It is the start of a new month and so once again it is time to deconstruct the Bureau of Labor Statistics’ Employment Situation Summary Report. Time to peel back the many layers, and scrutinize the good, the bad, and the ugly of America’s labor markets.

The jobs report itself reminds us yet again why we must delve into the detail, as the lead paragraph does an excellent job of suggesting America’s labor markets are in good shape.

Total nonfarm payroll employment rose by 151,000 in February, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in health care, financial activities, transportation and warehousing, and social assistance. Federal government employment declined.

After last month’s exercise in massive amounts of Lou Costello Labor Math, we are well advised to take that first paragraph with several grains of salt.

Alas, when we do peel back the layers of data, we quickly find that there is not a lot of good, a fair amount of bad, and more than a soupcon of ugly in the February jobs data.

There is absolutely no joy to be found in the February’s jobs report.

Corporate Media Loves To Spin

For its part, corporate media offered up its usual mix of propaganda, spin, and anti-Trump cynicism.

The Associated Press felt the jobs numbers were “solid”, even though the unemployment rate rose to 4.1%.

U.S. employers added solid 151,000 jobs last month, but the outlook is cloudy as President Donald Trump threatens a trade war, purges the federal workforce and promises to deport millions of immigrants.

The Labor Department reported Friday that hiring was up from a revised 125,000 in January. Economists had expected 160,000 new jobs last month.

The unemployment rate rose slightly to 4.1% as the number jobless Americans rose by 203,000.

Of course, what the AP left out was that the jobs numbers from December and January had been revised down a net of 2,000 jobs.

The change in total nonfarm payroll employment for December was revised up by 16,000, from +307,000 to +323,000, and the change for January was revised down by 18,000, from +143,000 to +125,000. With these revisions, employment in December and January combined is 2,000 lower than previously reported.

Once again, not only are the current month’s numbers a little anemic, but prior numbers were not as good as first reported.

ABC News highlighted that the jobs report did not meet economists’ expectations, taking pains to point out that February was Donald Trump’s first full month as President of the United States, making the jobs numbers his fault and his problem.

The U.S. added fewer jobs than economists expected in February, the first full month under President Donald Trump, according to government data released on Friday.

Overall, according to corporate media, the jobs report shows labor markets still doing well, even though the numbers did not match expectations.

But what are we to make of those expectations?

Expectations?

One has to marvel at the expectations of the “experts”, and their magical ability to forecast lofty goals for US labor markets, when the reality of the data gives scant reason for optimism at all.

We should not forget that the employment-population ratio in this country peaked in early 2023, and has been trending down ever since.

Nor should we overlook that the unemployment level in this country began rising in the summer of 2022.

Those not counted as being in the labor force began increasing in early 2022.

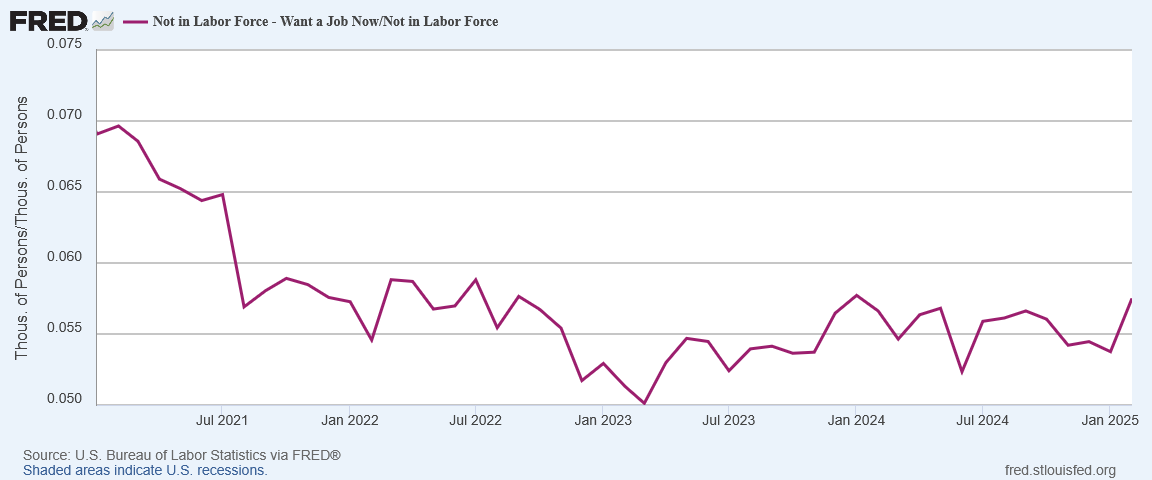

Perhaps even more ominous is the reality that the proportion of those not in the labor force but who want a job now has been steadily increasing since early 2023.

That particular demographic within that cohort not in the labor force also serves to illustrate the degree to which the “official” unemployment rate understates actual unemployment.

If we add the number not in the labor force but who want a job now to both to the unemployment level and back into the total civilian labor force, dividing the second quantity into the first gives a “real unemployment” rate that is far higher than what is reported currently. This “real” unemployment figure is at 7.6% nearly double the “official” rate of 4.1%, with nearly as many who want a job but are not counted in the ranks of the unemployed as those who are.

Nor should we be surprised by such data. We must remember that the Employment Level—part of the Household Survey side of the Employment Situation Summary—shows there was no job growth of any significance throughout all of 2024.

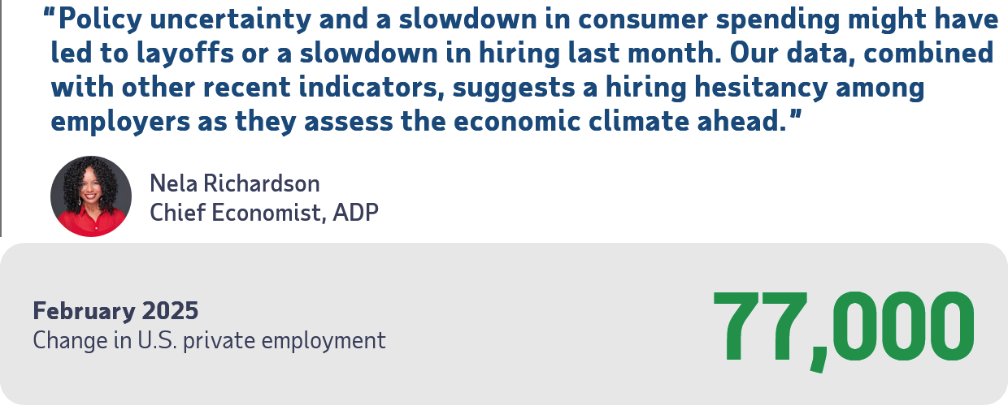

To round off the data that might help level set expectations, we should remember that ADP’s National Employment Report printed a jobs creation number that was far weaker than what has been reported by the BLS.

One has to wonder what the economists are looking at that they have such lofty expectations for the job market in the first place. They certainly do not appear to be looking at the data itself!

Top Level Payroll Data Appears “Okay”

That lack of reflection upon what the data has shown is a chronic condition both within corporate media and among the “experts”, which is how corporate media can conclude that the jobs numbers are solid. After all, if you look at just the top level numbers, the data does indeed look “okay”. Yes, the reported growth in total non-farm payrolls is lower than it has been, but the number is still near the middle of the pack compared to prior months.

Even a focus on exclusively private payrolls (no government workers) suggests the jobs numbers are on par with the average of the previous year.

However, the ADP data absolutely should give even the “experts” pause, because it once again is tracking far weaker than the BLS data.

Moreover, the ADP print for February is well below what it has been on average during 2024.

Manufacturing/Goods Producing Employment Still Weak

What the ADP data most especially highlights is that manufacturing and goods-producing employment is still very weak.

According to ADP, manufacturing concerns actually shed manufacturing jobs in February.

The BLS data on goods-producing jobs was not much better.

While the BLS did not report any loss of manufacturing jobs in February, the historical data shows that manufacturing employment in this country peaked in November, 2022, and has been trending down ever since.

President Trump has his work cut out for him if he is going to succeed in making the United States a “manufacturing superpower” as stated in his Agenda 47 from the campaign trail.

Workers Are Working Less, Still Earning Less

It is not merely the number of jobs not created that should give us pause. The Employment Situation Summary also shows that workers are working less, and that means they are earning less.

The average hours worked per week has been trending down since at least 2021, and that cuts into the average worker’s average paycheck.

This is particularly problematic because, because nominal wages in this country have not at all kept pace with inflation. This is made immediately plain when we index the Average Hourly Earnings and the Consumer Price Index to January of 2021.

With inflation starting to print hotter in recent months, that wages have not risen to meet inflation to date is sure to become an even larger pain point for the average worker and consumer in the near future.

Workers working less—and therefore earning less—is not a good look for US jobs markets. The truest sign of labor market health is when workers are working more and earning more.

Data Disconnect

One reason the experts might have been misled in their February employment estimates is that we are seeing something of a “data disconnect” across the entire breadth of available data points regarding the US economy.

The Institute for Supply Management’s Manufacturing Purchasing Manager’s Index suggests that manufacturing has been having something of a recovery in recent months.

The S&P Global Manufacturing PMI has been even more optimistic in the past couple of months.

Yet any rebound in manufacturing activity has been of the “jobless” variety, which makes the question as to how reliable the PMI metric is highly problematic.

Even the non-manufacturing PMI metrics from both the ISM and S&P Global paint a rosier picture for the economy than shows up in the jobs data.

However, when we look at capacity utilization in the economy, we see that also has been on the decline since mid-2023.

Indeed, since the beginning of 2024, manufacturing production has had far more months of decrease than of increase.

This data tracks fairly well with the weak manufacturing jobs numbers. A weak and underperforming manufacturing sector is not going to have the same ability to create jobs that a vibrant and robust sector will.

When we look across the broader cross-section of economic data for this country, we see very few reasons for any real optimism about the economy, or optimistic jobs creation forecasts.

DOGE Effect

We do need to pause for a moment to reflect on how President Trump’s Department Of Government Efficiency (“DOGE”) might be having an impact on the jobs numbers.

As I noted last week, DOGE is definitely having an impact on overall spending.

It would be quite surprising if there was not an apparent effect in employment as well. And there is an effect, although the degree to which the effect is a good one will forever be an open question.

The most obvious impact of DOGE comes in the form of 10,000 federal government jobs shed just in February alone.

Intriguingly, state government employment also largely evaporated in February. While DOGE has not been targeting state agencies, one does have to wonder if the roiling of federal disbursements has not persuaded state governments to get conservative on hiring at least for the moment.

Corporate media is convinced that DOGE is having an impact. NBC News took particular pains to call attention to the monthly Layoff Report from executive placement firm Challenger, Grey, and Christmas, which shows federal layoffs have pushed overall layoffs to their highest level since 2020.

The firm reported that U.S. employers announced 172,017 layoffs for the month, up 245% from January and the highest monthly count since July 2020 during the heightened uncertainty from the Covid pandemic. In addition, it marked the highest total for the month of February since 2009 during the global financial crisis.

Reuters has had similar reporting in recent days, suggesting DOGE was causing a federal employment apocalpyse.

Government accounted for the bulk of layoffs, with Challenger tracking 62,242 announced job cuts by the federal government from 17 different agencies. The government has laid off about 62,530 workers in the first two months of the year, a whopping 41,311% increase compared to the same period in 2024.

Forbes also sounded the layoff alarm, and also pointed the finger at DOGE.

“Private companies announced plans to shed thousands of jobs last month, particularly in Retail and Technology. With the impact of the Department of Government Efficiency [DOGE] actions, as well as canceled Government contracts, fear of trade wars, and bankruptcies, job cuts soared in February,“ said Andrew Challenger, Senior Vice President and workplace expert for Challenger, Gray & Christmas.

At a minimum, we can safely conclude that corporate media is convinced that DOGE is having a profound impact especially on federal employment levels.

However, the DOGE effect is really the only “good” that is to be found within the Employment Situation Summary for February. The rest of the detail data falls either into the “bad” or “ugly” buckets.

The report definitely shows that, regardless of the jobs actually created, many more jobs are needed. A declining employment-population ratio means by definition we are not creating nearly enough jobs for the population that we have.

The report shows also that manufacturing continues to be an underperforming sector in the economy. Donald Trump has only recently returned to the Oval Office, has only recently begun to enact Agenda 47, and so we should not impute any criticism of him in noting the weakness within manufacturing. However, we should be mindful that the weakness of the sector magnifies the task Trump has ahead of him if he is to make the US a “manufacturing superpower” as outlined in Agenda 47.

The distance that has to be covered is quite a bit larger than might have originally been presumed.

We do need to hope that Trump’s policies will be successful in expanding US manufacturing, because right now the jobs recession in the US economy is undeniably getting progressively deeper. This country is continuing to shed jobs, and not just DOGE-derived layoffs of DC Swamp Rats.

Corporate media prefers propaganda and spin, and cannot resist anti-Trump cynicism, but the jobs recession remains the sober reality of the Employment Situation Summary Report.

There is no joy to be found in the jobs data, certainly not for February.

Obama promised thousands of "shovel ready" projects and jobs when he was first elected. That turned into an utter farce.

FDR tried to goose employment with the New Deal, and saw employment crash all over again when he tried to withdraw the programs in 1937.

Nixon's meddling in the workplace in 1971 very nearly crashed the US economy.

The reality is there is very little the government can do to stimulate job creation, and even less that it should do.

President Trump definitely inherited a very shaky economy, which we all knew, and the prior administration skewed the numbers.

There’s going to be economic pain for quite some time before we get relief.

The people I see online complaining that food prices have not come down since he took office just make me roll my eyes.

Seriously!?

The Biden White House did everything they could to destroy the economy.

It can’t be fixed overnight.

I thank the Lord every day that Harris was not elected. Our country would have ceased to exist as we know it.

Thank you Peter,for your terrific work!