With each new economic data point released on China, the corporate media comes ever closer to acknowledging what the data has been saying literally for months: China’s economy has never “recovered” from Zero COVID, and is not poised for any sort of recovery even now.

China's factory activity contracted faster than expected in May on weakening demand, heaping pressure on policymakers to shore up a patchy economic recovery and knocking Asian financial markets lower.

The official manufacturing purchasing managers' index (PMI) was 48.8 from 49.2 in April, according to data from the National Bureau of Statistics (NBS), its lowest in five months and below the 50-point mark that separates expansion from contraction. The PMI also dashed forecasts for an increase to 49.4.

Bear in mind that with PMI indices, any reading below 50 indicates the industry/sector is in contraction. Any “increase” to a number below 50 merely means the contraction is slowing.

This is but the latest in a string of bad economic numbers to come out regarding China, as its economic outlook is already being battered by slumping imports and exports, as well as the specter of deflation, which could herald a “lost decade” for China.

Hoping for a robust China recovery to lift the world economy? Prepare to be severely disappointed.

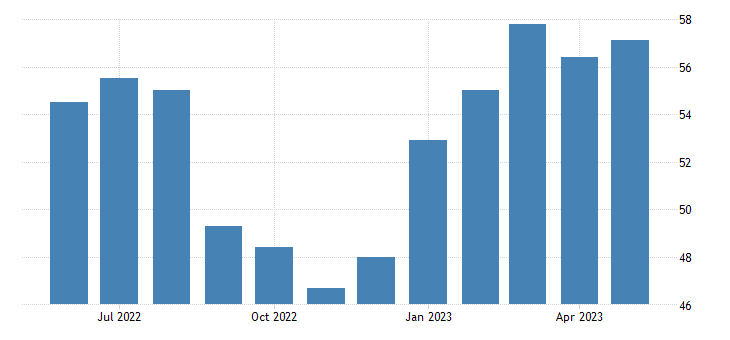

The latest PMI data is a stark reversal from earlier data showing a robust recovery was developing particularly in the manufacturing sector.

Officially, the PMI data shows virtually the all productive sectors of the economy accelerating in 2023, as both Zero COVID and the last COVID “wave” recede into fading memory.

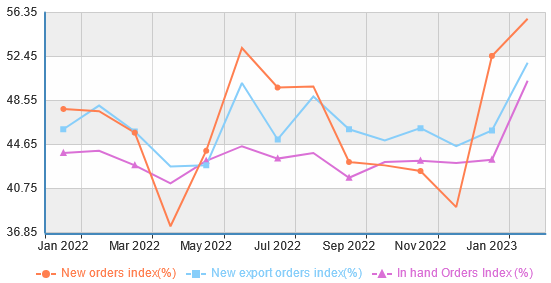

In February, new order growth appeared to be ascendant, and was taking the Chinese economy with it.

However, that burst of activity turned out to be just a flash in the pan, as new orders quickly collapsed again, to below their 2022 closing values.

Even the upbeat news from China’s small and medium-sized factories does not alter the economic picture. The uptick in the Caixin Manufacturing PMI is a positive, but the Caixin data is an outlier that is difficult to extrapolate across the broader economy.

The Caixin manufacturing Purchasing Managers’ Index (PMI) rose to 50.9 in May from April’s 49.5, according to a private survey. This is the first improvement of the index since February and signals its return to expansion territory.

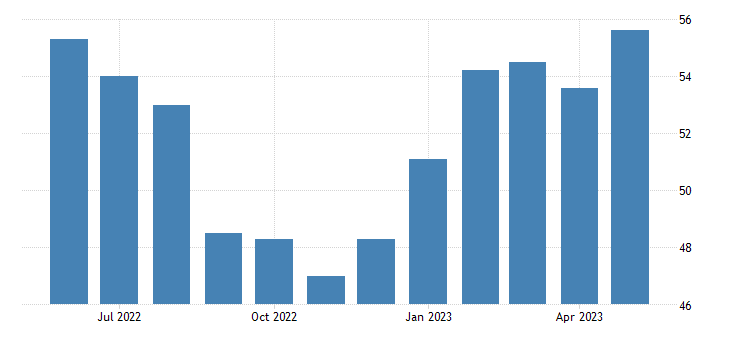

The Caixin Services PMI also staged a modest rise in May, to 57.1

It is therefore unsurprising that Caixin’s Composite PMI also rose, to 55.6.

We should not dismiss the growth in the Caixin PMI numbers, but with nearly every other signal going in the opposite direction, we should not place too great a weight on them. There is significant probability the Caixin numbers are more than a little wishful thinking.

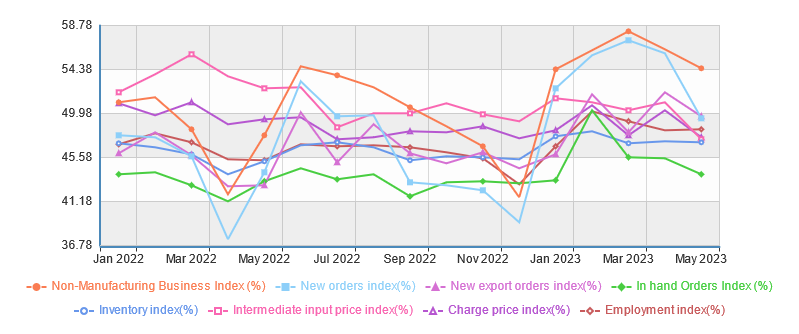

Indeed, there are few if any signals from China’s National Bureau of Statistics’ PMI data which are moving in anything resembling a positive direction. Virtually every NBS Manufacturing PMI stat is trending down.

Even the Non-Manufacturing (Service) PMI statistics are trending negative.

When everything is heading south there can be no thought of economic recovery by definition. Such things simply cannot happen.

Nor is it merely the PMI data that shows China’s economy heading deeper and deeper into recession. For all the hopium about China’s consumers leading the economic expansion, retail sales have been declining since December.

Zero COVID was lifted and retail sales dropped. This is not a trend to indicate even economic stability, let alone economic expansion.

To further reiterate the lack of economic growth after Zero COVID was ended, we should note that China’s freight traffic indicators show literally no surge of any kind in the amount of goods and raw materials moving throughout China.

If China’s economy were in recovery, freight traffic would be rising significantly. By China’s own scorekeeper, the NBS, it hasn’t risen at all.

Nor is the financial outlook in China all that encouraging, as loans to banks appear to be the primary source of loan growth in the Middle Kingdom.

Financing to the private sector—also known as “total social financing”—dropped significantly in April.

Even global commodity prices argue against the premise of economic recovery in China.

Copper prices have been trending down since the start of 2023.

Steel prices peaked in mid February and have been heading down ever since.

Cobalt prices have been in decline for well over a year.

Nickel prices have also been trending down.

But by far the clearest signal that China’s economy has not been recovering and is not about to recover lies in the ultimate of all global commodity signals—oil prices.

Quite simply, there is no shift in the price trends for global crude oil that points to increased economic activity in China.

The only major event since the beginning of 2022 to put any upward price pressure on oil was Russia’s invasion of Ukraine—and that event has been fully digested by now, with oil prices lower now than they were a month before the invasion.

Even the spot prices for Russia’s benchmark Urals crude do not show signs of increasing demand (and thus increasing economic activity) from China.

It was apparent even in April that the corporate media narrative regarding China’s recovery was, to say the least, “factually challenged”.

We can tell from all of these things taken together that China’s economic “rebound” is, as has become de rigueur for the media, more a matter of narrative fiction than of empirical fact. We can tell just from the existence of this data that China has more than its share of economic problems

We can tell from this data that if these problems are not resolved, there is a day of reckoning up ahead where the narrative will no longer be of China’s growth but rather of China’s collapse.

May’s economic data has not improved that outlook. Rather, it has shown it to be even worse. The signs of economic recovery that have been claimed in recent months are proving to be mere flashes in the pan, distractions from a steadily deterioriating economic situation in China.

While we are still quite a distance from discussing China’s economic collapse, we are without a doubt exploring the road that leads to China’s economic collapse, and not the road that leads to China’s economic recovery.

China’s economy is not getting stronger. It is getting steadily weaker, and the prospects for Beijing to reverse this trend any time soon are growing steadily fainter.

China will not be rescuing the global economy this time around.

Isn’t this at least partially related to the cheap money-created and Covid-worsened banking and interest rate crisis? The global economy was flooded with Covid relief dollars printed out of thin air and we are paying for it now with high prices . Totally predictable.

"When everything is heading south there can be no thought of economic recovery by definition."

You just keep handing us quotes like this we can use.

Fantastic work!

Edwin