On Thursday I detailed Wall Street’s fundamental non-reaction to the Fed’s Wednesday decision to raise interest rates by 50bps.

The 50bps rate hike came as a moderation from the previous string of 75bps rate hikes throughout the summer and fall, and was occasioned by the continuing decline, albeit marginal, of consumer price inflation.

Investors initially reacted negatively to the expectation that rates may stay higher for longer, and stocks gave up earlier gains. During a news conference, Chairman Jerome Powell said it was important to keep up the fight against inflation so that the expectation of higher prices does not become entrenched.

“Inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases,” the chair said at his post-meeting news conference. “But it will take substantially more evidence to have confidence that inflation is on a sustained downward” path.

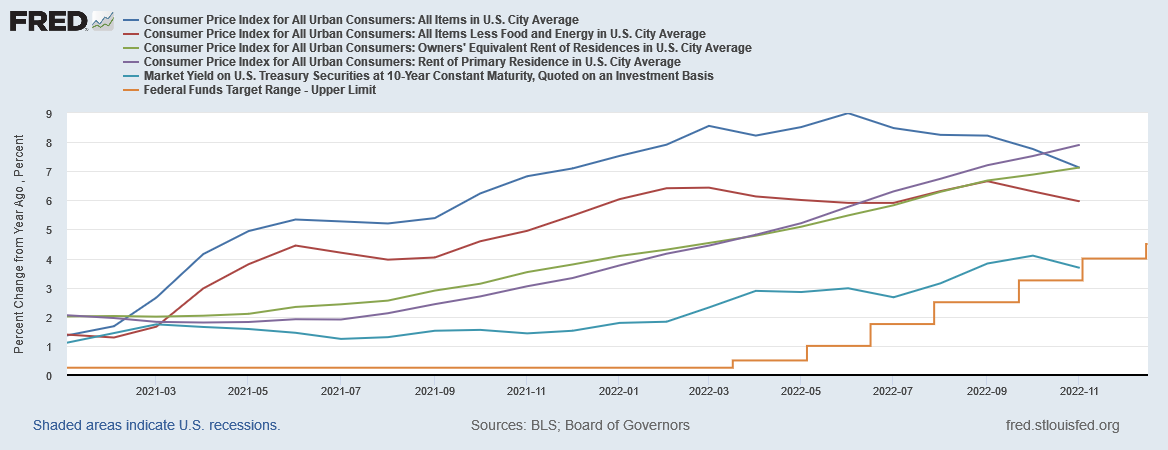

Per the November Consumer Price Index Summary, consumer price inflation fell to 7.1% year on year, a drop of 0.6% from October’s level.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally adjusted basis, after increasing 0.4 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.

Core inflation, as measured by the all items less food and energy index, dropped to 6% year on year, a drop of 0.3% from October.

Yet as welcome as the decline in headline and core consumer price inflation is, there are still areas where inflation remains a significant issue.

While both energy price inflation and food price inflation have declined in recent months, both subindices remain significantly above headline consumer price inflation.

Inflation may be declining, but in these essential categories it is still in double digits and still a major concern for most consumers.

Moreover, despite the decline in headline consumer price inflation, one category where inflation is still very much increasing is shelter. Both the index for the owner equivalent rent and for the rent of a primary residence have now risen above headline consumer price inflation.

If the rising trend in shelter price inflation continues, it will soon overtake food price inflation as well, making shelter price inflation one of the most significant elements of inflation in the US economy at the present time.

All of which cuts against the prevailing narrative from both government and the corporate media of a robust and growing economy—a narrative which runs into problems as soon as one explores the details within available economic data.

This narrative of economic growth is embedded in the Federal Reserve’s foundation for its inflation-fighting strategy.

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

If economic growth is questionable, then the Fed’s inflation-fighting strategy of repeated interest rate hikes must also be deemed questionable.

The disconnect between the Fed’s strategy and the market impacts of late may be attributable to the disconnect between the Fed’s strategy and the available economic data. The contractionary forces within the economy are very likely overwhelming the Fed’s efforts to boost interest rates and tighten monetary policy.

The disconnect between the strategy and the data certainly is in evidence when viewing shifts in consumer price inflation, which to date has shown litttle indication it is influenced by interest rates. Inflation’s rise and fall is moving on its own timeline, without much regard for interest rates.

In particular, the persistent rise of shelter price inflation, which has shown no indication of bending in response to interest rates is serving to keep headline consumer price inflation high.

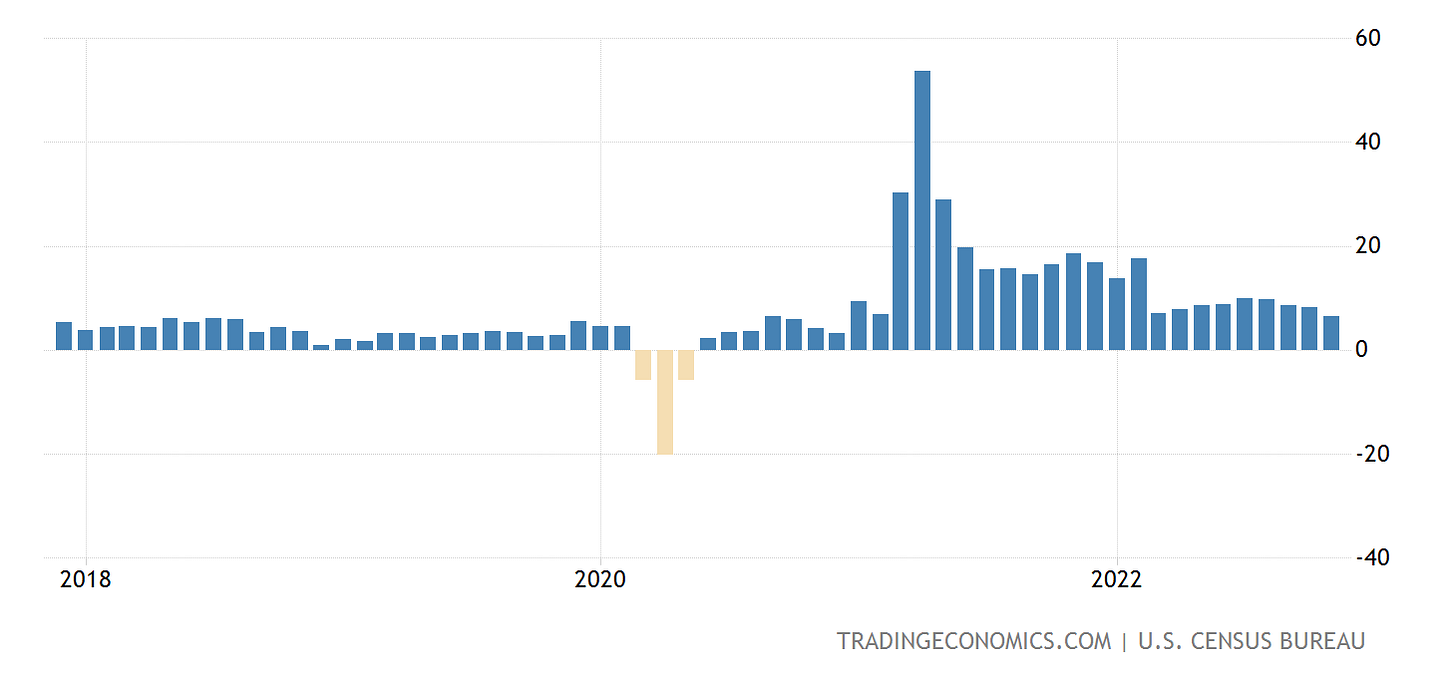

What is bringing inflation down? Almost certainly it is a deepening recession, highlighted by retail sales shrinking in November by 0.6% month on month.

Even viewed year on year, retail sales in the US have been softening in recent months, and are becoming weaker than pre-pandemic levels.

At the same time, the ISM manufacturing PMI slipped into contraction for November, indicating an economic slump extending beyond retail sales and consumption.

Housing prices, of course, have been in decline for several months.

Major retailers are struggling with continuing inventory overhang, resulting in major price discounts being offered for many larger items.

Multiple big-box stores continue to struggle with an inventory overhang stemming from the pandemic boom, leading some to forecast their uncertainty, even as they create opportunities to entice consumers.

Data from the research group Factset show inventory levels among retailers including Walmart, Target, Amazon and Best Buy remain significantly above pre-pandemic levels. It's a consequence of the end to the stay-at-home buying frenzy that snarled supply chains worldwide.

Among more durable purchases, used car sales dropped by around 10%, according to automotive marketing services firm Cox Automotive.

For the full month of November, Cox Automotive estimates used retail sales declined 10% from a year ago and 1% from October, based on same-store estimates from Dealertrack.

Slumping demand and a deepening recession is what is moving inflation numbers down, not the Fed’s interest rate hikes.

As the rising shelter price inflation metrics show, interest rates fail to touch key aspects of inflation. Even recession is not enough to bring some prices down, or to bring them down to historical levels. Food price inflation remains elevated, as does energy price inflation, even though declines in both mean they are contributing less to overall inflation than before.

Additionally, as I detailed on Thursday, the Fed’s increases in the Federal Funds rate have been having increasingly small impacts on overall interest rates, and in the day immediately following the Fed’s latest rate hike announcement, the rise in the Federal Funds rate was virtually ignored by Wall Street, with yields changing hardly at all or even falling.

With inflation likely to remain elevated for some time into 2023, the Fed is likely to keep raising rates into 2023—but this last rate hike shows the Fed is exerting almost no influence over inflation or interest rates. Barring a major change in overall economic conditions, there is little reason to expect the Fed to regain control over interest rates, while the inflation data demonstrates once again the Fed has never had much influence over consumer price inflation, despite the persistent myth of an inflation-slaying Paul Volcker from the early 1980s.

Forget the media narrative about economic “soft landings”. The US economy is in recession, a recession which is getting worse, and which will bottom out in an extremely “hard landing” for the US consumer, as economic contraction meets persistently high inflation in a stagflationary stew of economic bad news.

We're getting the recession we should have had in 2020-2021 as a result of the crippling lock-downs. The FedGov (and governments around the world) papered that over by borrowing a bunch of freshly printed money, which created demand for things, but no supply and thus made inflation inevitable.

the privately owned "federal" reserve /becoming/ irrelevant?

they've always been irrelevant. just another means to devalue the fiat currency and shift money to the already rich.