Russia's Declining Stock Market Signals The Depth Of Russia's Economic Woes

Putin Has Not Escaped The Global Economic Contraction

No depiction of global economic collapse would be complete without at least a brief discussion of the state of Russia’s economy. After having opted to invade Ukraine to start the Russo-Ukrainian War1, Russia has had an outsized influence on both energy and food price inflation globally. It is appropriate to examine whether or not Russia is weathering the global economic storm of which it is an integral part.

Several indicators within Russia suggest the answer to that question is “not well”, with the abysmal performance of the Moscow Stock Exchange in recent weeks and months providing a major warning signal that Russia is not thriving on the home front.

Duelling Narratives

Before diving into the reported economic data on Russia, it is important to understand that media reporting on Russia is heavily influenced by a state of dueling narratives, with both corporate and alternative media sites weighing on both narratives.

One narrative is that Russia is bleeding heavily from its war with Ukraine, that Russia's military has underperformed and that its economy is reeling from sanctions imposed by the west.

The other narrative is that Russia is winning the war on the ground and has weathered the West’s economic sanctions, which are doing grave damage to Western economies and minimal damage to Russia’s economy.

These are, of course, simply narratives, and the “truth” is almost certainly a problematic mixture of both narratives. For the purposes of this exploration, both narratives are largely immaterial, and I mention them solely to be able to address potential issues of bias in various sources. My focus is on the extant signals of Russia’s overall economic health, regardless of whether the signals are the results of sanctions, of the war itself, or of the pre-war state of Russia’s economy. This is not a debate over whether sanctions are “working” or not, or if Ukraine is kicking tail against Russia.

What signals do we have about Russia’s rude economic health?

The MOEX Has Been Dropping….And Dropping…And Dropping

The most intriguing signal of late has been the performance of the Moscow Stock Exchange (MOEX). The ruble-denominated MOEX index cratered in the immediate aftermath of Putin’s announcement of his special military operation, but what is notable is that the index has yet to stage a meaningful recovery, but has instead languished at around that low point.

While the Moscow Exchange is no more a true proxy for the Russian economy than is Wall Street for the US economy, the MOEX does give us a view into investor sentiment in Russia—and it is difficult to see where investors have any great optimism about the future of Russia’s economy. At the same time, it is important to note that the MOEX began declining from its peak in October, indicating that Russia was heading into rough waters even before the attack on Ukraine.

Equally intriguing is that immediately after Putin announced that investors from “friendly” countries would be able to participate in the exchange again beginning today, the MOEX index declined, with the speculation being that the return of foreign investors—even “friendly” ones—would result in a wave of stock sell-offs.

"The stock market is likely to take a bearish trend on Monday due to the high probability of non-residents ditching the blue chips," said Andrey Eshkinin, an analyst at Alor Brokerage.

Their return "will create a supply overhang in the short term and could lead to a decline in share prices," said Natalya Malykh, head of equities research at Finam brokerage.

This assessment implies that even “friendly” foreign investors will re-enter the Moscow markets simply to unwind their positions and exit again—hardly a vote of confidence in the Russian economy.

A little detail that might escape attention at first is significant in this context: Russian retail investors currently account for 74% of the Russian stock market. The less than stellar performance of the Moscow Exchange since February 25 is the result of a lack of Russian confidence in Russian enterprises.

Gazprom—Not Producing Enough Gas?

Reflecting the parlous state of the MOEX stocks overall has been Russian natural gas giant Gazprom, who’s stock value plummeted after the Ukraine invasion, broadly recovered, only to plunge again at the end of July—apparently on reports that its natural gas production levels were the lowest since 2008.

According to data released by the media on Monday, Gazprom's daily natural gas production in July was 774 million cubic meters, down 14% from June; the year-to-date natural gas production was 262.4 billion cubic meters, down 12% from the same period last year. In addition, the company plans to produce 494.4 billion cubic meters of natural gas throughout 2022, down 4% from last year.

With Russian retail investors comprising 74% of exchange activity in Moscow, the inference to be drawn is that Russian investors are not enthused about Gazprom or its future.

Russian oil companies Rosneft and Lukoil have been in similar bear market territory. Despite news accounts reporting that Russia’s oil revenues have hit record levels in recent months, both Russian energy firms have not at all rebounded from their February crashes.

This begs the question: Why would Russian investors be souring on Russian energy stocks? There are few answers to that question which augur well for Russia’s energy sector overall.

Russian Inflation Was Double That Of EU Before Invasion

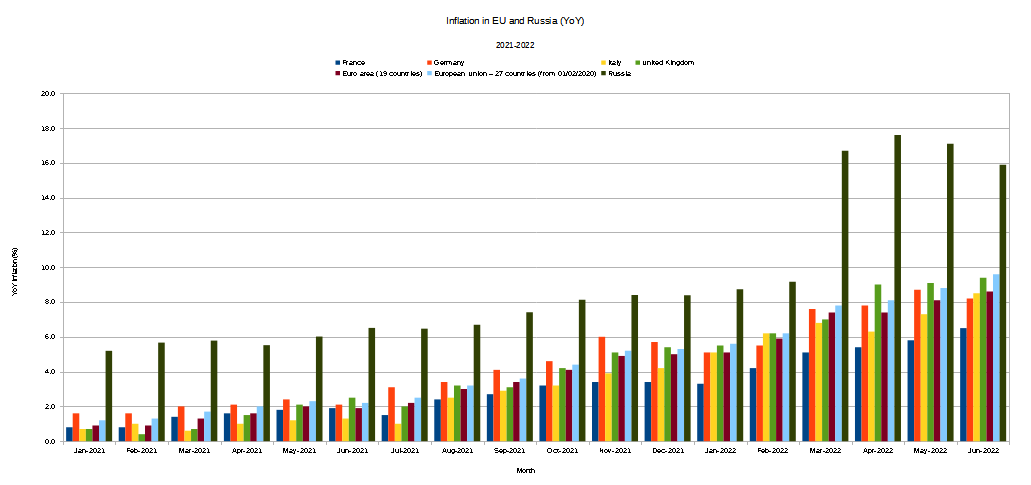

Russia has been grappling with the same rising inflation woes in the aftermath of the 2020 COVID lockdowns—but at twice the levels broadly since across Europe2. The Russo-Ukrainian War has merely exacerbated what was already a worrisome economic trend.

Despite the double digit inflation, a consensus among economists polled by Reuters forecasts an overall economic contraction in Russia of 5% this year—and that is an improvement over prior predictions.

The average forecast among 17 analysts polled in late July suggested the Russian economy was on track to shrink by 5% this year. A similar poll in June had predicted a contraction of 7.1%

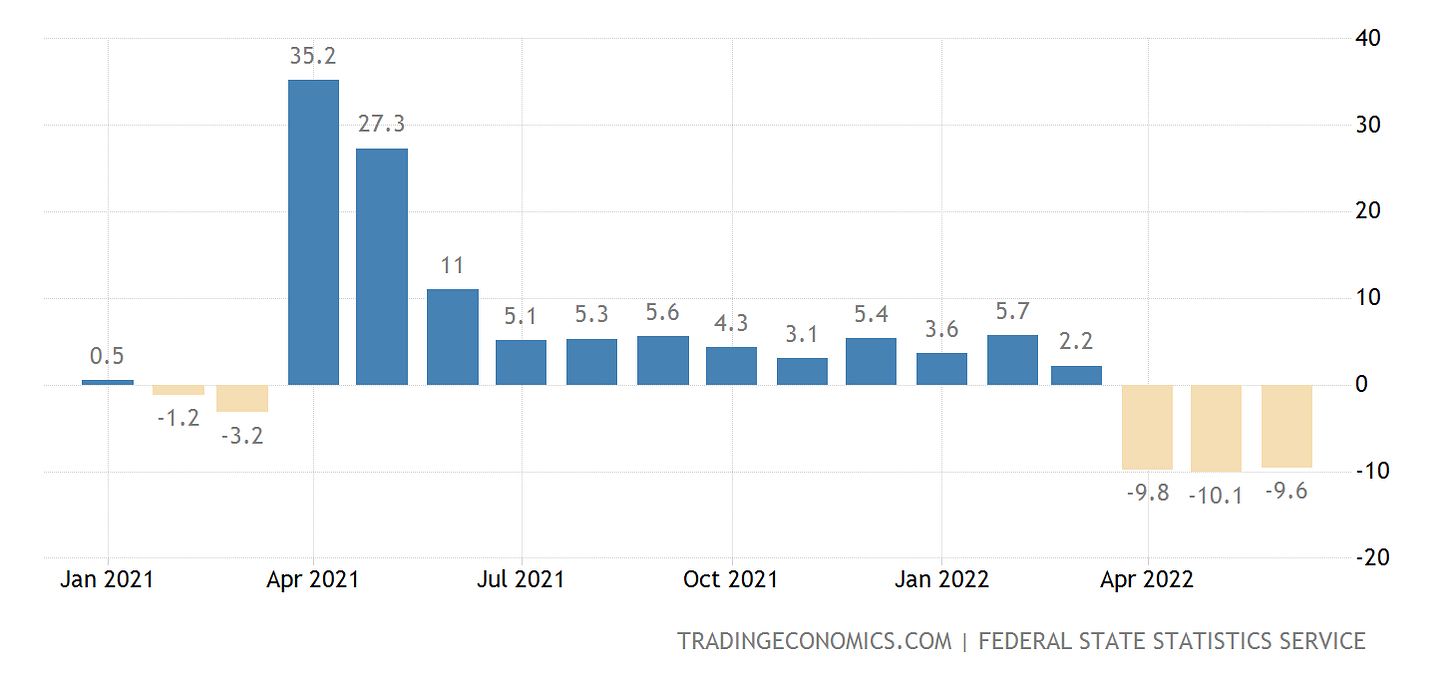

Certainly, economic data released by Rosstat, Russia’s official statistics bureau, tracks with economic contraction: Disposable income, industrial output, and retail sales have all declined in recent months.

Industrial output fell 1.8% year-on-year in June, a sharper drop than in May, and retail sales continued their slump, down 9.6% when compared with June 2021. As in the previous month, unemployment was the outlier, with the jobless rate hovering at a record low 3.9%.

Viewed from a year-on-year perspective, Russia’s retail sales are especially ugly, having been in contraction since April, and in a downward trend overall since April of 2021.

Russia Is Part Of The Global Economy, And Is Part Of The Global Collapse

To state with certainty how “bad” things are within the Russian economy would require greater access to Russia’s own internal economic metrics than is widely available. However, the data that is publicly available does not portray an economy that is at all healthy, thriving, and prosperous. Most of the publicly available signals through sites such as Trading Economics suggests that Russia’s economy peaked in late 2021, and has been sliding into recession ever since (and well before the obvious disruptions of the war with Ukraine, which have hardly helped matters).

Whether such a dismal economic performance is attributable to the West’s sanctions regime or not is largely immaterial. Regardless of the relative influences of war, sanctions, and Russia’s own internal issues, the end result is that, just as Russia has been part of the global economy, so too is it part of the global economic contraction and collapse we are currently experiencing. The “red flags” seen in economies across the globe are just as evident in the Russian economy. Russians are shedding wealth alongside the Chinese as well as Western investors.

It is this synchronized picture of economic contraction that escalates contraction into collapse. The negative data from one region is not being offset by positive data from elsewhere, but is being amplified by still more negative data from everywhere. Russia’s woes are the world’s woes, and vice versa.

Russia’s dismal economic outlook means there are no safe havens, no ports in which to ride out the coming economic storm.

For Russia and for the world, the prognosis remains equally foreboding:

Chaos is coming.

Whether Russia has an adequate casus belli for commencing military operations against Ukraine is a debating point on several social media sites. Regardless of this, the reality is that Russia fired the first shot, and that Russia is fighting Ukraine on Ukrainian soil.

The final three months of Russian inflation percentages are courtesy of Trading Economics.

Thanks very much for this analysis.

It is hard to see how Russia or China (with sanctions if it invades Taiwan) could maintain existing machinery or build new machinery for all types of production, and for many defense purposes (at least to build the weapons, even if the weapons have no electronics inside them) when they are cut off from

the rest of the world's semiconductors and other electronic components.

Many components are built in exactly one place - not in Russia or China. Electronic designs need a large number of different components, which are highly specific in electrical behaviour and physical package dimensions. Without even one component, the final product can't be made.

The most advanced CPUs do not come from China - and Russia has only a very small, antiquated, semiconductor industry which produces a few exotic parts.

For a country to be productive, it has to be able to access the latest end-products and often the latest components.

This makes the idea of China or Russia actually attacking anyone the rest of the world cares about a really bad idea. Since there is such corruption, malfeasance and ineptitude in politicians, this fact does not mean that such attacks will not proceed. Exhibit 1: Ukraine.

If the data is from America, then most likely to be manipulated to fit the narrative. Russia has lot of food , American government are killing the farmer and food supply.