And Then Reality Set In....

Even The "Experts" Can No Longer Deny China's Deflating Economy

Eventually, even the “experts” run out of excuses. They run out of spin. They run out of ways to hide data with narrative.

All that remains is the harsh reality of the data itself, left to settle in, much to the discomfort of “experts” everywhere.

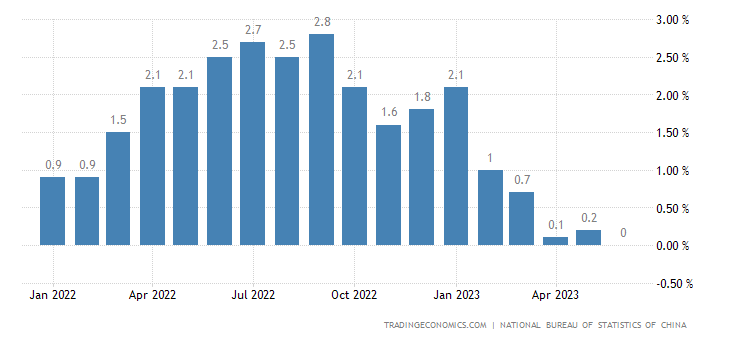

For China watchers, that moment has arrived, as China’s consumer price inflation dropped to 0% in June.

China’s economy teetered on the brink of deflation in June, adding to calls for Beijing to launch a stronger stimulus package to sustain the country’s sputtering post-Covid recovery.

The consumer price index was flat year on year and declined 0.2 per cent compared with the previous month, while factory gate prices fell at the fastest pace since 2016 as demand for consumer and manufactured products softened.

“Deflation” is another way of saying that China’s economy is contracting—and it is contracting in just about every sector at this point.

Of course, the data has been screaming “deflation” for several months. It was good of the “experts” to finally notice.

To understand the depth of the disconnect among the “expert” class, we must recall the projections that have been made about China’s economy—projections which have been consistently and persistently wrong.

Even as late as last month, the official assessments for China’s economic outlook were quite rosy.

According to China Daily, the OECD raised its economic growth projection on China to 5.4% for 2023.

The Organization for Economic Co-operation and Development rose the economic growth expectation on China again in a report released on June 7 local time to 5.4 percent this year and 5.1 percent next year, deeming that China's economic recovery fuels the global economy, China News Service reported Friday.

The World Bank had joined in on the optimistic view of China’s situation, even though there was no support for the assessment in the publicly available data.

For its part, the World Bank projects China’s economy will grow 5.6% in 2023.

The World Bank predicted that China's economy will grow by 5.6 percent in 2023 and the OECD set this figure at 5.4 percent.

Spokesperson Wang Wenbin said that several international organizations and institutions such as the United Nations, the World Bank and the International Monetary Fund have recently raised their forecast for China's growth. Some of them even revised up the forecast more than once.

"It shows their confidence in China's economic prospect. The Chinese economy will continue to serve as an engine of growth and contribute to global economic recovery," he said.

How that is supposed to happen with collapsing exports, slumping imports, and collapsing corporate profits remains a mystery.

What the “experts” have constantly overlooked, however, is that the inflation rate in China has been dropping steadily for the better part of ten months.

Since January of 2022, China has had more months with a monthly decline in consumer price inflation than with a gain.

From February onward, China’s CPI has been showing steady disinflation.

With the inflation rate falling to zero—at a time when China’s “recovery” is supposed to be hitting its stride—there was no way to spin the numbers but to state the obvious: China’s economy is in decline.

Core inflation, which excludes volatile food and energy costs, slowed to 0.4% from 0.6%. Producer prices fell 5.4% from a year earlier, the deepest pace since December 2015.

“The risk of deflation is very real,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd.

This, of course, is pretty much what I have been stating for some time: China is heading for a “lost decade” of economic stagnation.

The producer price decline is what is spooking the financial media the most about China’s economic situation.

Momentum in China’s post-pandemic economic recovery has slowed from a brisk pickup seen in the first quarter amid faltering manufacturing and lackluster consumer confidence.

The producer price index (PPI) fell for a ninth consecutive month, down 5.4% from a year earlier, marking the steepest decline since December 2015. That compared with a 4.6% drop in the previous month, and a forecast for a 5.0% fall in a Reuters poll of analysts.

Producer prices generally are a bellwether for consumer prices, so a steep drop in producer prices indicates further drops in consumer prices are on the way.

China’s producer prices have dropped every month since October of last year.

However, the longer macro-trend for producer prices has also been one of decline

China’s producer prices peaked at the beginning of 2022—while Zero COVID was still in full swing—and have been dropping ever since.

Nor have there been industries where producer prices are not in decline. The contraction is being felt across the board.

In true totalitarian fashion, Beijing refuses to admit there’s a problem, even as it publishes data which shows quite clearly that the economy is in crisis.

Such concerns are somewhat overplayed, because trade data fluctuate greatly from month to month. In fact, since 2018, China's foreign trade performance has repeatedly impressed some market observers, especially those who do not clearly understand China's exact trade situation. For example, in 2019, when the Sino-US trade conflict intensified, many were worried that China's foreign trade would be under great pressure. Also, at the beginning of this year, there were fears that the global economic downturn, geopolitical deterioration, coupled with the establishment of US industrial and supply chain alliances and the consolidation of diplomatic alliances, will inevitably make China's external situation deteriorate comprehensively, leading to a further downtrend in China's foreign trade.

However, looking back at the situation over the past three years, it is foreign trade performance that among all major economic drivers has been the most supportive of macroeconomic stability. During this period, the average growth rate of China's trade exceeded 20 percent. So why has China's foreign trade not "collapsed" as many predicted, but bucked the trend and shown a different trend from global trade in general? To arrive at the answers, it requires us to deeply study the changes in China and the global economy, and also carefully analyze how the competitiveness of China's foreign trade has changed in the context of the current great changes.

Yet even as it put forward the rationalizations about “foreign trade”, Beijing acknowledged declining imports and exports for most of the past year.

With most months showing contraction rather than expansion for both imports and exports, the unavoidable mathematics are that China’s economy is contracting and not expanding overall.

Global forex markets, however, have not been swayed by Beijing’s spin, as the fact that the yuan has hit 5-year lows against the dollar twice in the past year, after reaching a peak in March of 2022.

Ending Zero COVID had only a brief salutary effect on the yuan, but otherwise did nothing to slow its decline this year against the dollar.

Nowhere is China’s economic decline being felt harder than among its young people, who are experiencing an unemployment rate an entire order of magnitude greater than the overall national unemployment rate, with the jobs that are being created offering low pay for long hours.

As the world’s second-largest economy emerges from three years of Covid-19 restrictions, young jobless graduates such as Wang are bearing the brunt of a tepid recovery. In May, 20.8 per cent of 16 to 24-year-olds were unemployed, the largest proportion since the data series started in 2018 and higher than in European countries such as France and Italy.

The Chinese economy is still generating millions of jobs, and the overall unemployment rate was stable at 5.2 per cent in May. Yet many openings are in low-end work unattractive to university graduates. Beijing’s crackdown of the past few years on the technology, finance and gaming sectors has choked off opportunities in what were once appealing sources of employment.

Even though unemployment overall has been trending down in China, youth unemployment has been trending up.

The youth unemployment figure is particularly worrisome for China, as the longer youth go without steady employment the less their job skills will be developed—youth unemployment today translates into diminished prospects for economic growth tomorrow.

Thus while the data has been pointing to sustained long-term economic decline for some time, only with the inflation rate falling to 0% have the “experts” in the financial media run out of ways to spin the economic news as sustaining the narrative of a Chinese economic “recovery.”

The reality is that there is no recovery, nor has there been a recovery. That was always nothing but narrative and spin.

At zero percent, China’s consumer price inflation rate has left no doubt that China is in long-term economic contraction and decline. Now even the experts have to acknowledge it.

Will the same thing happen here ? Deflation.