The new China Narrative on the Chinese economy is pretty much the same as the old China Narrative on the Chinese economy: the economy is healthy, the economy is sound, and the economy is poised to grow and meet 2024 GDP targets.

China's industrial profits rose 10.2 percent in the first two months of 2024, reversing a decline of 2.3percent in 2023, government data showed on Wednesday.

Observers said that the steady performance showed that China's industrial sector had bottomed out and entered an expansionary phase, laying a concrete foundation for GDP growth this year.

The worst is over, according to China’s state media outlets. Let the recovery begin!

Or will it?

Industrial profits are an important economic gauge, but they are not the only economic gauge.

Can rising industrial profits pull the real estate sector out of its years-long death spiral?

Or is this rise in industrial profits a momentary bump in the middle of an extended double dip recession?

The answer, as always, relies chiefly on which data you use.

To be sure, China’s National Bureau of Statistics has reported that in January and February of this year, China’s industrial firms saw their profits increase by 10.2% year on year, printing at CNY914 Billion over the CNY887 Billion in January and February of 2023.

That is a healthy increase over the start for 2023, but it still lags even 2022’s start of CNY1.16 Trillion, or even 2021’s CNY1.11 Trillion. While it is accurate to say that industrial profits are improving, they still have quite a ways to go before they reach their prior levels.

Additionally, the bulk of that profit gain came from export-oriented firms. Industrial activity for domestic consumption did not improve nearly so much.

Activity in the manufacturing sector is largely supported by goods exports, which have regained strength since the autumn. In January-February 2024, exports even rebounded by +7.1% y/y in current USD terms. Growth in goods imports also picked up (+3.5% y/y). The increase in exports affected all trade partners and benefited a wide range of products, ranging from low value-added consumer goods to green technology products.

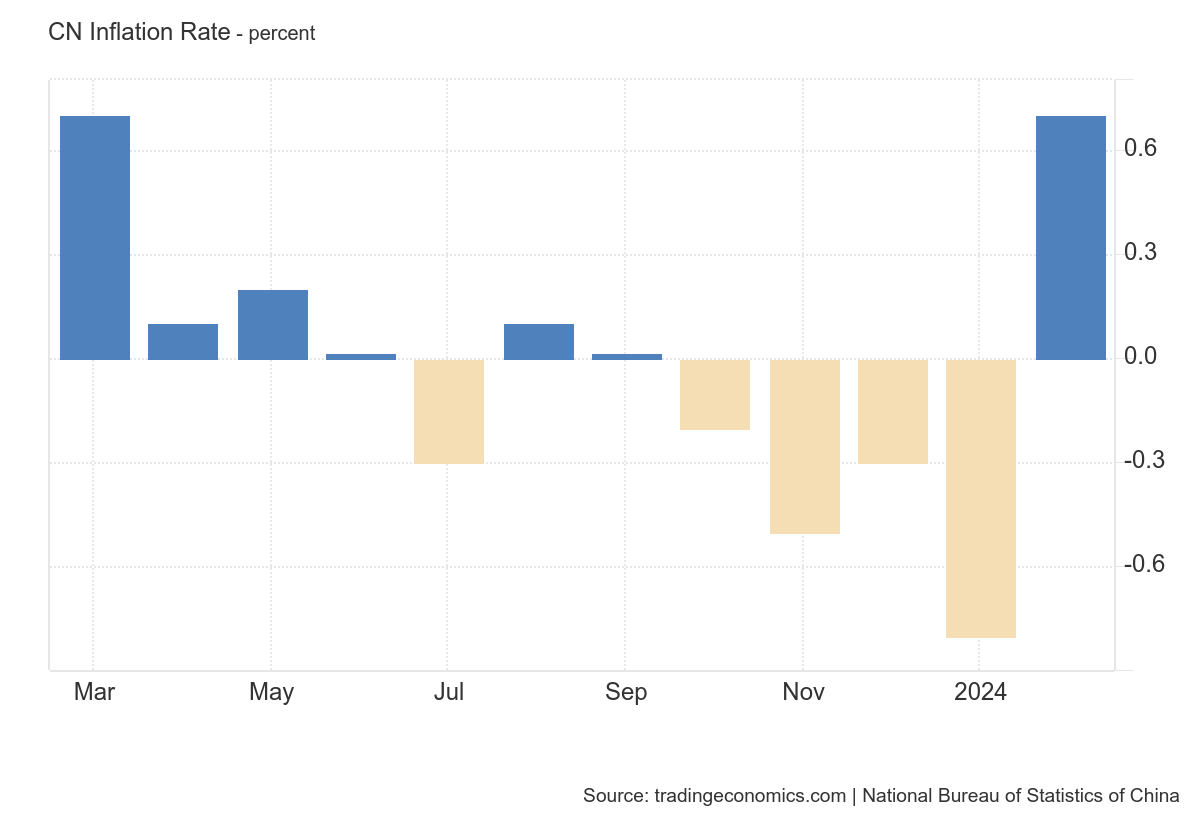

Meanwhile, sectors that depend on the domestic market remain sluggish. Activity in the services sector grew by +5.8% y/y in January-February 2024 compared to +8.5% in Q4 2023. Household consumption did not really improve, with retail sales up by only around 6% in real terms over the first two months of the year (after +8.7% y/y in Q4 2023). Reflecting weak domestic demand and the imbalance between supply and demand, consumer price inflation was slightly negative in Q4 2023 (-0.3% y/y) and almost zero on average in January-February 2024.

Weakness in domestic consumption was such that January’s 0.8% year on year deflation rate was only barely canceled by February’s 0.7% year on year inflation metric.

While the February CPI data coming out of China indicates the Chinese economy is at least momentarily escaping from the deflationary debt spiral, as with industrial profits it will take more than the good February numbers to overcome the deflation book in Q4 2023.

Additionally, there is reason to suspect that the consumption gains which were recorded might not be quite as substantial as Beijing would like people to believe.

In the first two months of 2024, China's Ministry of Commerce reports total retail sales for consumer goods reached more than eight trillion yuan, a year-on-year increase of 5.5 percent.

Retail sales for communication equipment and automobiles increased by more than 16 percent and 8.7 percent respectively, while catering revenue increased by 12.5 percent. Especially during the Spring Festival, travel spending by domestic tourists increased by 7.7 percent compared to 2019, and the number of cinemagoers also hit a new high.

GUO TINGTING Deputy Minister, Ministry of Commerce "We encourage trade-in programs in consumer goods such as automobiles and home appliances. We'll cultivate and expand green consumption, and promote the innovative development of the consumption of services."

People in the US might recall the concept of government trade-in programs for automobiles. That was the essence of “Cash for Clunkers”1, one of the more counterproductive ideas for dealing with the fallout from the 2008-20009 Great Financial Crisis—and the ultimate economic benefit of that program was practically nil.

A key rationale for fiscal stimulus is to boost consumption when aggregate demand is perceived to be inefficiently low. We examine the ability of the government to increase consumption by evaluating the impact of the 2009 “Cash for Clunkers” program on short and medium run auto purchases. Our empirical strategy exploits variation across U.S. cities in ex-ante exposure to the program as measured by the number of “clunkers” in the city as of the summer of 2008. We find that the program induced the purchase of an additional 360,000 cars in July and August of 2009. However, almost all of the additional purchases under the program were pulled forward from the very near future; the effect of the program on auto purchases is almost completely reversed by as early as March 2010 – only seven months after the program ended. The effect of the program on auto purchases was significantly more short-lived than previously suggested. We also find no evidence of an effect on employment, house prices, or household default rates in cities with higher exposure to the program.

The undoing of that program a decade ago was that all it succeeded in doing was pulling forward sales of cars that would have happened shortly anyway, such that the burst of new car sales it achieved created a sales slump later which entirely negated the economic benefits of the initial sales surge.

Is China making a similar policy error by incentivizing trade-ins? Are the increases in car sales (and other product sales) merely pulling forward sales that, absent the trade in programs, simply would have happened six months later?

There is, of course, no way to know this up front, but the US experience with the “Cash for Clunkers” program tells us such counterbalancing reactions in the marketplace are not only possible, but even probable.

The fact that Xi Jinping, while courting US business leaders (seeking US investment in China enterprises), promised additional “policy support” further suggests that the boost in industrial profits and the uptick in consumption may have less to do with the marketplace and more to do with government intrusion into the marketplace.

While industrial profits might be up, industry as a whole might not be.

When we look that the NBS Purchasing Manager’s Index for industry, we see that it has been printing contraction since October.

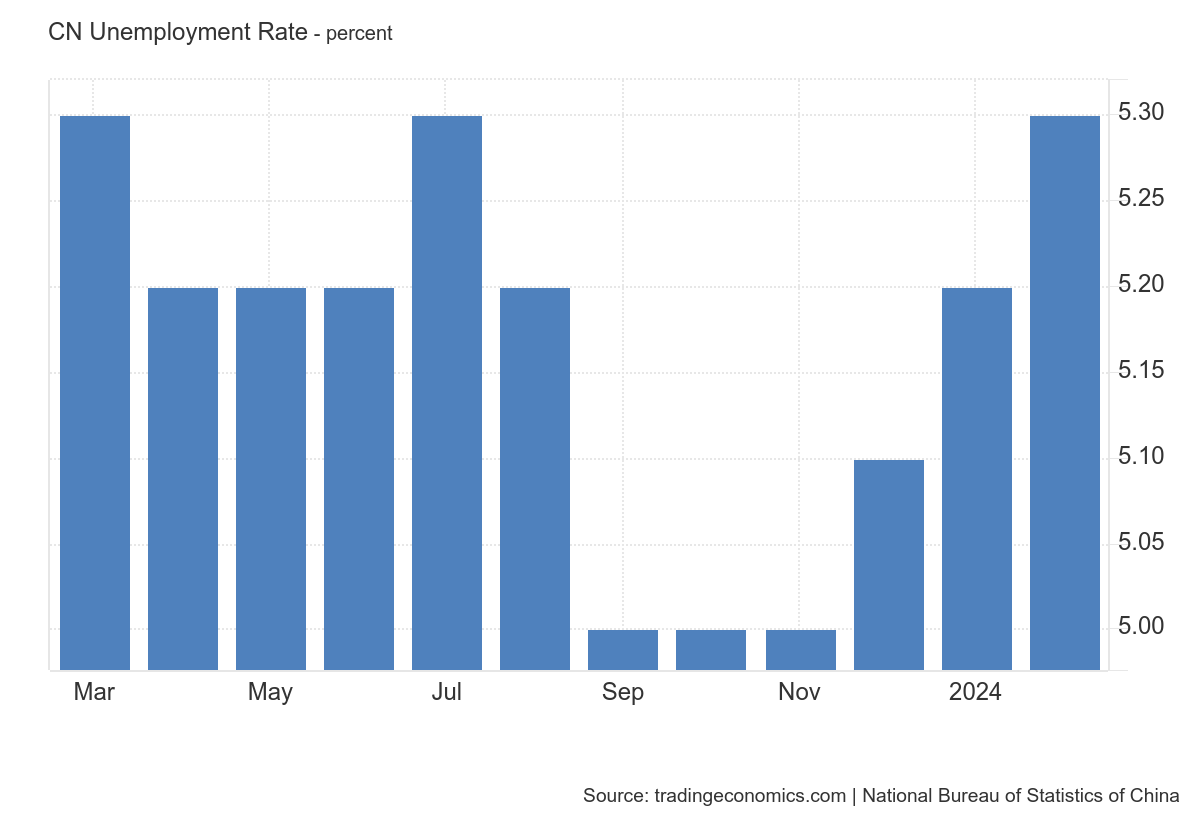

It certainly does not speak to increasing industrial production when the unemployment rate rises a tenth of a percent every month.

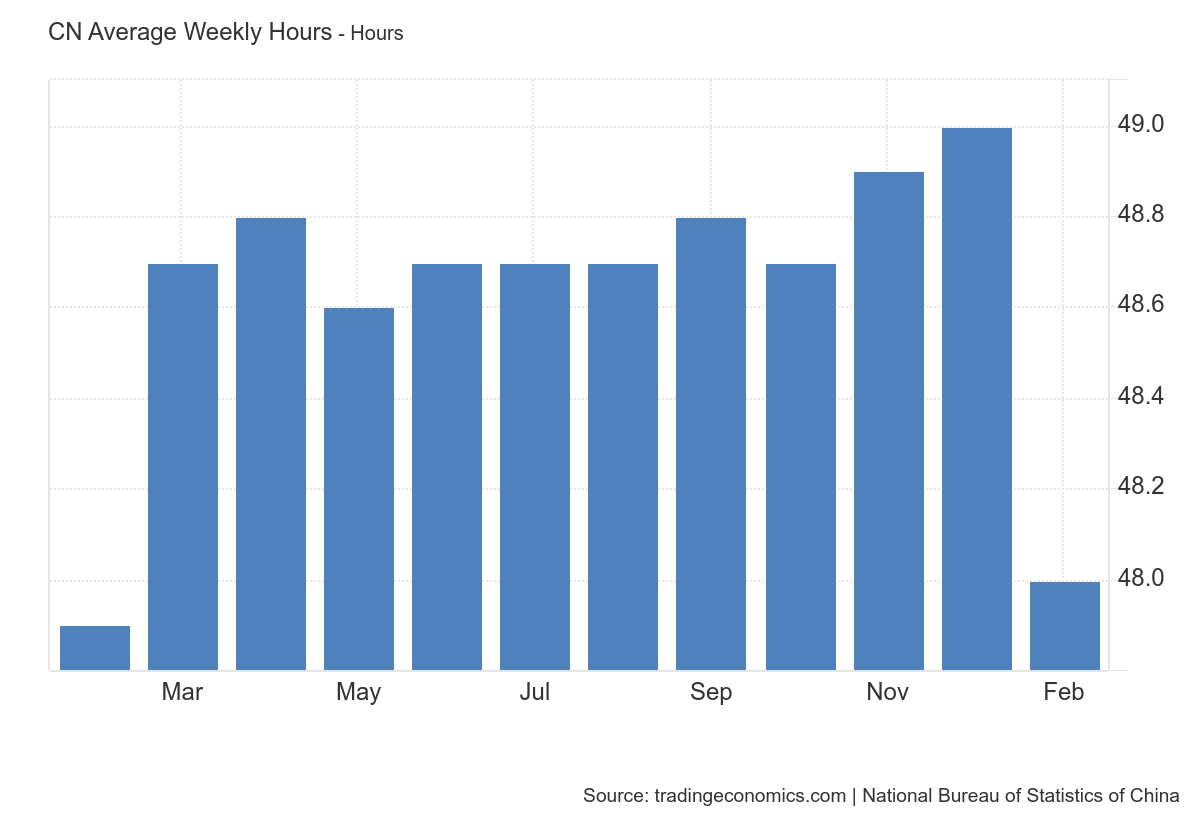

A narrative of expanding industrial activity is further undermined by NBS data showing the average hours worked per week declining rather than expanding.

That industrial production rose by an incrementally smaller amount in February suggests that the Chinese economy is getting weaker, not stronger.

Industrial profits are good. There is no question about that. There is also no real question that profits are about the only bright economic spot even within Chinese industry.

We also should not focus exclusively on the industrial base. One of the largest portions of the Chinese economy, real estate, recently got a fresh reminder that its troubles are far from over. One of China’s premier private developers, Country Garden, is once again flirting with financial distress, when it failed to publish its latest financial reports on time.

Troubled housing giant Country Garden announced late Thursday that it would delay the publication of its annual results, in the latest sign of the turmoil still coursing through China’s huge property sector.

In a filing provided to the Hong Kong stock exchange, the company said it needed more time to collect information due to the complexity of the work required amid its debt restructuring.

Country Garden’s inability to meet a deadline of March 31 to post earnings means its stock is likely to be suspended from trading Tuesday under Hong Kong’s stock exchange rules.

This just a few weeks after state-owned developer China Vanke apparently burned through most if not all of its available cash to pay off a maturing $630 Billion offshore bond.

While the property sector continues to deteriorate, the distress of developers such as Country Garden and China Vanke is having a contagion effect on China’s banking industry, as bad loans and non-performing loans have been rising.

The "Big Four" state-owned banks, Industrial and Commercial Bank of China (ICBC), Bank of China (BOC), China Construction Bank (CCB), and Agricultural Bank of China (ABC) reported this week that their total nonperforming loans reached 1.23 trillion yuan ($170 billion) in 2023, up 10.4% from 1.117 trillion yuan in 2022.

The lenders said rising bad debts don't hit their bottom lines because they have set aside abundant provisions, and they are ramping up risk controls in lending to property developers. But the spillover effects are emerging.

Bad loans to property developers rose to 183.9 billion yuan in 2023, from 180.1 billion yuan in 2022, with CCB and ABC reporting increases of 43.31% and 1.25%, respectively. ICBC and BOC reported a decline of 8.03% and 13.93%.

Additionally, bank earnings are coming under increasing pressure as the PBOC’s reduction in interest rates squeezes profit margins.

Two other top lenders warned of growing risks to debt repayments as a slowing economy threatens job security, while a drop in asset prices impacts buildings used as collateral for bank loans. Local governments, which count on selling land to repay debts, are also struggling.

Bankers make less money from new loans as lending rates go down, and selling wealth products like mutual funds are less profitable due to regulatory caps.

Rising industrial profits are not likely to be rising enough to compensate should China’s banking system tank along side its real estate sector.

As is so often the case with any narrative, the narrative of China’s economy being poised (again) for “recovery” rests on a narrow set of fairly obviously cherry-picked data—industrial profits.

There are indications that the industrial sectors of China’s economy are doing better. Rising profits are always an indication of that.

However, industrial profits do not change the reality of China’s real estate apocalypse, nor the possibility that both Country Garden and China Vanke might find themselves heading into liquidation in the not-to-distant future, as their finances turn ever more parlous.

Industrial profits do not slow the rise of non-performing commercial real estate loans which could drag down bank balance sheets and precipitate a banking crisis on top of China’s real estate crisis.

Increases in domestic consumption are of questionable importance if they are the result of “policy support” (stimulus) from Beijing. As the US learned from “Cash for Clunkers” back in 2009, “policy support” measures often bring sales and purchases forward, particularly for durable goods, which produces a drop in consumption roughly equal to the initial surge in consumption.

If China can untangle the mess that is its property sector, and contain the contagion effect on the banking sector, it is quite possible China’s economy could rebound and even begin growing in real terms. Rising industrial profits do give China that much hope.

However, the key word is “if”. Absent a cleanup in the property sector, a true economic rebound for China is just not going to be a likely outcome.

Mian, Atif R. and Sufi, Amir, The Effects of Fiscal Stimulus: Evidence from the 2009 'Cash for Clunkers' Program (September 2010). NBER Working Paper No. w16351, Available at SSRN: https://ssrn.com/abstract=1674795

Oh sure, CCP, “happy days are here again”. Why, “prosperity is just around the corner!” Please. Those platitudes didn’t change economic reality in 1933, and they still don’t today.

The fact that the CCP is making these feeble moves shows us that they really don’t have many options to deal with their huge structural economic problems. “All Facts Matter” has consistently given us the hard data - and thank you, thank you for that - showing the magnitude of China’s problems. They are going to learn a hard lesson in the reality of market forces whether it fits their ideology or not.

And, sad to say, so is the US. For example, Biden pushing electric vehicles despite market data showing that nobody wants them. The big car companies in Detroit have been complaining to Biden that they have lost billions on producing EV cars that sit unsold on their lots. I read this stuff in the news and think, jeez, our government is not that different from China’s! Shudder.

Peter, I would value your facts and brilliance over just about any other possible assessment. I am grateful.