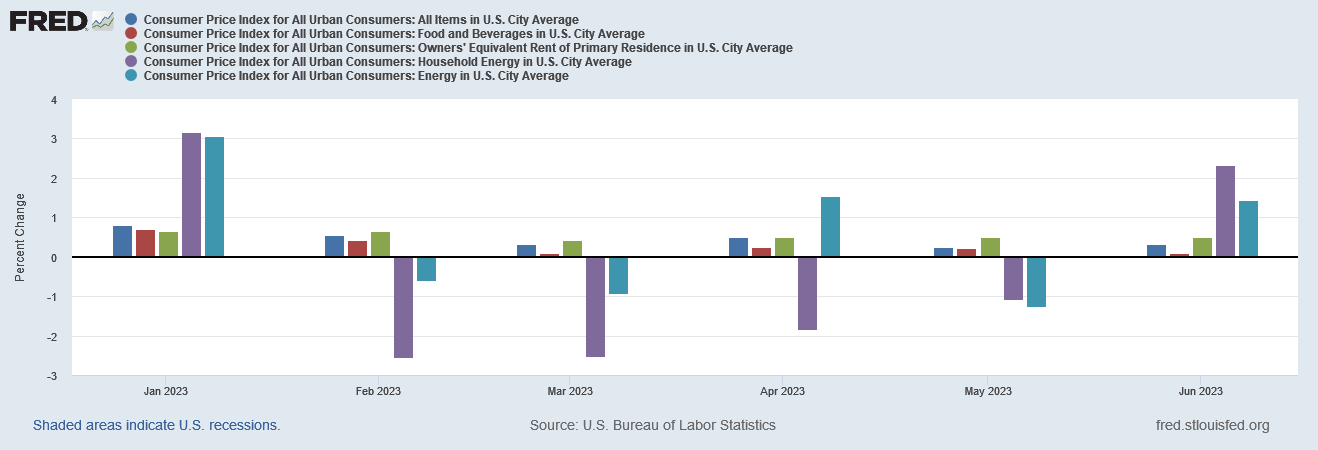

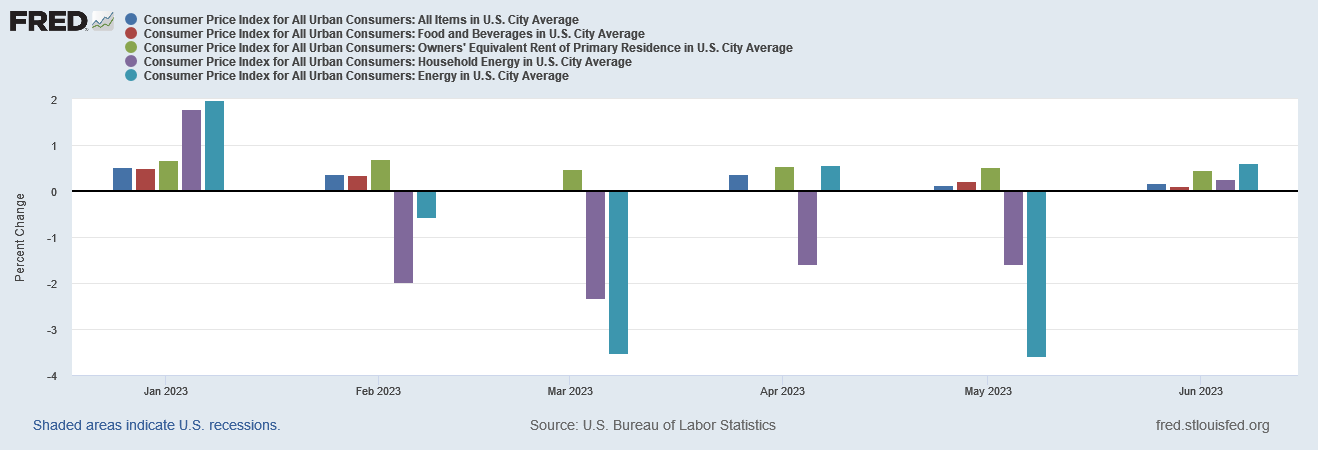

However, month on month, unadjusted headline inflation and energy price inflation both rose in June.

The seasonally adjusted data is not much different, with a progressing disinflation/deflation trend year on year.

Month on month, the seasonally adjusted headline inflation and energy price inflation metrics also rose in June.

While it is unlikely July will show sufficient energy price increases to eliminate the year on year energy price deflation margin, that energy prices ticked upward in June suggests that the disinflation/deflation trend is ending for energy, and we should anticipate a few months at least of month on month energy price inflation.

Certainly, the recent rises in supply concerns within oil markets is highly supportive of higher energy prices, and we should expect those to continue to be transmitted through to the CPI.

One point is not up for debate: energy prices have risen in July. It is mathematically certain the month on month energy price inflation metric will be positive.

It may be even be significantly positive, for energy prices have risen literally across the board.

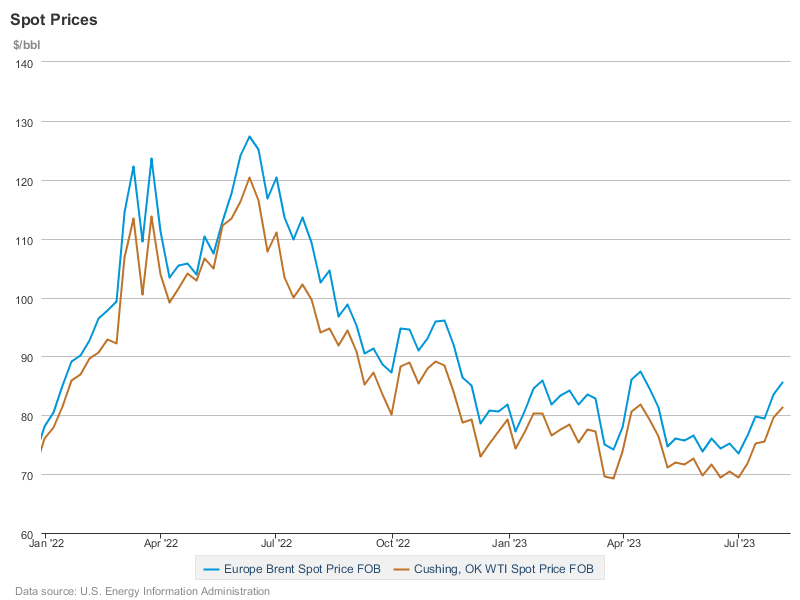

Crude oil prices are up.

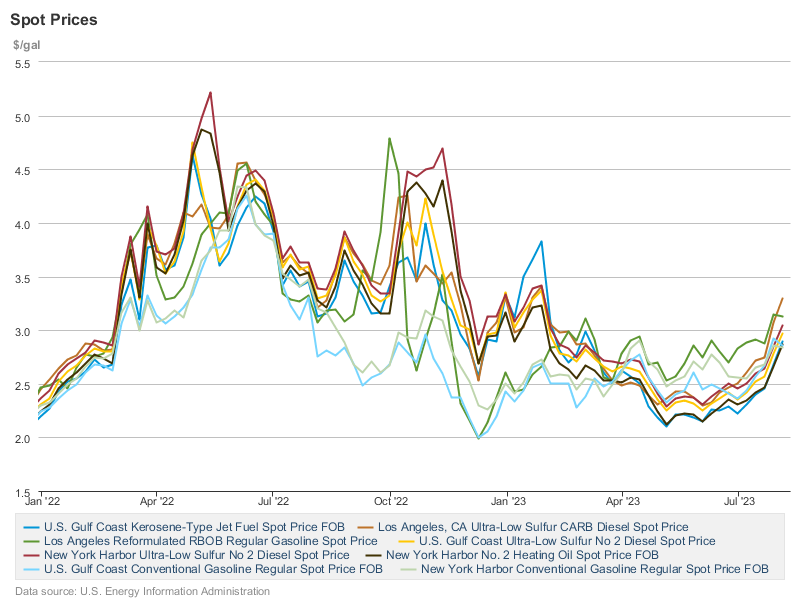

Refined product prices are also up.

Year on year, crude prices are still down from where they were in July of 2022, which indicates continued disinflation along that dimension. Refined product prices are a bit more problematic year on year, with some prices such as gasoline actually higher than they were in July, 2022. Energy prices will likely still show disinflation year on year, although it will likely be significantly less than it was in June.

With ongoing supply constraints and potential new supply risks from the war in Ukraine emerging, we may very well see a sustained period of month on month rises in energy price inflation. Whether they will be sufficient to unwind the energy price deflation we’ve seen year to date is problematic. I certainly do not rule it out, but there is nothing at this time which definitively says it must happen this time.

We may also see an uptick in food price inflation, particularly if the US follows the global trend as reported by the UN Food and Agriculture Organization. The FAO saw food prices inch up in July.

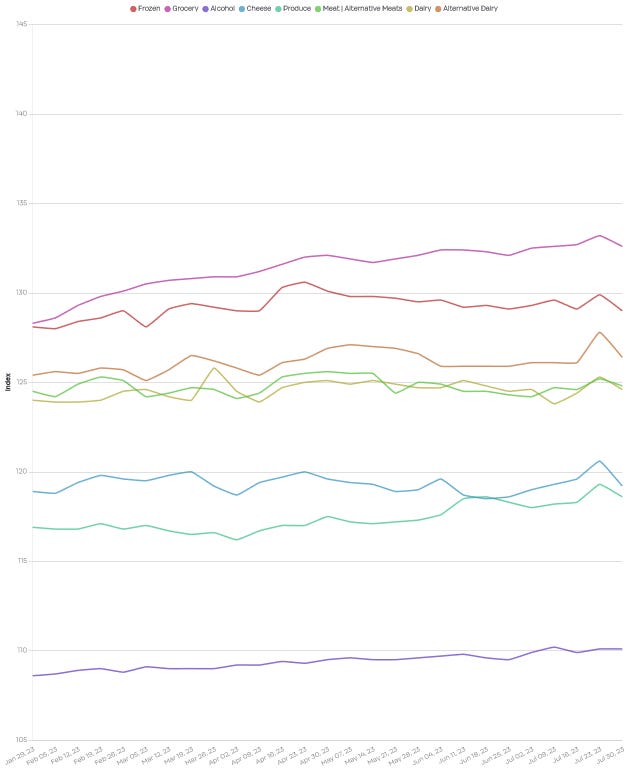

Broadly speaking, grocery prices in the US are mostly stable or trending up only marginally, according to retail analytics firm Datasembly.

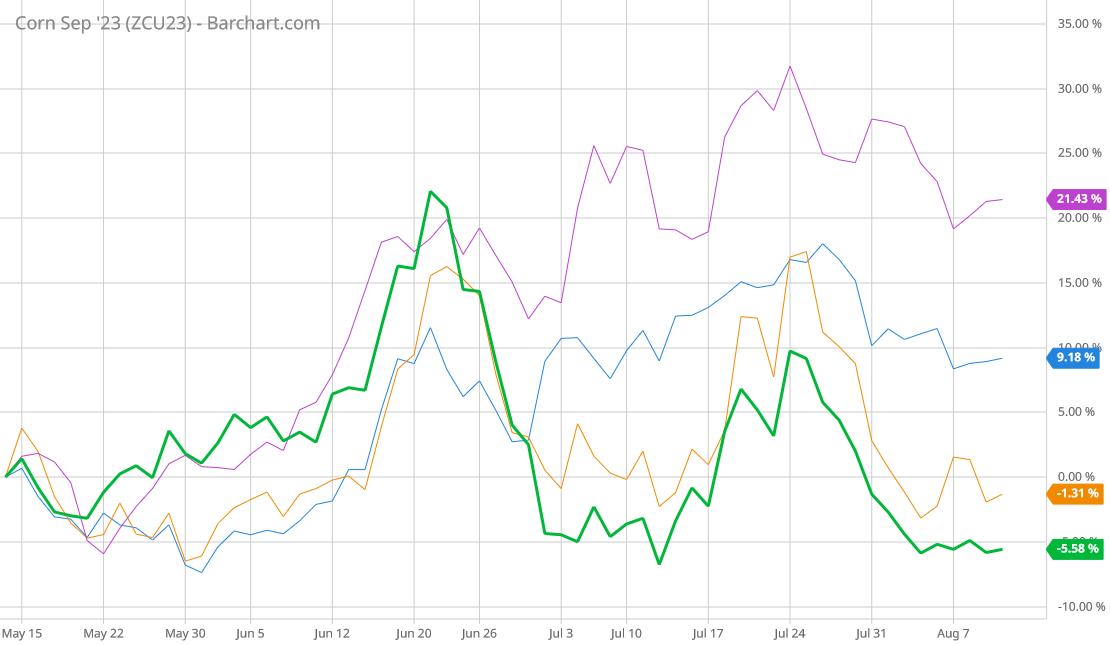

Grain commodities have had a mixed performance over the past two months, with corn and wheat posting modest decreases on the September contract while soybeans and oats posted increases.

Between global trends and US retail trends, there may be some moderation of food price inflation still, but it is not likely to be much, and we may even see food price inflation rise month on month.

Food and energy are traditionally the most volatile of the Consumer Price Index sub-indices. It is perhaps not too surprising that we might see reverses in the disinflation trend for both. That we are facing an equally volatile geopolitical situation at the moment, almost of all of which is centered on the Black Sea and the war in Ukraine, we have to contemplate that increased prices to some degree are indicative of increased risk—whether those risks will continue even in the near term is impossible to say.

However, there are enough upward price pressures in both food and energy to make an incremental uptick in consumer price inflation likely, and enough geopolitical instabilities in regions where it counts to anticipate renewed energy price inflation and food price inflation.

I will leave numbers to the notional “experts” who microparse those numbers as if there is any relevance to them beyond the trends established across the data set. The data presents enough evidence that we should expect an incremental increase in consumer price inflation at multiple levels—anywhere from 3.2% to 3.4% for the headline rate.

Tomorrow we will know for certain how good my assessment here is. Fingers crossed!