Powell's Press Conference Pleases

He Got The Facts Wrong But The Narrative Right. That's All Wall Street Wanted.

Yesterday, as expected, the Federal Open Market Committee elected to trim the federal funds rate by 25bps.

In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-1/2 to 3‑3/4 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

If that had been all there was to yesterday’s announcement, there would be very little to be said.

However, tucked in at the tail end of the press release was a small blurb that signaled the Fed has reached the end of its latest Quantitative Tightening phase, and is restarting asset purchases.

The Committee judges that reserve balances have declined to ample levels and will initiate purchases of shorter-term Treasury securities as needed to maintain an ample supply of reserves on an ongoing basis.

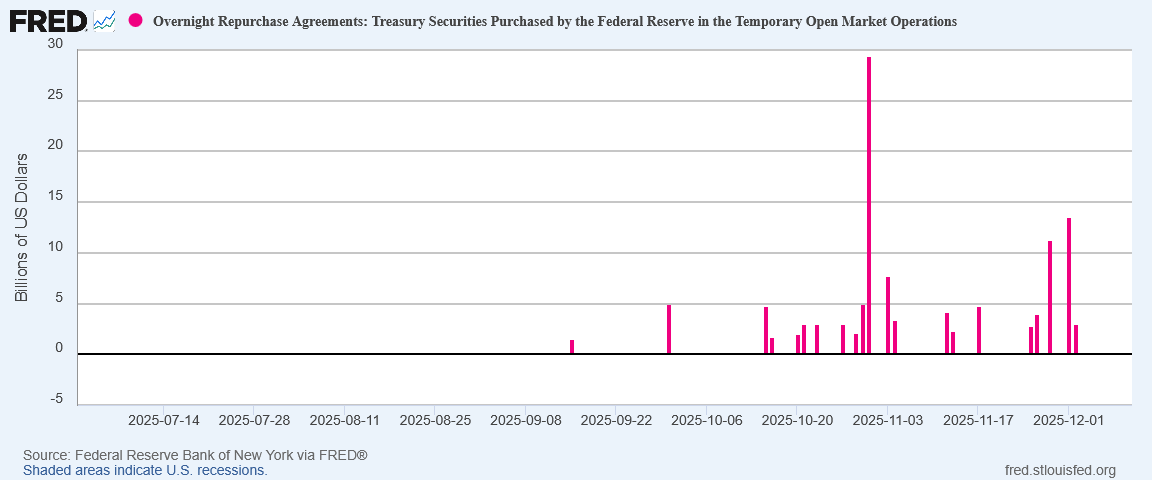

There is very little mystery as to what prompted this policy shift—overnight repo volumes have been elevated of late, indicating growing liquidity pressures in financial markets. The potential liquidity crisis I discussed last month apparently seemed real enough to the Fed that they decided to do something about it.

That overnight repo volumes continued to spike even across the Thanksgiving Day holiday weekend is a strong indicator that banks are coming up short on liquidity at crucial moments.

We should pause to understand what is meant by “liquidity”. In the context of the Federal Reserve’s overnight repo facility, when we speak of “liquidity” we are largely referring to overall “market liquidity”—that is, the ability to convert other assets into cash quickly.

Obviously, in order for market participants to be able to convert assets into cash, buyers (or, more likely, their bankers) have to have a ready supply of cash for purchasing said assets.

When banks are no longer able to convert assets into cash, markets start to lock up and bank runs commence. The Fed provides facilities such as the overnight repurchase facility in order to ensure that cash can always be obtained to allow transactions to be completed.

As was clear during the first half of the year, and through much of the third quarter, in “normal” circumstances there is very little volume in the overnight repo facility. Since October, however, that volume has been spiking with some regularity. Banks and other funding sources are needing quick jolts of cash, and there’s none available in normal market channels.

The Fed’s proactive solution to this potentially destabilizing situation is to inject more liquidity into the system by purchasing short-term securities. The Fed’s hope is that with more liquidity in financial markets overall, there will be less pressure on the overnight repo facility.

While the Fed is very likely correct about easing liquidity pressures, there is no avoiding the reality that these asset purchases will expand the money supply. This might not be officially called “quantitative easing” but at the very minimum it is “QE-lite.”

What consequences will an expansionary monetary policy have on inflation rates? Probably a larger one than President Trump’s Liberation Day tariffs.

As with everything in this world, liquidity comes with a cost.

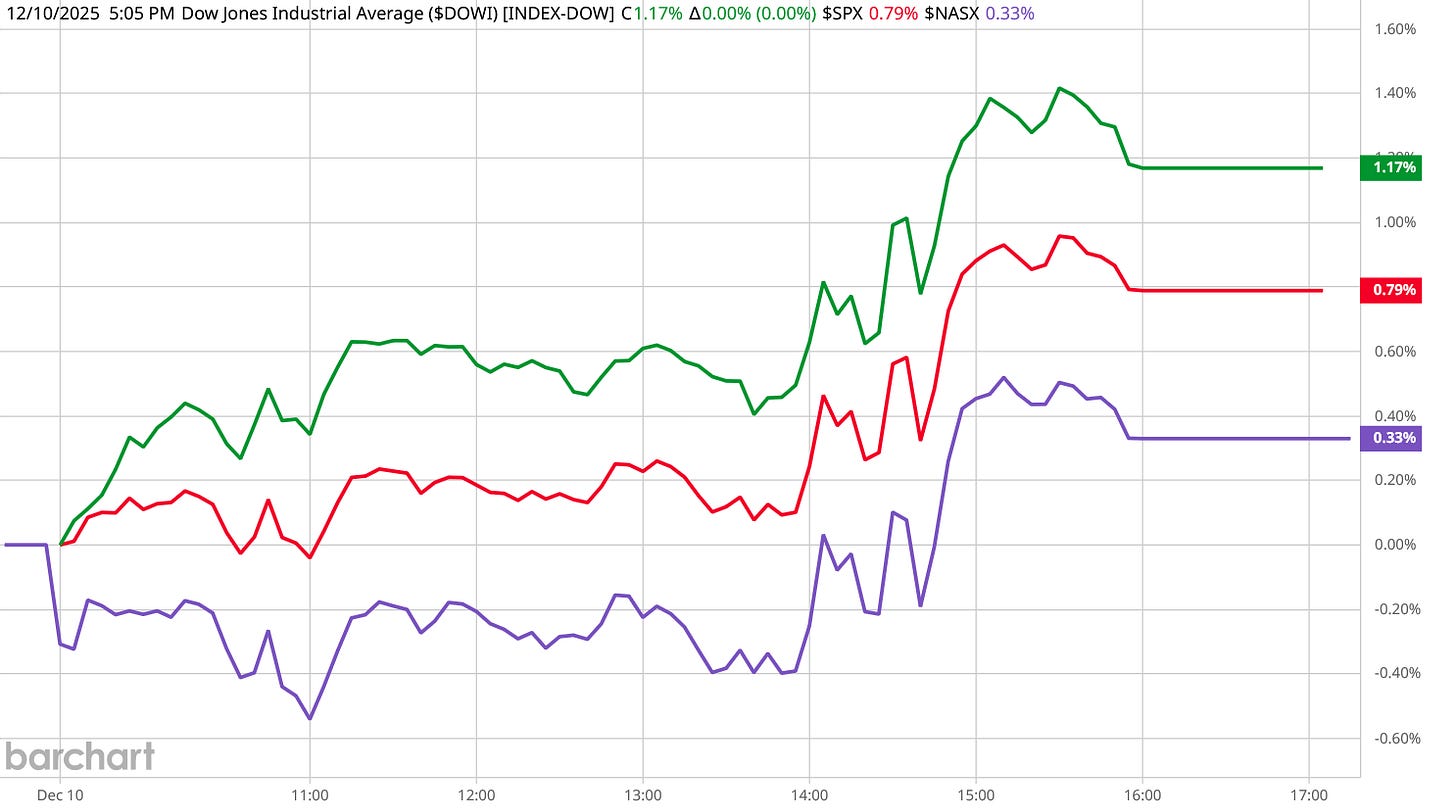

The other surprise on the day was Powell actually managing to navigate the entire post-meeting press conference without putting his foot in his mouth even once. That does not normally happen, and more than once markets have responded favorably to the rate cut announcement only to reverse when Powell starts speaking.

That did not happen this time. Equities rose throughout Powell’s presser.

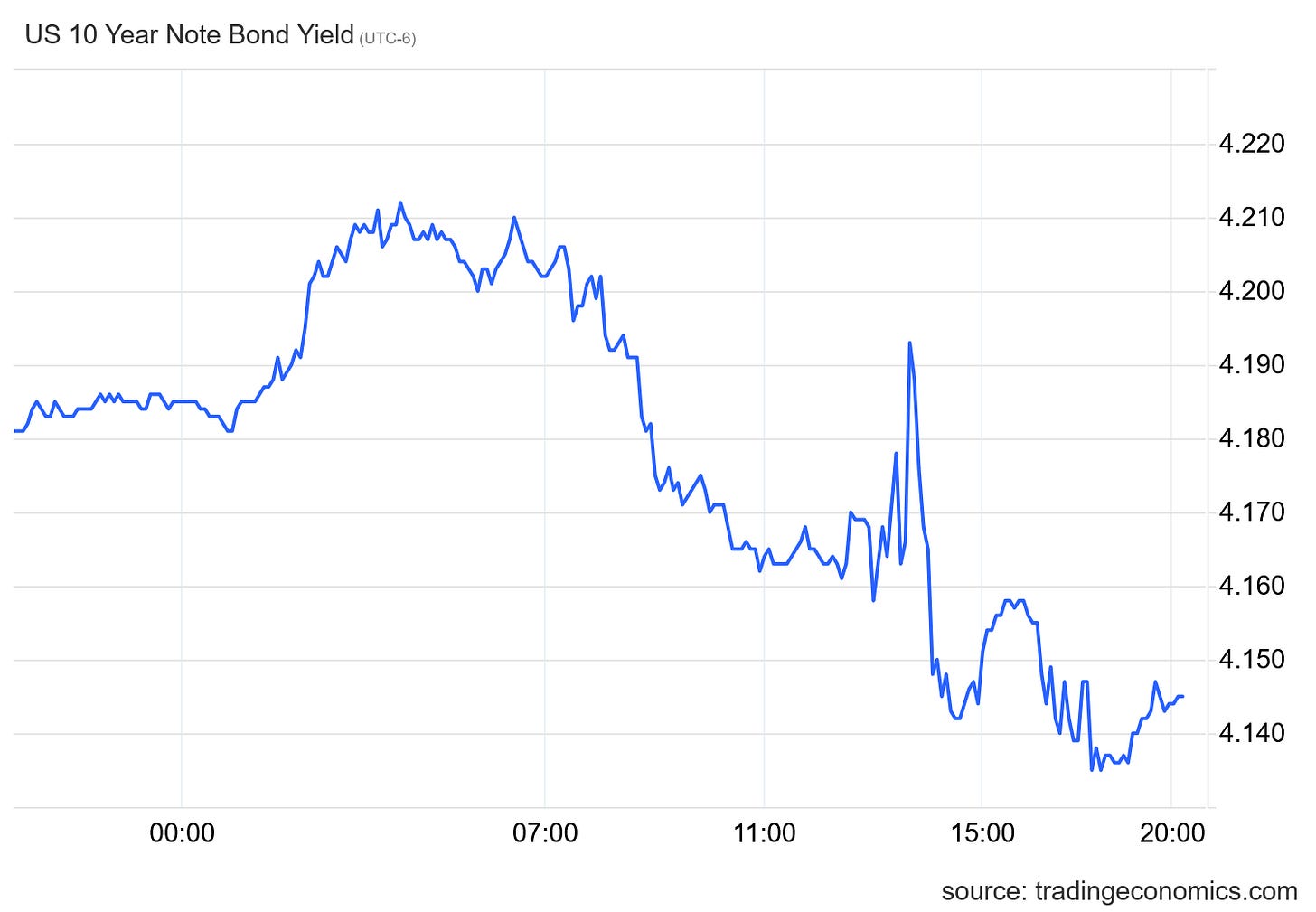

Even bond yields responded well to the press conference.

For once, the Fed cut the federal funds rate and Jay Powell did not erase all the positive market momentum the rate cut announcement generates!

How did Powell manage to avoid melting down markets as is his custom? Mainly by using a lot of words and not saying anything.

There were no surprising departures from his opening statement, which was little more than a regurgitation of the FOMC press release. For once Powell stuck to the script and Wall Street rewarded him for it.

This is not to say that Powell had his facts straight. He didn’t. That much did not change from the typical Powell presser.

Unsurprisingly, the numbers Powell got completely wrong were the jobs numbers. Either Powell simply does not look at employment data or he does not understand it.

Although important federal government data for the past couple of months have yet to be released, available public and private sector data suggests that the outlook for employment and inflation has not changed as much since our meeting in October.

Conditions in the labor market appear to be gradually cooling, and inflation remains somewhat elevated.

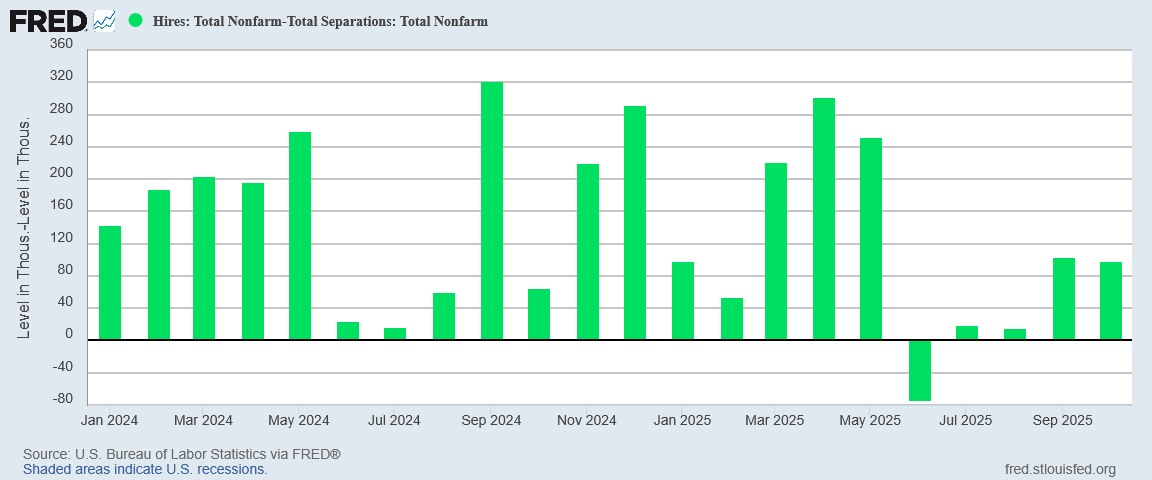

This part of his opening statement is darkly comical, given the negative JOLTS report that came out yesterday. That data shows hiring dropped sharply after May.

With the whole JOLTS report negative from top to bottom, labor markets are deteriorating, not “gradually cooling.”

Powell also ignored a major source of “private sector data”, ADP’s National Employment Report, which printed a net job loss for November.

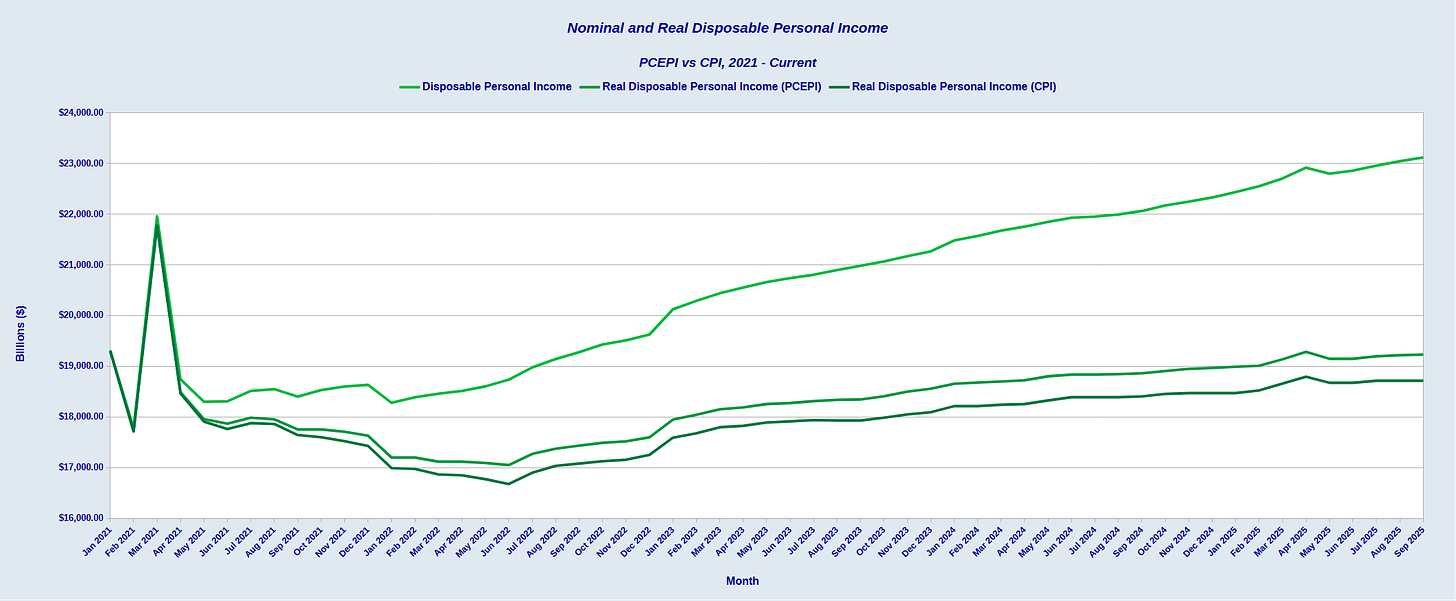

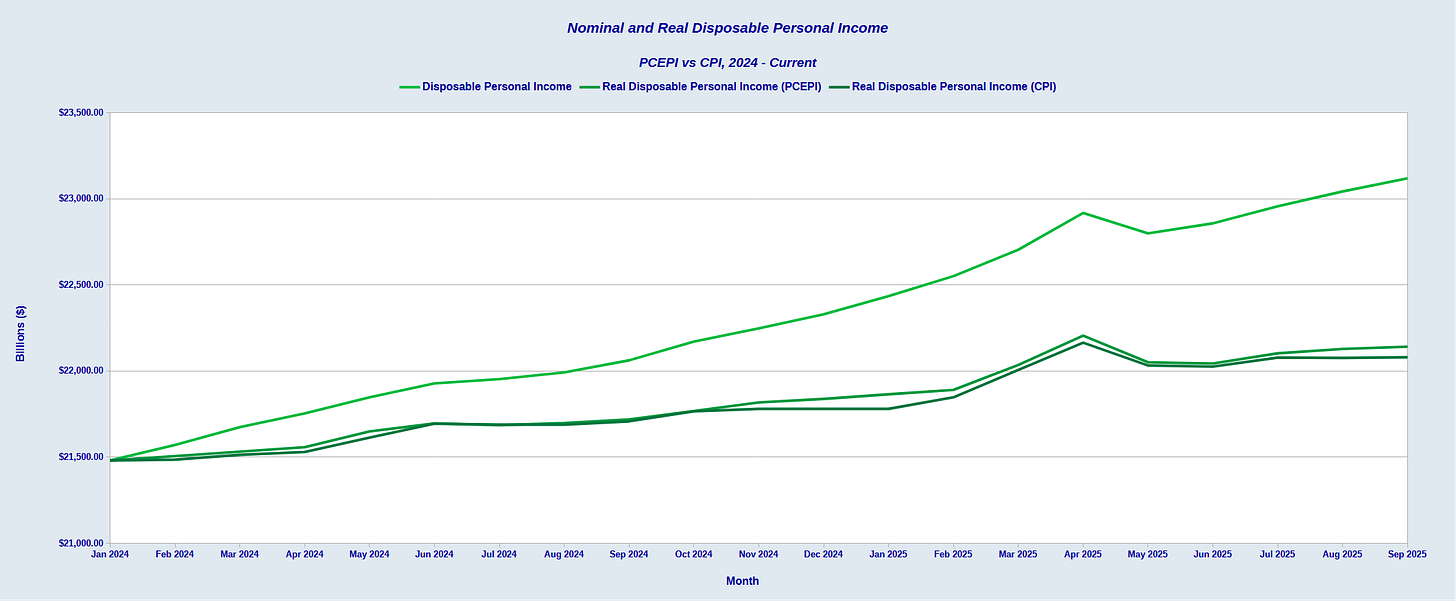

What has “cooled” of late has been real disposable income. When we calculate real disposable income from nominal values using both the CPI and PCEPI indices, we can see how incomes have yet to recover from the body blows they endured during the Pandemic Panic in 2020.

Real incomes have recovered since their 2022 nadir, but further growth is required just to get back to pre-panic levels.

Even more worrisome is that real disposable personal income has actually trended slightly downward since the spring.

The jobs data—of which Powell is presumably aware—shows US labor markets not just cooling, but deteriorating quite significantly.

The jobs data is why I have maintained for quite some time that the Fed should have trimmed by at least 50bps yesterday, or even a full percentage point.

Powell did not do that, of course. Instead we got a performative and likely inadequate 25bps that I do not believe will prove to have any discernible impact on the jobs data.

Powell chose to stick with the prevailing media and Wall Street narrative that the economy is overall doing well and is growing.

The jobs data rejects that narrative completely. How can the economy as a whole be doing well when workers are struggling and losing ground to inflation?

How can the economy as a whole be doing well if the Fed sees a need to once again inject liquidity into financial markets?

The correct answer, of course, is that the economy cannot be doing well if those things are true. As those things are true, the economy is not doing at all well.

The prevailing narrative, however, ignores those awkward realities. The prevailing narrative says the economy is doing well and not to pay any attention to the emerging negative data on jobs.

As unrealistic as that narrative is, Powell managed to stick with that narrative during his press conference, and did not contradict it. For once Powell did not say anything to cause Wall Street to recalibrate their response to a rate cut.

Powell genuflected to their chosen economic narrative, and did so without any hiccups or glitches. That was all that mattered to Wall Street

If the money supply grows, so does inflation - which will definitely be blamed on Trump by corporate media. Peter, is there anything Trump can unilaterally do, via Executive Orders, that could counteract some of the inflation? Anything that is politically viable?