This week has not lacked for surprising news!

Yesterday, 11 of the nation’s biggest banks banded together to bailout First Republic Bank, the 14th largest bank in the US by total assets. In an unusual move, JPMorgan, Bank Of America, Citigroup, Wells Fargo, Morgan Stanley, US Bancorp, Truist, PNC, State Street, and the Bank of New York Mellon joined forces to deposit $30 Billion in uninsured cash with First Republic.

The infusion from 11 of the nation's biggest banks, including JPMorgan Chase (JPM) and Bank of America (BAC), follows a steep drop in the shares of First Republic, which was the nation's 14th-largest bank as of Dec. 31 with $212 billion in assets.

JPMorgan, Bank of America, Citigroup (C) and Wells Fargo (WFC)—the four largest lenders in the U.S. by assets—deposited $5 billion apiece. Goldman Sachs (GS), Morgan Stanley (MS) each deposited $2.5 billion while U.S. Bancorp (USB), Truist (TFC), PNC (PNC), State Street (STT) and Bank of New York Mellon (BK) each deposited $1 billion. The deposits have to stay at First Republic for 120 days and earn interest at the same rate of current depositors, according to a person familiar with the pact.

The extra cash, as deposits rather than access to a liquidity line, goes directly towards bolstering the bank’s liquidity and coverage ratios. With the cash committed to First Republic for at least 120 days, the object of the exercise, one organized by the US government, is to give the bank some breathing room while it attempts to stabilize and right its finances.

Why did the banks deposit cash, instead of providing another funding option? In a word, liquidity.

By depositing cash the big banks directly reinforce First Republic’s liquidity and coverage ratios. This makes it qualitatively different from the support mechanism it had earlier lined up with JPMorgan, which was simply a borrowing facility of up to $70 Billion.

The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies, and further strengthens First Republic’s existing liquidity profile. The total available, unused liquidity to fund operations is now more than $70 billion. This excludes additional liquidity First Republic is eligible to receive under the new Bank Term Funding Program announced by the Federal Reserve today.

Whereas the earlier support vehicle merely gave First Republic the capacity to borrow from JPMorgan and the Federal Reserve, this time the banks are directly bolstering First Republic cash position.

When we look on the First Republic balance sheet from their 10-K filed with the SEC for FY2022, we can see what impact this has on First Republic’s finances.

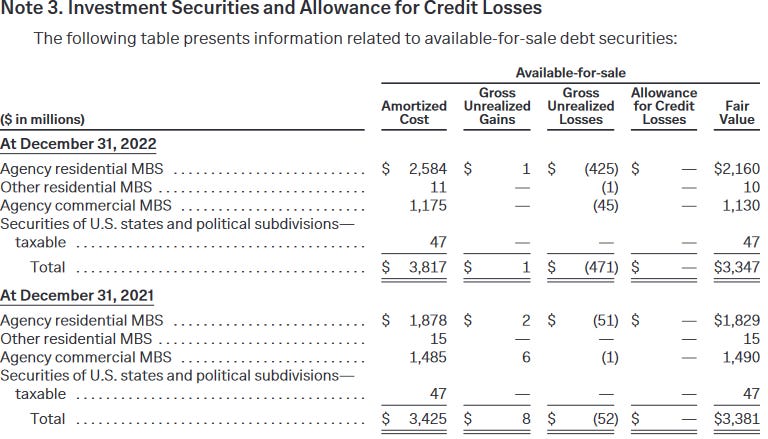

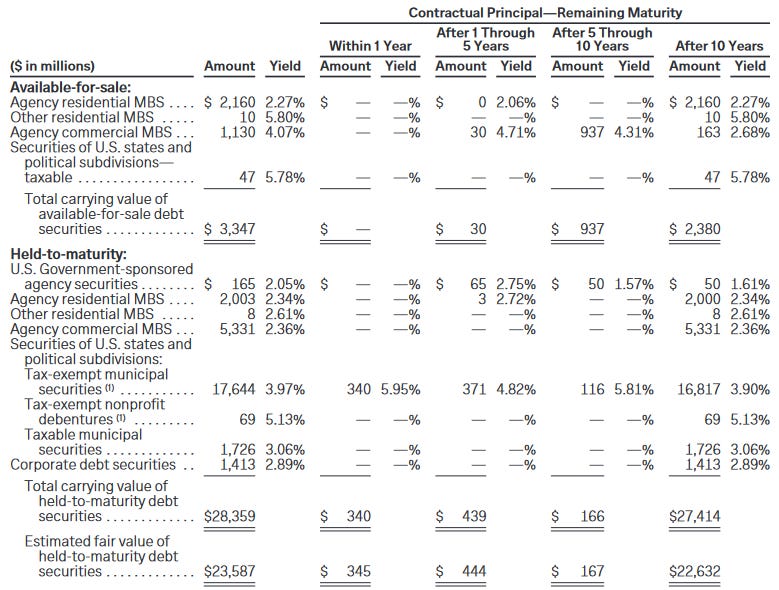

At the end of FY2022, First Republic had $31,217 Million in liquid assets, comprised of cash and cash equivalents, debt securities booked as “available-for-sale”, and debt securities booked as “held-to-maturity”.

Available-for-sale securities1 and held-to-maturity securities2 are exactly what the portfolio names suggest: securities held specifically for resale in the secondary market, and securities held until they reach maturity and repayment of contract principal is recieve.

Note that while on the balance sheet the “held-to-maturity” portfolio has a carrying value of $28,348 Million, for the purposes of computing the bank’s coverage ratios the fair value of the portfolio, $23,587, is used. This is because should the portfolio need to be liquidated to cover customer deposits, the fair value is the amount the bank would likely receive.

As one can see in the supplementary analysis of the available-for-sale portfolio provided in the bank’s 10-K filing, that portfolio is always shown on the books at fair market value, net of applicable unrealized losses, and so no further adjustment is required.

The liquid assets shown on the balance sheet were what would be immediately available to cover customer deposits in the event of a major withdrawal (i.e., a bank run).

A company’s ability to cover liabilities with liquid assets is called the “coverage ratio”3, and is a benchmark of a company’s financial health.

Based on the FY2022 10-K, First Republic’s coverage ratios looked like this:

At most, First Republic had enough cash to cover only 17.69% of customer deposits—in the wake of SVB’s collapse, clearly not enough to withstand a bank run.

By accepting deposits of $30 Billion from the group of 11 banks, the coverage ratios are improved considerably.

The $30 Billion in cash deposits nearly doubles the “worst case” coverage ratio where the held-to-maturity portfolio has to be liquidated to cover deposits.

As described by First Republic, the earlier liquidity support from JPMorgan did not provide this level of balance sheet relief, because it was only “access” to up to $70 billion in borrowings, not $70 billion in cash.

The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies, and further strengthens First Republic’s existing liquidity profile. The total available, unused liquidity to fund operations is now more than $70 billion. This excludes additional liquidity First Republic is eligible to receive under the new Bank Term Funding Program announced by the Federal Reserve today.

Thus the earlier facility provided no improvement on the bank’s immediate cash position.

$30 Billion in fresh deposits is also a fairly dramatic vote of confidence in the bank’s operations, which in theory at least should forestall any bank run for the immediate future.

Unsurprisingly, the US government response to this act of corporate benevolence was one of appreciation—the big banks essentially bailed out First Republic without another government backstop and depositor guarantee.

Today, 11 banks announced $30 billion in deposits into First Republic Bank. This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system.

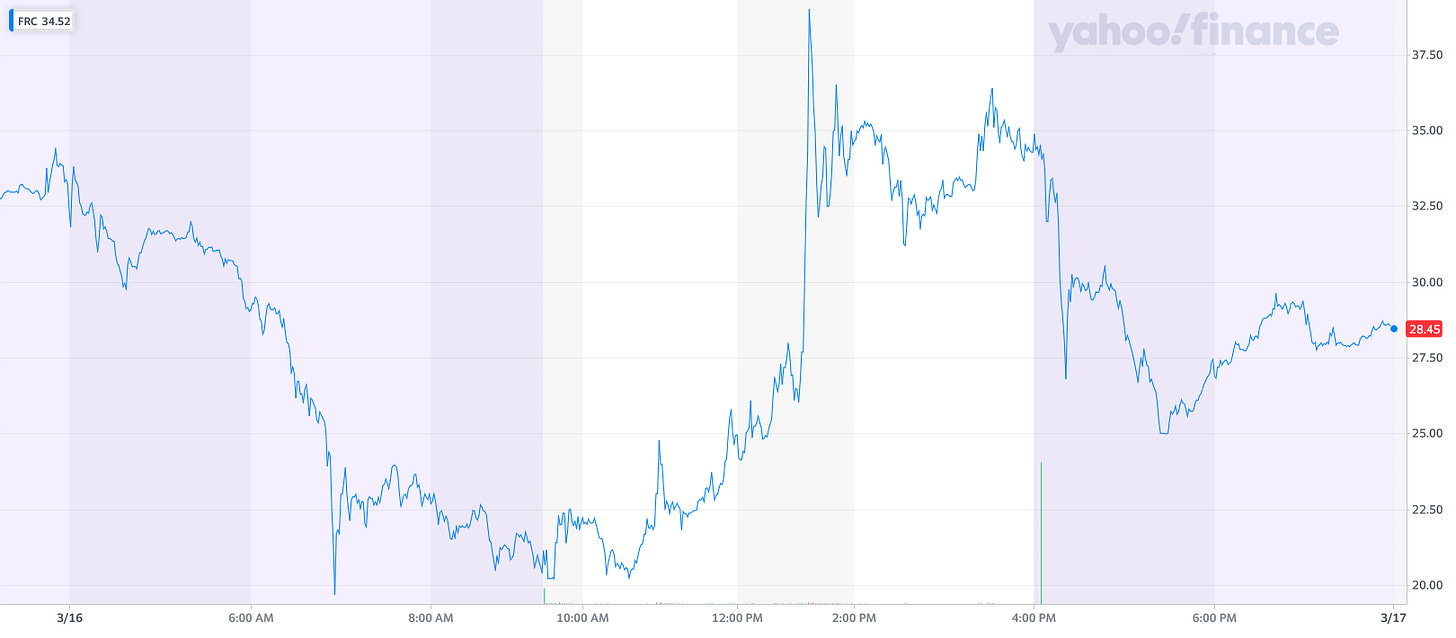

Wall Street’s reaction could be more accurately described as relief: First Republic’s stock shot up on announcement of the deal, and closed the day’s trading having gained some 9.98%.

Ironically, the stock surrendered much of that gain in after hours trading, as First Republic announced a suspension of its cash dividend.

First Republic Bank (NYSE:FRC) dropped 12% in after hours trading after announcing it was suspending its dividend after big banks pledged the troubled lender $30 in deposits.

"The Bank is focused on reducing its borrowings and evaluating the composition and size of its balance sheet going forward," First Republic said in a statement. "Consistent with this focus and during this period of recovery, the Bank’s Board of Directors has determined to suspend its common stock dividend."

The move makes sense, however—it would be the height of folly to expend even a portion of the newly won cash on dividends. The lack of dividends, however, make any stock that much less attractive, and the share price declined accordingly.

Why did the 11 banks agree to this unusual gesture of support? The most likely rationale was to preserve the bank while takeover options were being explored, as after the bailout there were unconfirmed reports several of the 11 are interested in acquiring First Republic.

Many of the institutions involved in the bailout of the beleaguered First Republic Bank are also said to be looking to make a possible purchase of the San-Francisco-based institution, Fox Business has learned.

Those said to be interested include Morgan Stanley and PNC Bank — several of the same firms that put up the $30 billion in bailout money to keep First Republic from following Silicon Valley Bank (SVB), Signature Bank and Silvergate into insolvency, according to people with direct knowledge of the matter.

While the bailout exercise itself raises some significant ethical questions regarding the government’s involvement in organizing the effort—one always has to wonder how much like Vito Corleone Treasury officials sounded when they approached the 11 banks to “make them an offer they couldn’t refuse”—the structure of the bailout serves to underscore a point I made earlier: what is dragging US regional banks down is the erosion in fair market value of their debt securities portfolios due to rising interest rates, not a sudden surge in default risk.

However, it is important to understand that, regardless of how one view the propriety and necessity of the government’s eleventh-hour decision to backstop SVB and Signature Bank depositors, what has been unfolding has not been a replay of the 2007-2008 Great Financial Crisis, as a quick perusal of loan delinquency and default rates from both then and now illustrates.

When we look at First Republic’s 10-K filing, for its breakdown of its debt securities portfolios, we see assets that are notionally healthy, but low yielding.

Some of the portfolios even have yields in excess of current market interest rates, and thus provide at least some unrealized gains.

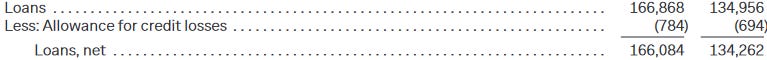

Based on the allowance for credit losses on loans, First Republic’s loan book is arguably not in bad shape.

The bank’s income for FY2022 before recognition of unrealized losses on their debt securities held available-for-sale was an increase over FY2021, and fully diluted earnings per common share rose by $0.53 in FY2022.

While liquidity amidst a bank run was definitely cause for concern, even with the loss of fair market value on the debt securities loan portfolios First Republic likely would have been able to soldier on for quite some time before it was forced into the same desperation moves SVB made just prior to its takeover. Whether First Republic’s management would be willing to acknowledge the mounting unrealized losses in its debt securities portfolios is an open question.

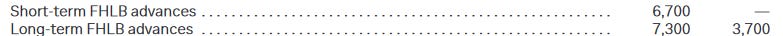

Still, judging by the increase in FHLB advance borrowings in FY2022, First Republic has already been feeling the liquidity pinch throughout last year, and has been attempting to paper it over with FHLB loans.

An increase in total FHLB advances of $10,300 million in a single year is a definite red flag on the bank’s liquidity, and suggests that First Republic’s management was, like SVB’s leadership, attempting to avoid the liquidity day of reckoning by any means necessary. First Republic might be financially in better shape than SVB was for the moment, but there are definitely warning signs within the bank’s financials.

Once again, we see the bank management mistake of attempting to avoid having to answer for being caught short when the Fed’s rate hikes tanked the value of the bank’s debt securities portfolios—as with SVB and even Silvergate Capital, First Republic simply refused to proactively address the impaired value of those portfolios, even though it was immediately obvious the impairments were permanent.

Is First Republic “out of the woods”? Probably not, although they likely have at least 120 days’ grace to work out a more permanent solution—which at this juncture very likely entails a sale to one of the bailout partners. However, given that First Republic has not held a fire-sale on their debt securities portfolios, it seems reasonable to infer that First Republic was not yet at the SVB position of having to desperately raise cash by any means necessary. In time, First Republic could come to that same SVB position of desperation, which would necessitate a shuttering and fire-sale auction of either the entire bank or its assets piecemeal, but it is not there yet.

For now, First Republic at least as a new 120-day lease on life. Whether that will be sufficient to bring anxiety levels in the US banking sector down to a level resembling “normalcy” remains to be seen.

Tuovila, A. “Available-for-Sale Securities: Definition, vs. Held-for-Trading”, Investopedia. 9 Aug. 2020, https://www.investopedia.com/terms/a/available-for-sale-security.asp.

Murphy, C. “Held-to-Maturity (HTM) Securities: How They Work and Examples”, Investopedia. 28 Nov. 2020, https://www.investopedia.com/terms/h/held-to-maturity-security.asp.

Hayes, A. “Coverage Ratio”, Investopedia. 29 Sept. 2020, https://www.investopedia.com/terms/c/coverageratio.asp.

I’m glad you’re addressing this matter today. When I first heard that it was ‘uninsured’ funds being transferred, I thought, is that going to be good enough to inspire depositors’ confidence? But what you say makes sense - the other banks will eventually have a shark fest, carving up and devouring the next big bank to go under.

This is the first time I’m hearing about the Fed’s new Bank Term Funding Program, so I know nothing about it. As time goes by, could you please let us know what you think of it? Is it a good idea, is it working out as planned, are there particular downsides to the program that you can see developing? Thanks!

"Out of the woods?"

For one thing, they do think it is their money!

Thirty billion dollars from 11 banks?

Thirty billion dollars. Not whose thirty billion dollars, just thirty billion dollars.

Oh well, compared to 6.9 trillion dollars, it is pocket change.