Shout-out to subscriber PAULA ADAMS for requesting a comparison of the US economy during the first three years of Donald Trump’s term of office against Joe Biden’s three years to date.

With the Bureau of Economic Analysis having released its advance estimate of fourth quarter real GDP growth as well as the full year real GDP growth for 2023, we now have enough data to begin doing true “apples-to-apples” comparisons.

Certainly there are reasons to look askance at the US economy’s performance over the past few years, not the least of which is the “pause” that real GDP growth took for literally all of 2022.

That 2022 “pause” is reason enough on its own to argue the failure of “Bidenomics.”

Yet while Donald Trump did not experience such an economic pause during the first three years of his Presidency, neither were his policies an unstoppable engine of economic growth and employment expansion. Indeed, by the end of 2019 the US was well on the way towards another recession with or without COVID.

Donald Trump does have a superior economic track record to Joe Biden, but only somewhat. Neither Trump nor Biden can be said to have any sort of “magic touch” when it comes to economic policy, and even without 2020, Trump’s economic stewardship was not an untrammeled success.

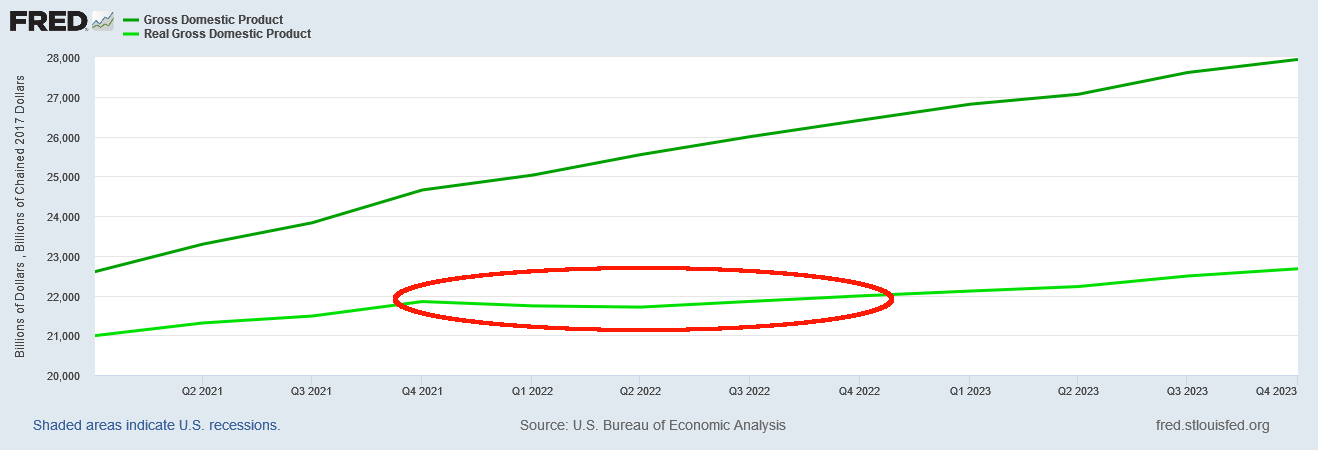

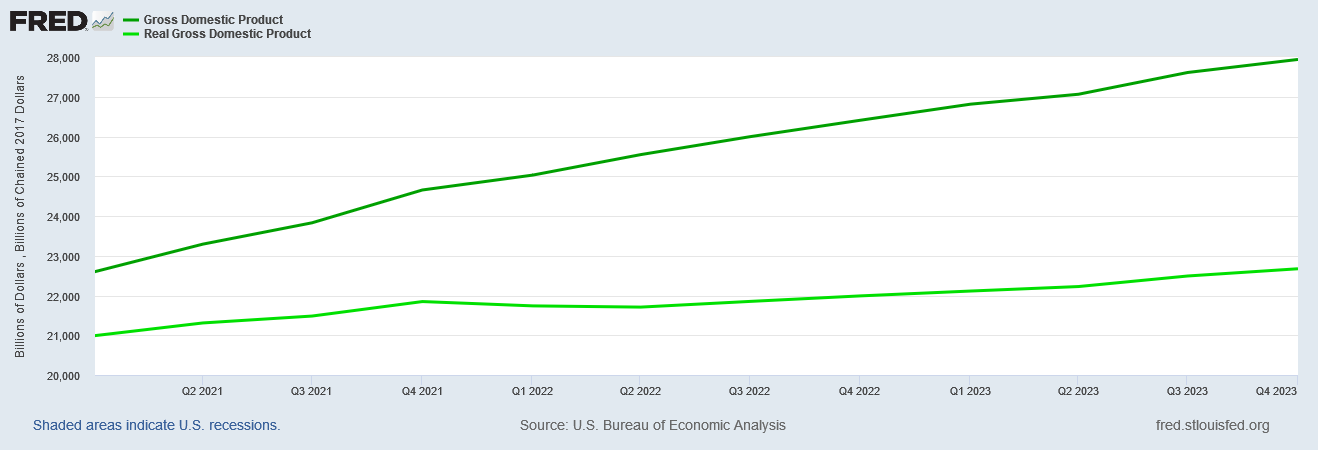

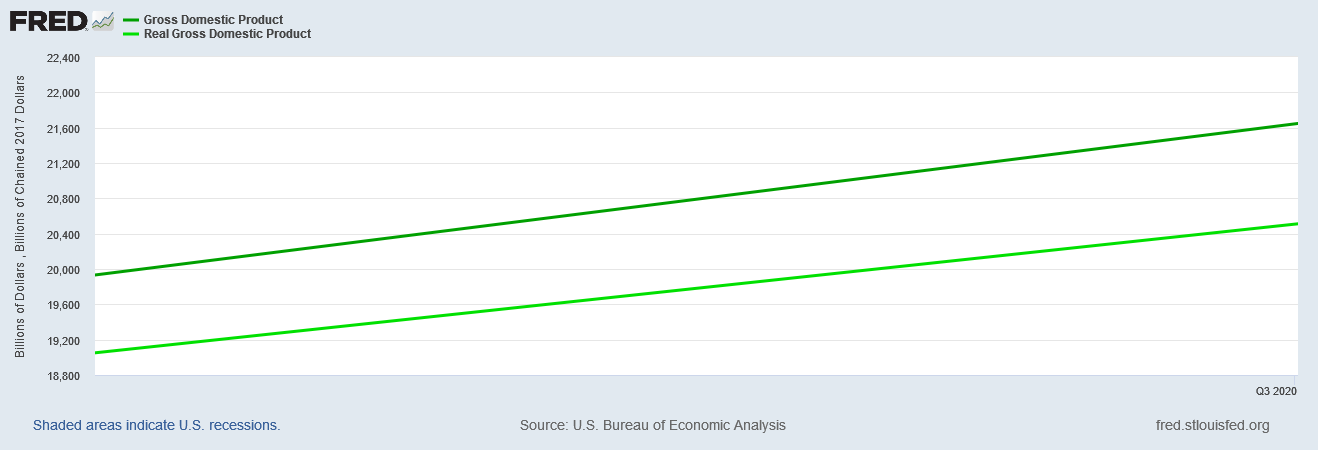

One of the first comparisons to make, one with some fairly obvious differences, is the growth in both nominal GDP and real GDP from 2017 through 2019 vs 2021 through 2023.

Because of the aforementioned “pause” in real GDP growth in 2022, over the past three years there has been a marked divergence between nominal and real GDP.

By comparison, the differential between nominal and real GDP from 2017 through 2019 was far more constant.

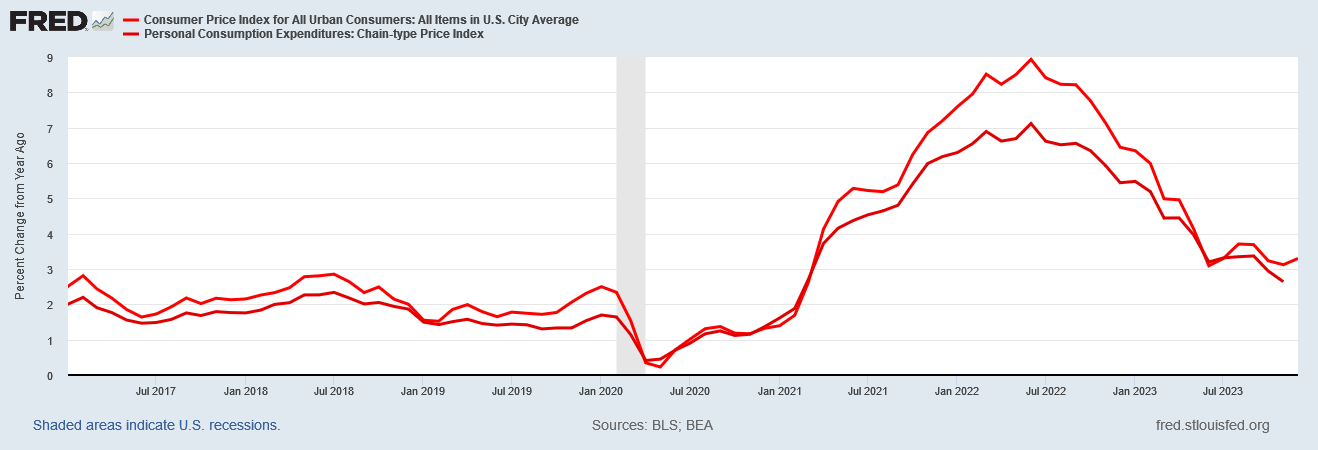

We should note immediately that one reason for this difference is, of course, the recent episode of hyperinflation this country has experienced, and potentially is still experiencing.

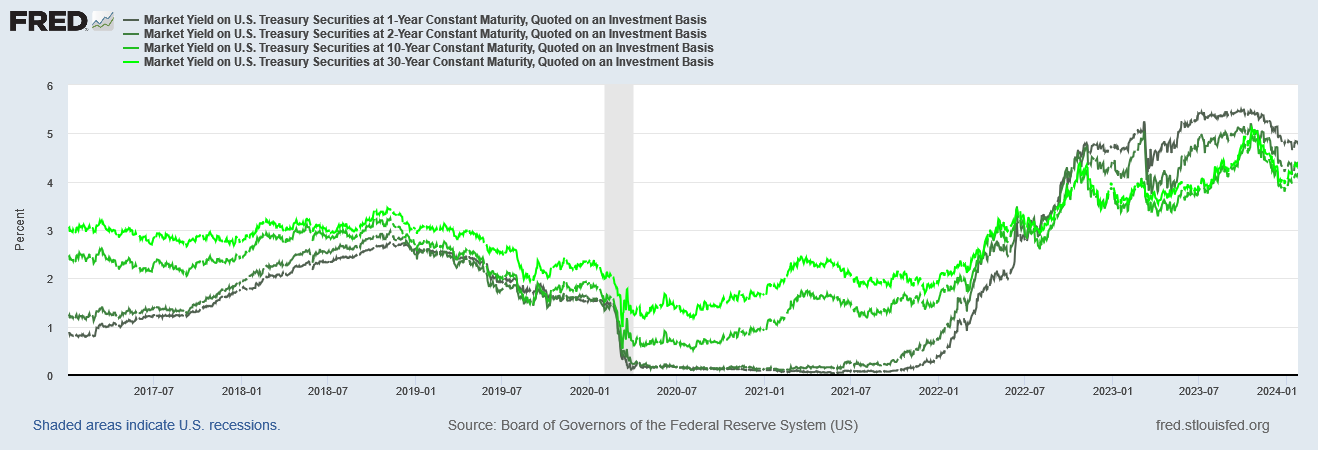

We should also be cognizant of how Treasury yields have shifted since 2017.

Consumer price inflation was largely a non-issue from 2017 through 2019, and even by January 2021 year on year inflation was still below the Federal Reserve’s magical 2% threshold.

Between 2021 and 2022, however, not only did year on year inflation rise dramatically, but shorter term yields—specifically 1-Year and 2-Year maturities—also crept up.

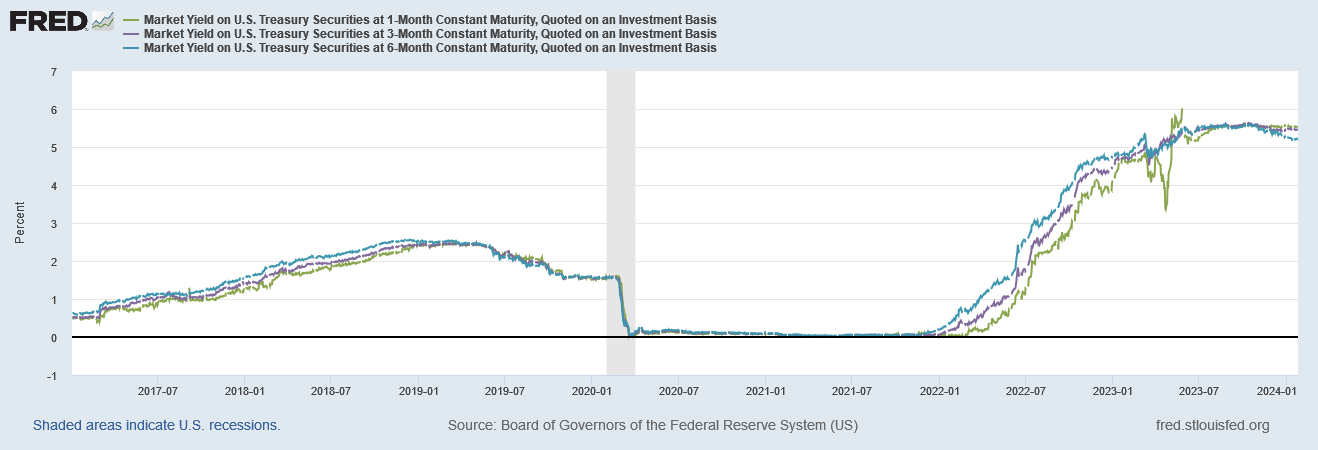

One possible reason consumer price inflation might have been triggered in 2021 could be that the shortest term yields—1-Month through 6-Month maturities—were right at the zero bound alongside 10-Year and 30-Year maturities.

The drop to near zero interest rates across the yield curve was the consequence of Fed policy in the aftermath of the Pandemic Panic Recession.

We have to be careful before putting too much emphasis on interest rates and inflation, however, because while the shortest term maturities and the longest term maturities were kept at the zero bound until 2022, 1-Year and 2-Year maturities especially rose even as consumer price inflation rose. In fact, the correlations between interest rates and inflation historically speaking has been problematic at best. The experiences across the major central banks of the world has been that Milton Friedman’s proposition that inflation is a monetary phenomenon is far more nuanced than the prevailing narrative is willing to admit.

Still, inflation was much less of an issue from 2017 through 2019 relative to 2021 through 2023. On that basis, at least, Donald Trump’s economic tenure comes out ahead.

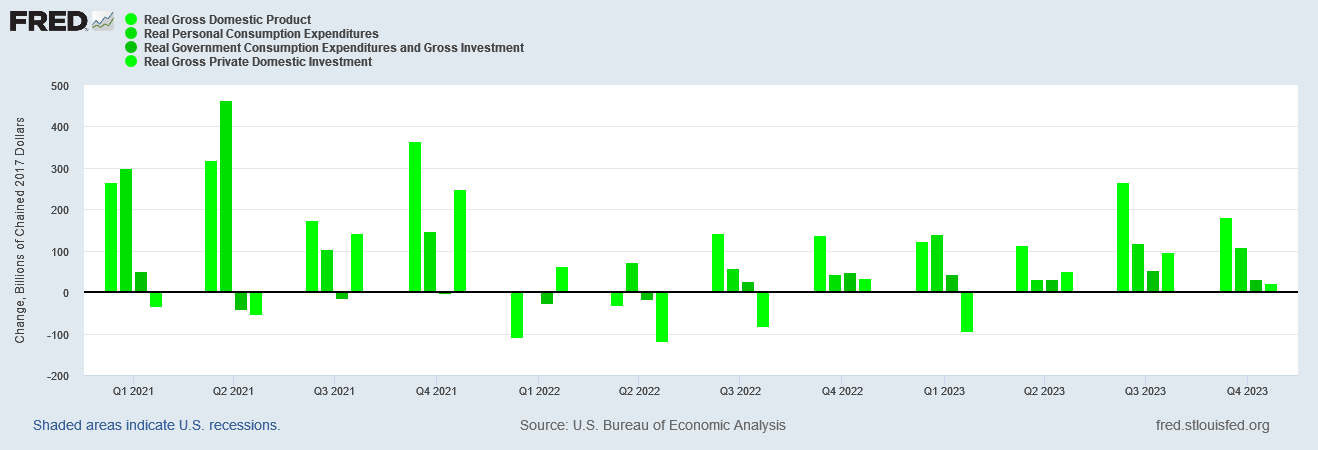

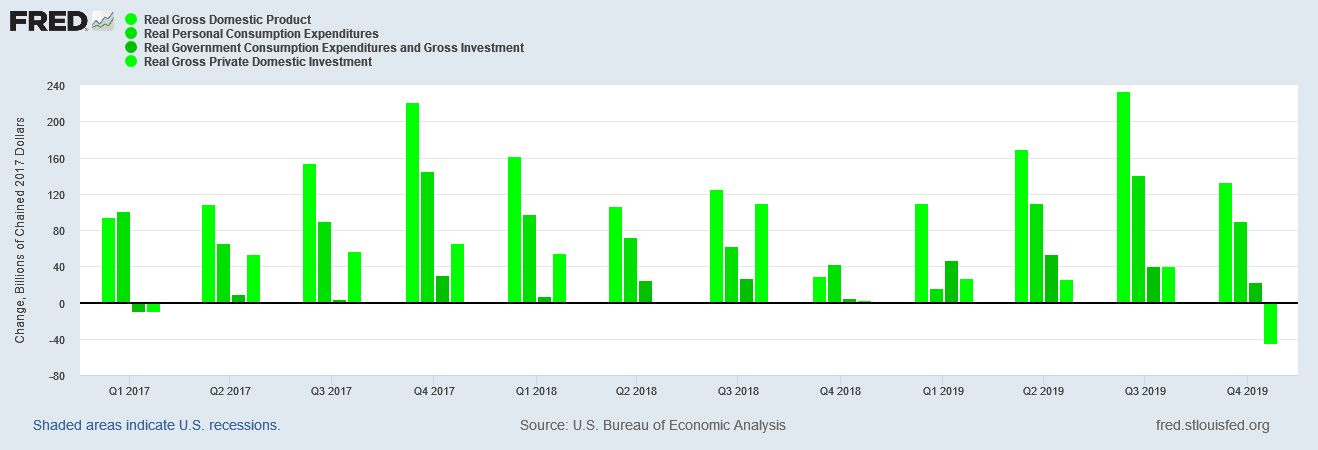

When we compare the year on year growth of Real GDP and the primary sub-components: Personal Consumption, Government Consumption and Investment, and Private Domestic Investment, we can see the 2022 slowdown in the economy writ large.

We can also see that even at the end of 2023, real GDP growth has not fully recovered.

If we look at that same time frame for quarter on quarter changes in Real GDP, we see especially that Private Domestic Investment contracted and has staged a problematic “recovery” in 2023 at best.

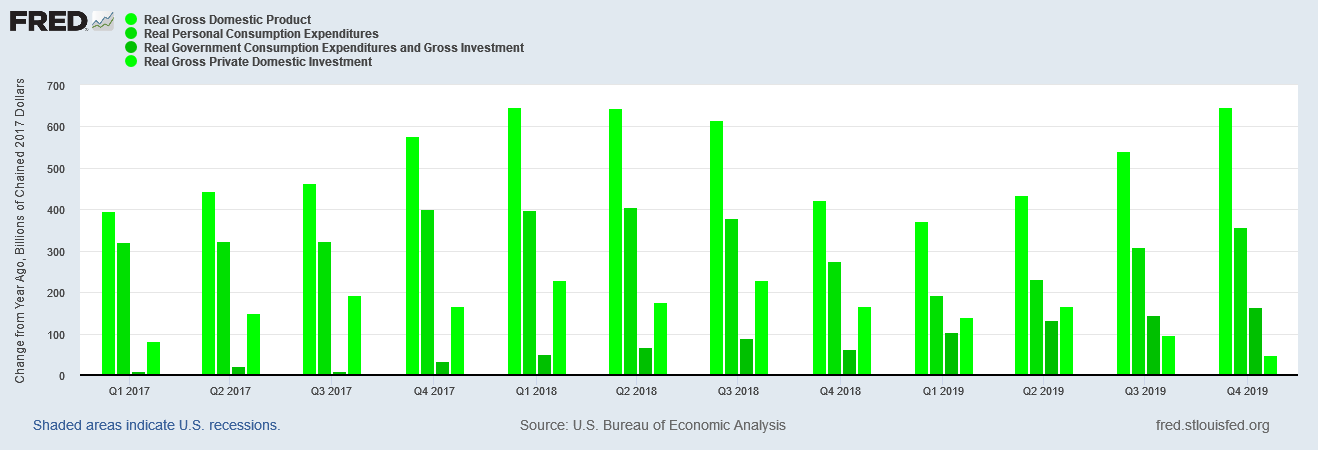

By comparison, during Trump’s first three years Private Domestic Investment started rising, although year on year growth began to taper off in 2019.

If we look at quarter on quarter changes, we see that Private Domestic Investment growth under Trump peaked in 2018, and was headed for decline by the end of 2019.

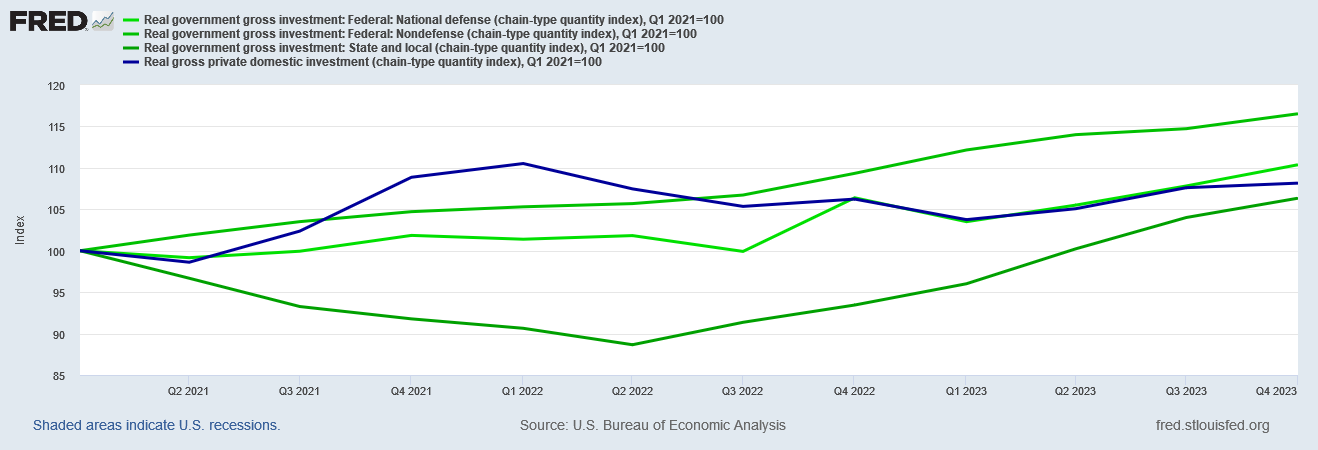

We should also note that, as Private Domestic Investment slowed, Government Consumption and Investment under Trump accelerated in 2019.

By the end of 2019, there is very little doubt but that the economy even under Trump was heading into a recession, and that the economic growth Trump’s policies arguably catalyzed was proving to be shortlived at best. If Trump’s economy enjoys any overall advantage in comparison to Biden’s it is that the slowdown did not come until the third year for Trump, whereas it came in the second year for Biden, and has not fully left yet.

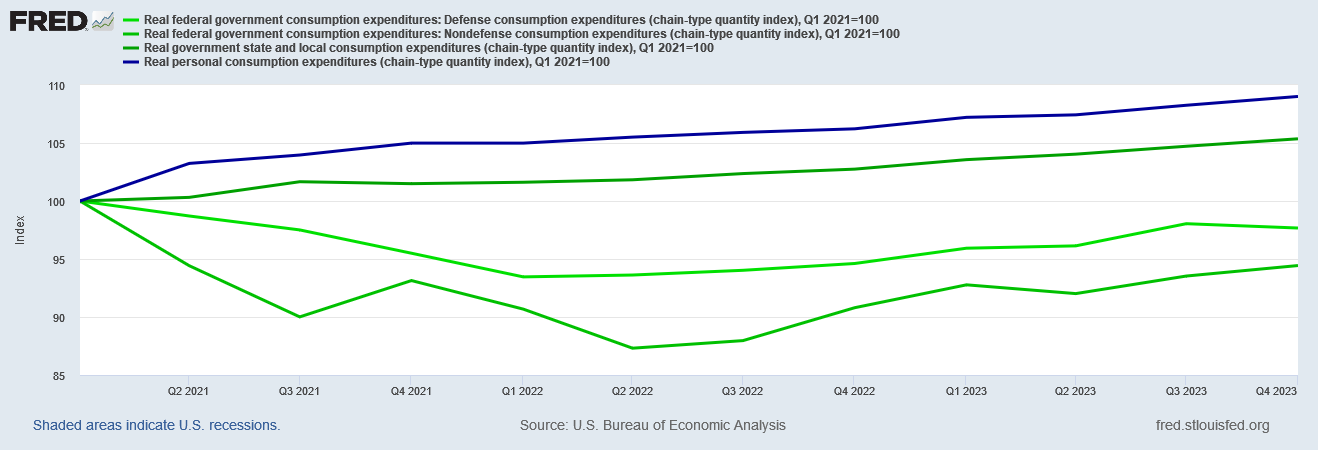

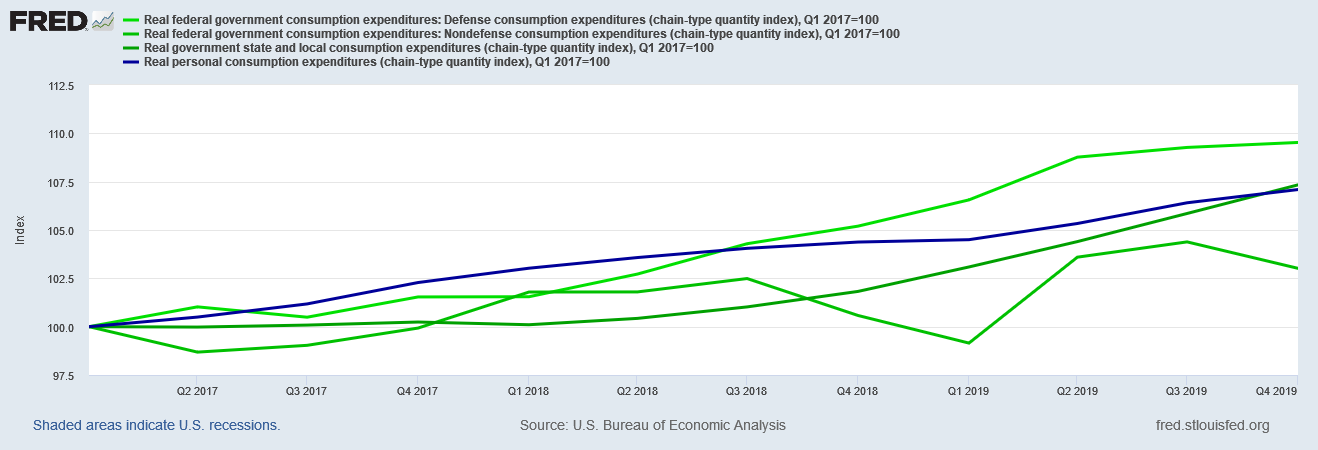

If we look at consumption spending, indexed from the start of either 2017 or 2021, arguably the Biden economy shows the better performance of private consumption vs government consumption.

However, the one category of government consumption which first outpaced private consumption under Trump was defense-related consumption, with non-defense consumption spending declining through the first quarter of 2019.

Even state and local consumption spending did not catch up to private consumption spending until the end of 2019.

Was Donald Trump’s greater spending on defense items good policy or bad policy? While defense itself is a legitimate reason for federal government expenditures, a reflexive presumption that all such spending is wisely or efficiently done is speculation at best.

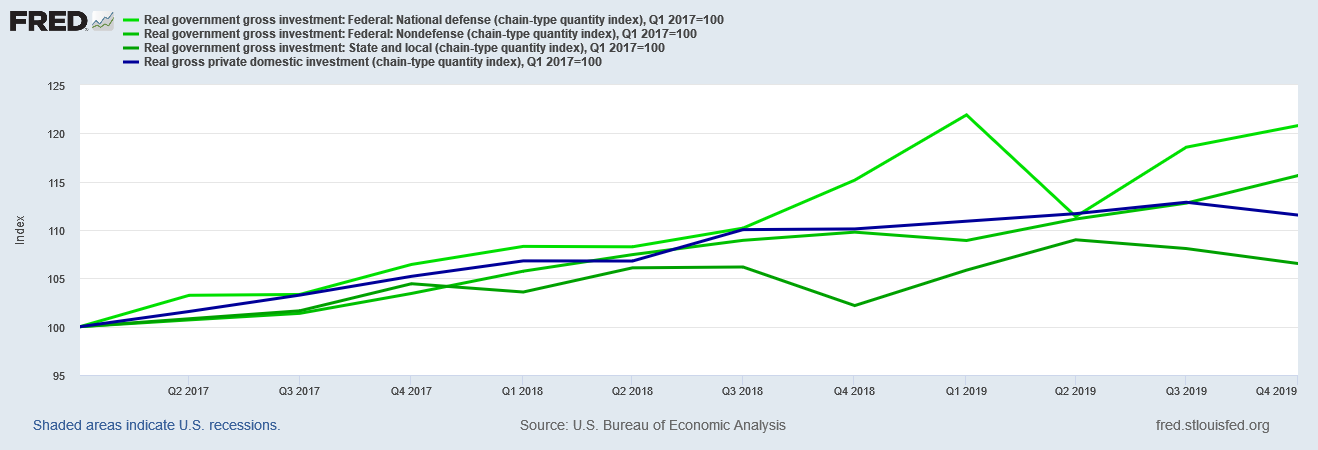

However, what is not speculation is that Private Domestic Investment under Trump did not decline until the end of 2019, while for Biden it has been trending down since Q1 of 2022.

Again, we have under Trump the awkward reality that the biggest investment amounts were for defense related items during the latter part of Trump’s first three years in office, but that sits alongside rising Private Domestic Investment for most of Trump’s first three years. Regardless of the good or bad of defense investment spending and non-defense investment spending. rising private investment is unquestionably a good thing.

There are many more potential dimensions one can use to explore the differences between the Trump and Biden economies.

One notable difference beyond the broad aggregates charted above is that during Trump’s first three years average wages rose faster than average consumer price inflation.

That has not happened under Biden.

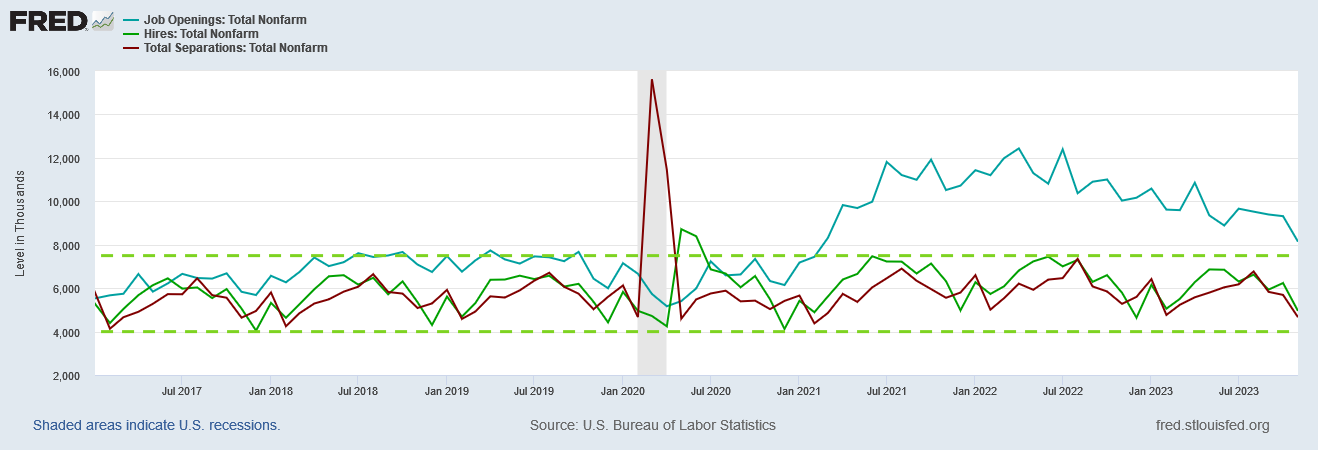

We also did not see under Trump the rise of “phantom” job openings which have failed to be reflected in increased hiring or decreased separation rates.

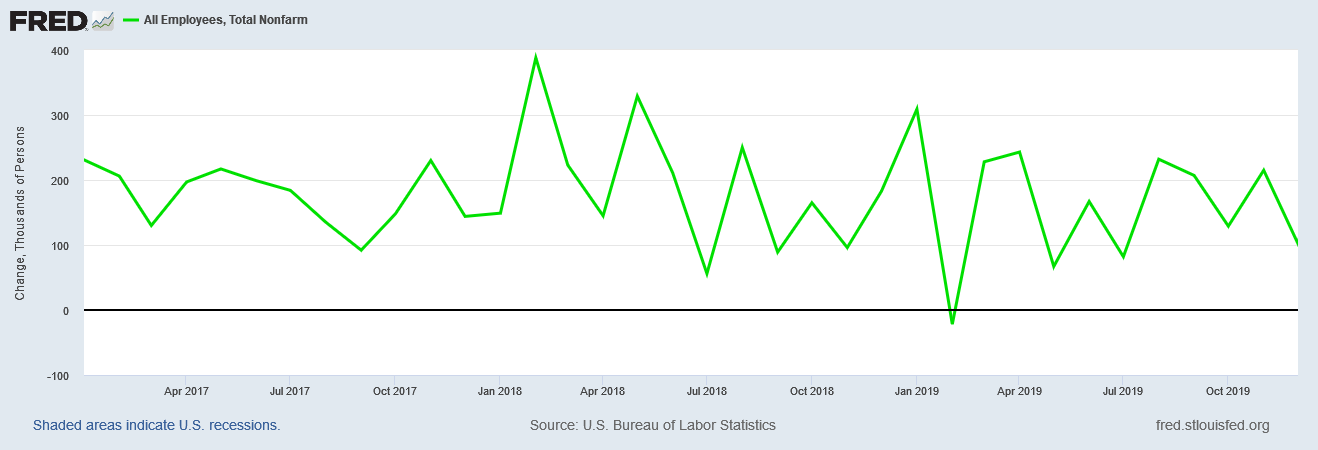

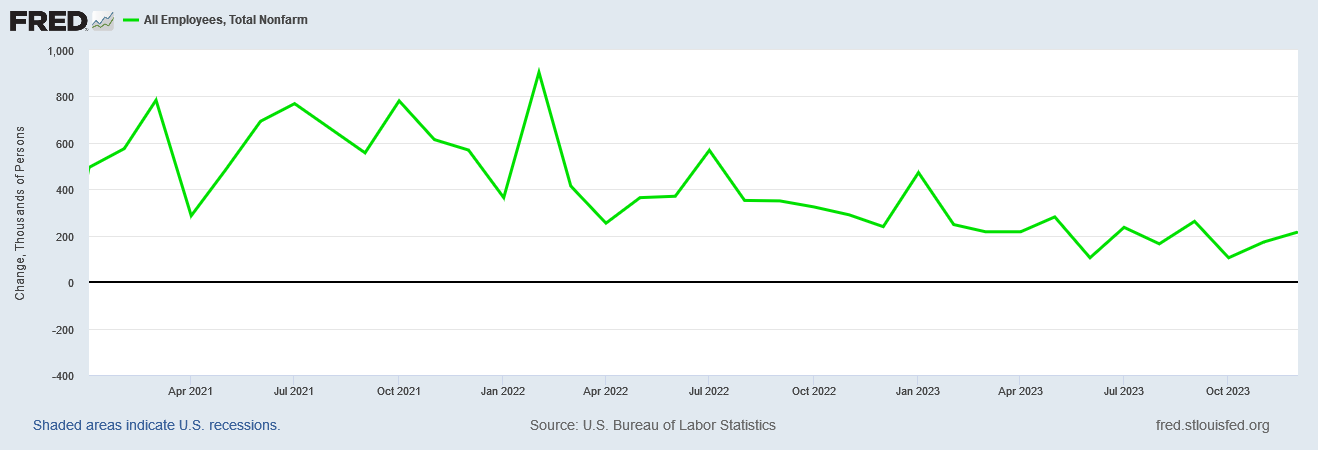

Trump also oversaw a period of broad stability within payroll growth, with only moderate softening by the end of 2019.

Biden’s tenure on payroll growth is not nearly as good, with a general decline in payroll growth throughout his term of office to date.

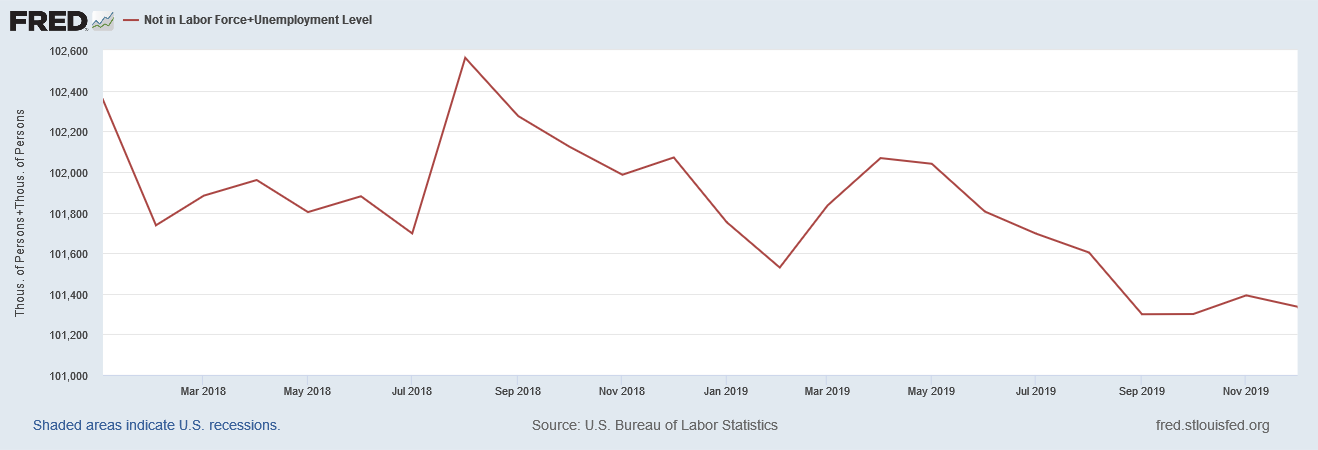

When we examine the broad numbers of people without a job—both the technically “unemployed” as well as those counted as “not in the labor force”—the result is a similarly nuanced “win” for Donald Trump.

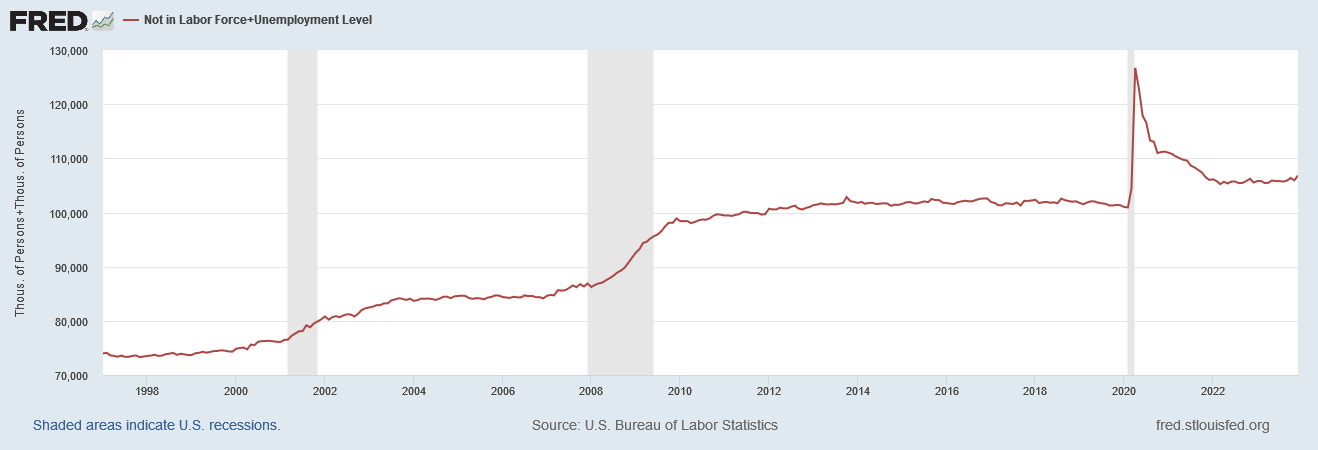

It is important to set the proper backdrop for this comparison. If we look at total numbers of people without a job, that figure has grown at each recession since at least 2000.

Perhaps the most glaring structural weakness in the US economy is this long term deterioration in employment.

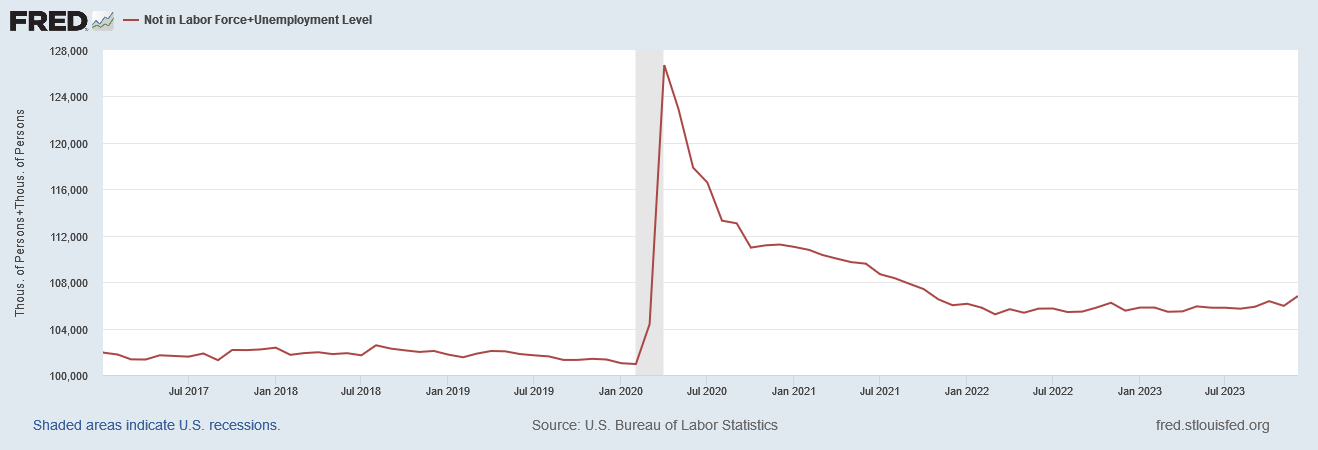

Because of the impacts of recession on employment, any comparison of the Trump years and the Biden years in this regard necessarily requires the inclusion of the disruptive year 2020 and the Pandemic Panic Recession. The numbers of workers forced out of employment by that recession was several orders of magnitude greater than in previous recessions, leaving lasting residual impact on the numbers of people without a job in this country.

Thus while Trump’s first three years saw a net decline in total people without a job of approximately one million, Biden would appear to have done far better—but 2021 is still very much a “recovery” of sorts from the 2020 extremes.

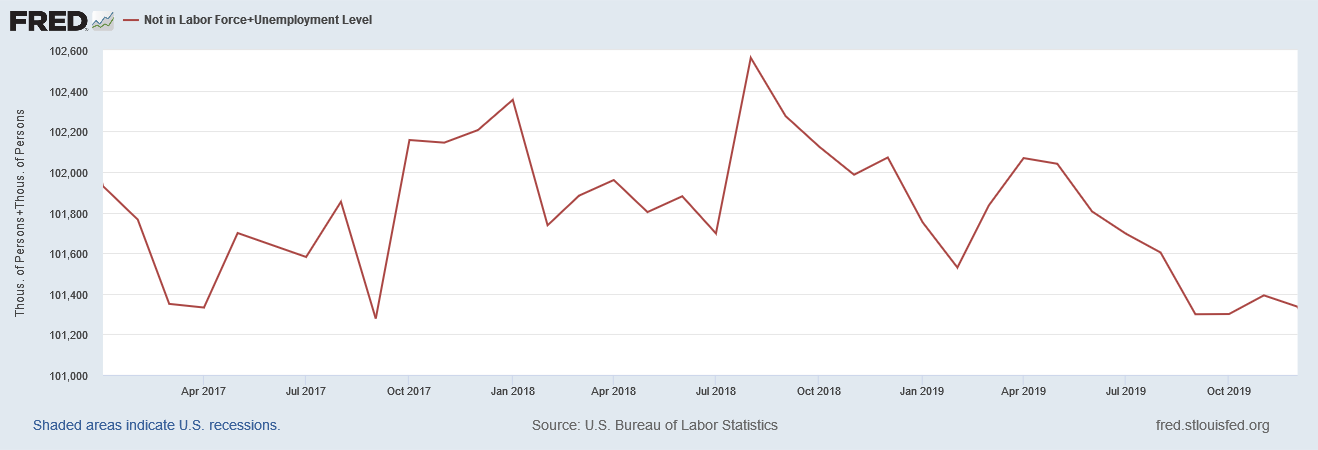

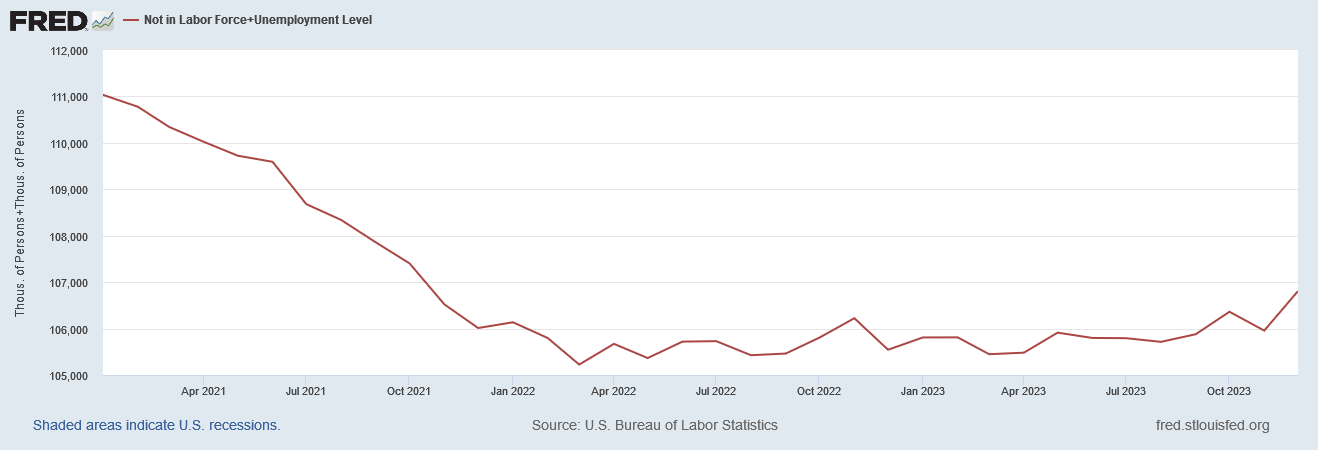

If we want a comparison of Trump’s economic policies vs Biden’s without the impacts of the Pandemic Panic Recession, we have to confine the scrutiny on total people without a job to the last two years for each President: 2018-2019 for Trump, and 2022-2023 for Biden.

When we look at the two year intervals, Trump’s employment track record moves ahead of Biden’s significantly. In the two years prior to the Pandemic Panic Recession, Donald Trump oversaw a decline in the total number of people in the economy without a job.

Biden, on the other hand, oversaw an increase in that same metric.

Bear in mind that the number of people in the US economy who do not have a job is among the best indicators as to whether or not there is real economic expansion taking place. Employment is the engine of wealth creation, and has been acknowledged as such ever since Adam Smith wrote “Wealth of Nations.”

One of the main “tells” that the US has been in an extended recession has been the steadily rising number of people in the US who do not have a job, a rise that began in March of 2022.

Overall, the “Trump economy” was overall stronger and delivered more prosperity than has the “Biden economy”. Donald Trump certainly oversaw a period of employment growth in this country, whereas Joe Biden has not.

Moreover, Donald Trump also oversaw a period of greater private investment growth and greater personal consumption, while Joe Biden has seen less of both. Arguably, this is one reason why Trump’s labor results are better than Biden’s. Private investment and private spending is always superior in economic terms to government “investment” and government spending.

However, as with so many Presidents before him, including those notionally committed to fiscal restraint, Donald Trump was not shy about spending the public fisc. When private investment spending began to falter in 2019, Donald Trump’s administration stepped in with more government investment spending.

Nor were Donald Trump’s policies an unrestrained engine of economic growth or even job growth. In fact, by the end of 2019, Trump’s policies had largely run out of steam and not only was economic growth fading but job growth was also fading. Even without COVID and the Pandemic Panic Recession, Donald Trump’s economic track record would have not necessarily worked to his favor during a reelection campaign.

Because of the Pandemic Panic, and the lunatic lockdowns that followed it, 2020 is very much an aberrational year, for which no good comparisons can be made. 2020 was the year that every apple cart got upended. However, that year occurred on Donald Trump’s watch and not Joe Biden’s. The government policies that produced those disruptions were Donald Trump’s and not Joe Biden’s.

Yet even without the Pandemic Panic, the data shows that Trump’s economic stewardship started out solid, but by 2019 had more or less run aground. The first few months of 2020 were going to be a recession in the United States with or without COVID, although without COVID we would not be contending with the economic chaos of lockdown even today.

Would a Trump second term of office be better for the economy than a Biden second term of office? Arguably, yes, it would. There is no question that Donald Trump did better on overall employment and wage growth from 2017 through 2019 than Joe Biden has done over the past three years. On that measure alone, Donald Trump is the superior economic steward.

Can Trump craft an economic message of renewed prosperity that persuades voters to give him a second bite at the Presidential apple? Of that there is also no doubt. If Donald Trump pledged just to repeat the economic policies of 2017 through 2019, that potentially could position the US economy for greater growth and greater prosperity than would otherwise be the case. That alone could be a winning economic message for Donald Trump, especially if he is able to address criticisms about 2020 and the Pandemic Panic.

Are the economic policies of 2017-2019 a realistic possibility in a post-COVID, post-Pandemic Panic economy? That is a far murkier question. Donald Trump can certainly craft a popular economic message based on 2017-2019, but that message will be of little benefit if the constraints imposed as a result of 2020 and the entire lunacy of the COVID Pandemic Panic make a repeat of 2017 through 2019 impossible.

The “Trump economy” was somewhat better than the “Biden economy” has been. The extant economic data shows this to be true in most dimensions.

Yet that same “Trump economy” was not a perfect economic engine, and Donald Trump does not have an untrammeled economic track record. Neither can we be assured that a second “Trump economy” would unquestionably lift the US economy out of the recession and stagflation that it has endured for at least the past two years.

We can be assured that a second “Trump economy” would represent a break with the policies of the past three years. Donald Trump might not be able to make things better for the US economy, but Joe Biden seems almost certain to make things worse.

This is a good comparison of the data of Trump’s economy vs. Biden’s, and you have wisely included several factors - such as private investment vs. government spending - that other economic analysts would overlook entirely. However, to assess the actual PERFORMANCE of Trump vs. Biden’s administration other variables must be included, several of which would be difficult to quantify, and data might be hard to find. Three that immediately come to my mind are:

1) How much political resistance and opposition did each President have to fight in the enactment of their economic policies? It may just be my subjective memory, but I remember Trump’s policies being fought tooth and nail by his opponents, far more that Biden’s. If there is a ‘weighting factor’ that exists to apply to our comparison, I’m not aware of it. Still, to be fair to Trump, this level of opposition needs to be considered.

2) The economic starting points of Trump’s administration vs. Biden’s we’re so different, because of the Covid lockdown years, that some kind of special analysis and weighting would have to be applied. (Some economist will write a PhD thesis on this that could have the heft of a book.) The stretch of 2022 that showed ‘flat’ improvement should have showed a pretty strong growth rate, as Covid restrictions were being lifted and economic activity resumed. To me, Biden clearly blew that opportunity.

3) Long-range vs. short-range investments of the two administrations need to be considered. Did Trump enact economic policies that would have greater long-range payoffs than Biden did? More factors that might be subjectively measured, if data can be found at all.

I’m sure you can immediately think of other variables that could be included in this comparison, but I’m not asking you to write a book. I just wanted to point out a few items that I think would weigh in Trump’s favor.

Thank you for doing this, Peter. Just now seeing it. I feel like Trump coming in after Obama pushed us much closer to socialism and the resistance and irrational hate that Trump got from the Democrats means that he had an uphill battle, so maybe he should get a little more credit for what he did accomplish? But I also feel like America is part of larger global economic reorganization and changes and it is not going to be easy to remain strong, no matter who is President. I don't think Biden is really the one running the country anyway. As far as defense spending, Trump had to increase that didn't he, because Obama decreased it if I recall correctly. The most important part of your data is that more working class and middle class people were working and wages increased. That is why people liked Trump and felt like the economy was 'better'. The bad part of the total picture is that the super rich continue to get richer no matter what happens. Have a blessed day. (My daughter is still in the hospital)