Inflation Drops To 3%. Is There A "But..."?

Inflation Dropping Does Not Mean Prices Are Dropping

After the June Consumer Price Index Summary dropped, anticipating the media reaction was easy:

Who could blame them? The headline data unquestionably looks good.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in June on a seasonally adjusted basis, after increasing 0.1 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment.

With headline inflation almost at the Fed’s magic 2% goal, how could this be anything but good news?

Reuters had the most restrained response:

U.S. consumer prices rose modestly in June and registered their smallest annual increase in more than two years as inflation subsided further, but probably not fast enough to discourage the Federal Reserve from resuming raising interest rates this month.

The report from the Labor Department on Wednesday also showed underlying consumer prices posting their smallest monthly gain since August 2021. The considerable slowdown in underlying inflation ignited a rally on the stock market, with investors convinced that the U.S. central bank's fastest monetary policy tightening cycle since the 1980s was drawing to a close.

By comparison, CNN was absolutely ecstatic:

What a difference a year makes.

US annual inflation slowed to 3% last month, according to the latest Consumer Price Index released Wednesday by the Bureau of Labor Statistics.

That’s a sharp cooldown from June of last year, when surging energy costs helped inflation spike to 9.1% — the fastest annual rate since November 1981, when Olivia Newton-John’s “Physical” sweated its way to the top of the charts.

Yahoo! Financial was somewhat more guarded but still upbeat.

Consumer prices rose at the slowest pace since March 2021 as inflation showed further signs of cooling in June, according to the latest data from the Bureau of Labor Statistics released Wednesday morning.

The Consumer Price Index (CPI) rose 0.2% over last month and 3% over the prior year in June, a slight acceleration from May's 0.1% month-over-month increase but a slowdown compared to the month's 4% annual gain.

Naturally, Dementia Joe’s handlers had take their victory lap on Twitter.

However, not every voice was upbeat. Emily Miller, who writes the Substack Emily Posts News, noted that regardless of how much inflation had “cooled”, things still cost more than before.

Sen. Minority Leader Mitch McConnell explained how inflation has affected our daily lives in a list of how much more everything costs since Biden has been in office, like these:

Grocery (food at home) prices have increased 20%.

Gasoline (all types) prices have increased 52%.

Furniture prices have increased 18.8%.

Apparel prices have increased 10.8%.

But…surely inflation falling to 3% is a good thing? How can she be so wide of the mark to miss all this wonderful good news?

Comes the answer: Emily is not wide of the mark. Rather, she’s accurately pointing out that “disinflation” is not “deflation”—slower and smaller increases in the consumer price index are not the same as actual decreases, and without actual decreases it is not possible to truthfully say that costs are coming down.

As is plainly obvious from the Consumer Price Index itself, along with the Consumer Price Index Less Food And Energy (“core” inflation), prices are still going up.

It is important to remember that consumer price inflation itself is merely the rate of change in the Consumer Price Index. It is the slope of the graph for the line. Unless the slope becomes negative, unless the absolute value of the index itself shrinks, price levels are not coming down. Without that negative slope, without inflation becoming deflation, prices will not ever come down.

The differences in the slope of the CPI and the CPI less Food and Energy graphs also highlight how much headline inflation has been driven by energy price rises. That both graphs have a steeper slope after the government-ordered recession of 2020 than before highlights the reality that prices have risen much more sharply since the recession.

If we baseline both indices to the end of the 2020 recession, we also see that while headline inflation slowed significantly after June 2022, core inflation has remained largely unchanged.

If we instead look at the percent change year on year, the persistence of core inflation at 6% ±0.5% becomes clear.

This view also confirms that, for the second month in a row, core inflation has printed below that range, with headline inflation printing quite a bit lower than core inflation.

This “disinflation”—a slowing of the rate of price increases—is what Dementia Joe’s handlers rather artlessly characterize as “costs coming down.” As the data shows, overall price levels have not come down at all, but have continued to rise.

Returning to the absolute metrics of the indices themselves, when we look a the Consumer Price Index with either food, or energy, or both factored out, with the indices set to the end of the 2020 recession, we can see just how significant the surge in energy prices has been since 2020.

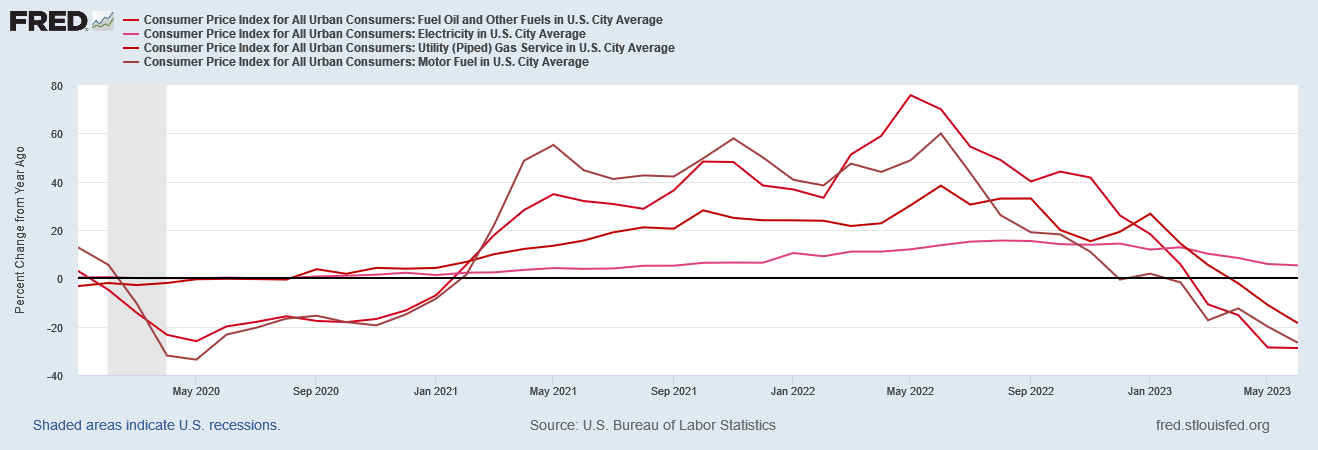

When we look at the index for just energy prices, we can see that energy prices both rose sharply after the 2020 recession, and have been declining since June of 2022.

So extreme was the rise in energy prices and so extended has been its decline that the year on year percent changes in energy prices put them in deflation since March of this year.

Viewed another way, since 2020, energy prices are still significantly higher—49.7% higher than at the end of the 2020 recession.

At the same time, since June of 2022 energy prices have fallen on average 16.5%.

If “Bidenomics” began twelve months ago, at least for energy prices it would arguably be success. Since “Bidenomics” began in January 2021, roughly two-and-a-half years ago, claims of its success are, to put it mildly, greatly overstated.

We should also note that even when we drill into energy prices, not all energy price categories have experienced deflation since June of last year. While the cost of electricity has had the smallest rise among energy categories, it is still rising and is not in actual price deflation.

Average shelter prices, on the other hand, have trended up since 2020, with no deflation showing up (yet) in the indices.

Moreover, food categories have risen between 11% and 24% since 2020, and are continuing to rise even after June of last year.

The prices of medical services have risen between 5% and 11% since 2020.

The prices for new and used cars, as well as their maintenance, have risen between 21% and 45% since 2020.

These are just a few of the various categories of goods and services tracked in the CPI, all showing significant price increases since 2020, and many of these are still rising.

Clearly, that tweet about costs coming down was mostly nonsense. “Bidenomics” might be working over the past twelve months for energy prices, but it’s not working for a great many other goods and services, and it certainly cannot be said to be working from January 2021 onward.

At the same time, while many prices themselves are not trending lower, the pace at which they are trending higher is slowing, and doing so across the board.

Energy prices have been rising at progressively slower rates over the past year, before declining outright beginning in March of this year.

Rates of increase in housing prices have also eased recently.

Food price inflation has also abated to a significant degree across all food categories.

Medical price inflation is somewhat more muddled, but it is also declining in recent months.

The prices for cars and their maintenance are also rising slower than recently, with the prices of used cars actually falling.

Clearly, prices are not rising now as fast as they have been. We normally should consider this a good thing. However, outside of the prices where actual deflation is occurring, even the prices which rise more slowly are still rising faster than average weekly wages.

This is certainly the case for food.

It is true for medical care products as well as hospital services.

It is still true for new cars.

Thus, even though prices are not rising as fast as they have been, outside of energy prices the rate of growth in consumer prices still exceeds the rate of growth in weekly earnings.

Thus, while inflation means that consumer prices have risen 18% since 2020, and “core” consumer prices have risen 16%, weekly earnings have only risen 12%.

It doesn’t matter how slow prices rise if they are rising more quickly than earnings. So long as that is happening people are seeing their purchasing power erode, and that is exactly what has been happening since after the 2020 recession.

Moreover, with multiple prices trending down within the CPI, we have to ask: what if the disinflation doesn’t stop, but becomes actual deflation across the board for all consumer products?

This is a question we have to ponder,because the declining year on year inflation rates also mean that consumer prices have been in deflation month on month for quite some time.

Month on month there is a definite downward trend among energy prices, with disinflation becoming deflation.

We see a similar downward trend among several food categories as well, although disinflation has not yet become sustained deflation.

For medical services the picture is much more muddled, but there has been a period of deflation for most of the medical service categories.

Cars are the outlier here, as there was a strong burst of inflation month on month just recently for used cars, after an extended period of deflation.

While price declines are generally a positive for the consumer, when there is a broad downturn in prices across several categories of goods and services, we must ponder whether that trend shows merely and easing and ultimately end to consumer price inflation or is the harbinger of broad deflation within an economy.

As we are seeing in China, when price deflation becomes widespread in an economy, the result is broad economic decline.

Nor is China unique. Japan’s serial “lost decades” of economic stagnation and decline have been chiefly characterized by sustained consumer price deflation.

While high inflation and hyperinflation are damaging to people’s finances and to an economy’s overall health, deflation can just as bad and even worse. Deflation indicates sustained declining demand—people simply buy less stuff, and there is a reduction in aggregate economic activity.

Is the US economy at risk of deflation? If the Federal Reserve is making the same mistake with its rate hike strategy that the Bank of Japan arguably made in the 1990s with its rate hike strategy, we must at least entertain the possibility:

In other words, the Bank of Japan made the same technical error in the early 1990s the Federal Reserve is making now—conflating the money supply growth with the money supply itself in correlating money supply to inflation.

This is the relationship between money supply and prices Friedman asserts is controlling. The supply of money in an economy defines the price level in that economy.

However, this is not the relationship Jay Powell and the economists at the Federal Reserve infer. Rather, their monetary policies presume a relationship between money supply growth and inflation, which is not the case and which Friedman does not assert to be the case. Indeed, owing to the concurrent influence of money velocity, it is not possible to establish a clear correlation between money supply growth and inflation. Velocity becomes a confounding factor that invariably disrupts all such calculations.

When the BoJ responded to Japan’s bubble economic conditions by clamping down on money supply growth, inflation turned to deflation—substantially for the inverse of why too large a money supply drives inflation—instead of consumers looking to unload excess money stocks, they opted to hold onto money stocks. As the BoJ tightened monetary policy, Japanese consumers saved rather than spent, thus causing prices to fall…and fall…and fall.

Whether the Federal Reserve has raised the federal funds rate either too far or too fast is not something we will know with certainty until it is too late. Certainly there are some commentators who feel that, if anything, the Fed has not been fast enough, and that last month’s pause in the rate hike strategy was unwarranted.

The Federal Reserve’s recent pausing of interest-rates hikes opens America’s door to stagflation. Going into the Fed’s June policymaking meeting, analysts made a big deal about how the U.S. central bank over the past 14 months had implemented the sharpest rate increases in recent memory. But challenges to both growth and inflation have been much tougher now than during the 1990s, 2000s and 2010s.

However, we must remember also that money velocity plays a crucial role in short term inflation.

Money velocity among the lower economic strata in this country has been declining, a decline that appears to correlate with the decline in headline inflation.

Thus there is a very real risk of the Fed overshooting and tipping the economy into overall outright deflation. This risk is compounded by the reality of an ailing global economy, with demand shrinking in Europe as well as in China.

After having seen consumer price inflation in this country flirt with double digits, a month where inflation prints at 3% year on year is undeniably a good thing. 3% overall consumer price inflation is a vast improvement over 9.1% year on year.

Even core inflation at 4.8% year on year is a notable improvement, particularly as it breaks core inflation out of the range in which it had been bound for well over a year.

Yet this improvement does not alter the reality that we have significantly higher prices today than just three years ago. It does not alter the reality that we are paying more for food, on average. It does not spare us the purchasing power squeeze that arises when rising prices outpace rising wages.

Nor does it do anything to assure us that the inflation the Fed so desperately wants will not turn into extended deflation., stagnation, and decline. The US is not in deflation yet, but it is difficult to overlook the similarities between the Fed’s situation now and the Bank of Japan’s situation in responding to a burst of inflation in the 1980s. Forcing inflation down under 2% year on year accomplishes nothing if, once inflation and then prices begin moving down, there is nothing within the economy to halt them, leaving prices in as well as the economy in free fall.

Inflation has come down. That’s a good thing. Whether inflation is returning to equilibrium at or near 2%, or whether it is about to flip from inflation into deflation remains to be seen.

Thank you, your title was my reaction to the Yahoo article. “Yet this improvement does not alter the reality that we have significantly higher prices today than just three years ago. It does not alter the reality that we are paying more for food, on average. It does not spare us the purchasing power squeeze that arises when rising prices outpace rising wages.” And yet with the President’s Tweet of Good News, it seems cognitive dissonance also has not changed in the past 3+ years.

I’m sure I’m not the only one who is looking for ways to cut back on costs , including by buying less. I’ve even been able to save money by switching cell carriers and life insurance companies, but my auto insurance went up . We’ll get a break on our property taxes if that passes , but I’m sure my homeowners insurance will go up. Fuel prices are pretty variable so I don’t get too excited about temporary drops. Next winter could be different. Thanks for another great analysis.