Inflation Ends 2023 With A Comeback

Stagflation Persists As The Fed's 2% Inflation Goal Remains As Elusive As Ever

Consumer price inflation refuses to exit, stage left.

That is the message to take away from the Bureau of Labor Statistics’ December Consumer Price Index Summary, which showcased consumer price inflation creeping back up once again, doggedly refusing to bend towards the Federal Reserve’s 2% inflation goal.

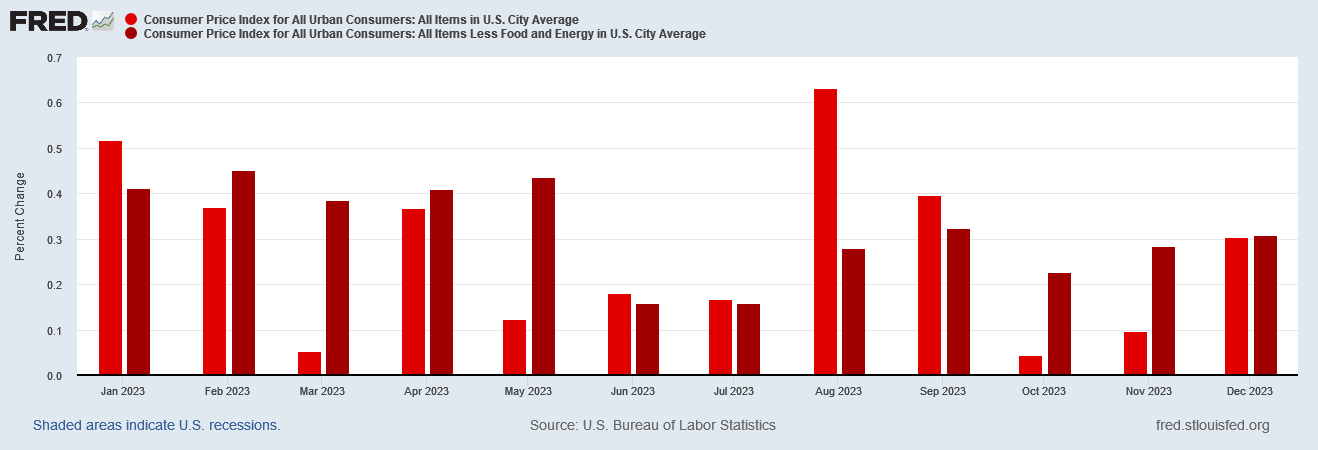

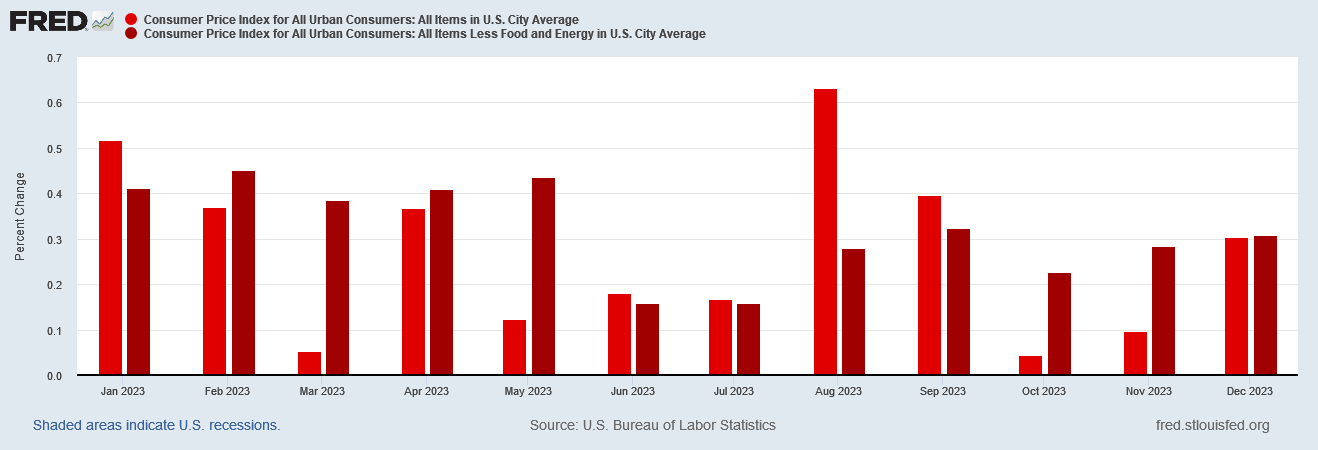

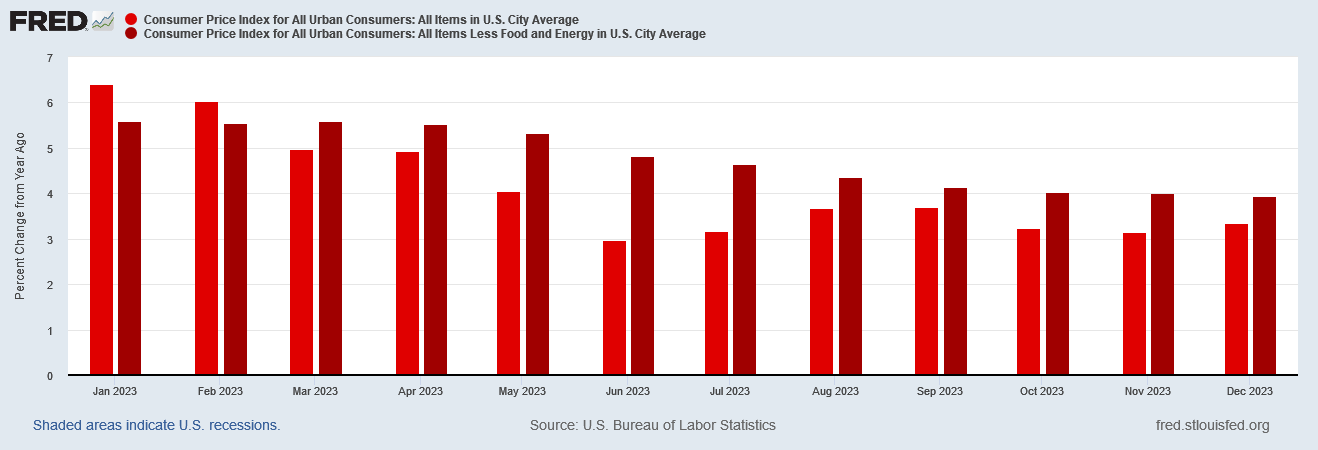

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in December on a seasonally adjusted basis, after rising 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.4 percent before seasonal adjustment.

The index for shelter continued to rise in December, contributing over half of the monthly all items increase. The energy index rose 0.4 percent over the month as increases in the electricity index and the gasoline index more than offset a decrease in the natural gas index. The food index increased 0.2 percent in December, as it did in November. The index for food at home increased 0.1 percent over the month and the index for food away from home rose 0.3 percent.

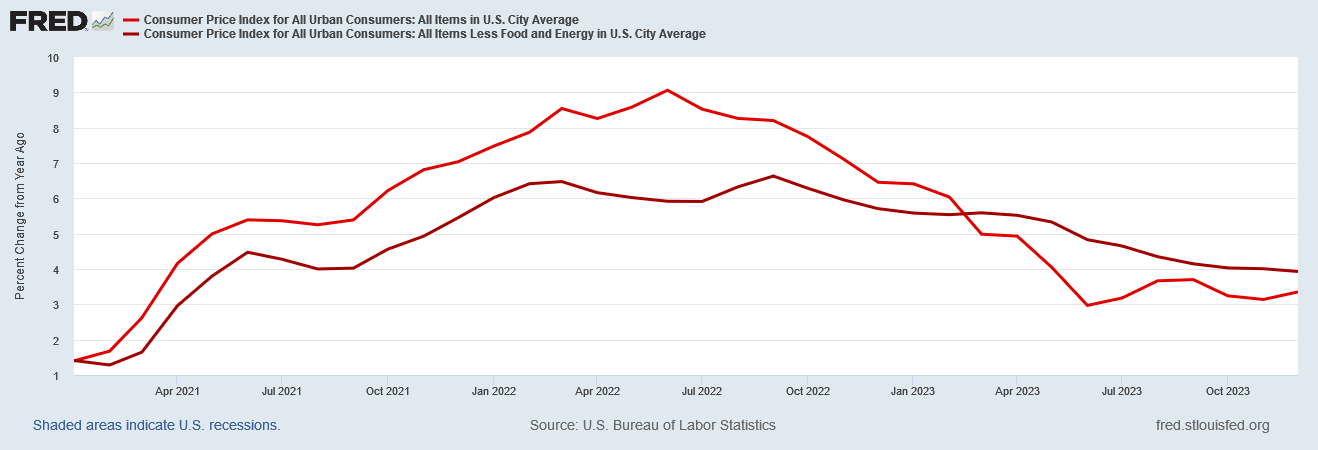

This was not the inflation report Wall Street expected, which had anticipated year on year inflation of 3.2%, a repeat of the November number.

In the 12 months through December, the CPI rose 3.4% after increasing 3.1% in November. Economists polled by Reuters had forecast the CPI gaining 0.2% on the month and climbing 3.2% on a year-on-year basis.

They didn’t even get that on the seasonally adjusted numbers, where year on year inflation still rose 3.3%.

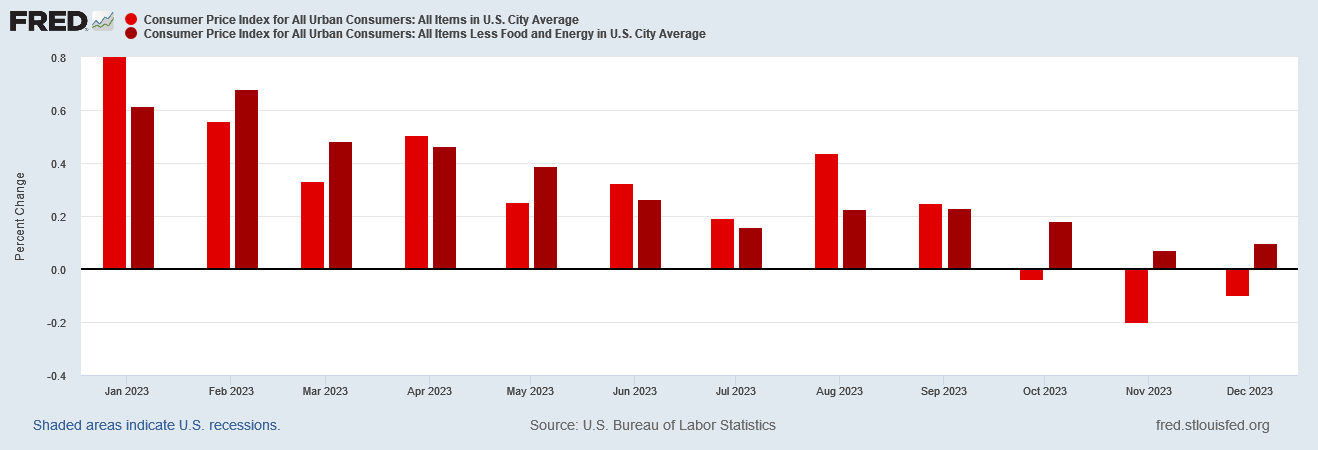

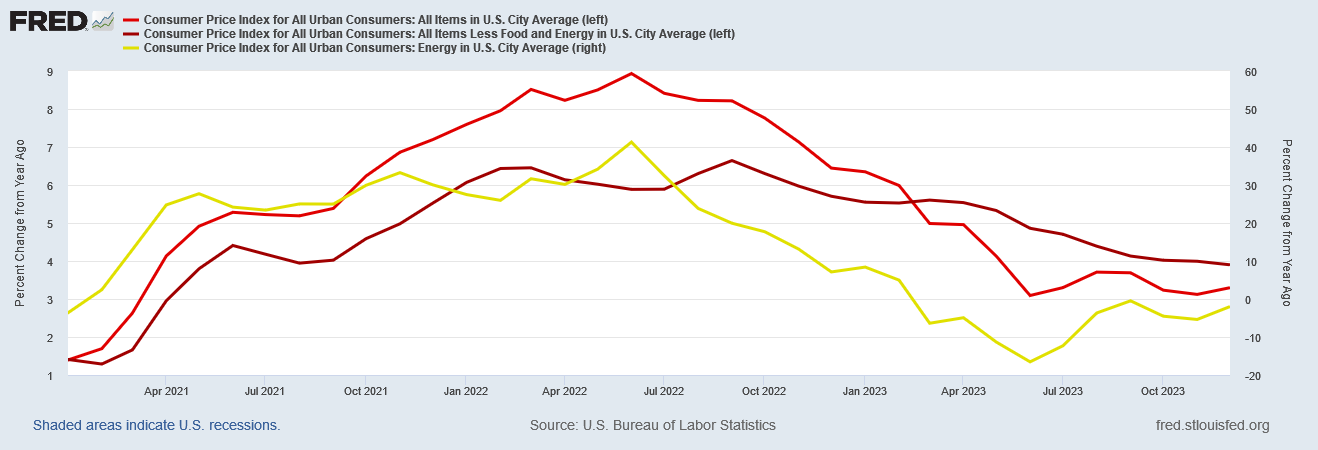

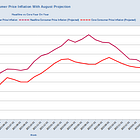

Going by the seasonally adjusted numbers, inflation is making a comeback, despite being well above the Fed’s goal of 2% year on year consumer price inflation.

Going by the unadjusted numbers, consumer prices are deflating but may also be showing signs of bottoming out—again, well above the Fed’s 2% goal.

Resurgent inflation or structural stagflation for 2024. Heads consumer’s lose, tails consumers don’t win.

That is the message embedded in the Consumer Price Index Summary for December.

Surprisingly, Dementia Joe’s handlers still found a way to take their monthly undeserved victory lap on the data:

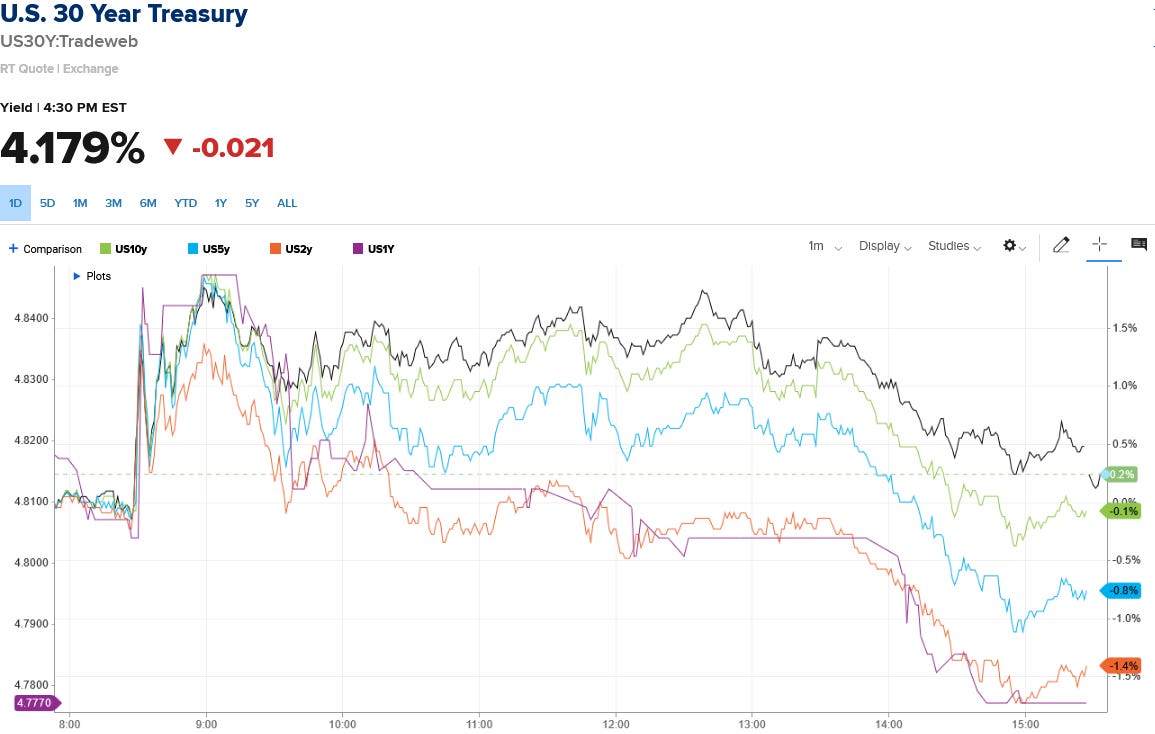

Wall Street, however, was considerably less impressed. Equities dropped immediately following the release of the BLS data, and only barely managed to climb back into positive territory by the end the day’s trading.

Treasury yields moved in the exact opposite direction, surging first and then falling back again.

Remember that bond yields are the inverse of price, which is to say that Treasury yields displayed the exact same sentiment as equities and it was not a good one.

Perversely, and to underscore the extent to which stagflation truly is taking hold within the US economy, the unadjusted year on year rise in inflation was accompanied by yet another month of month on month consumer price deflation.

To be sure, the unadjusted index does show the headline figure coming down, albeit at a much slower rate in December than in November.

The end result is that, while prices have come down in the past few months, they are still significantly higher than they were 12 months ago, producing the year on year uptick in inflation.

Of particular note is that year on year inflation was at its unadjusted lowest in June of last year, when it printed at 2.97%. Consumer price inflation has not flirted with that lower bound since, and remains well above even that level, let alone the 2% goal the Fed seeks.

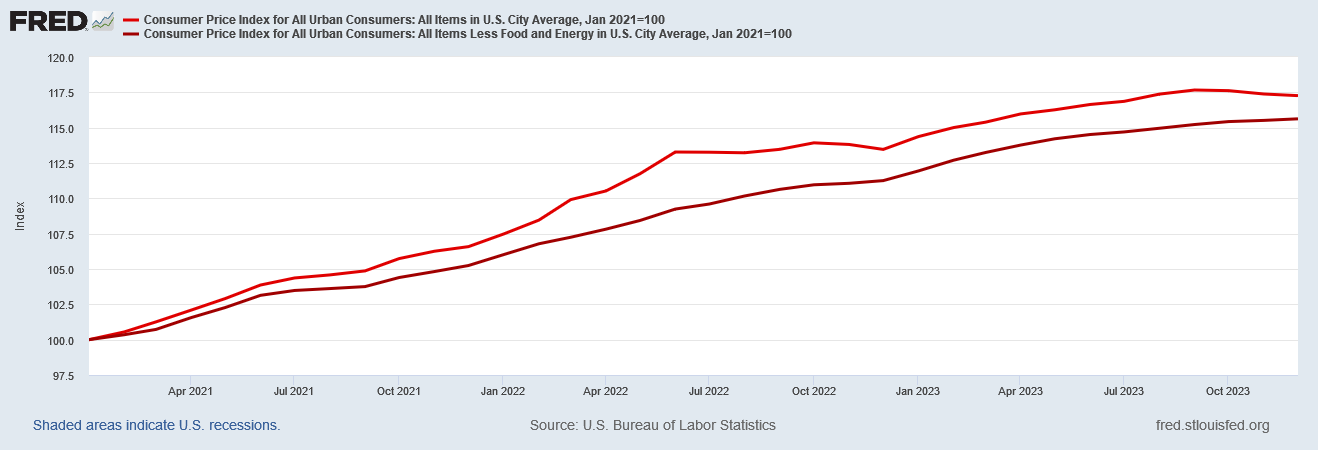

Without a significant drop in consumer price inflation, the US economy is facing a structurally embedded higher rate of inflation for the longer term—and this structurally higher rate of inflation would be regardless of whether the economy is growing or expanding.

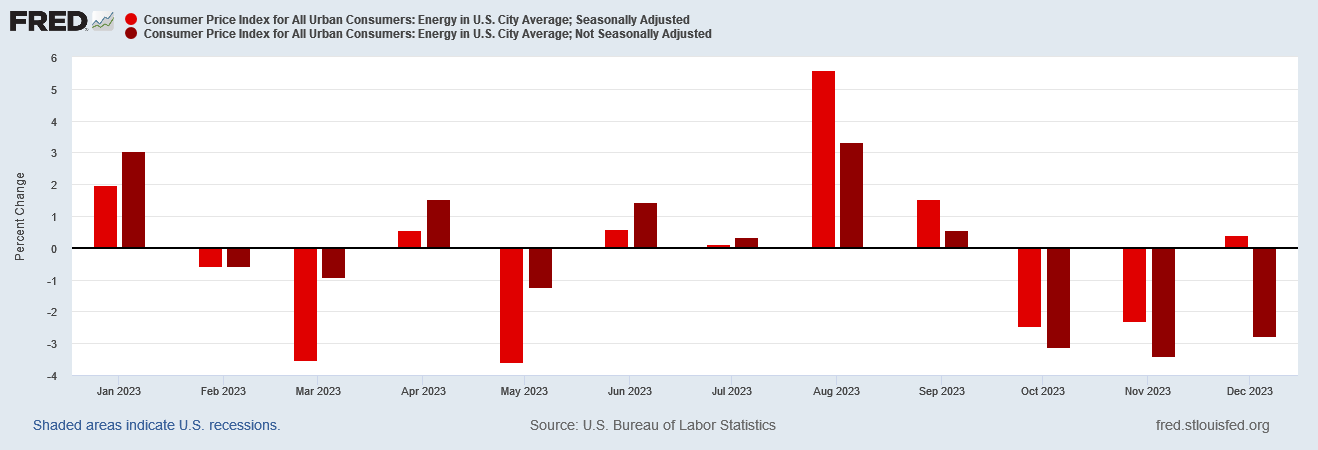

Nor is there much mystery about why consumer prices rose year on year in December, or why the seasonally adjusted month on month numbers show inflation rising for the third straight month, or the unadjusted numbers show inflation bottoming out: Energy price deflation has either slowed (in the unadjusted data) or has turned to energy price inflation (in the adjusted data).

Energy price deflation has been the major factor in consumer price inflation first trending down and then turning into deflation in recent months.

With energy price deflation slowing down, and with energy prices even rising in December, the principal driving force behind consumer price disinflation abated. With core inflation continuing to outpace headline inflation, the uptick in the year on year numbers was inevitable.

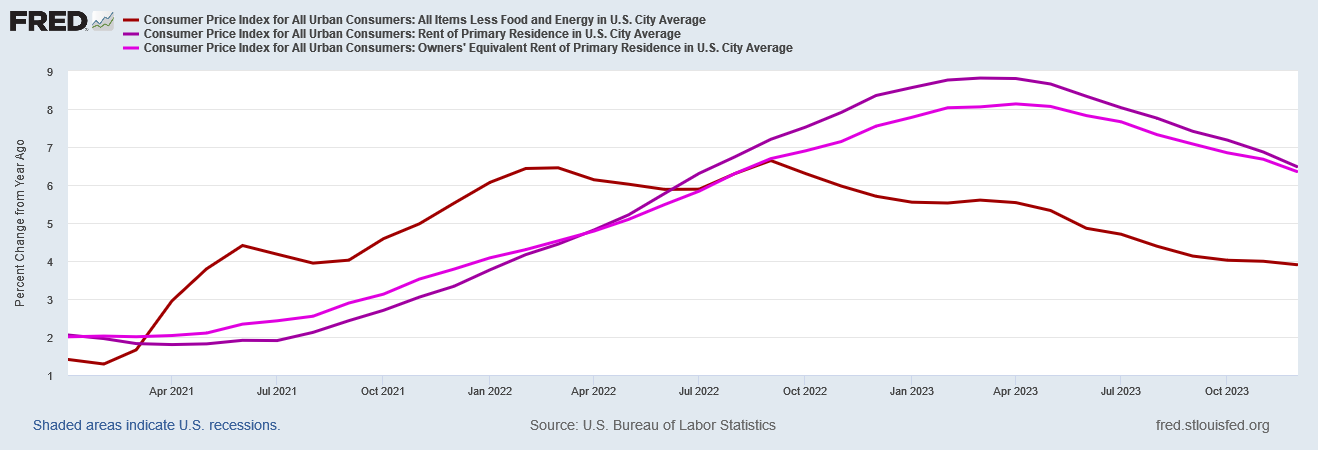

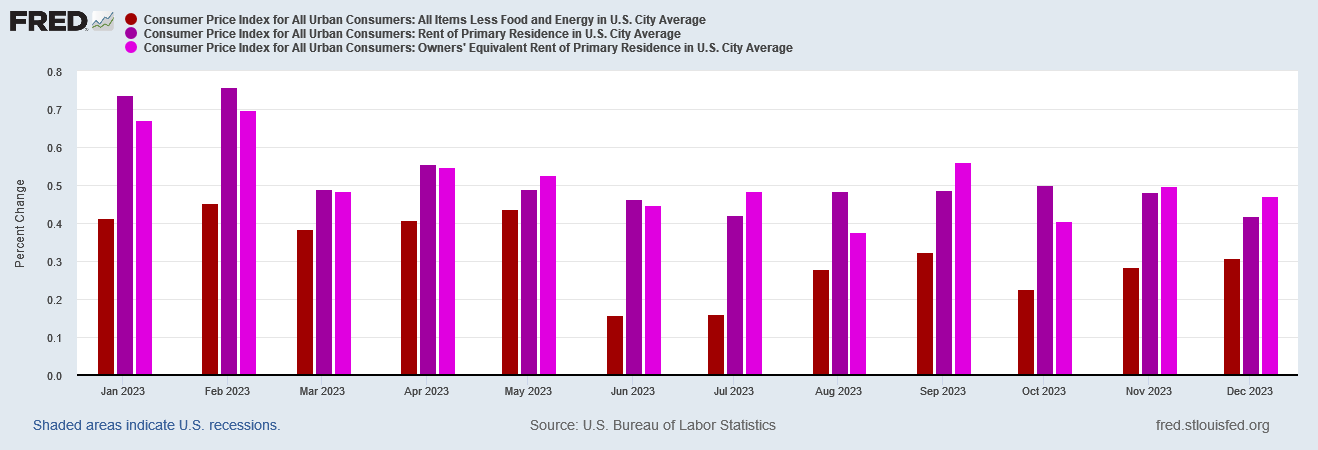

Core inflation continues to outpace headline inflation in large measure because housing price inflation remains well above core inflation.

Shelter price inflation itself, while trending down year on year, may also be bottoming out, as the month on month changes have been minimal since early 2023.

Again, we are looking at a higher rate of inflation becoming structurally embedded in the economy—which guarantees stagflation for the near term at least.

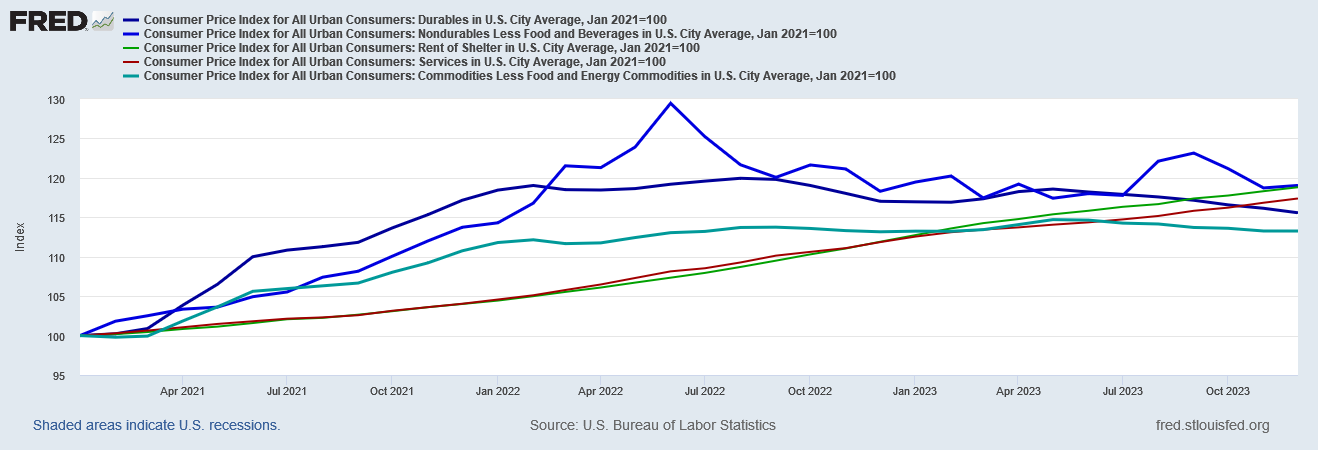

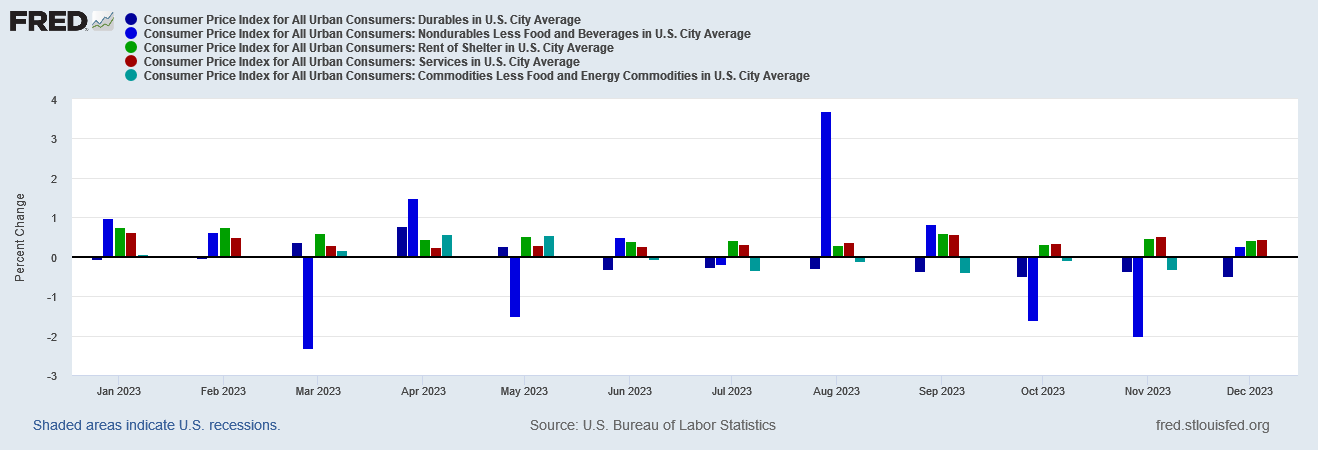

Nor is the inflation divide between goods and services showing any signs of closing. While prices for durable and non-durable goods have actually come down, along with the prices of various commodity items, services and rent of shelter prices have continued to increase with little change in overall trend.

Throughout 2023, month on month inflation for goods and commodities fluctuated significantly, but service price inflation remained relatively consistent.

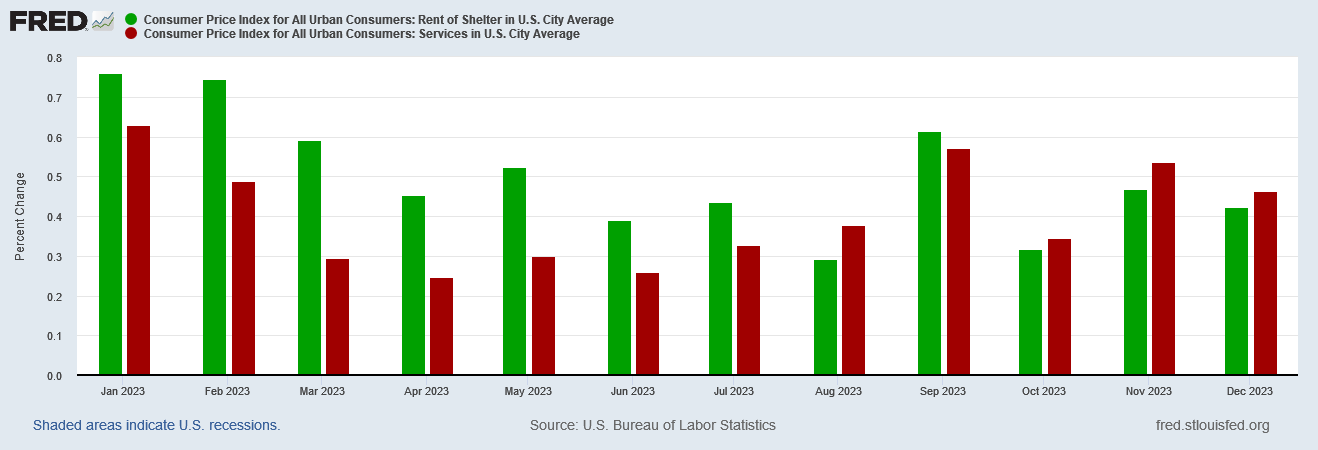

If we zero in on month on month service price inflation, we see that the trend across the whole of 2023 is largely horizontal—neither showing sustained rise or sustained decline.

So far, shelter price inflation and service price inflation have proven stubbornly resistant to both the Fed’s rate hike strategy and market forces.

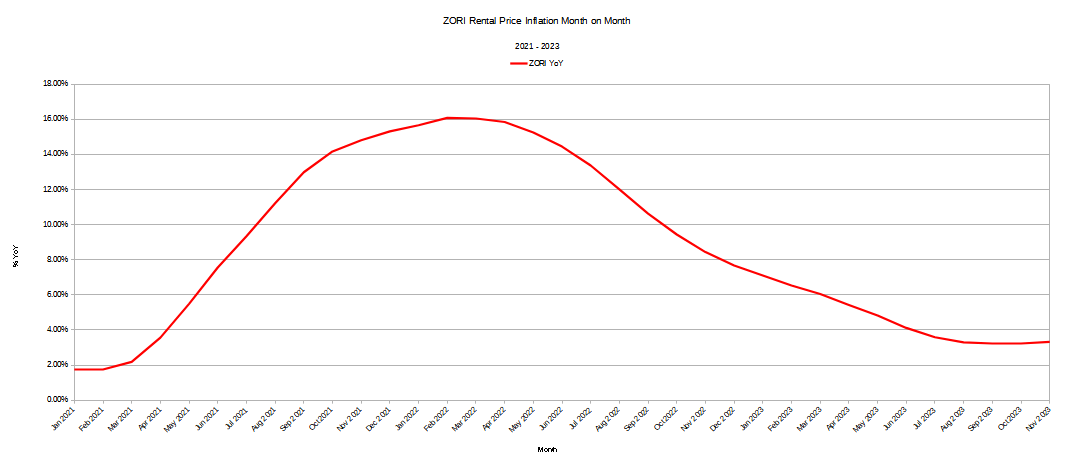

Even the Zillow Observed Rent Index (ZORI) has bottomed out year on year.

While there is reason to hope that shelter prices will start trending down more broadly, at the moment all we are seeing is a seasonal price contraction that quite possibly has already reversed back into expansion. If the year on year trend prevails, shelter price inflation will be “stuck” above 3% year on year—well above the Fed’s 2% target.

As I pointed out last month, the rising month on month inflation numbers alone makes the idea of the Fed achieving its 2% target any time soon a pipe dream.

The month on month inflation having risen for the second month in a row makes any prognostication that the Fed’s 2% year on year inflation goal will be reached in early 2024 simply absurdist wishful thinking. The data also makes plain that, without energy price deflation having been predominant in 2023 to date, inflation would be significantly higher. Given the influence of energy prices on other price categories, energy price deflation is undoubtedly as influential in the easing of both headline and core inflation as energy price inflation was in the acceleration of both in 2021 and 2022.

Moreover, if Iran should manage to get its way and provoke a major war in the Middle East, energy prices are sure to skyrocket.

While at the moment Iran’s escalation efforts are not producing the desired results, and are even backfiring on Iran, war is inherently unstable.

Iran may yet succeed in spawning a larger war in the Middle East, and may spike the price of oil as a consequence.

Unless energy prices continue to deflate, there is little reason to expect overall consumer price inflation to continue to abate. Energy prices have been a driving force behind consumer price inflation both up and down (in a manner very reminiscent of the 1970s hyperinflation episode), a factoid that all by itself renders the Fed’s rate hikes and future rate cuts largely meaningless.

Even without energy price inflation returning, shipping disruptions from Houthi attacks in the Red Sea are causing shipping rates from Asia to the US East Coast to rise dramatically—bringing renewed inflation fears with them.

But the Red Sea crisis is now having a significant impact further afield with shipping costs between Asia and the U.S also spiking. Shipping rates from North Asia to the U.S. East Coast have jumped 137% to $5,100 for a 40-foot container from early October, according to S&P Global. Rates from North Asia to the U.S. West Coast have jumped 131% to $3,700 during the same period.

JPMorgan told clients on Tuesday that the fight against inflation could stall in the coming months if shipping costs push the price of goods higher.

“Renewed increases in global shipping costs may actually add to consumer price inflation over the next several months, should these increases ultimately pass through into higher final goods prices,” the investment bank’s economic analysts told clients in a research note.

December’s inflation rise could be the beginning of a resurgence in consumer price inflation.

Meanwhile, every recessionary warning sign and red flag from November is still very much in evidence for December. The economy is continuing to weaken, and continuing to contract, and it is likely to continue to do so for the near term.

That puts the Federal Reserve in a bind. If they want to stimulate the economy and reverse the recessionary trends, they will need to loosen monetary policy (or so they think), and that will likely spark renewed inflation. If they don’t loosen monetary policy, or so the thinking goes, the economy will continue to stagnate and continue to contract.

Heads the Fed loses. Tails the Fed doesn’t win.

Yet even if the Fed does nothing, there are ample forces at work that will either push the economy further into recession and stagflation or will reignite consumer price inflation. The Fed has no control over any of them.

Heads the Fed loses. Tails the Fed doesn’t win.

Ultimately, the BLS data shows not only that inflation is “back”, but that in several substantive ways it never really left. The BLS data also shows we’re likely to be stuck with elevated inflation for some time come, as higher inflation rates are becoming embedded in the US economy, even as the economy declines.

In other words, everybody loses. Nobody wins.

Good article, linking it today @https://nothingnewunderthesun2016.com/

Not sure if you are familiar with David Haggith's work but he had an article that I'm linking as well with pretty much the same conclusion.

Heads Biden loses the election. Tails Biden doesn’t win.