January Producer Price Inflation Can't Be Blamed On BLS "Fudges"

Even With Recent Revisions, The PPI Is Still Up Significantly

When the Bureau of Labor Statistics released the January Consumer Price Index Summary last Tuesday, the prevailing question was whether or not the BLS had fudged the numbers “too much” with their annual “corrections”, or not enough.

On Friday when they released the January Producer Price Index Summary, it was clear that the annual “corrections” were not a huge part of the surge in factory gate inflation for the month.

The Producer Price Index for final demand increased 0.3 percent in January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices declined 0.1 percent in December 2023 and advanced 0.1 percent in November. (See table A.) On an unadjusted basis, the index for final demand rose 0.9 percent for the 12 months ended January 2024.

In January, the advance in the index for final demand can be traced to a 0.6-percent rise in prices for final demand services. In contrast, the index for final demand goods decreased 0.2 percent.

As the chart for the archival data shows, the corrections made to the historical data sets are simply not large enough to account for the significant increase in January factory gate inflation.

With or without revisions, the PPI shows that inflation is coming back to the US economy in a big way.

What makes the PPI inflation data for January alarming is that factory gate inflation is up more or less across the board.

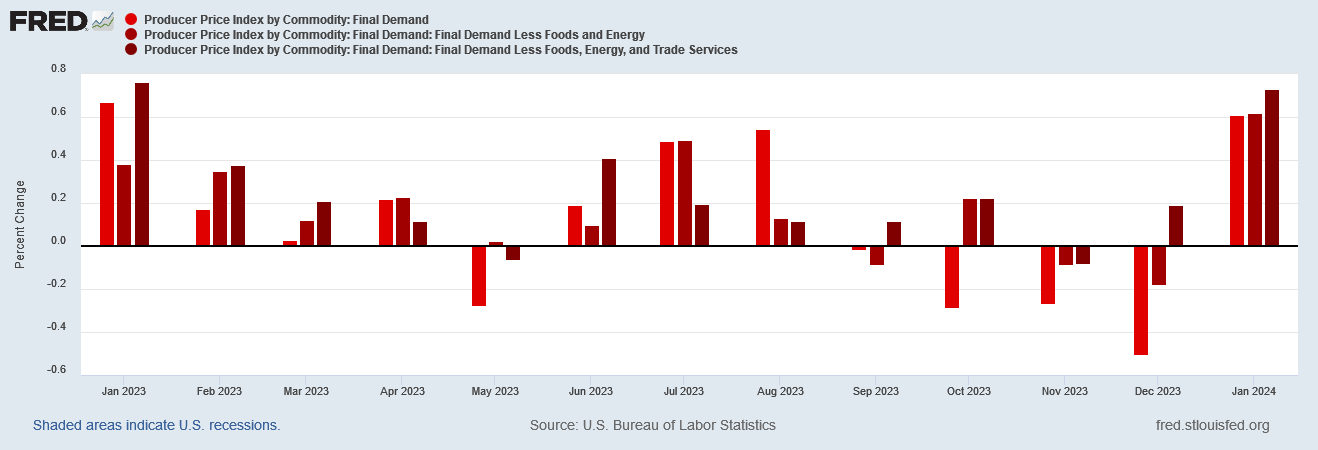

PPI for Final Demand was up. So was PPI for Final Demand Less Foods and Energy. So was PPI for Final Demand Less Food, Energy, and Trade Services.

At both the headline and the core metrics, the Producer Price Index showed factory gate inflation to be up.

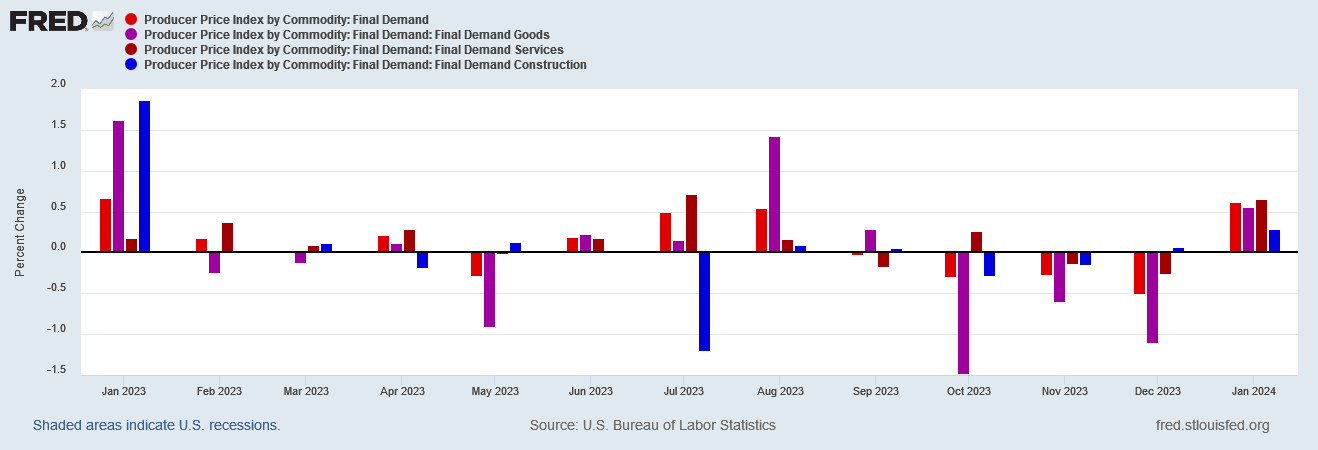

Factory gate inflation was up across categories as well.

Goods, Services, and Construction all notched month on month gains in factory gate inflation.

Given that the PPI is frequently a leading indicator for the CPI—and that factory gate inflation generally precedes consumer price inflation by a few months—the January PPI report is a clear signal that renewed inflation is coming to the US economy, Federal Reserve rate cuts be damned.

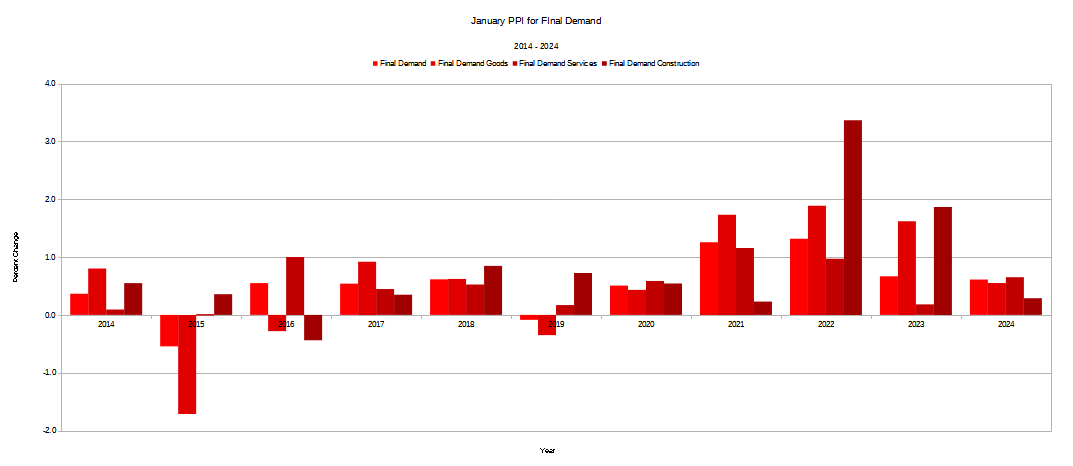

However, we should inject a note of caution about the reading: the PPI ticks up in January more often that it does not.

Since 2014, the PPI has been down month on month in January only twice. A January surge especially in the headline number is not unusual, and is therefore perhaps less significant than it might appear at first glance.

What undeniably is significant, however, is that year on year factory gate inflation has been rising over the past few months.

At every level—headline, PPI less food and energy, and PPI less food, energy, and trade services—year on year factory gate inflation has risen since November.

With month on month consumer price inflation having risen during the same time frame (from October of last year rather than November), this is a disconcerting trend to see in the PPI.

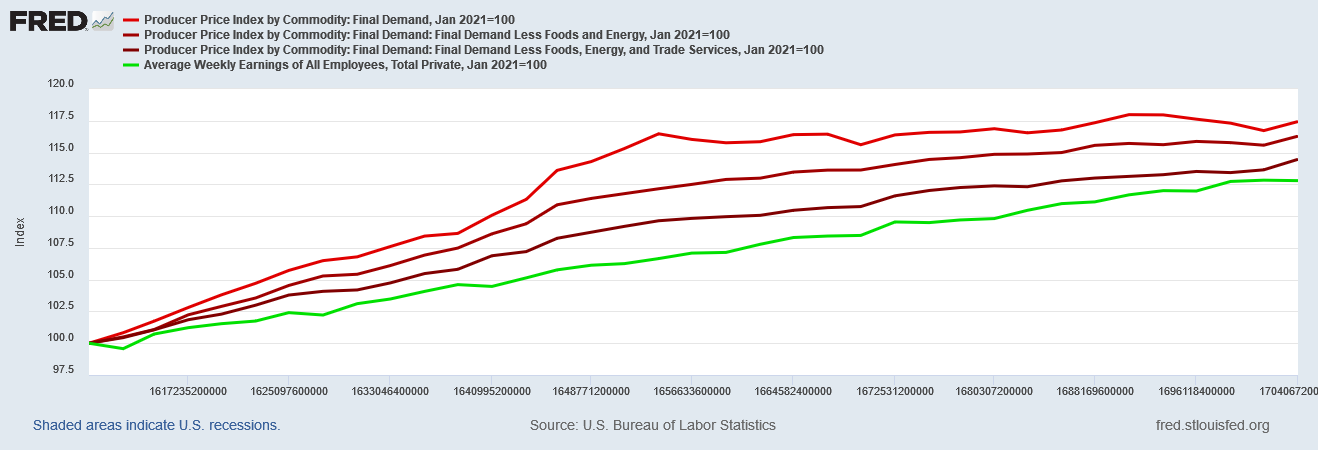

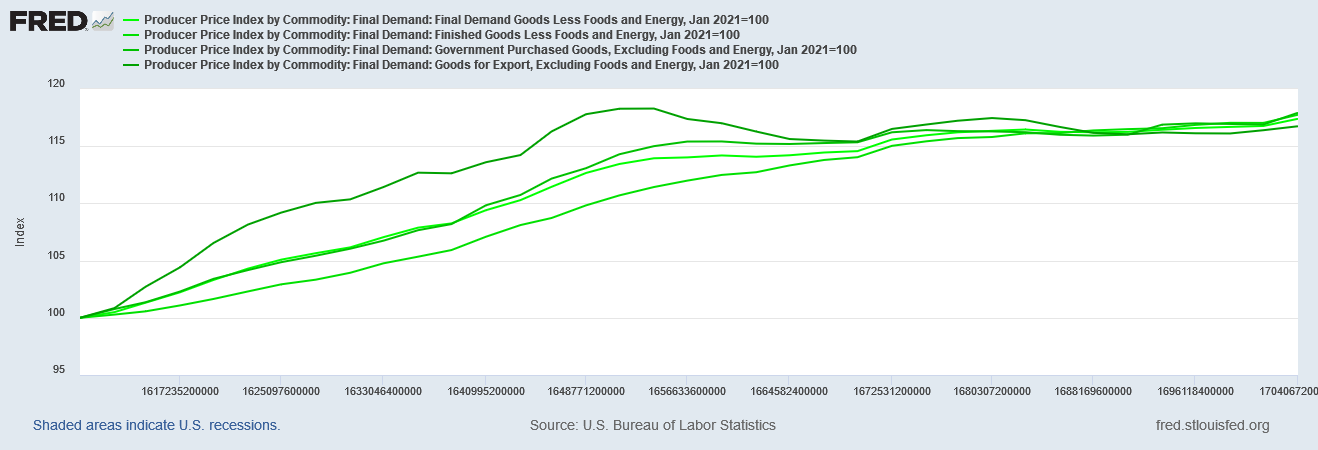

This trend is reinforced when we index the PPI to January of 2021.

The declines that were noted last month completely reversed.

Compounding the problem with rising factory gate prices is that average weekly earnings were largely flat in January.

With upward price pressures increasing in the US economy, workers’ paychecks are once again getting the pinch. While the degree to which a January rise in the PPI may signal future rises in the CPI is somewhat problematic, what is not problematic is the degree to which inflation rises in January impact workers paychecks in January.

If we reindex the PPI to January of 2023, we can see that if the most recent trends among the PPI levels as well as average weekly earnings continue for any period of time, all the gains in real earnings workers ostensibly realized in the last half of 2023 will soon be eliminated.

Earnings have only recently begun to outpace inflation, having lagged behind since 2021. If inflation ticks up again to any degree, earnings will quickly fall back further behind inflation.

Equally unsettling is the rising in factory gate inflation for various categories of goods.

After having been in deflation for quite some time, goods price inflation could be making a comeback.

Again, we should be cautious about reading too much into that rise, because when we look at the month on month percent change we see a similar “January effect” as we saw earlier with the headline figures, where some of the rise in the PPI is ultimately a phenomenon of the calendar.

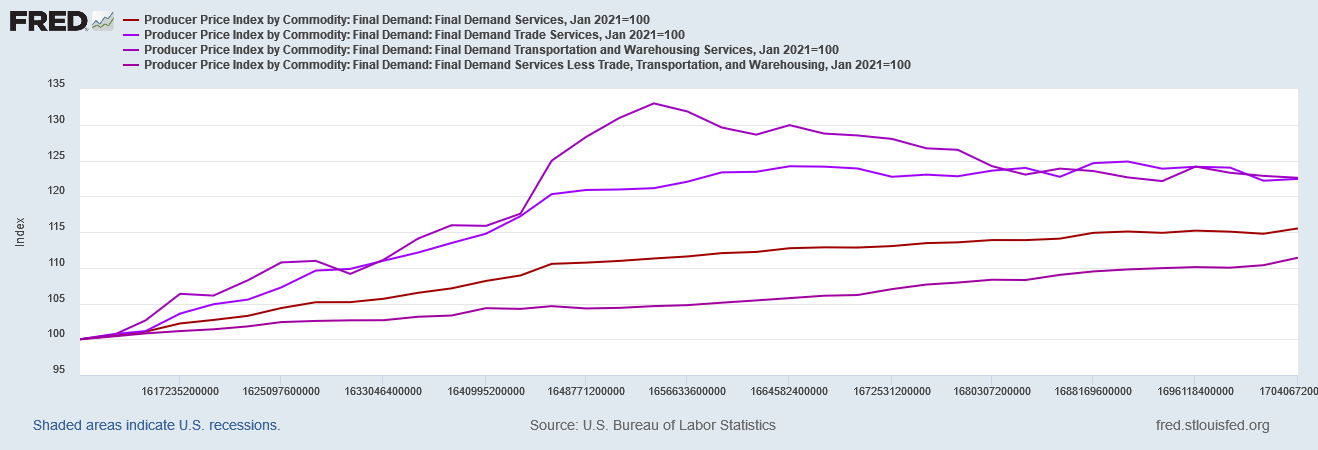

However, with the exception of PPI for Transportation and Warehousing Services, we see similar increases year on year among the services categories as well.

Factory gate prices for services have not been decreasing (except for transportaion and warehousing—so it is easy to overlook the rise in factory gate inflation among services, but even there inflation is showing signs of heating up anew.

The services inflation rises we need to take somewhat more seriously than goods inflation, because in services we see no “January effect” when we look at month on month inflation, at least not in 2023.

We do see factory gate inflation for services rising this past month, however, and that again highlights that inflation is rising.

Unsurprisingly, factory gate inflation for energy goods ticked up in January.

With tensions steadily rising in the Middle East and oil prices slowly being pushed higher in recent weeks, if anything the surprise is that January factory gate inflation for energy goods was not more pronounced.

We should not forget that energy price inflation returned to the PCE in December, albeit by a small amount.

We should also not forget that energy price inflation returned to the unadjusted CPI data in January.

Even before looking at the January factory gate prices for energy items, we already have an abundance of signals that energy price inflation is staging a comeback.

For its part, Wall Street was not pleased with the Producer Price Index report. While the major stock indices dropped right at the starting bell on Friday, their efforts to recover and move into positive territory ultimately fell short, with prices surrendering to the bad day towards the end of the afternoon.

Treasury yields similarly started the day off badly, although they managed to quickly recover for the most part, finishing the day moderately higher across the bulk of the yield curve.

Wall Street is by now realizing that such adverse inflation reports are sure to push back the date of the much-anticipated cuts to the federal funds rate by the Federal Reserve, signaling that it is time for a broader retreat among interest rates and bringing back a measure of the cheap and free money that defined Fed policy since the Pandemic Panic Recession. Wall Street continues to price in the Fed standing pat on rates at the next FOMC meeting in March.

Barring a sea change in inflation come the February data, it is a near certainty that there will be no trimming of the federal funds rate in March. Today’s panic attacks aside, Wall Street is becoming increasingly inured to the prospect of no rate cuts until well into the summer (if then).

If there is a silver lining to the January Producer Price Index Summary, it is that consumer price deflation may be receding from the US economy for at least the near term. While it is disquieting to witness prices rise once more, rising prices at least offer the hope that the US economy can yet escape a “Japanification” deflationary crisis such as is happening in China right now.

However, that is ultimately the only positive note to take away from the January PPI data. While it is January and so the PPI normally trends up in that month, we are still left with the reality of factory gate inflation having moved up this past month. We are still left with the reality that factory gate prices are moving up pretty much across the board.

Inflation is rising in this country, once again taking bigger bites out of worker paychecks. Inflation is rising, and the PPI data suggests it will continue to rise for the next few months at least.

Welcome to 2024.

Is this a surprise? This administration (and all others) manipulate the numbers to tell the story they want, and a compliant economic press rarely drill into it.

This is disappointing news. But there is one other silver lining, which is the fact that by Election Day ordinary citizens will be fed up with their struggles to balance their finances and will likely vote out the current administration.

Analysts are predicting a volatile year, worldwide, in part because 60% of the world’s population hold elections this year. Peter, can you foresee plausible scenarios developing that would hold down our rising inflation? For example, if China’s deflation and related economic troubles accelerate in certain ways, would they significantly affect the US inflation rate? I don’t mean catastrophic collapse, just serious volatility in other countries that would temper our own troubles.